Macro guru Raoul Pal says Ethereum (ETH) rival Solana (SOL) isn’t done rallying yet, even after surging in recent weeks.

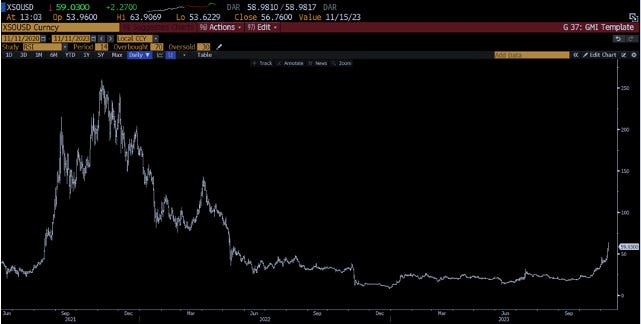

In a new edition of Pal’s Global Macro Investor (GMI) newsletter, the former Goldman Sachs executive say that Solana entered an uptrend after breaking a classic bullish pattern.

“SOL broke out of its inverse head-and-shoulders situation last month and is now up more than 475% year-to-date. This was one of our core transactions at GMI (Global Macro Investor) this year and it worked out very well.”

However, he warns that SOL is likely to bounce back after the sudden surge based on the relative strength index (RSI), a widely used momentum indicator that aims to determine whether an asset is overbought or oversold.

“In the short term, SOL is overbought with an RSI of 89 (the highest since September 2021), so we should expect some selling pressure soon. This shouldn’t surprise anyone: we’re up 240% in two months!”

Zooming out, Pal expects Solana to continue to rise based on SOL’s broader historical price pattern.

“But then you look at this [chart] and realize that it is all still to play for.”

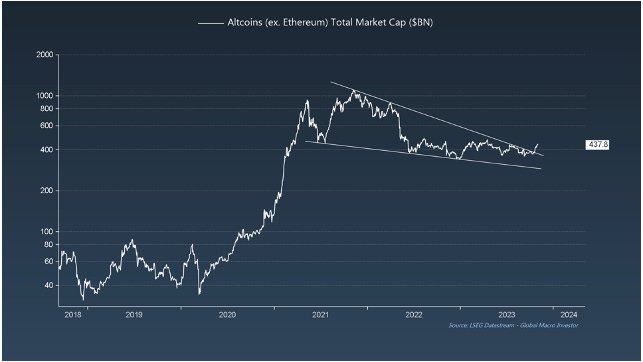

He also suggests that the overall market cap of Solana and other altcoins is in an uptrend after breaking a bullish falling wedge pattern.

‘And this graph too. Goddamnit.”

Solana is trading at $52.53 at the time of writing, down 6.3% in the last 24 hours.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Featured image: Shutterstock/Shacil/WhiteBarbie