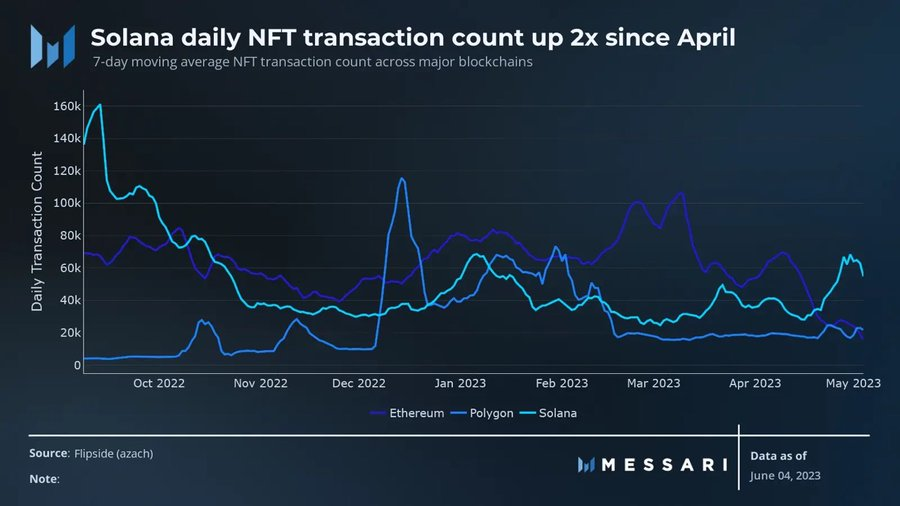

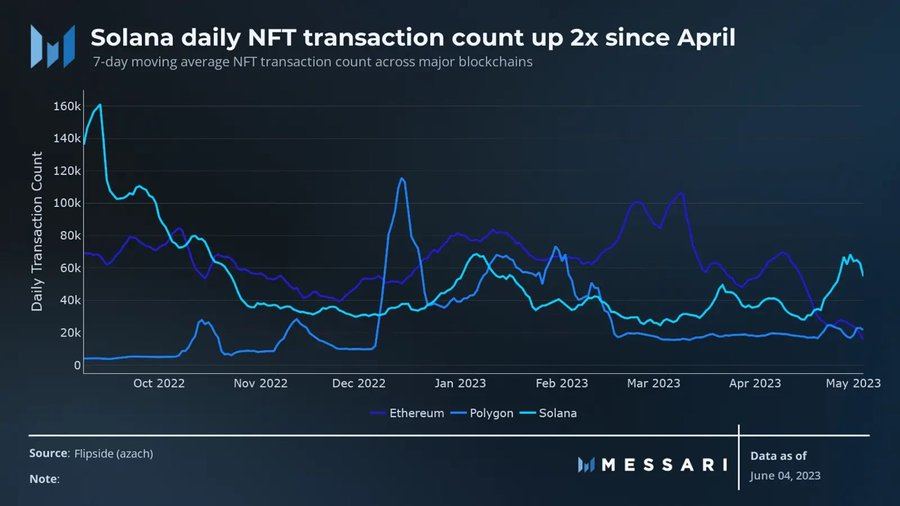

Crypto research and analytics platform Messari shared a post on Twitter earlier today stating that Solana (SOL) has experienced a notable increase in its daily NFT trades. Solana’s NFT trades alone have doubled in the past 30 days, according to the post.

Solana daily number of NFT transactions (Source: Twitter)

Messari added in the post that Solana’s NFT success can be attributed to increased activity with consumer apps. As a result, Solana was even able to surpass both Ethereum (ETH) and Polygon (MATIC) in terms of NFT transaction volume.

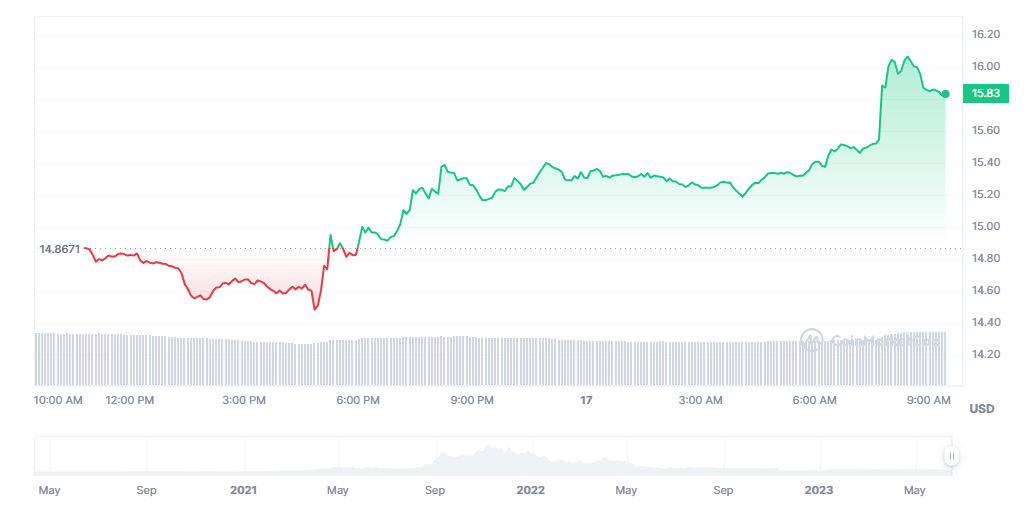

Solana’s success in the NFT space was accompanied by a decent increase in the price of the altcoin over the past 24 hours of trading. Crypto market tracking platform CoinMarketCap indicated that SOL was trading at $15.85 after the crypto saw a price increase of more than 6% over the past day.

SOL price (Source: CoinMarketCap)

This price increase was enough to push SOL’s weekly price performance even further into the green, despite a rough week in the market. At the time of writing, SOL was up around 13.07% over the past seven days.

It is also worth noting that the price of SOL was still able to rise despite New York-based digital asset platform Bakkt deciding to delist SOL, MATIC and ADA. This came in response to regulatory uncertainty and recent SEC lawsuits against multiple crypto exchanges.

In related news, SOL was unable to regain the No. 9 spot on CoinMarketCap’s largest crypto projects in terms of market cap. The Ethereum killer lost the spot to TRON (TRX) last week. However, there is still a chance that SOL is able to reclaim the position from TRX in the coming weeks.

At the time of writing, SOL’s market capitalization was estimated at approximately $6.137 billion. Meanwhile, TRX’s market cap was around $6.406 billion. The margin between the two market caps has narrowed over the past 24 hours as TRX was only able to print a 1.62% gain over the past 24 hours.

disclaimer: The views and opinions, as well as all information shared in this price analysis, are published in good faith. Readers should do their own research and due diligence. Any action taken by the reader is strictly at your own risk. Coin Edition and its affiliates cannot be held liable for any direct or indirect damage or loss.