Solana (SOL), the world’s fourth-largest cryptocurrency by market cap, is on the verge of hitting an all-time high after breaking through a crucial resistance level.

Following pro-crypto candidate Donald Trump’s victory in the US presidential election, sentiment in the cryptocurrency landscape has shifted from a downtrend to an uptrend, leading to breakouts in Solana (SOL) and other cryptocurrencies.

Solana technical analysis and upcoming levels

According to CoinPedia’s technical analysis, SOL has experienced a significant price increase that has led to breaking a sloped resistance level that it has been facing since March 2024. Previously, whenever the asset’s price approached this level, it experienced selling pressure and a price drop.

However, with the sentiment changes and breaking this level, its breakout, there is now a high chance that SOL could rise significantly and reach its all-time high of $259.90 in the coming days. Currently, the asset is trading above the 200 Exponential Moving Average (EMA) on a daily time frame, indicating an uptrend.

In addition to this breakout, SOL’s upward rally could gain even more momentum if it closes a daily candle above the $205 level, unless it may take longer to reach its all-time high.

Bullish statistics in the chain

On-chain metrics further support this bullish outlook. According to the on the chain analysis firm Coinglass, SOL’s Long/Short ratio stands at 1.05 at the time of writing, indicating strong bullish sentiment among traders.

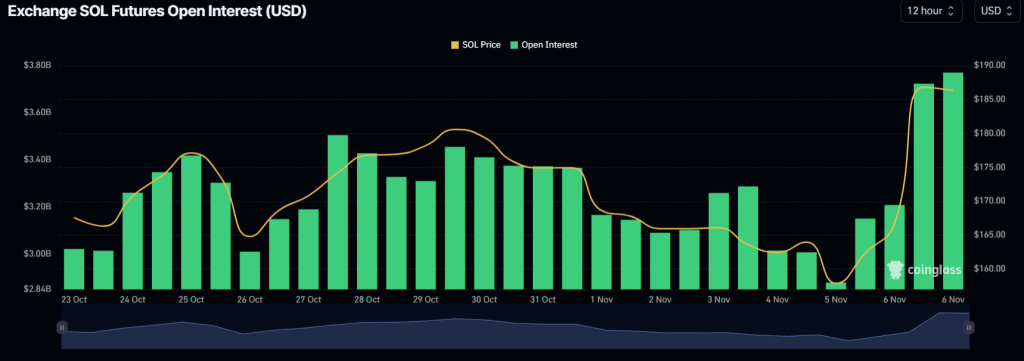

Additionally, SOL’s open interest has risen 18% over the past 24 hours, further indicating a bullish outlook. An increase in open interest indicates that derivatives traders are building new positions, anticipating a rally or a decline depending on market sentiment.

Combining on-chain metrics with the technical analysis, it appears that bulls are currently dominating the asset and could help SOL reach its all-time high in the coming days.

Current SOL price

Currently trading around $186, SOL has experienced a price increase of over 12% in the last 24 hours. During the same period, trading volume increased by 185%, indicating greater participation from traders and investors after the outbreak.