Solana (SOL), the world’s fourth largest cryptocurrency by market cap, is poised to hit its all-time high after a bullish price action pattern on the daily time frame. While other cryptocurrencies struggle to gain momentum, SOL has broken a crucial barrier and experienced an impressive price increase of over 6.6%.

Solana price analysis

Currently trading around $232, SOL has seen a trading volume increase of over 56% in the last 24 hours. This notable increase in volume indicates increased trader participation following SOL’s bullish price action.

This remarkable price rally and bullish outlook is not only driven by the price action, but is also supported by positive on-chain indicators and current market sentiment.

Solana technical analysis and upcoming levels

According to expert technical analysis, SOL has emerged from a strong consolidation zone that emerged after the price broke a significant resistance level at $200.

Based on historical price momentum, an asset trading within a narrow range after a breakout is considered a bullish sign. Whales and investors typically pile up during this period, resulting in parabolic moves at the next breakout. This time, however, whales and investors expect similar price momentum in the coming days.

With the breakout of the consolidation zone, there are high chances that SOL could reach the $270 level in the coming days and move even higher if sentiment remains unchanged.

Bullish data on the chain

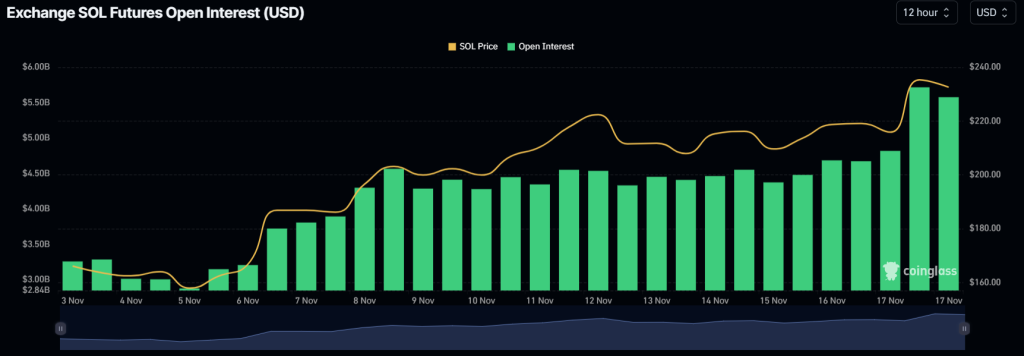

In addition to this technical analysis, the on-chain metrics further support the bullish outlook. According to on-chain analytics company Coinglass, SOLs open interest (OI) is up 21% over the past 24 hours, indicating greater trader participation amid the asset’s bullish momentum.

Meanwhile, SOL’s Long/Short ratio on Binance currently stands at 1.50, indicating strong bullish market sentiment among traders. According to the data, 60% of the top Binance traders currently have long positions, while 40% have short positions.

A combination of these on-chain metrics and technical analysis suggests that bulls are currently dominating the asset and could support SOL’s upcoming rally.