Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Solana shows signs of strength while it pushes above a key resistance level, which suggests that bulls begin to get some control back after weeks of weakness. The wider cryptomarkt remains volatile, powered by continuous macro -economic uncertainty and increased trade stresses between the US and China. Despite these risks, the sentiment of investors seems to improve somewhat, which feeds the hope that Solana and other altcoins could enter into a recovery rally.

Related lecture

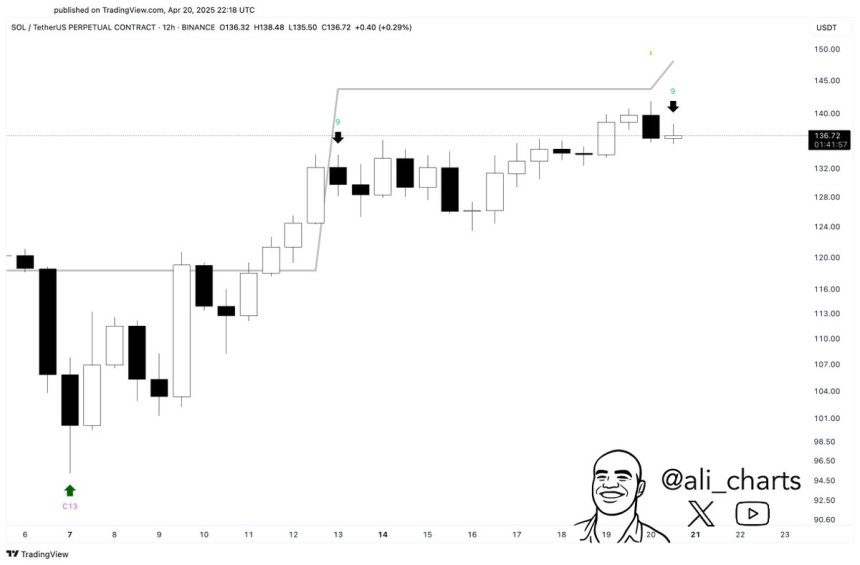

However, caution is justified. Top analyst Ali Martinez shared a technical signal that pays recent optimism-with his analysis of his analysis, Solana can be due to a short-term pullback. A sales signal is flashed on the 12-hour graph using the TD sequential indicator, which has marked historically local tops and price external phases.

Although the recent outbreak of Solana is encouraging, the presence of this bearish signal suggests that the rally can lose steam in the short term. Investors will keep a close eye on to see if SOL can keep support above the recovered levels or whether it withdraws under sales pressure. For now, the market is trapped between early signs of recovery and the always present risk of another leg down.

Solana is confronted with the most important resistance as the improval signal occurs in the short term

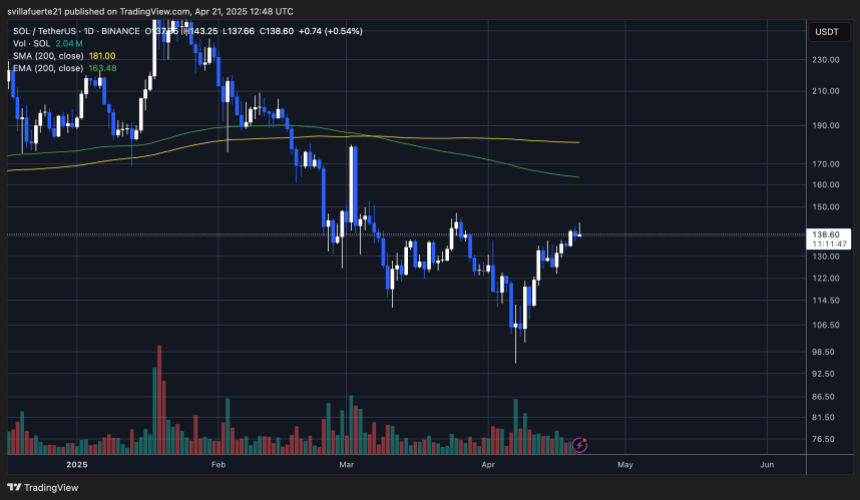

Solana has risen more than 48% since 7 April and signaled the renewed momentum after a long -term period of intense sales pressure. Bulls are now confronted with a critical test as the price approaches the level of $ 150 – an important resistance zone that has retained further progress in the past.

Despite the recent recovery, Solana remains one of the most affected assets during the downward trend of 2025, after he has lost more than 65% of his value since the January peak. This underlines the importance of the current movement and the importance of higher levels to confirm a real reversal.

Nevertheless, caution is justified. Martinez shared data about X Emphasizing a TD sequential sales signal on the 12-hour graph-one technical indicator that often precedes the exhaustion or reversations in the short term. The TD sequential works by identifying a series of price movements that can indicate Overbought or over -sold circumstances. If the signal takes place, Solana can be confronted with a temporary withdrawal before a long -term benefit continues.

Macro -economic factors remain in the game, with continuous trade tensions between the US and China that still shape sentiment on the global markets. However, the hope for a possible agreement between the two countries and the expansion of global liquidity gives Bulls some optimism, especially within the Altcoin sector.

Related lecture

Sol Price Hovers at Pivotal Zone: What is the following?

Solana (SOL) is currently trading at critical levels and tests the most important $ 150 resistance zone after a sharp recovery of recent lows. Bulls must reclaim and retain this level to confirm an outbreak and to validate the start of a persistent uptrend. A decisive movement above $ 150 would probably continue to buy Momentum, possibly lead to a retest of higher goals that have not been seen since the beginning of March.

However, if SOL does not break this barrier in the short term, a period of consolidation between the levels of $ 130 and $ 120 can still signal the strength. Holding this zone would suggest that bulls build a base for constant upward price action and absorbing the sales pressure without an important return. Such consolidation phases are often considered healthy in bullish market structures, so that sailing can be built before the next leg is higher.

Related lecture

On the other hand, it is not possible to maintain the support level of $ 120 Sol to deeper losses, with the $ 100 zone as the next important demand area. A break below this level would make the current bullish outlook invalid and possibly restore a wider downward trend. For now, all eyes are aimed at Sol’s reaction around $ 150.

Featured image of Dall-E, graph of TradingView