- Solana climbed to $ 125, but whale outputs and dense food zones near $ 140 brought the risk of a long squeeze.

- The recent leap looked more like temporary assistance.

Despite Solana’s[SOL] Recent recovery up to $ 120, large holders stay deep in the red, which influences the total market sentiment.

Data on chains Shows a large whale that recently liquidated 274,188 Sol at an average price of $ 108. With an initial cost base of $ 148, this capitulation locked a stunning $ 11 million in realized losses.

Even with SOL that now floats around $ 125, a bounce of 30% of its $ 95 low, the whale would still be under water.

This behavior reflects the continuous distribution between smart money, because whales use liquidity peaks to leave instead of gathering. For retail traders it is a caution flag in the midst of a fragile macro and on-chain background.

Key Supply Zone in Focus

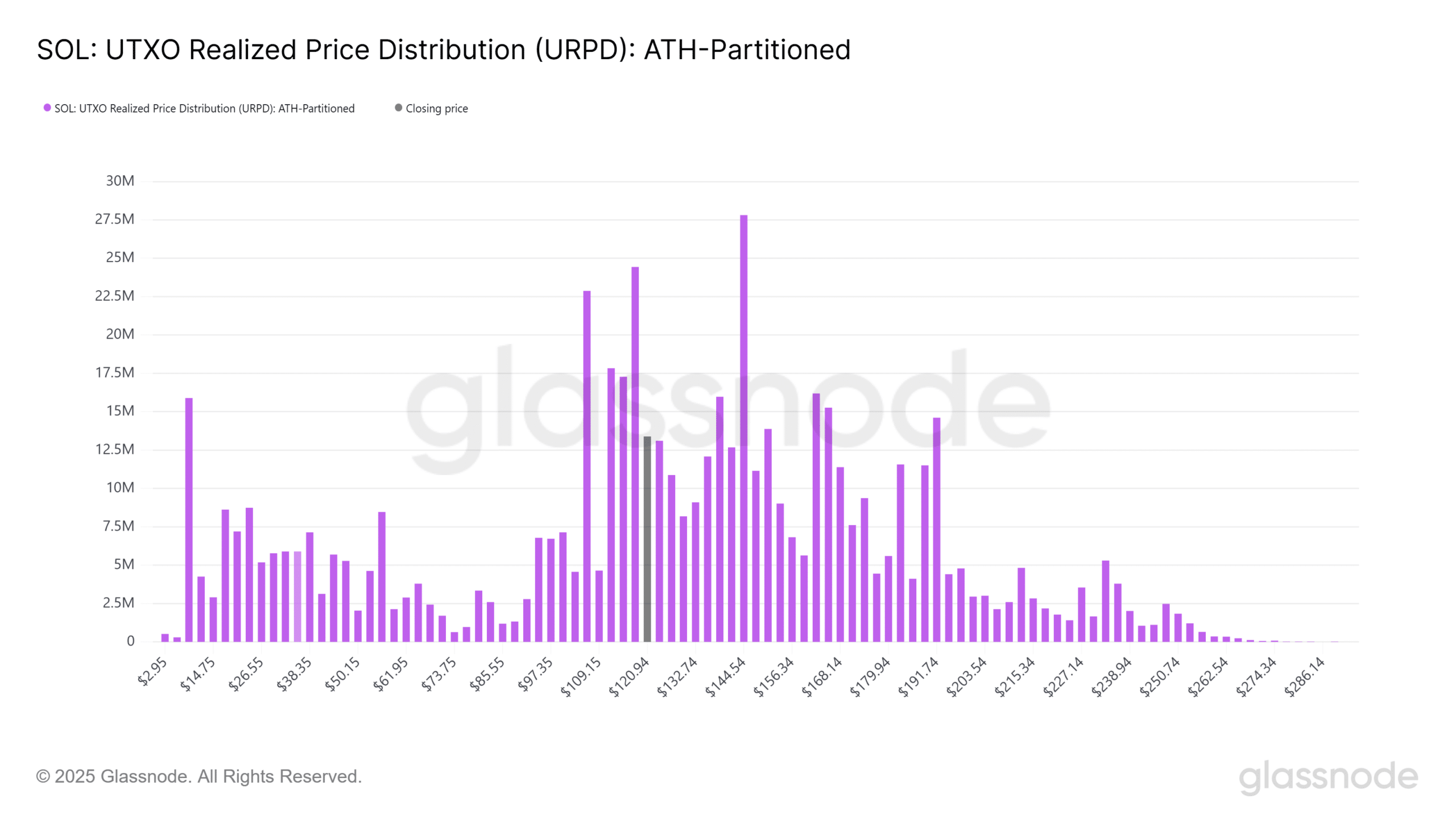

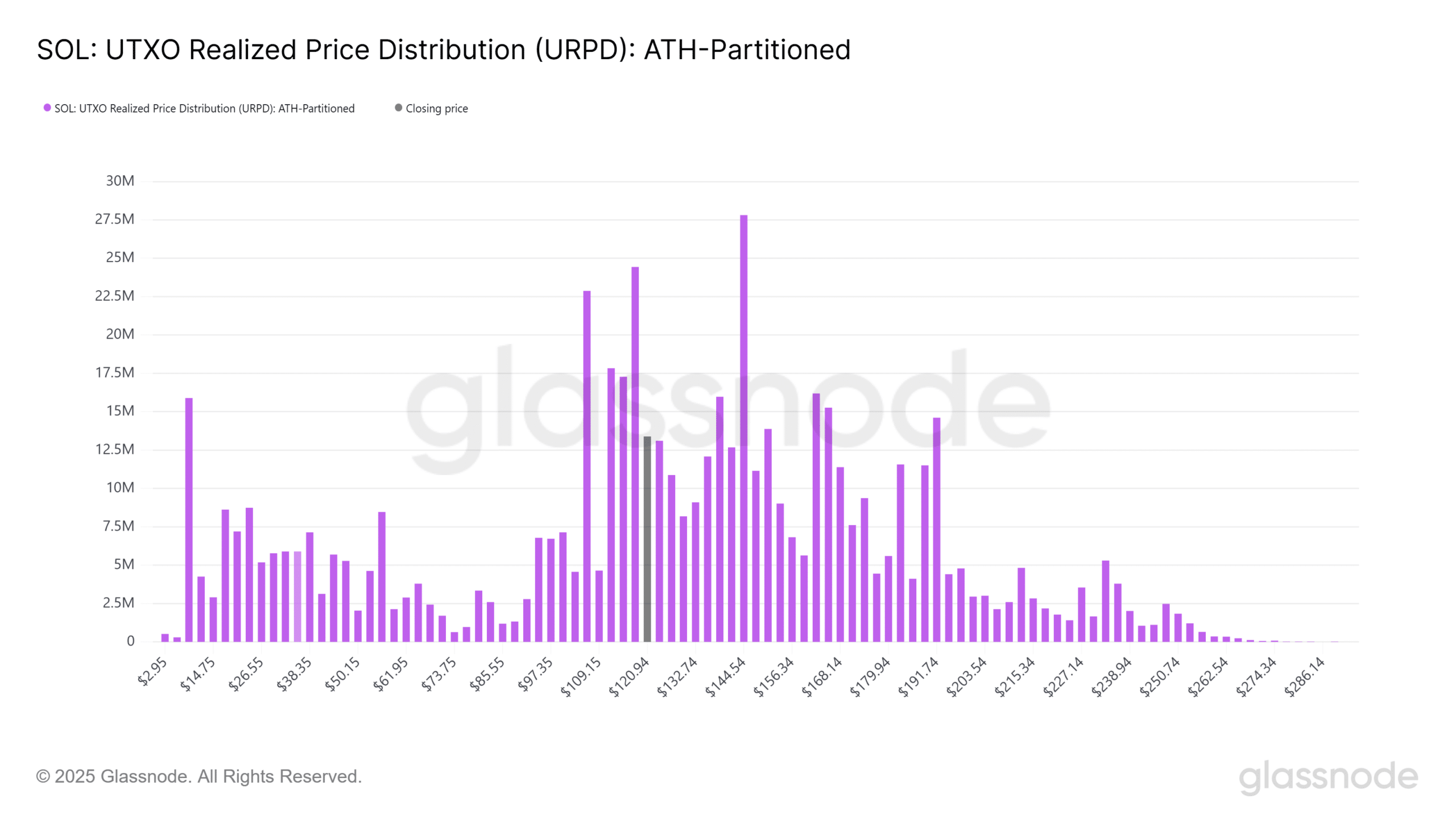

The UTXO realized price distribution (URPD) offers a grainy breakdown of where Solana coins were last handled and mapped at price levels.

For SOL, the data emphasizes three large supply clusters – around $ 100, $ 120 and $ 140. These concentrations indicate that a significant part of the circulating supply at these levels has been obtained.

The $ 140 zone stands out among them, with more than 27.8 million Sol concentrated there, accounting for around 4.75% of the total circulating food.

This cluster represents an important resistance area, because many holders are in the vicinity of Breakeven or not -losses are confronted.

Source: Glassnode

That is why the risk of whale-driven sale does not remain the level of $ 140. A price that goes back to this threshold can lead to holders shifting in non -realized profits, which may cause a bullish rotation driven driven by FOMO and market for market.

Moreover, 38 million sol remains clustered between $ 117 and $ 120, making this range a potential hotspot for taking a profit if this ceiling breaks.

As a result, until the level of $ 140 has been tested, the price volatility in the Solana price action will probably continue to exist.

Futures -Data strengthens the market front views of Solana

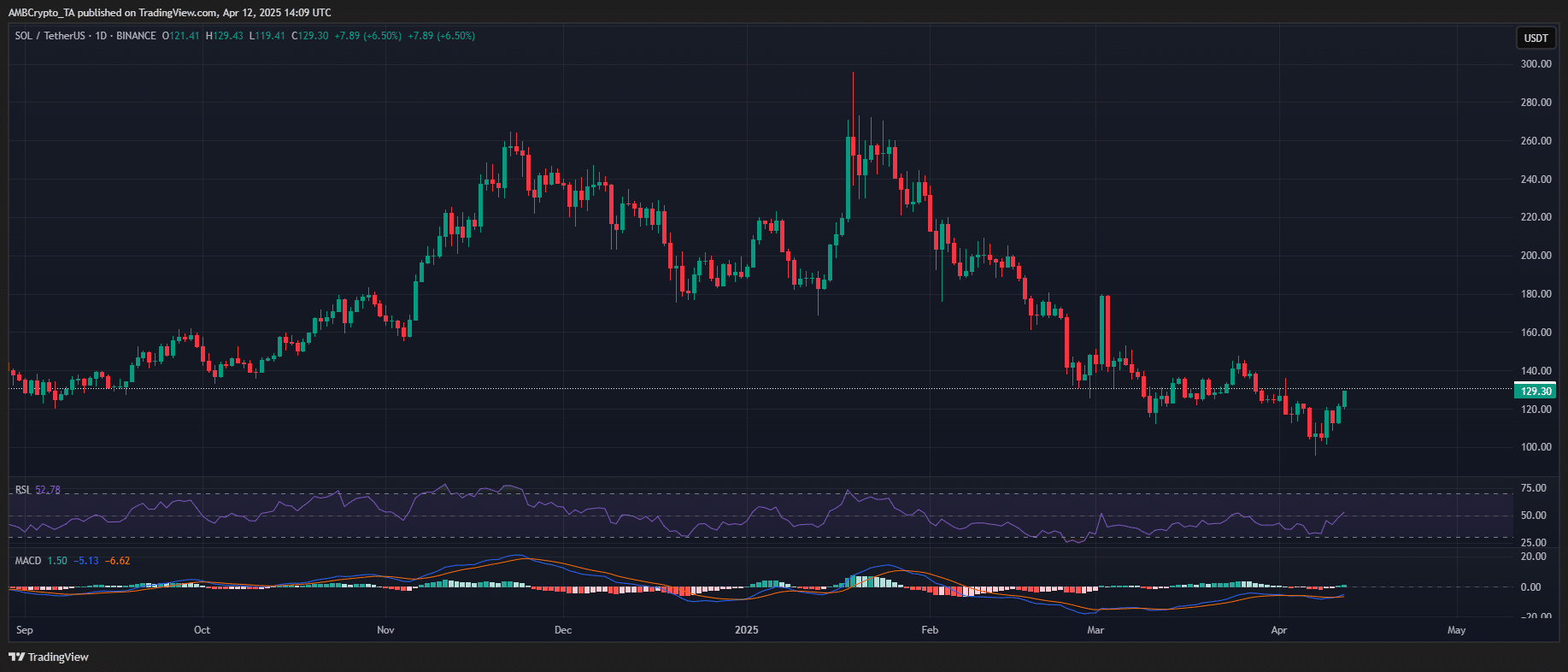

Solana’s 7.07% daily revival positions it as the leading top position in terms of recovery speed.

This rally is not only spot-driven- Derivate data confirms aggressive positioning. Open interest (OI) rose from 13.89% to $ 5.23 billion, indicating a new wave of livered exposure to the market.

At first glance this seems bullish. However, it also introduces vulnerability.

The whale distribution was still active and short-term holders (3-6 months) are still deep in the capitulation zone. Moreover, the recent infringement of a high density ($ 117- $ 120) is the stage for increased liquidation risk.

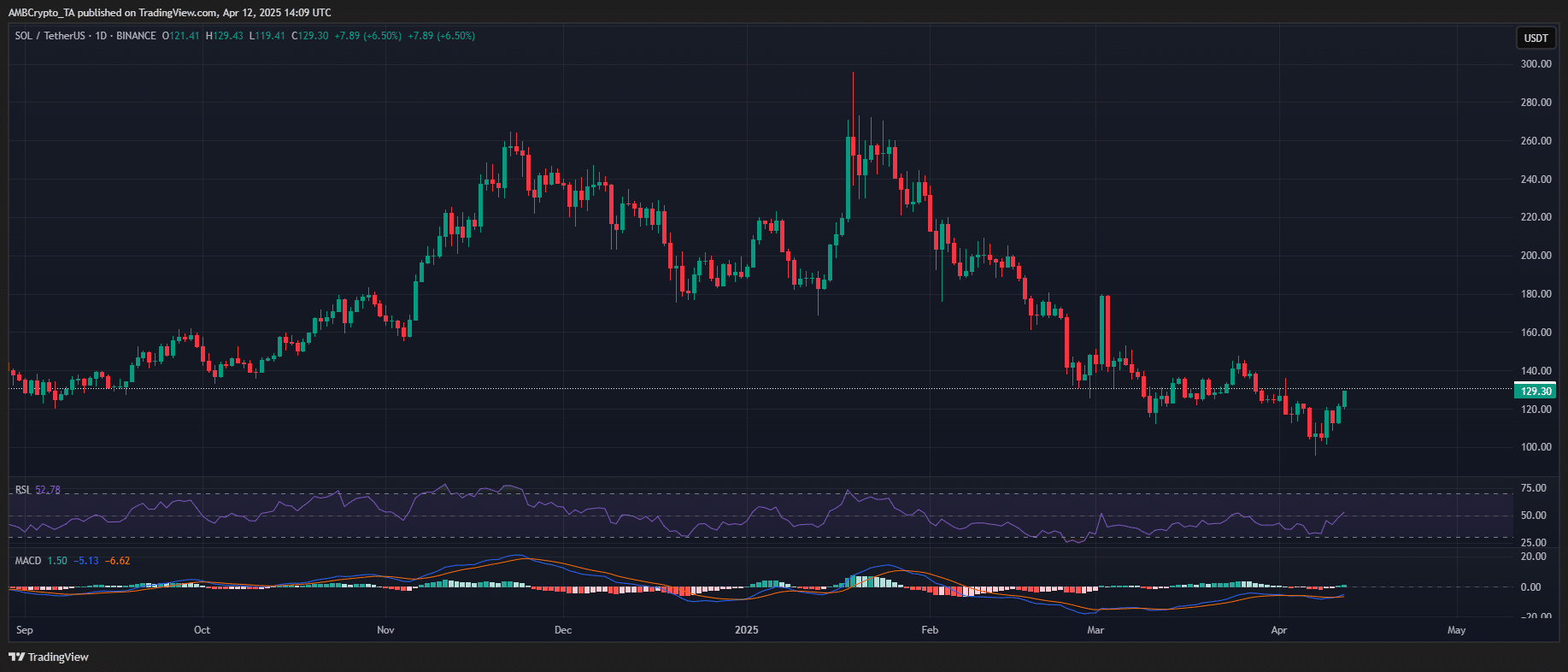

Source: TradingView (SOL/USDT)

If Solana does not maintain Momentum, a step -by -step long squeeze could cause a sharp downside volatility, in particular because the financing rates start to skewed positively.

In short, although the recent leap has led to optimism, these rally characteristics of a liquidity-driven auxiliary phase does not have a confirmed trend remote.

Until Solana retires and above the supply zone of $ 140 with conviction, the downward risk remains firmly on the table.