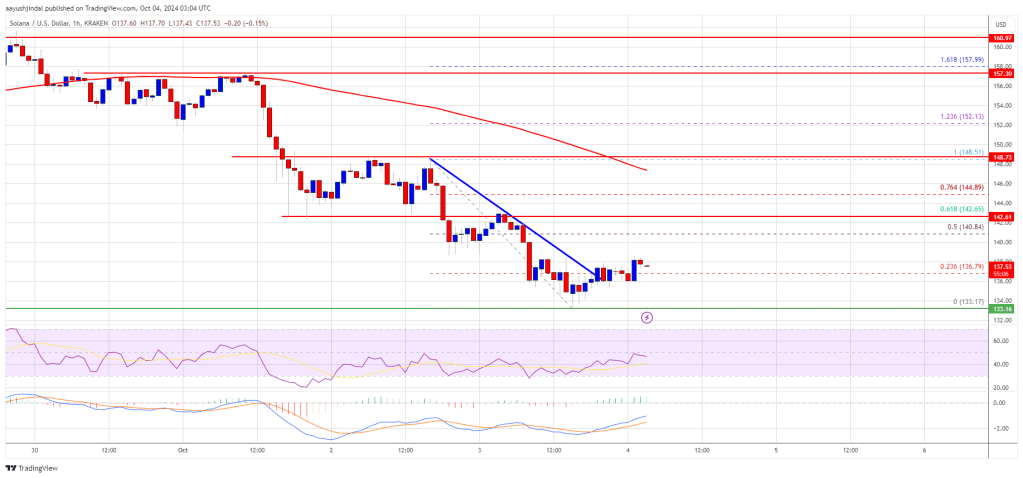

Solana cut gains and tested the $132 support. SOL price is consolidating and could aim for a fresh rise above the USD 140 resistance zone.

- The SOL price started a new decline below the $145 zone against the US dollar.

- The price is now trading near $142 and the 100-hour moving average.

- There was a break above a short-term bearish trendline with resistance at $136 on the hourly chart of the SOL/USD pair (Kraken data source).

- The pair could start a recovery wave if it remains above the $132 support zone.

Solana Price revisits $132

Solana price started a new decline through the USD 162 resistance, like Bitcoin and Ethereum. SOL fell below the USD 155 and USD 150 support levels. It even fell below $142.

However, the bulls were active above the USD 132 support. A low was formed at $133.17 and the price is now consolidating losses. There was a move above the USD 135 level. The price climbed above the 23.6% Fib retracement level of the recent decline from the $1482 swing high to the $133 low.

There was also a break above a bearish short-term trendline, with resistance at $136 on the hourly chart of the SOL/USD pair. Solana is now trading below $142 and the 100-hour moving average.

On the upside, the price is facing resistance around the $140 level. The next major resistance is around the $142 level. It is close to the 61.8% Fib retracement level of the recent decline from the $1482 swing high to the $133 low. The key resistance could be at $148.

A successful close above the USD 148 and USD 150 resistance levels could set the pace for another steady rise. The next major resistance is near USD 155. Any further gains could send the price towards the USD 162 level.

More disadvantages in SOL?

If SOL fails to rise above the $140 resistance, it could trigger another decline. The initial downside support is near the USD 135 level. The first major support is near the $132 level.

A break below the USD 132 level could send the price towards the USD 120 zone. If there is a close below the USD 120 support, the price could fall towards the USD 112 support in the near term.

Technical indicators

Hourly MACD – The MACD for SOL/USD is losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for SOL/USD is below the 50 level.

Major support levels – USD 135 and USD 132.

Major resistance levels – $140 and $148.