- Transaction activity on the SOL network has surged over the past 24 hours, indicating increased interest.

- Market sentiment in both spot and derivatives markets is gradually shifting in favor of a bullish outlook.

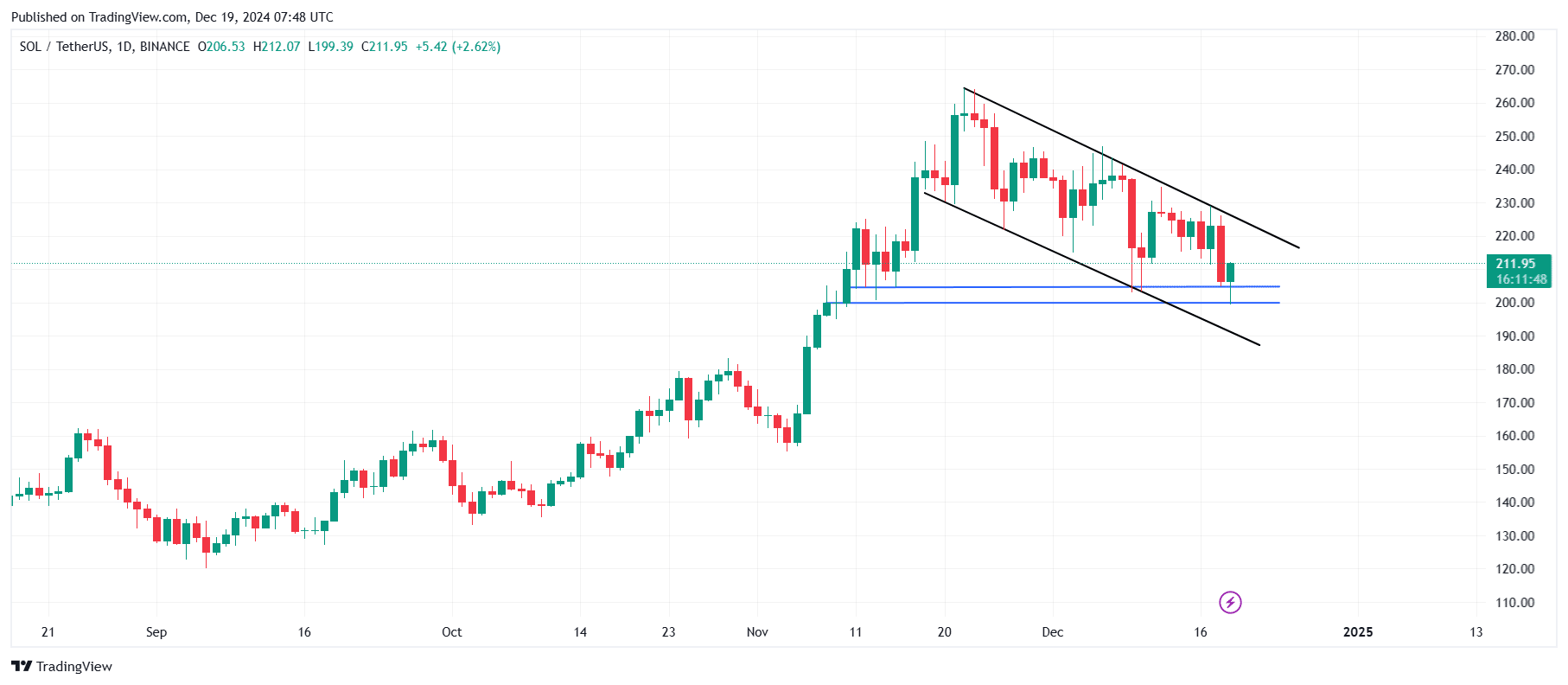

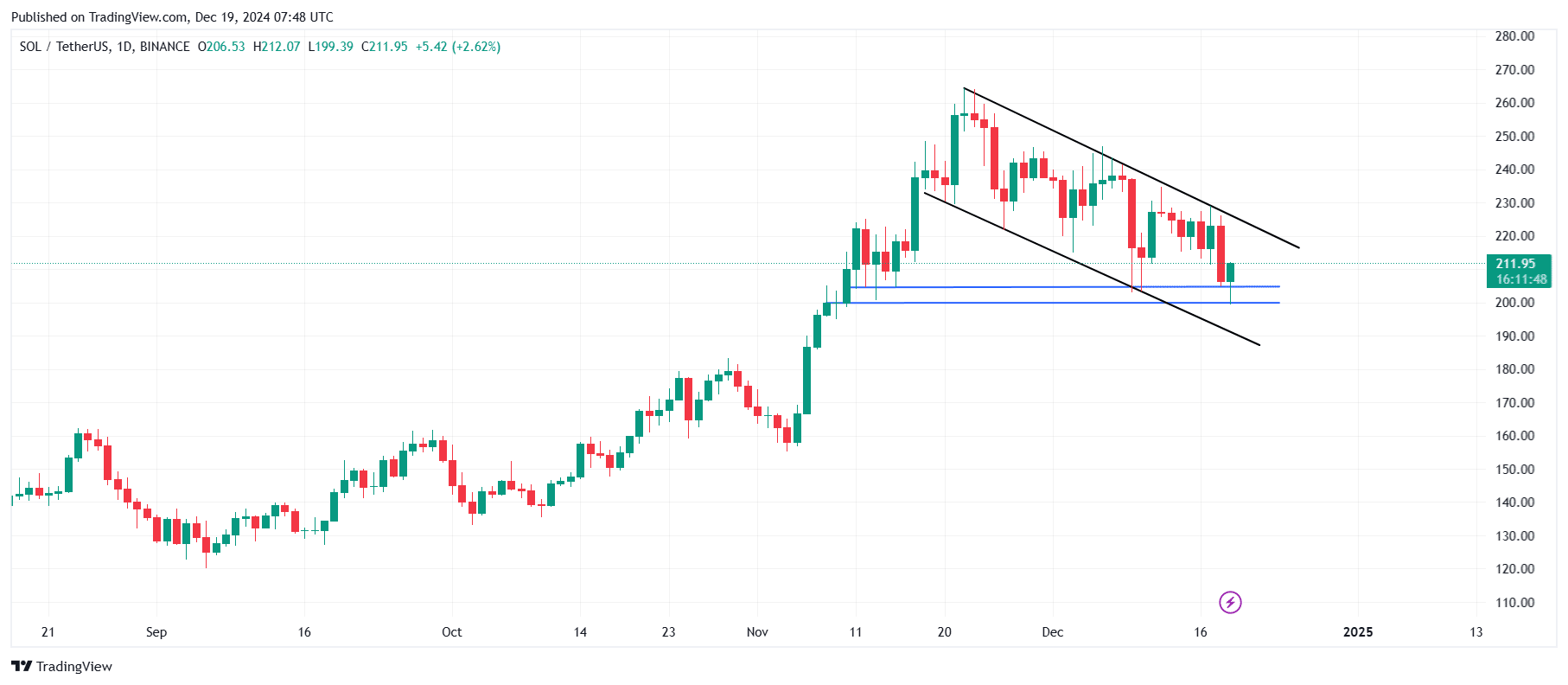

Solana [SOL] has struggled after hitting an all-time high of $264.39. Over the past month, the stock has fallen 13.20%, wiping out previous gains. On the daily chart, the asset is down 2.93% and trading at $209.44 at the time of writing.

AMBCrypto noted that increased trading activity could indicate selling pressure, but overall sentiment points to a possible bullish reversal.

Increased trading activity: what does this mean for SOL?

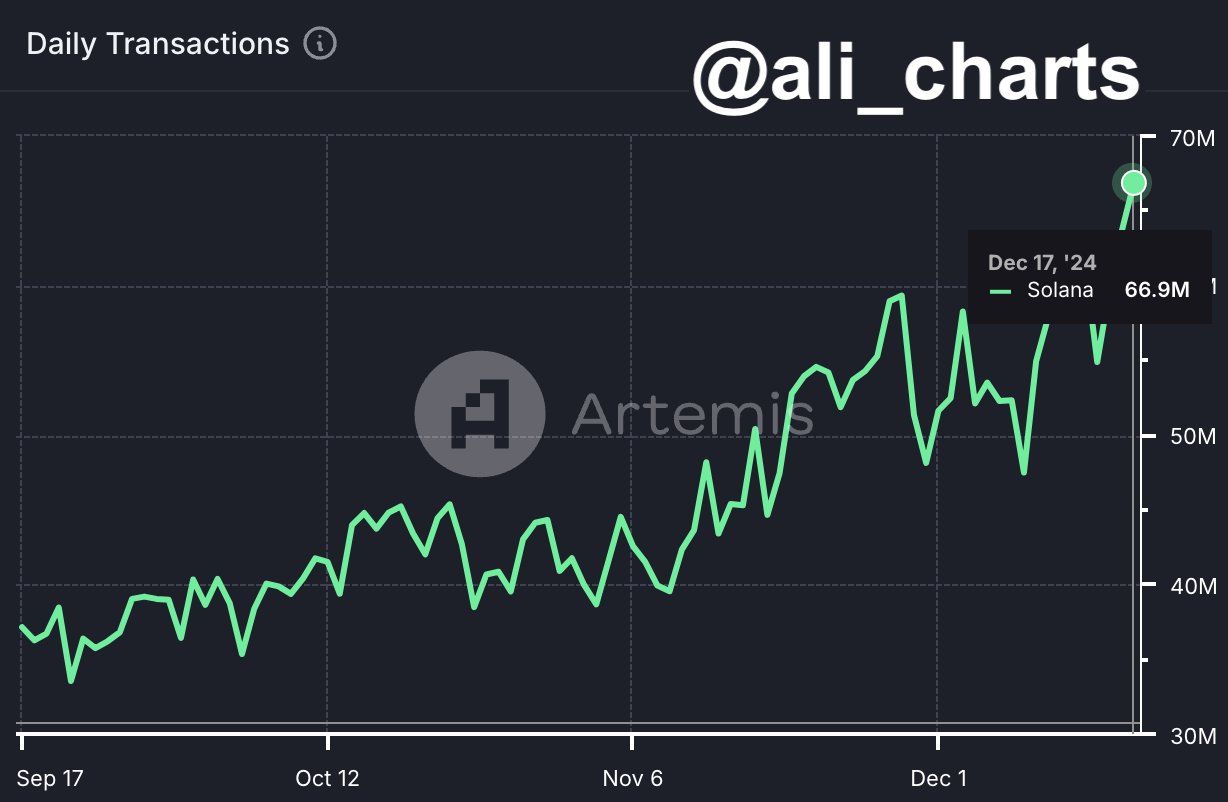

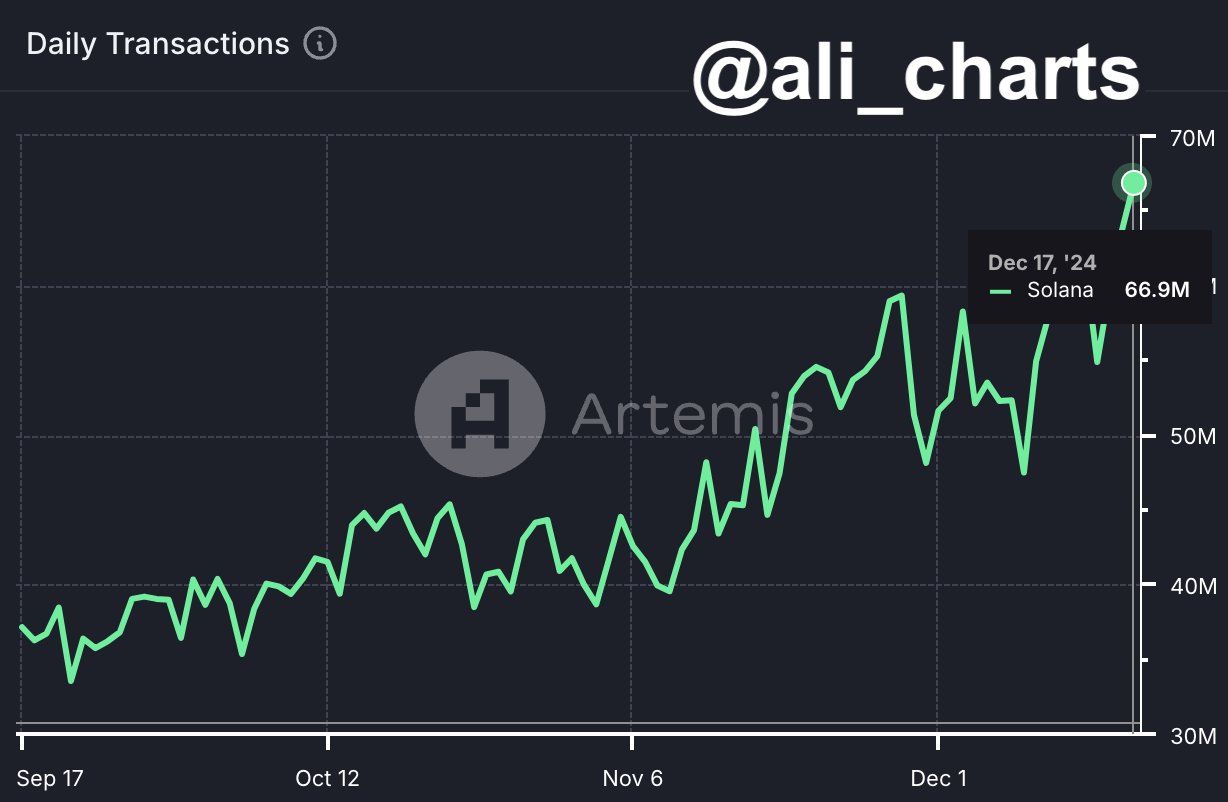

According to data from Artemis, daily transactions on the SOL network have soared, reaching nearly 67 million – levels not seen in recent months.

A spike in transaction activity can indicate positive or negative momentum for an asset, often depending on price movement.

Source:

In the case of SOL, the price has fallen by 2.93%, suggesting that the increased trades could indicate selling pressure. The asset recently hit a new weekly low, trading at $199.39.

However, this decline has pushed the SOL into a support zone on the weekly chart – a level that has historically been associated with strong buying interest. This support could trigger a potential price rebound in the short term.

Source: trading view

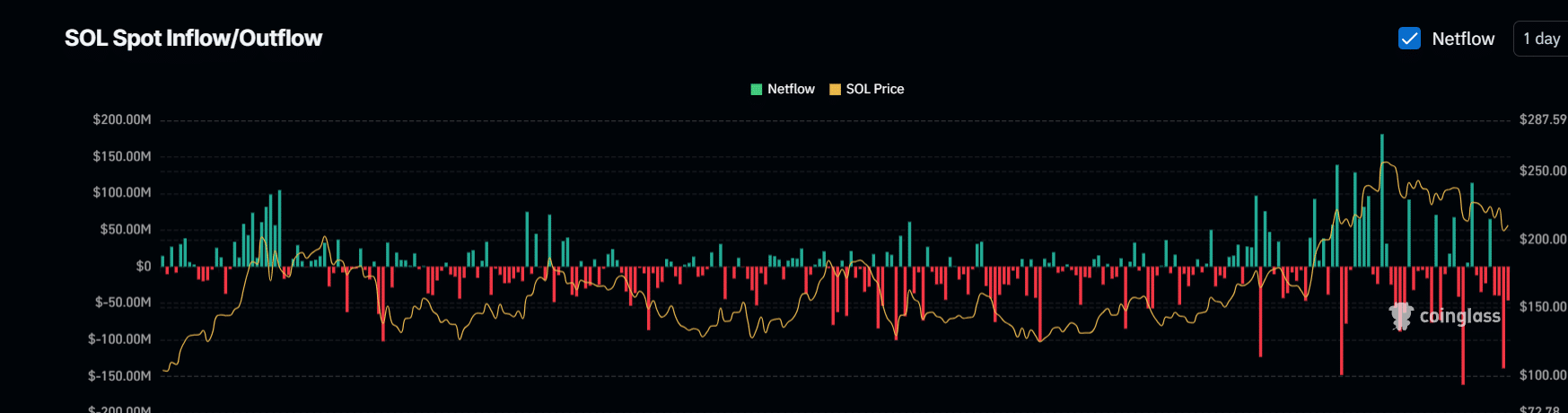

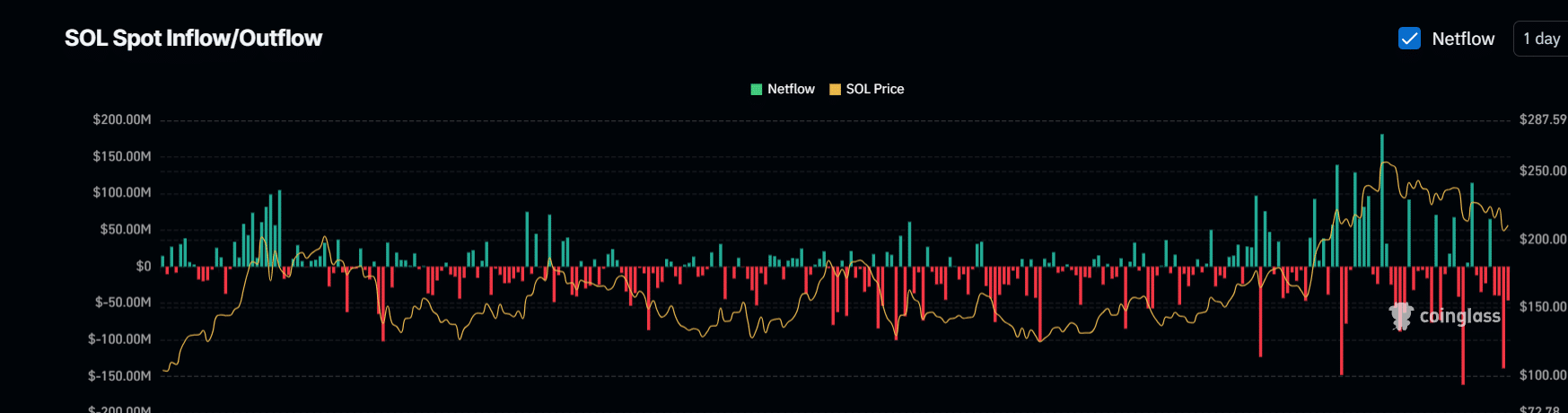

SOL bond outflows increase as belief changes

High outflows of SOL from the exchanges indicate that spot traders are moving their assets into wallets, meaning there is a potential long-term commitment despite the recent market decline.

Typically, spot traders deposit more assets into exchanges during such conditions. However, the current trend of pullbacks indicates increased bullish sentiment.

As of now, the Exchange Netflow is heavily negative, with over $264 million worth of SOL disappearing from the exchanges in the last 96 hours. $46.26 million worth of SOL was withdrawn in the last 24 hours alone, contributing to market strength after a further decline.

Source: Coinglass

Moreover, the market’s funding rate remains positive at 0.0057%, indicating that bullish long traders pay a periodic fee to maintain the balance between spot and futures market prices.

If this trend of increasing withdrawals and positive financing rates continues, SOL could be on track to reach new price highs.

Long liquidations set the stage for a bullish shift

There have been massive, long liquidations in the market over the past 24 hours, losing $21.35 million. This happens when the price of an asset moves downward, contrary to the upward bets of long traders, leading to huge losses.

While this is bearish, there is a gradual shift visible at lower timeframes, reflecting a change in trader sentiment.

Is your portfolio green? View the SOL Profit Calculator

Over the past four hours, short liquidations have risen above $936,150, while long liquidations have been below $150,000. This indicates that traders are turning bullish, indicating that the assets may trend higher.

Source: Coinglass

Furthermore, Open Interest grew by 0.62% over the same period, reaching a total of $3.52 billion. This increase indicates bullish momentum as the majority of unsettled derivative contracts are now positioned in favor of upward price movements.