- If SOL does not have the level of $ 136, it can fall by 12% to reach $ 120.

- Solana’s Bearish prospects may shift if it sticks and closes a daily candle above the level of $ 146.

Solana [SOL] Seems to be preparing for a price fall because it has formed a bearish price pattern.

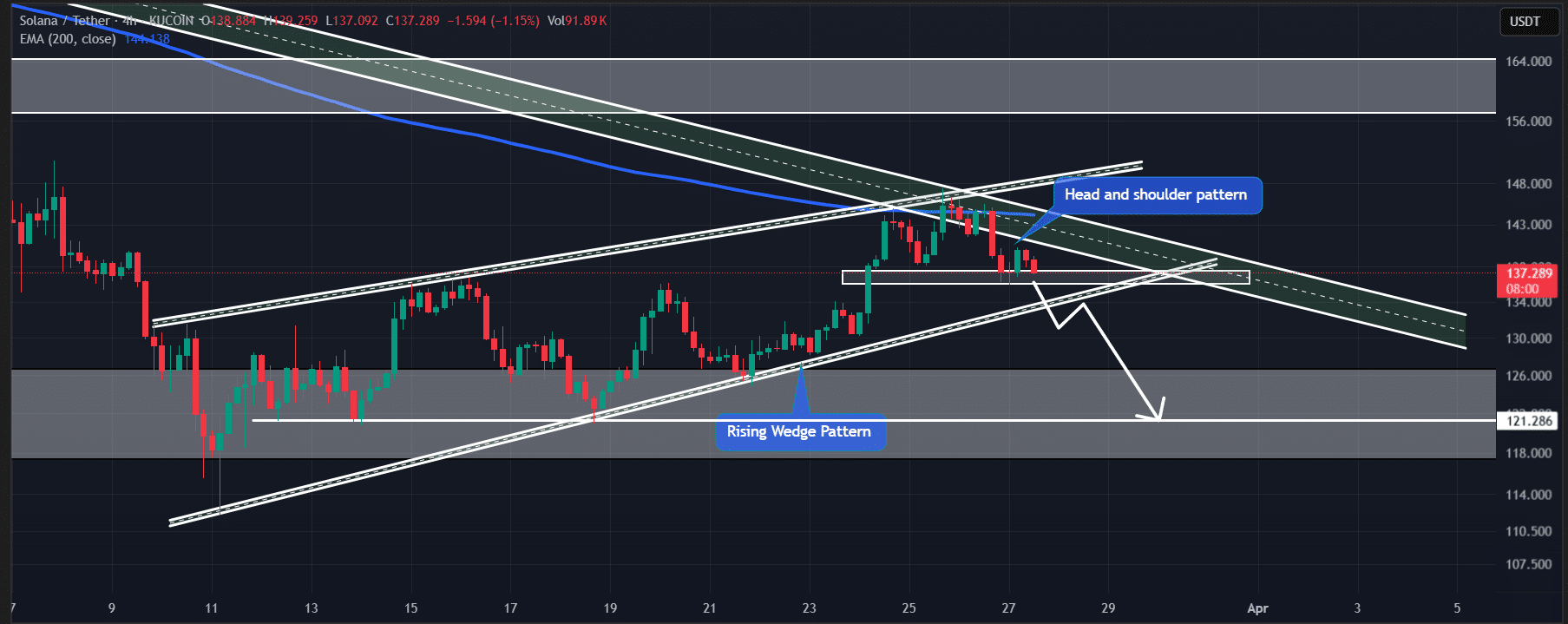

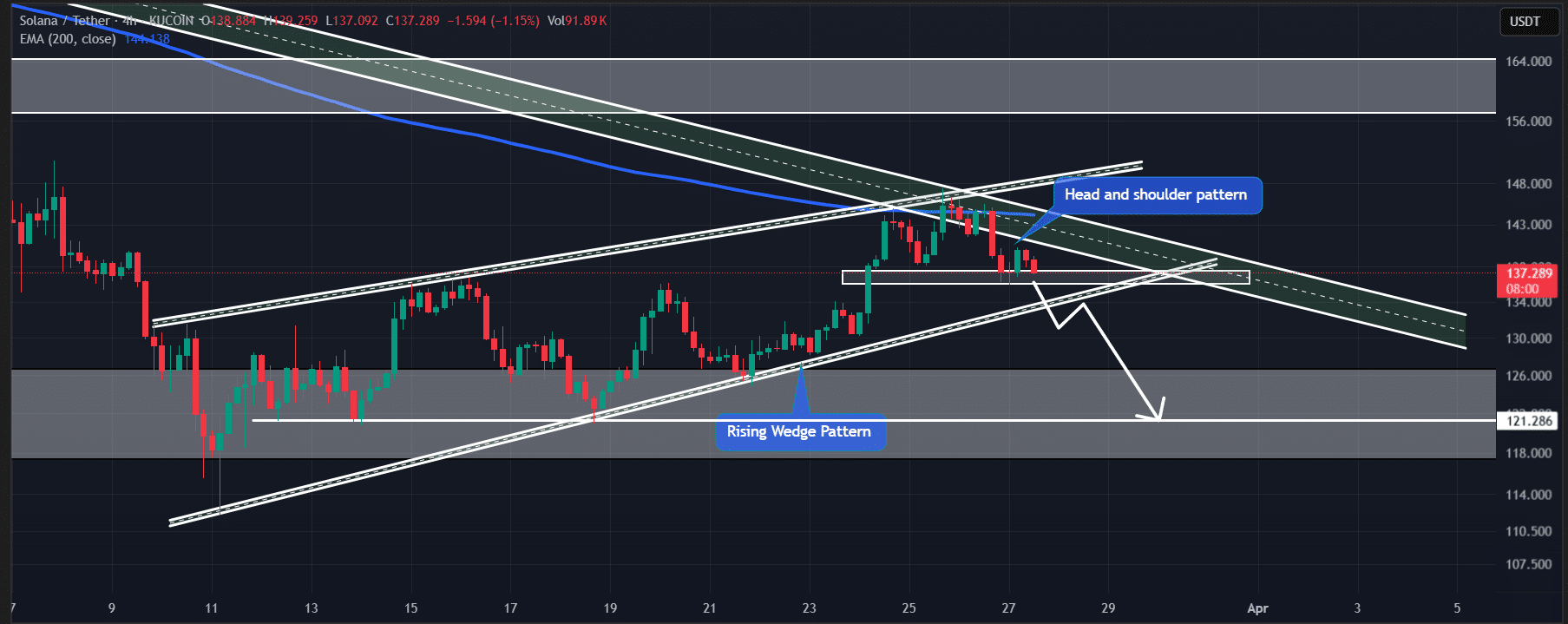

While the wider market is recovering, Solana has formed a bearish -falling wig pattern on the four -hour period, similar to Bitcoin [BTC].

Solana’s technical analysis and price promotion

At the time of the press, Sol traded near $ 137.5, reflection of a price decrease of 4.76% in the last 24 hours.

The trade volume fell by 10% during this period, which indicates reduced participation of the trader and investors compared to the previous day.

The price decline has brought Sol to the neckline of a bearish head and shoulder pattern on the four -hour period of time, located within a rising wedge, with $ 136 as the neckline.

The technical analysis of Ambcrypto suggests that if Sol closes a four -hour candle under $ 136, it could fall by 12%and reach $ 120 in the coming days.

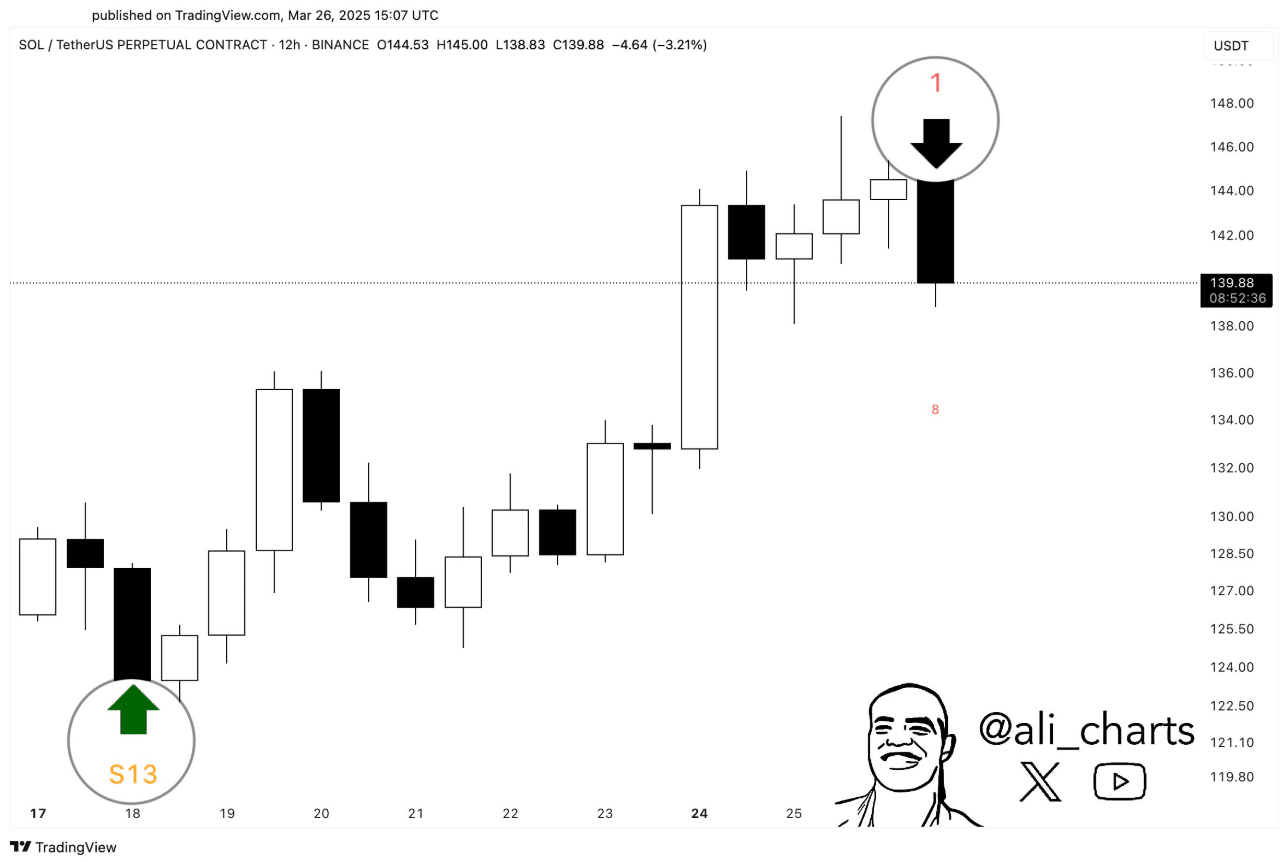

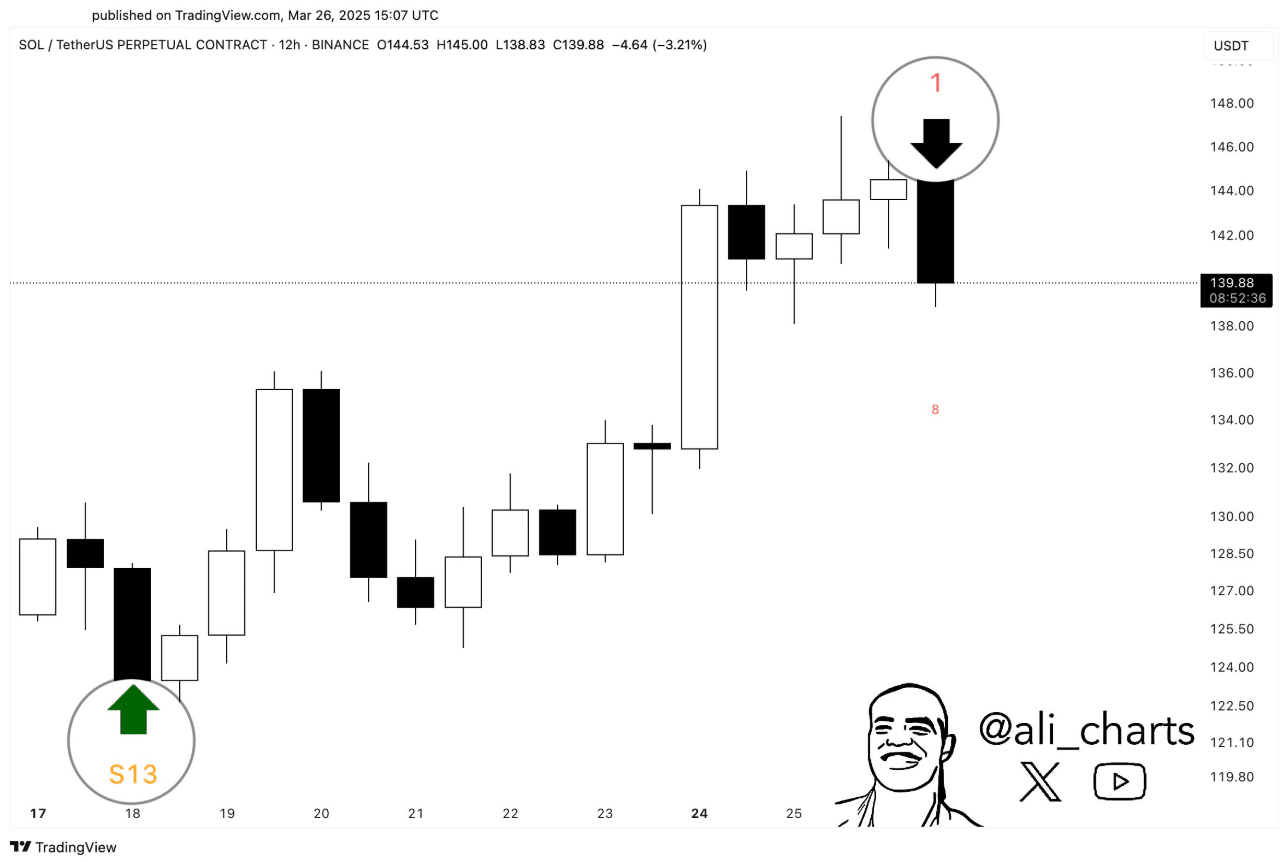

Source: TradingView

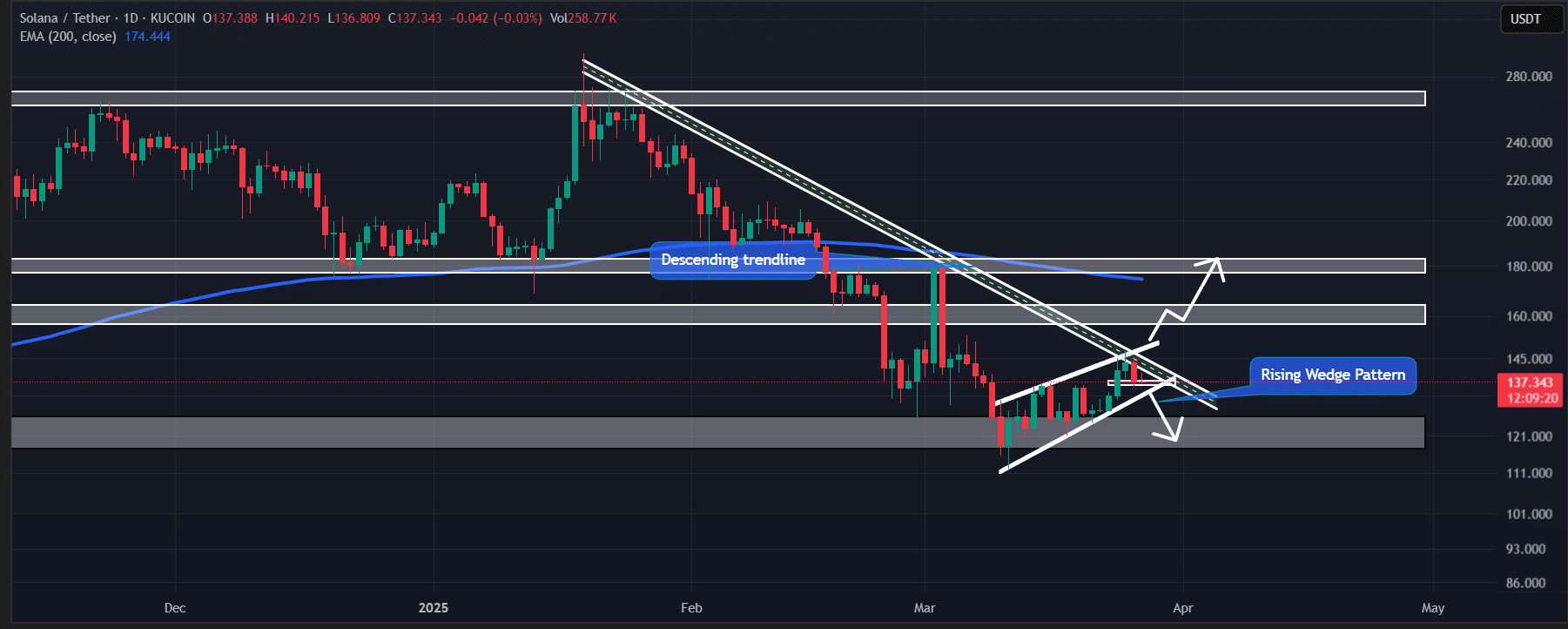

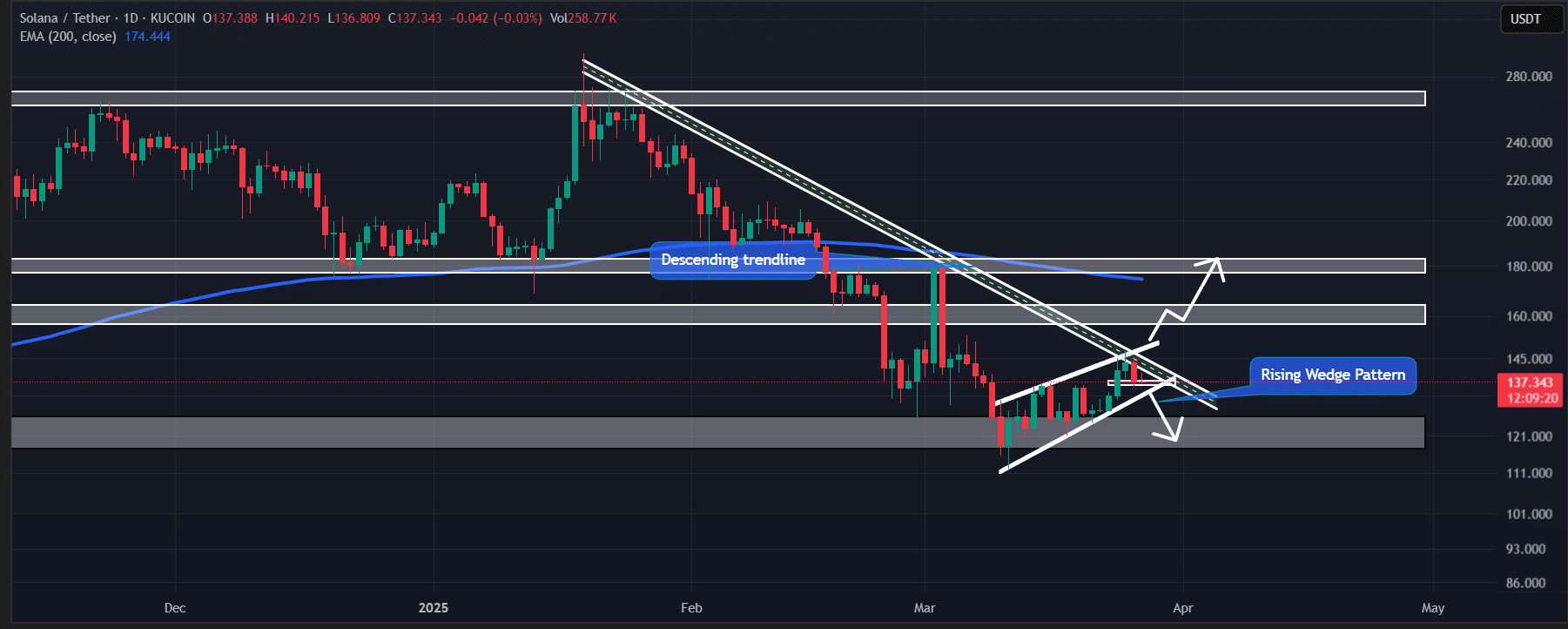

In addition to these bearish patterns, SOL has confronted with rejection of a falling trendline that has followed as a resistance level since January 2025.

This rejection, combined with the formation of a bearish -flooded candlestick pattern, reinforces the Beararish front views.

However, the bearish sentiment can change if Solana breaks the falling trendline and closes a daily candle above $ 147.50. If this happens, SOL might increase by 22% to reach $ 180 in the future.

Source: TradingView

Indicator blinking sales signal, says analyst

Has a remarkable crypto expert on X (formerly Twitter) strengthened The Bearish prospects for Solana.

Source: X

The expert emphasized that the TD -subsequent indicator, who previously signaled a buy for SOL’s 22% rally, is now showing a sales signal.

This raises questions about whether the price will continue to fall, or whether the indicator is only a signal.

Traders Bullish View for Solana

Intraday traders, however, seem to be contrary to the total market sentiment, because they bet strongly on the long side.

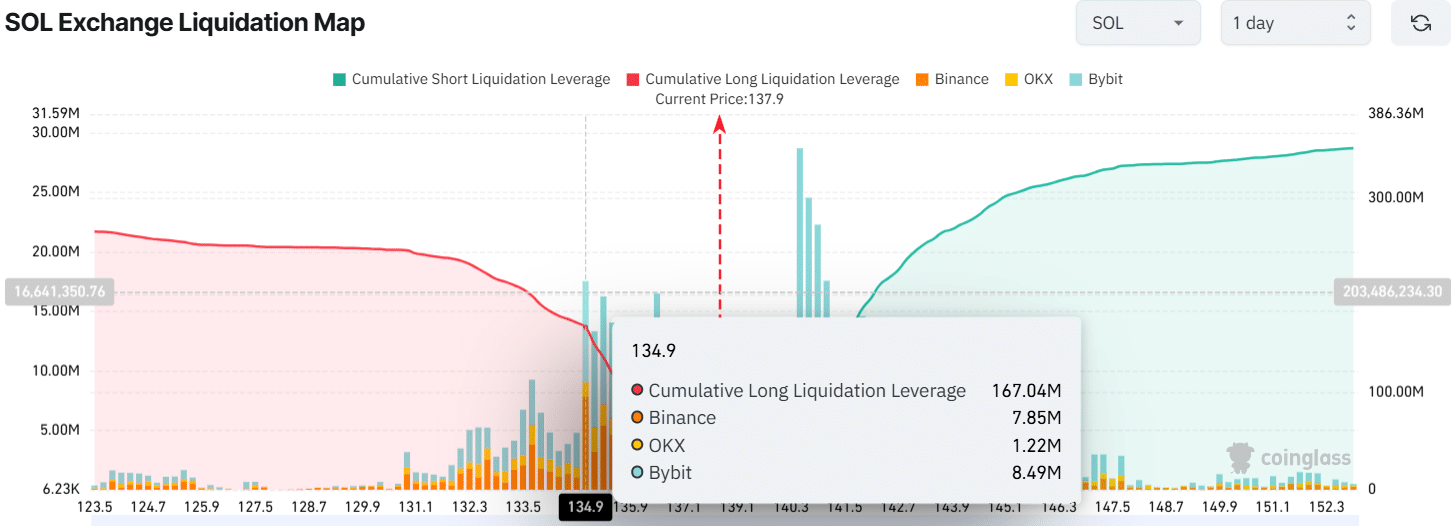

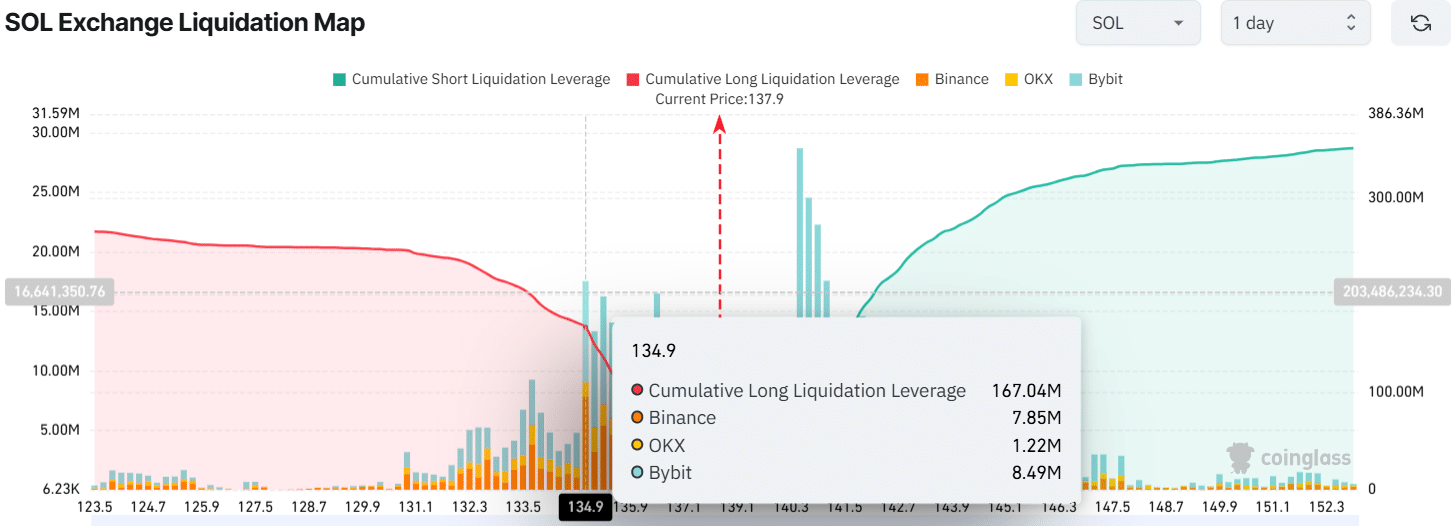

Data from the on-chain analysis company Coinglass has shown that traders are currently being used too much for $ 135 at the bottom, with $ 167 million in long positions.

In the meantime, $ 140 is another surplus level where intraday traders have built $ 83 million in short positions.

Source: Coinglass

This emphasizes that bulls are currently dominating despite the Bearish for views, so Sol does not fall any further.