Key learning points

- Solana made some big announcements on Breakpoint this weekend, but SOL was unresponsive.

- Solana has faced many challenges during the crypto winter, including continued outages and a decline in DeFi activity.

- While Solana has challenges to overcome and competition to face, it remains one of crypto’s strongest and most promising ecosystems.

share this article

Solana is one of many Layer 1 networks that have suffered from the ongoing crypto winter. But sunny skies may return, writes Chris Williams.

Solana impresses Breakpoint

It was a big weekend for Solana as the Layer 1 network hosted the 2022 edition of its Breakpoint conference. As for SOL? Not so much.

The thousands of Solana fans who flocked to Lisbon for the Layer 1 blockchain flagship event were treated to several major announcements during the conference. Arguably the biggest came Saturday when Google Cloud revealed that it was running a Solana validator and would start indexing Solana data through its BigQuery product in early 2023. Google Cloud will also make Solana available through its Blockchain Node Engine to help users run their own nodes in the cloud. Per CoinGecko Data, SOL immediately jumped double digits past $38 when the announcement was made, but the momentum didn’t last long. It has since cooled 5.5% and is trading around USD 34 today.

In a different approach to other blockchains like Ethereum, the various engineers working in the Solana ecosystem have focused on building products for the mass market. An example of such a product is the Saga phone, which aims to become the world’s first Web3-ready smartphone. Solana announced on Breakpoint that it would ship the product to developers next month.

USDC issuer Circle also appeared on Breakpoint, to announce that it would make its Euro Coin offering available on Solana in the first half of 2023. Euro Coin is already live on Ethereum. Circle also revealed that the forthcoming cross-chain protocol would support Solana.

Arguably GameFi’s most anticipated title, Star Atlas developers shared an early demo for the game over on Breakpoint. Solana’s high-speed capabilities (it claims to process 65,000 transactions per second) could make it a prime contender for the Web3 gaming space, but with no leading titles currently available to play, it’s unclear how much progress teams have made – and whether Solana becomes a hub for the niche. Games typically take years to develop, so Solana’s GameFi ecosystem may take some time to pick up.

The State of Solana DeFi

Like much of the crypto space, Solana has had a rocky year, not least in its DeFi ecosystem.

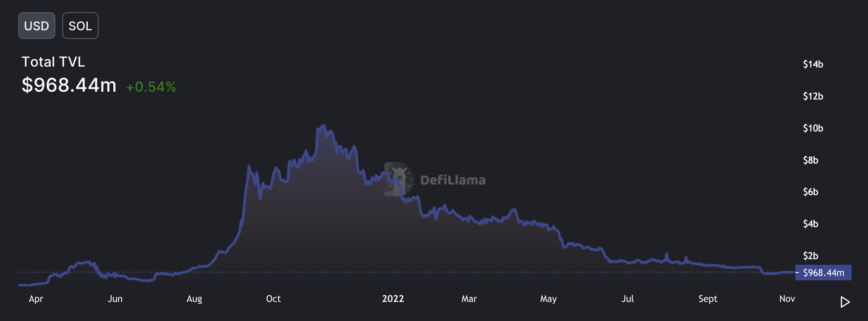

Solana reached over $10 billion in total locked value as SOL approached nearly $260 in November 2021, around the time of Breakpoint’s inaugural edition.

However, Solana DeFi has taken a beating this year thanks to crashing market prices, liquidity fleeing to other networks, and relentless token unlocking schemes diluting the value of some of the stars of the 2021 ecosystem. According to Defi Llama dataToday, the total value locked on Solana is about $968 million, which is slightly less than Avalanche’s $1.31 billion and a fraction of Ethereum’s $32.29 billion. If the numbers don’t change dramatically in the future, Solana may find it thrives in other areas. However, it is also worth noting that total locked value has remained more stable in SOL terms this year, down about 54% from its peak in June 2022 to about 31.3 million SOL.

Notably, Solana now follows the Ethereum Layer 2 network Arbitrum in terms of total value locking, and is only slightly ahead of Optimism. If Layer 2 continues to grow at its current rate, Solana could find itself not just competing with other Layer 1 networks for liquidity.

Both the Mango Markets and Solend exploits were possible because of the low levels of liquidity on their platforms, making it easier for whales to manipulate their markets to take out large loans. While Solana protocols come up with solutions to such problems, the network’s DeFi ecosystem may continue to experience problems as long as liquidity is low.

While Solana DeFi is down, by far the biggest criticism of the network is its repeated outages. Solana has experienced several hours of downtime over the last two years, most notably in September 2021 when it went down for 18 hours. Solana was hit by four major outages in 2022, with the most recent downtime occurring last month due to a misconfigured node.

While outages have been a persistent problem for the network, said Anatoly Yakovenko, CEO of Solana Labs said that an upcoming upgrade will prevent such incidents in the future. If Solana can overcome the problem, as he promises, the network should be in a much better position against the next crypto market boom.

Take advantage of high speeds and low costs

While Solana DeFi may be in a slump, the same cannot be said for the network’s NFT ecosystem.

With the second largest NFT ecosystem behind Ethereum, Solana has built a fast-growing community of so-called “JPEG enthusiasts”. This year, collections like DeGods and y00ts have taken the NFT scene by storm, trading for thousands of dollars on the secondary market despite adverse market conditions.

Solana has also attracted many big names from the digital art world. At Breakpoint, Metaplex announced that it would launch “immersive 3D NFTs” from Beeple on Solana, with notable branching from Ethereum. pplpleasr, another leading artist in the NFT space, has also previously launched Solana NFTs. Where much of the mainstream focus on non-fungible digital collectibles has been on Ethereum, NFT residents have seen activity grow on the strongest competitor’s network. The next NFT bull cycle could look different than the previous ones now that Solana’s NFT community and infrastructure have gained so much momentum in the bear market.

Solana also seems to be aware of its position in the GameFi world due to its fast, cheap capabilities. Breakpoint devoted an entire day to the bustling industry, where Star Atlas and other teams showed off their latest progress to a packed room of would-be Web3 gamers.

What’s next for Solana?

While the network has challenges to overcome, it is obvious that many positive developments are coming from the network. The various announcements made on Breakpoint prove that talented companies, artists and projects are showing great interest in the Solana network despite the difficulties it faces.

It is also worth pointing out that Solana and SOL are not the only victims of the crypto winter. While SOL is down about 86.9% from its peak after outperforming in 2021, many other Layer 1 networks have experienced similar losses. DeFi has also taken a beating across the board, with Ethereum coming out strongest. Historically, Ethereum’s competitors – sometimes referred to as “Ethereum Killers” – have seen activity slow down and their tokens die in bear markets, but none have seen as many positive developments as Solana in recent months.

Perhaps the biggest hurdle for the network lies in the competition. The new Layer 1 networks Aptos and Sui, both developed by former Meta employees, have been compared to Solana for their promise of high speeds, and both projects have delivered nine-figure war chests this year. Aptos, which claims it can process 100,000 transactions per second through its Move programming language, launched last month with a token airdrop and expectations for its growth are high. Sui would also prepare his own airdrop. Capital is merciless in crypto; if these projects successfully capture the space’s attention, they could surpass Solana in the next market rally.

As with other leaders of what is known as the “alternative Layer 1” space, Solana will also soon face competition in the form of Layer 2 networks. The rapid growth of Arbitrum and Optimism this year has proven that liquidity will flow into Layer 2 if Ethereum succeeds, and many other Layer 2 projects have yet to be launched in earnest.

Still, Solana has one of crypto’s most active and fastest growing ecosystems with several promising developments on the horizon. Despite the problems, it’s clear that the network isn’t going anywhere any time soon. As for SOL, while the utility token may not be moving today, that’s not unusual for crypto bear markets no matter how positive the news cycle looks. However, once the sentiment turns bullish, there is good reason to believe that SOL could see the upside.

Disclosure: At the time of writing, the author of this piece owned ETH and several other cryptocurrencies.