- Solana rose 58.75% to convert Binance Coin in market cap and could next target XRP

- XRP has faced stagnant price trends and mixed signals across the chain

Solanas [SOL] Its impressive performance in recent months has attracted attention in the crypto world, marking a notable shift in the rankings of the best digital assets. We start the new year with a milestone, Solana flipped the Binance Coin [BNB], strengthening its position as an important player in the market.

This rapid rise has led to discussions about whether Solana’s momentum could continue, potentially allowing it to surpass XRP and climb even higher in the rankings.

Solana Outpaces XRP – A Closer Look

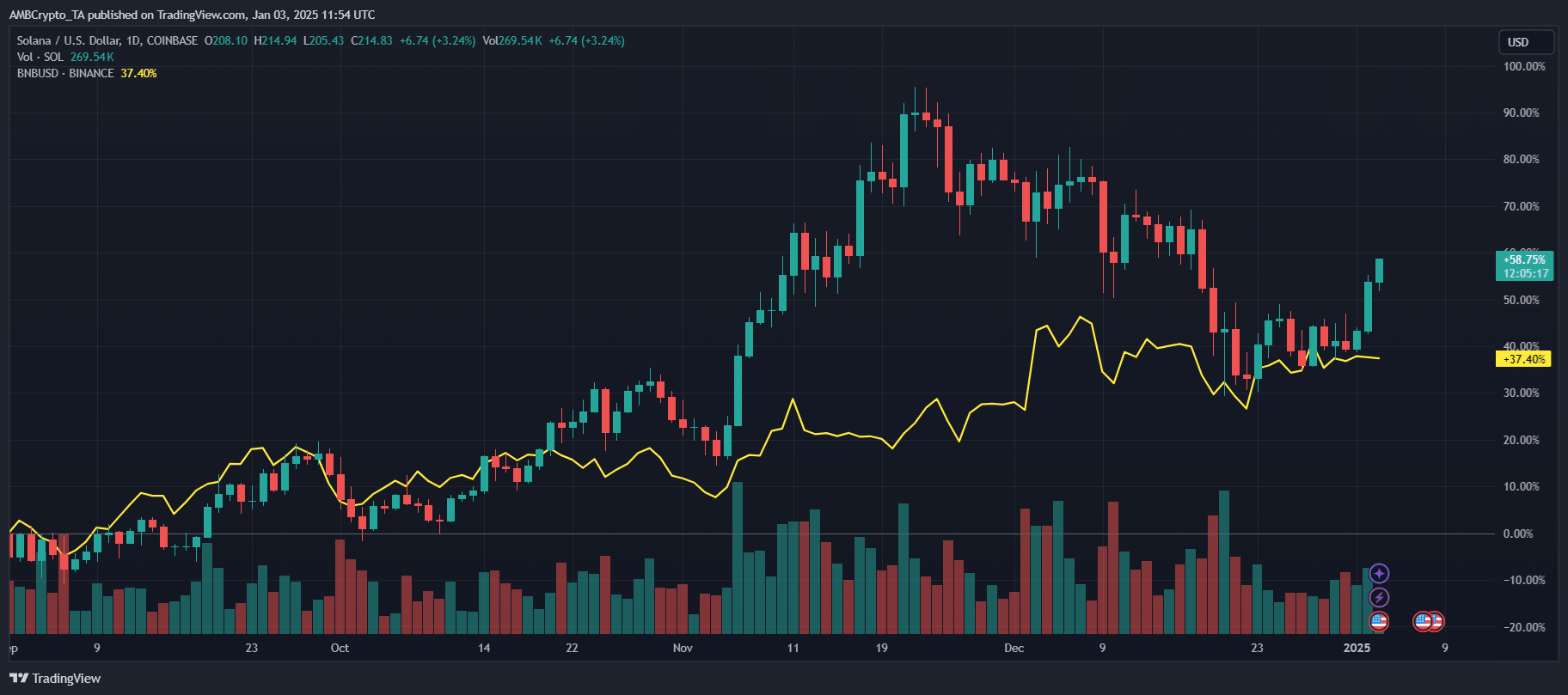

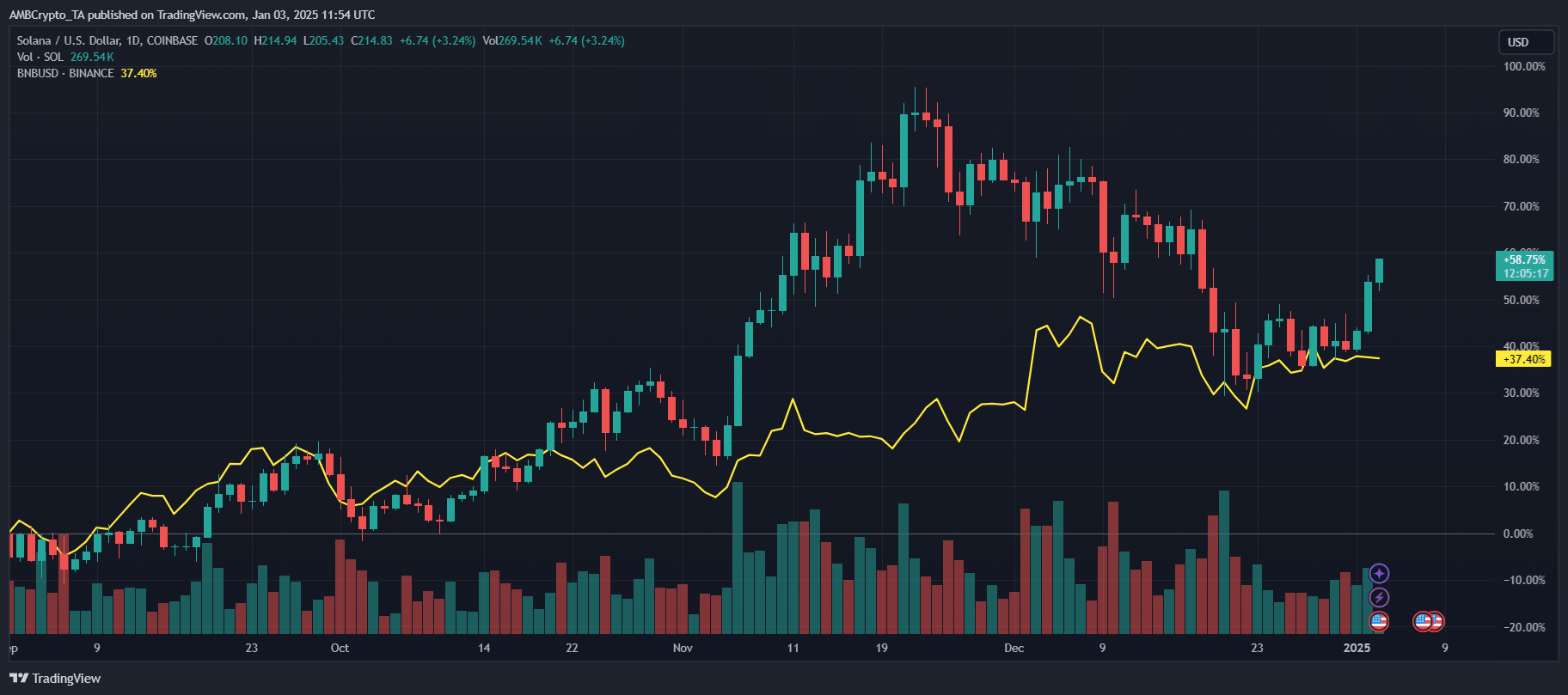

Solana has continued to turn heads with a sharp increase of 58.75% in recent weeks, showing a steady recovery and a strong uptrend as shown in the daily price chart. This performance strengthened its position above Binance Coin in terms of market capitalization, raising the possibility of a similar challenge against XRP.

Source: TradingView

On the contrary, XRP’s price action has remained relatively subdued. While XRP had moments of strength, its growth trajectory was overshadowed by Solana’s consistent bullish momentum. SOL’s ability to maintain higher trading volumes and investor interest is a sign of stronger fundamentals or market sentiment.

As SOL gets closer to XRP’s market cap, the difference in their respective price trends could indicate a broader shift in investor preferences. Particularly in the field of assets with high scalability and ecosystem development.

Statistics show mixed signals amid price stagnation

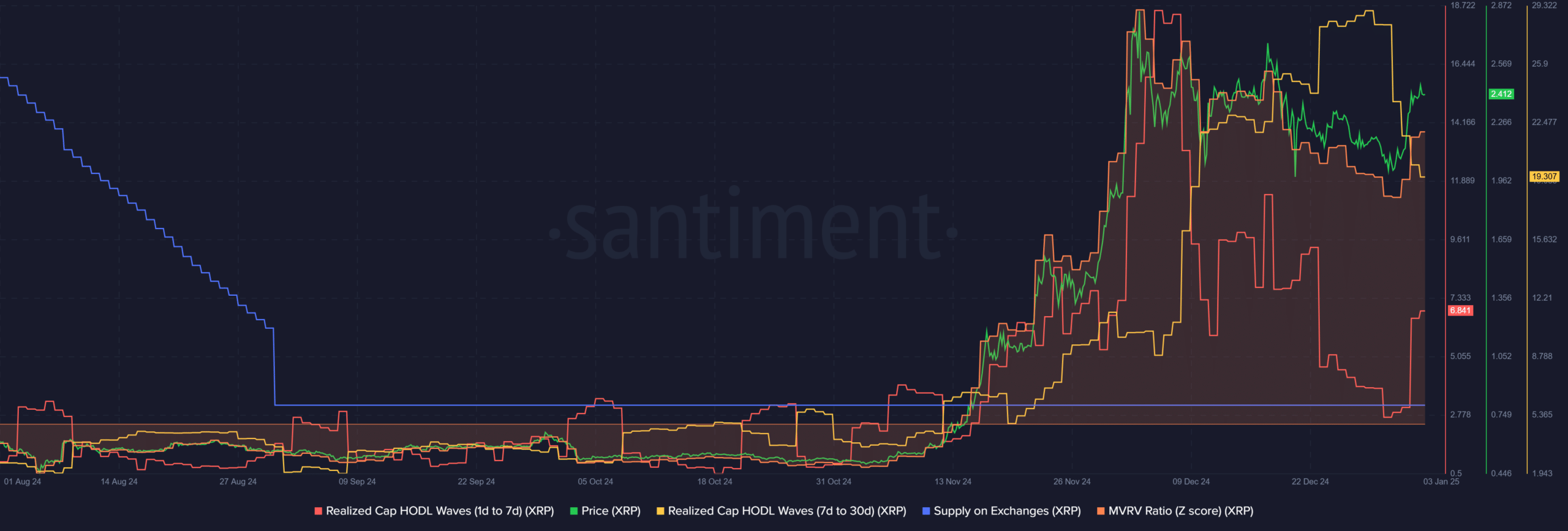

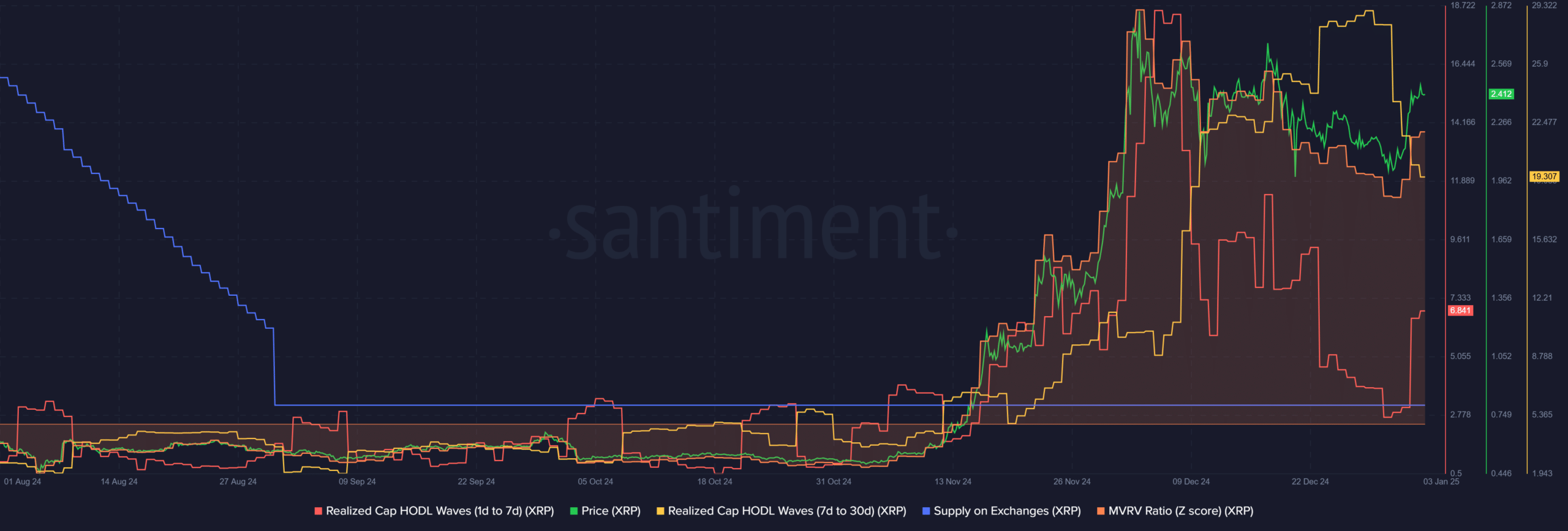

The chart highlighted XRP’s stagnant price movement against fluctuating on-chain metrics.

For example, the Realized Cap HODL Waves showed a significant decline in the number of short-term holders, indicating that speculative trading activity has decreased. Meanwhile, medium-term holders saw modest accumulation, suggesting there is some confidence in holding XRP despite limited price momentum.

Source: Santiment

Supply on exchanges has also remained high, due to potential selling pressure or hesitation among investors to remove tokens from trading platforms. Furthermore, the MVRV Z-Score, which evaluates overvaluation or undervaluation, appeared to be in a neutral zone, indicating a lack of overriding sentiment in the market.

These statistics together painted a picture of a market in limbo for XRP, with no clear bullish or bearish signals. In contrast, Solana’s more favorable on-chain data and price performance could give the company an edge in its potential market capitalization of XRP.

Read Solana’s [SOL] Price forecast 2025–2026

Can SOL flip XRP?

SOL’s consistent price recovery, robust trading volumes, and positive on-chain metrics reflected a market sentiment that was heavily tilted in its favor. Meanwhile, XRP could face headwinds from stagnant price action and mixed signals across the chain, including increased exchange supply and declining activity among short-term holders.

The outcome of this battle may depend on broader market trends, ecosystem developments and investor sentiment. If Solana can continue its upward trajectory and capitalize on its scalability and network activity, an XRP reversal could be on the horizon.