- Solana broke over $ 180 with a daily profit of 3.5%, supported by an increase of 11% in trade volume.

- Traders built $ 362 million in long positions near $ 171.8, with conviction in Sol Holding above important support.

Solana [SOL] This week registered a sharp rebound, broke from an important resistance level and attracted strong participation across the board.

These strong performance has received considerable attention from traders and investors, which moves a huge amount of Sol to wallet addresses.

Participation of retailers in Sol SkyRockets

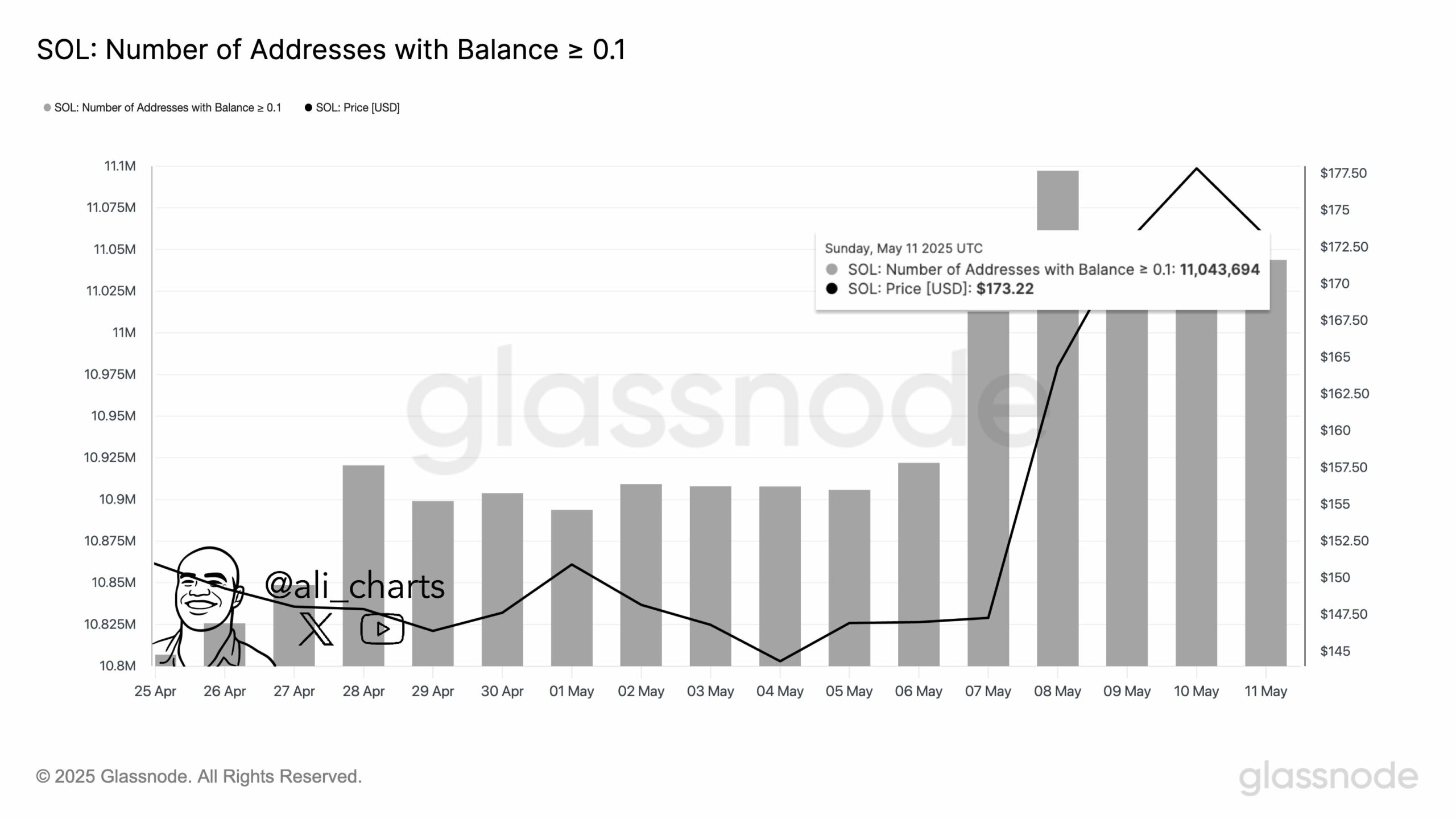

According to data from Glassnode, the number of addresses is to cling At least 0.1 Sol jumped to 11.04 million.

This reflected the growing interest and trust of retail investors and long -term holders in the active, which is a bullish sign in the long term.

This increase in the number of portfolios began when the SOL price consolidated in a tight reach above $ 150, after the outbreak of a long -term falling trend line.

At the time of the press, Sol traded near $ 180, after he won 3.5% for the past 24 hours.

In the same period, the participation of traders and investors has increased, which has led to an increase in trade volume by 11%.

This jump in volume, together with the rising price, indicates a strong momentum in the active and reflects the current market demand and interest.

Solana price promotion and upcoming levels

According to the technical analysis of Ambcrypto, Sol Bullish seemed ready to continue his upward momentum at the time of the press.

According to the Daily Chart, the Altcoin recently broke from an important resistance level at $ 180 after consolidating near this level for the last four trade days.

Source: TradingView

Based on the recent price promotion and historical patterns, the Breakout has opened the path for an upward rally of 40%, with Sol possibly reaching the level of $ 270.

Solana’s Bullish thesis will only apply if the SOL price remains above the level of $ 179, otherwise it can fail.

From the moment of the press, the relative strength index (RSI) of SOL stood at 72, indicating that it is active in Overbought Territorium and can experience a correction before he continues his rally.

Outflow points of $ 13 million to the battery phase

Given the current market sentiment, betting traders and investors strongly on the bullish side and they seem to collect token, by coinglass data.

Data from Spot -entry/outflow showed that trade fairs have witnessed an outflow of $ 13 million in Sol over the past 24 hours.

This outflow after the breakout indicates potential accumulation and can cause purchasing pressure, leading to a further upward rally.

Source: Coinglass

Sol’s liquidation map unveiled heavy leverage, clustered around the range of $ 171.8 – $ 186.5.

Interestingly enough, traders built $ 362.41 million in long positions near $ 171.8 support and $ 222.77 million in shorts near resistance.

Source: Coinglass

This data indicates that bulls are currently dominating Sol and believe that the price of the active is active It is unlikely that it will fall below the level of $ 171.8 at any time.