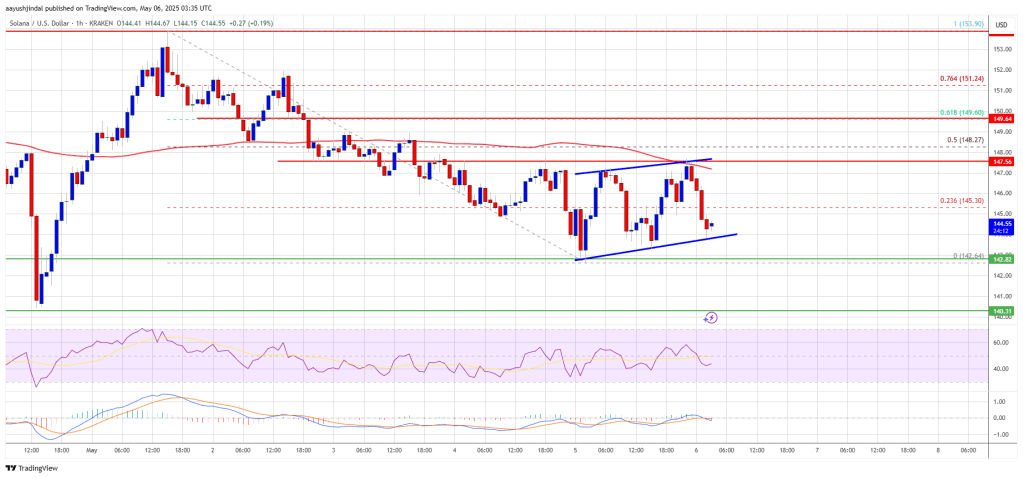

Solana started a new fall from the $ 155 zone. Sol Price now consolidates almost $ 145 and can extend losses under the support of $ 142.

- Sol Price started a new decrease below $ 150 and $ 148 levels against the US dollar.

- The price is now traded under $ 150 and the 100-hour simple advancing average.

- There is an increasing channel or a continuation pattern in the short term that forms with support for $ 144 on the hour table of the SOL/USD couple (data source of Kraken).

- The couple can start a new increase if it knew the $ 148 resistance zone.

Solana -Prize consolidates profits

Solana Price formed a base over the support of $ 142 and started a new increase, such as Bitcoin and Ethereum. Sol was given pace for a movement above the resistance levels of $ 145 and $ 150.

However, the bears were active under the $ 155 resistance zone. A high was formed at $ 153.90 and the price started a new decrease. The price fell under $ 150 and $ 148. A low point was formed at $ 142.64 and the price is now losing to consolidate.

There was a small movement above the 23.6% FIB racement level of the downward movement of the $ 153.90 Swing high to $ 142.64 low. Solana now acts under $ 150 and the 100-hour simple advancing average. There is also an increasing channel or a continuation pattern in the short term that forms with support for $ 144 on the hour table of the SOL/USD couple.

In addition, the price is confronted with resistance near the level of $ 147. The next major resistance is close to the level of $ 150 and the 61.8% FIB retracement level of the downward movement of the $ 153.90 Swing high to $ 142.64 low. The most important resistance can be $ 155. A successful closure above the $ 155 resistance zone could determine the pace for a new steady increase. The next key resistance is $ 165. More profits can send the price to the $ 180 level.

More losses in Sol?

If Sol does not exceed $ 150 resistance, this can start a new decline. The first support on the other hand is near the $ 145 zone. The first major support is near the level of $ 142.

A break below the level of $ 142 can send the price to the $ 135 zone. If there is an end under the support of $ 135, the price can fall to $ 122 support in the short term.

Technical indicators

Hourly MacD – The MACD for SOL/USD wins pace in the bearish zone.

Hours -hours RSI (relative strength -index) -The RSI for SOL/USD is below the 50 level.

Important support levels – $ 145 and $ 142.

Important resistance levels – $ 147 and $ 150.