Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

Solana has gathered more than 22% since last Thursday and rides on the wave of renewed Bullish Momentum on the wider cryptomarket. While Bitcoin pushes heights to all time and Ethereum breaks important resistance levels, Solana has followed an example with impressive strength. The price rose to a local highlight of $ 181 before he experiences resistance, where it now consolidates just below that brand, looking for support to feed the next leg higher.

Related lecture

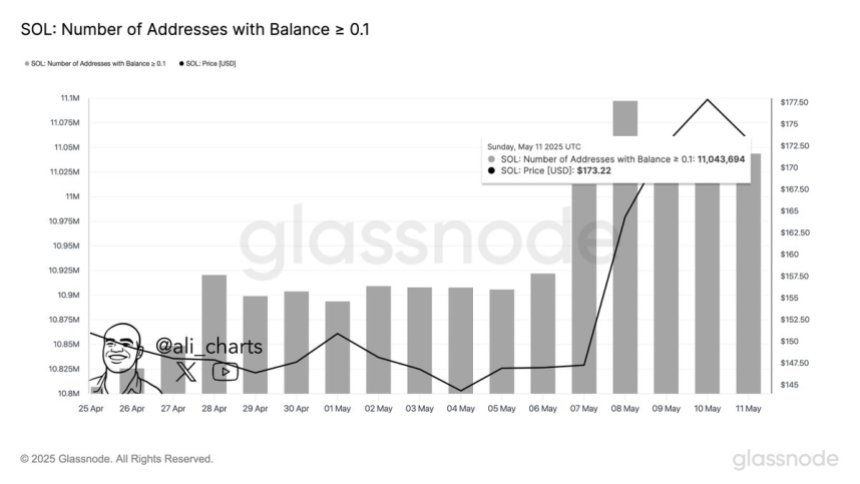

While price action cools at a crucial level, data on chains show considerable growth on the Solana user base. According to Glassnode, the number of portfolios has risen by 0.1 sol or more in the past two weeks to 11.04 million. This rapid increase in small portfolios indicates a rising wave of adoption and network participation, in particular because the interest in altcoins intensifies.

The consolidation of Solana, slightly less than $ 181, can act as a healthy break for a continuation such as Bullish Momentum. Now that market heating and the return of retail interest, the current price structure could provide the basis for a strong outbreak in the upcoming sessions. The combination of price performance and rising user involvement suggests that Solana may be able to position a greater role in the next phase of the bull cycle.

Solana has important support as a wallet -growth opportunities optimism

Solana is now confronted with a crucial test because it consolidates just below the $ 181 resistance zone. After a sharp rally of 22% in the past week, Bulls must defend the current levels to validate the upward trend and retain Momentum. Holding above the support range of $ 170 – $ 175 would confirm the power and could pave the road for a renewed push to the $ 200 level. However, the path ahead is not without risk. The wider macro -economic environment remains fragile, with persistent fears for a global delay and constant uncertainty about inflation and interest policy.

Despite this headwind, the crypto market organizes a powerful recovery and Solana is the top performers. This rally can be more than just a bounce in the short term it could mark the early stages of a larger bullish phase with a considerably upward potential. Investor sentiment improves, as well as the user involvement in important ecosystems.

Top analyst Ali Martinez Shared fascinating data about the chains That reinforces this perspective. According to Glassnode, the number of portfolios has risen by 0.1 Sol or more in the past two weeks to 11.04 million. This rapid growth in smaller holders suggests a growing retail interest and an ever-increasing user-critical-critical indicators for long-term strength.

Solana Number of addresses with balance> 0.1 | Source: Ali Martinez on X

Solana Number of addresses with balance> 0.1 | Source: Ali Martinez on XIf bulls can maintain control at the current level and do not aggravate macro conditions, Solana can be ready for a big step. The combination of technical momentum and involvement in the chain provides a strong basis for the next leg higher. All eyes are now aimed at whether the resistance of $ 181 breaks – or if Solana needs more time to build strength before the next phase of the rally starts.

Related lecture

Solana is confronted with resistance while the price withdraws to re -test support

Solana (SOL) consolidates just below the level of $ 181 after a strong rally of 22% last week. As shown in the graph, the price action rose over both 200-day EMA ($ 161.88) and 200-day SMA ($ 181.11), which indicates renewed bullish momentum. However, the current pullback from $ 180 to around $ 173.48 shows that the level of $ 181 acts as a key resistance, which has previously served several times as a rejection zone in the past.

The volume remains healthy and the recent step shows strong market participation, but Bulls must now keep the range of $ 170 – $ 172 to maintain control. A successful retest of this area as support could be the scene for an outbreak above $ 181. If you are not above this zone, a correction can go back to the region of $ 160 – $ 165, near the 200 EMA.

Related lecture

Technically, Sol tries to break a downtrend of several months and is a higher high structure for the first time since December. The convergence of the advancing averages suggests a crucial moment. If buyers intervene with conviction, a movement to $ 200 will probably be. Until that time, traders will keep a close eye on the level of $ 181 for a decisive outbreak or rejection.

Featured image of Dall-E, graph of TradingView