- Solana’s active addresses reached a record 75.2 million, highlighting growing adoption and interest.

- SOL faced resistance at $132 with bearish momentum as liquidation data reflected continued market volatility.

Solana [SOL] has reached a new milestone with 75.2 million monthly active addresses, an all-time high (ATH). This increase marked a substantial increase in user activity and adoption, demonstrating the growing popularity of the network.

Source:

The recent spike in activity highlights how Solana is attracting more and more developers, users and decentralized applications (dApps).

As the network continues to expand, the potential for further growth in adoption becomes apparent, especially with the launch of new features and updates in the coming months.

Exponential growth in user activity

The increase in the number of active addresses has been exponential since mid-2023, with the number of users skyrocketing in recent months.

This increase in user activity dwarfs previous peaks, highlighting the remarkable growth in Solana’s ecosystem.

The network has established itself as one of the most scalable platforms in the decentralized finance (DeFi) and non-fungible token (NFT) sectors.

Solana’s user growth is a testament to its ability to efficiently handle large transaction volumes, which is a key factor in its adoption.

With upcoming developments, this trend may continue as Solana looks to further solidify its position as a leader in the blockchain space.

Price outlook for Solana

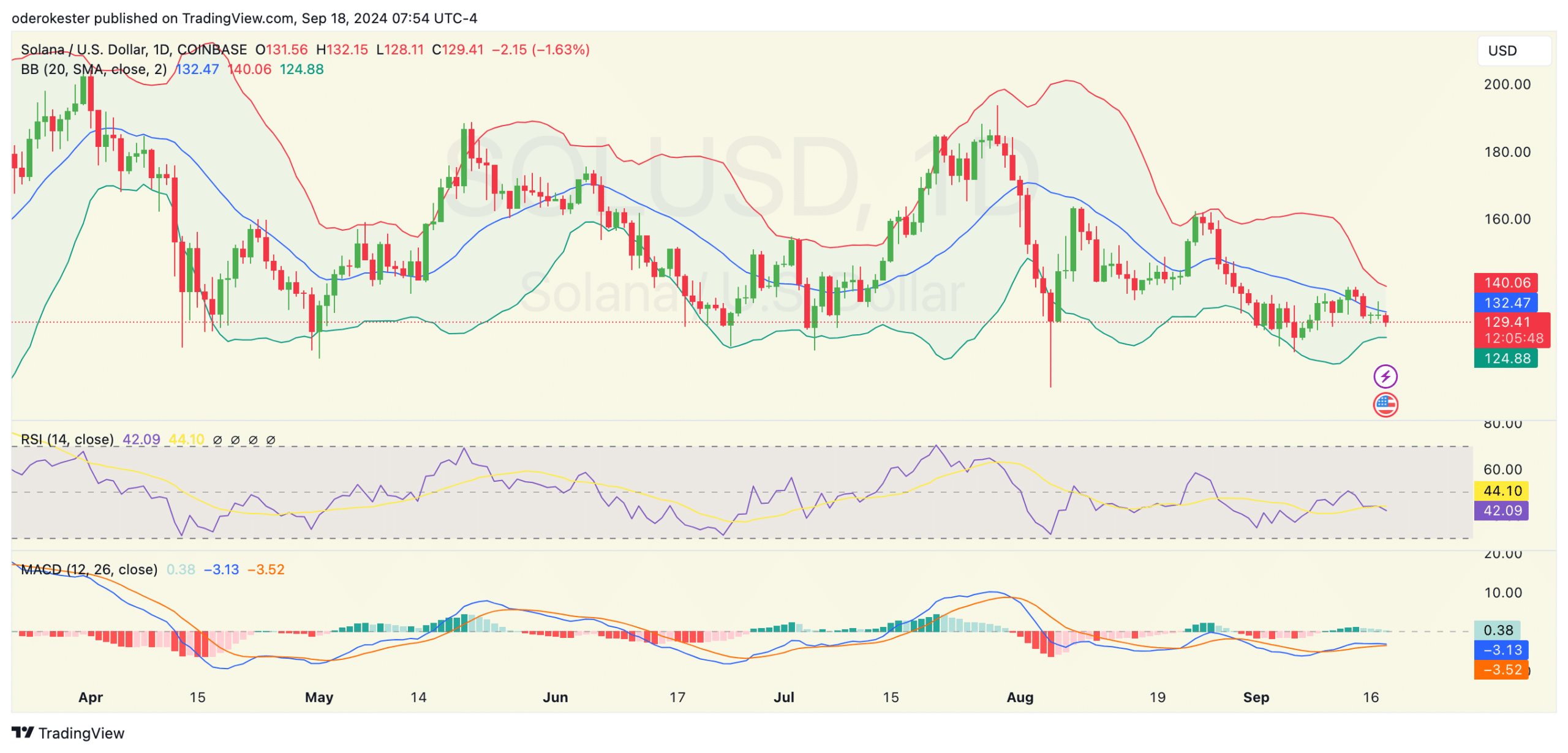

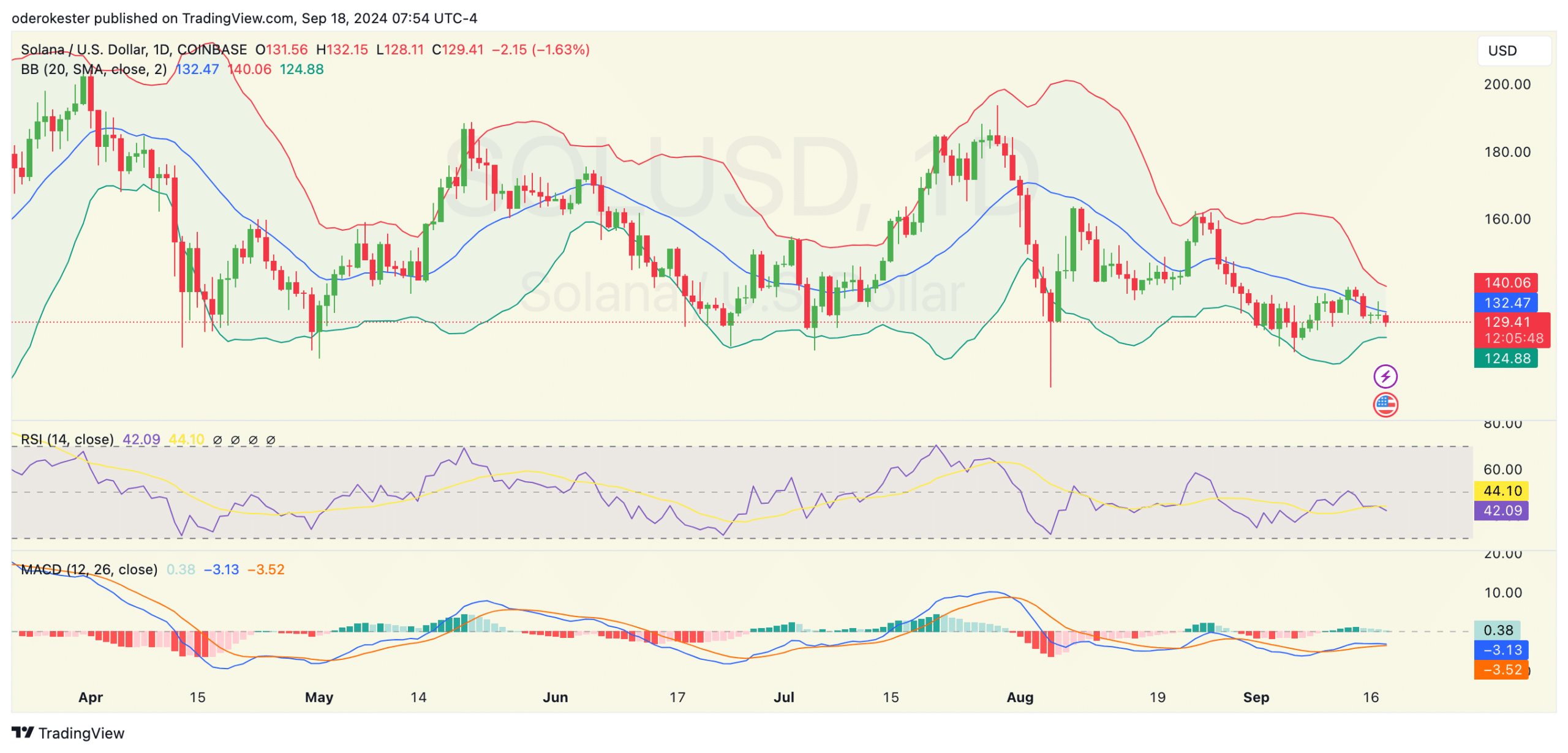

Solana’s price faced resistance around $132.47, with the Bollinger Bands narrowing, indicating a possible breakout in either direction.

Solana’s RSI stood at 42.07, showing weak momentum and hovering near oversold territory. This level indicated that bearish pressure could continue, but the price could see a reversal if buyers intervene.

Source: TradingView

Moreover, the MACD formed a bearish crossover, confirming the increasing selling momentum. If bearish sentiment continues, Solana could test the lower Bollinger Band at $124.88.

A break below could push the price towards the USD 120 support zone, while a reversal above USD 132.47 could lead to a test of the USD 140 resistance level.

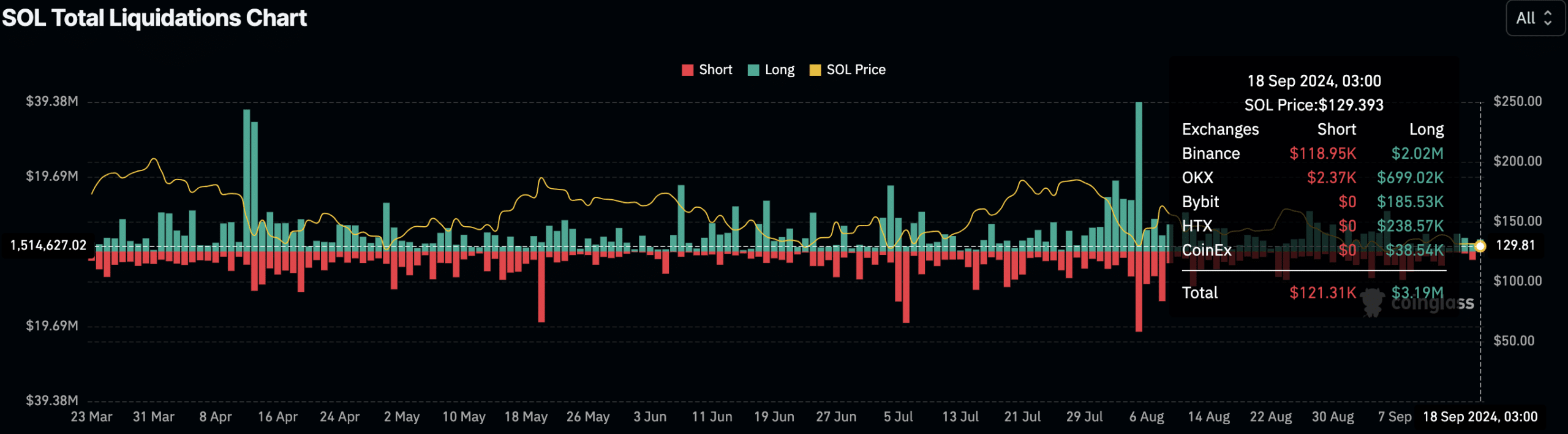

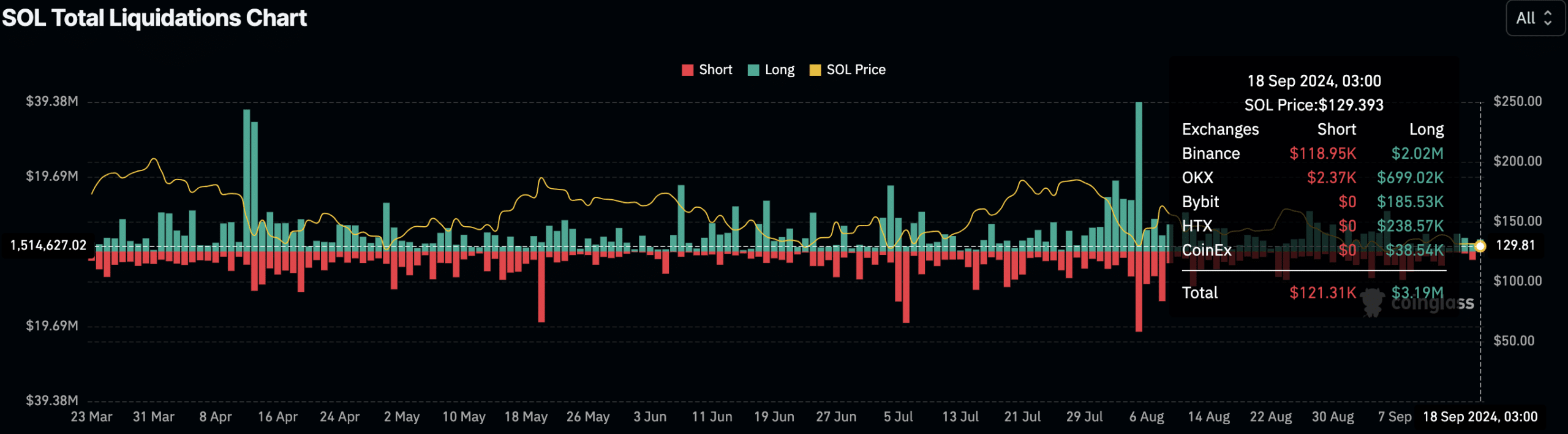

On September 18, Solana saw $121.31K in short liquidations and $3.19 million in long liquidations, indicating a more substantial impact on long positions.

Read Solana’s [SOL] Price forecast 2024–2025

Binance had the highest long liquidations, with $2.02 million, while $118.95K was liquidated for shorts. This data reflected increased volatility in the Solana market, which contributed to price fluctuations.

Source: Coinglass

Solana’s price at the time of liquidation was $129.39, demonstrating the impact of leveraged trades in today’s market. Traders should remain cautious as liquidation data points to continued volatility in the stock markets.