Crypto analyst Jacob Canfield has put together a comprehensive analysis showing that Solana (SOL) could be on the cusp of an unprecedented market surge. “In my opinion, I think Solana will continue to be one of the biggest drivers during this current bull market cycle,” says Canfield, suggesting Solana could potentially escalate its market dominance to the 12-15% range.

Can Solana reach $1,000?

Canfield bases his analysis on various indicators. He highlights the Solana Dominance (SOL.D) chart, noting that it didn’t even crack 3% at its highest market cap. Given current trends and SOLBTC’s breakout from its weekly resistance, Canfield foresees a scenario where Solana could enter a parabolic rally phase, which is further supported by the SOLETH chart showing a similar pattern. “SOLETH – Has also currently broken through a weekly resistance and appears to be forming a parabolic rally against it.”

A key factor in Canfield’s analysis is the current state of Ethereum Dominance (ETH.D). He notes that ETH.D is breaking off a long-term trendline and losing the 200 weekly moving average, which is now at 17%. “If Solana continues to develop against Ethereum and continues to decline to 2019-2020 levels, we could see SOL as the big winner of this cycle,” Canfield explains.

However, Canfield is not ignoring the potential consequences of recent news about an Ethereum ETF. “This may not fit into the current ETF announcement news as it will attract more attention,” he acknowledges, indicating that an approved Ethereum ETF could shift investors’ focus and capital back to Ethereum, fueling the rise of Solana could possibly dampen.

Despite potential headwinds from the Ethereum sector, Canfield highlights Solana’s robust partnerships with corporate giants such as Google, Circle and Amazon, stating that these collaborations can significantly drive adoption and increase Solana’s visibility in this crypto market cycle.

Furthermore, Canfield’s analysis goes beyond charts and partnerships. He delves into the Solana ecosystem and highlights projects that are paving the way for its expansion. From decentralized financial protocols and automated market makers to NFT storage solutions and governance tokens for gaming platforms, Canfield points to a range of innovation within Solana that parallels and in some ways aims to surpass Ethereum’s ecosystem.

In light of the FTX debacle, Canfield notes the psychological impact on Solana’s market sentiment, noting that with Sam Bankman-Fried’s legal troubles, there is an opportunity for Solana to redefine itself. “There is a bit of PTSD around the ecosystem, but it is time to become its own entity and forge its own future,” he states, suggesting that Solana’s future will be shaped by those who are deeply integrated in the ecosystem, from developers to traders and influencers.

His conclusion: “Solana could triple or quadruple her highest market dominance ever, around 12-15%, and if the trend against Bitcoin continues, she could easily see $1,000 per coin and take second place behind Bitcoin. ” When asked about Ethereum’s potential, Canfield emphasized: “There is no reason not to have allocations to both. It’s like trying to bet on Microsoft or Google. Tesla or Ford: just buy both.”

Short-term SOL price outlook

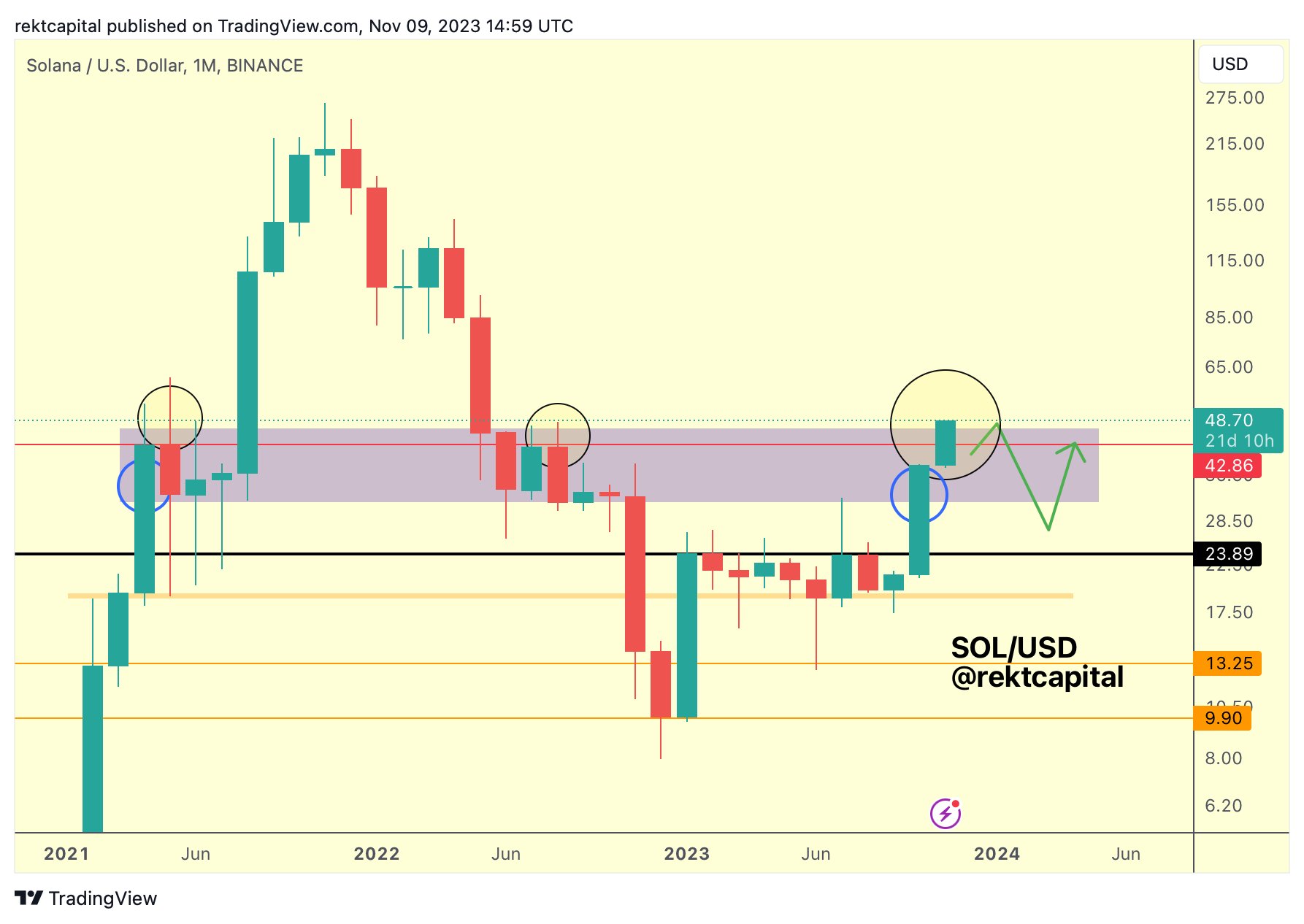

In the shorter term, analyst Rekt Capital recently drew attention to Solana’s price movements after about X. “Solana continues to outperform on the market. In 2021, the SOL upside diverged to $53 and then $61 before returning to the bottom of the purple box,” he noted, referring to a specific zone on the price chart that has historically functioned as both resistance and support.

In the Rekt Capital chart, SOL is currently breaking above the zone. However, if history repeats itself and the zone acts as strong resistance again, SOL price could experience a serious pullback. Using the green arrow in the chart, Rekt Capital sketches a scenario in which SOL initially falls back towards $30 before the price rises again towards $42.

Featured image of ABCC Exchange chart from TradingView.com