- The 1-day market structure looked bearish.

- Solana’s performance against Ethereum and increased question were bullish signs.

Solana [SOL] Saw increased transaction activity in the chain and in the short term bullish impulse that produced prices above $ 120.

However, the presence of a strong food zone of around $ 140 meant that the bulls would have a tough task to initiate a real recovery in the long term.

The Solana Network exceeded the Ethereum [ETH] one on more fronts. The SOL/ETH pair made new highlights and Sol saw an increased influx compared to the Ethereum network, among other things. Could these factors be sufficient to stimulate a persistent price rally?

Increased purchasing pressure gives Sol Investors Hope

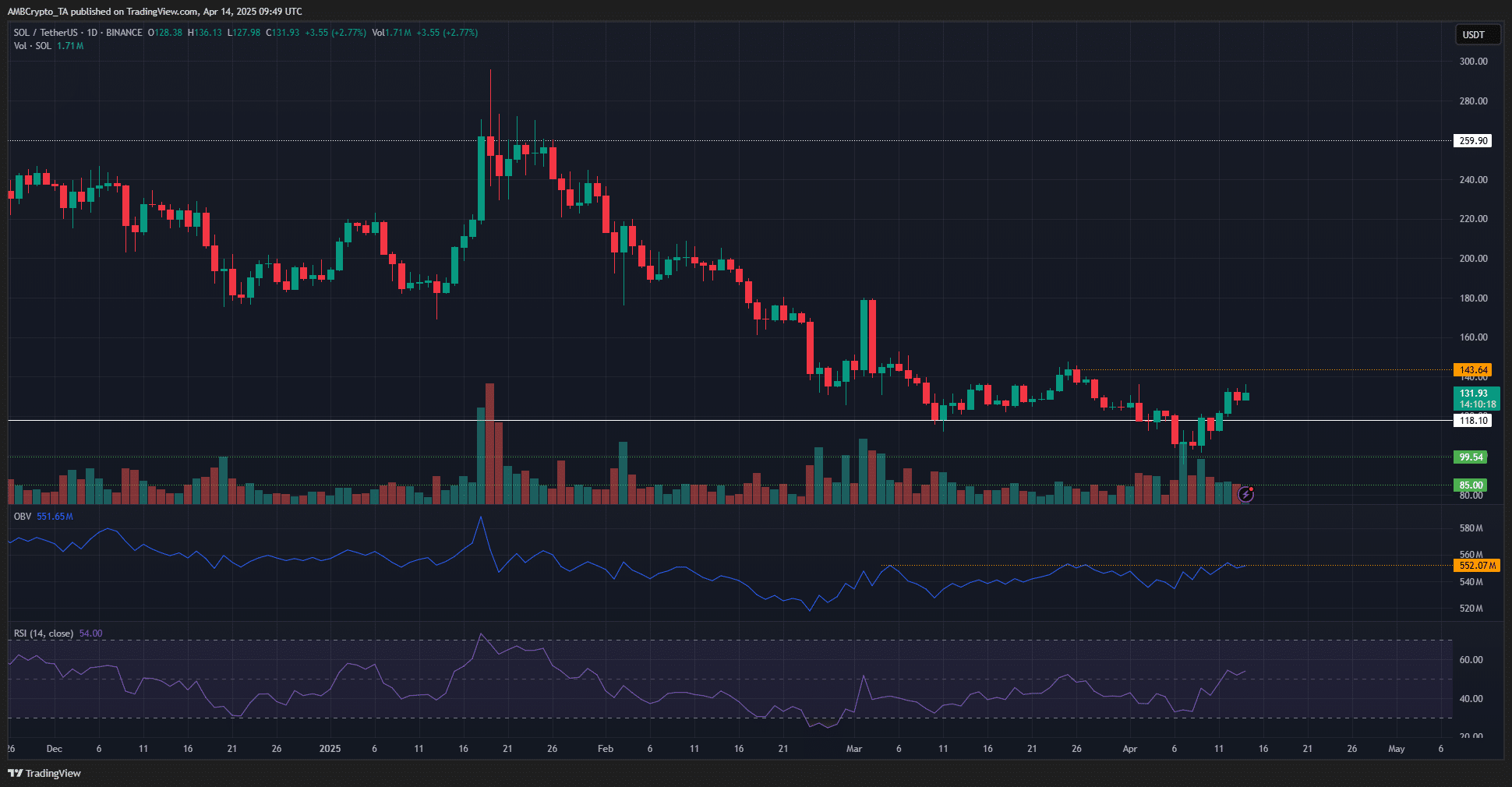

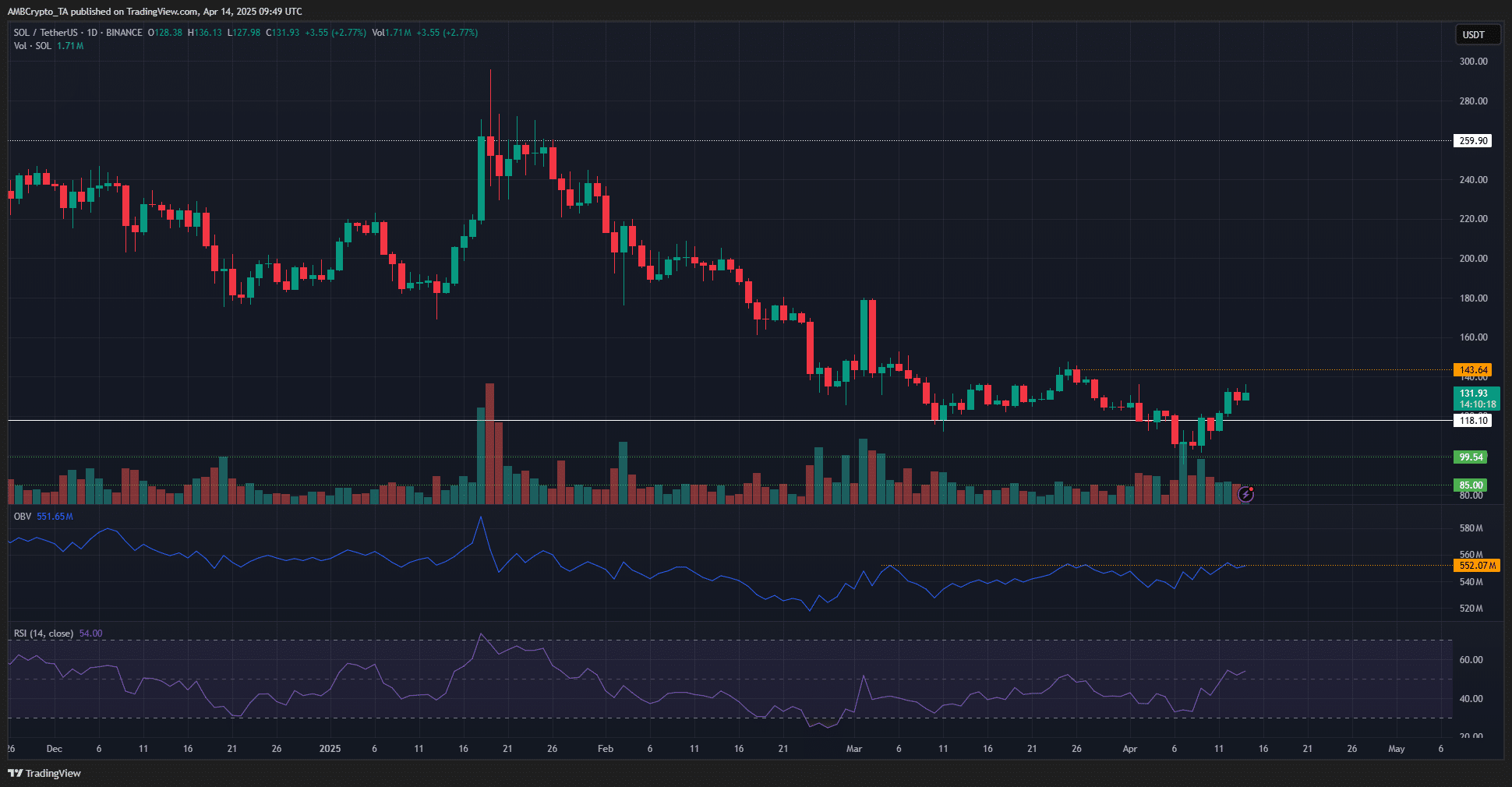

Source: SOL/USDT on TradingView

The level of $ 143 marked the lower high of the downward trend of the past three months. This was the level that had to be violated to turn the 1-day market structure bullishs. There were early signs that this outcome would be reached in the coming week or two.

The RSI climbed above neutral 50 to mark a bullish momentum shift. It was still early, but it had stayed over 50 for three days, the longest period since January. Moreover, the OBP challenged the highlights that came out at the beginning of March.

At the time, the price of Solana was around $ 180. That is why it indicated on rising purchasing pressure, which could propel the prices above $ 143. Until this is the case, traders and investors can remain careful.

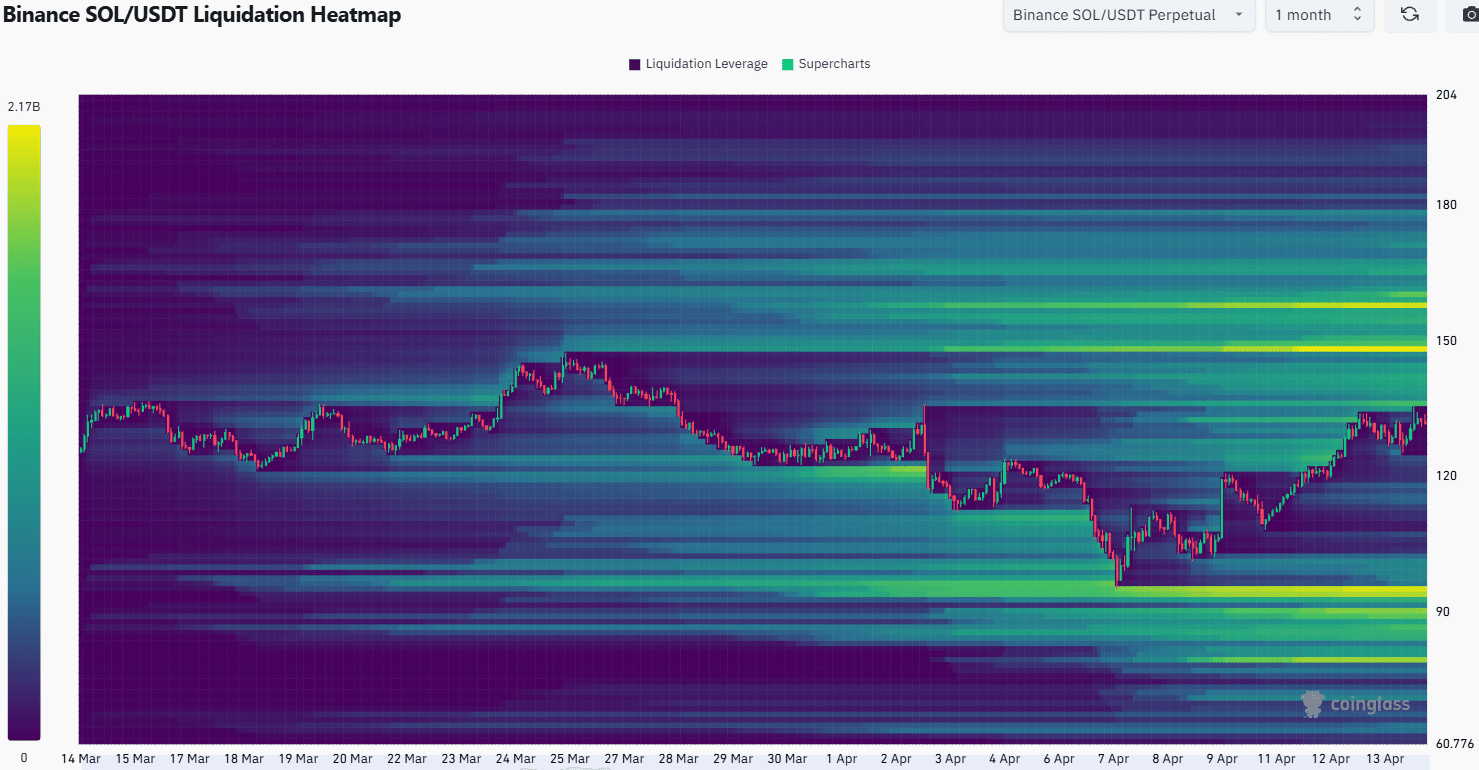

The liquidation heat jap, with a back period of 1 months, emphasized $ 150 and $ 158 as the most important magnetic zones in the neighborhood. These levels contain more than $ 2 billion in liquidations. The range of $ 136- $ 142 was also a significant liquidity cluster.

Further south, a remarkable liquidation bag was observed at $ 95. Because of its distance, it is unlikely that it is a price objective in the short term. Based on the heat and technical indicators, a movement to $ 150- $ 160 seems likely in the coming days.

Whether bulls can keep the level of $ 140 as support and maintaining their position remains uncertain.

Success at this level can indicate the start of a bullish trend, depending on a bitcoin [BTC] Recovery and positive sentiment in the wider crypto market.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer