- SOL has achieved a victory over its rivals with a weekly increase of 10%.

- However, this does not guarantee a break with the consolidation.

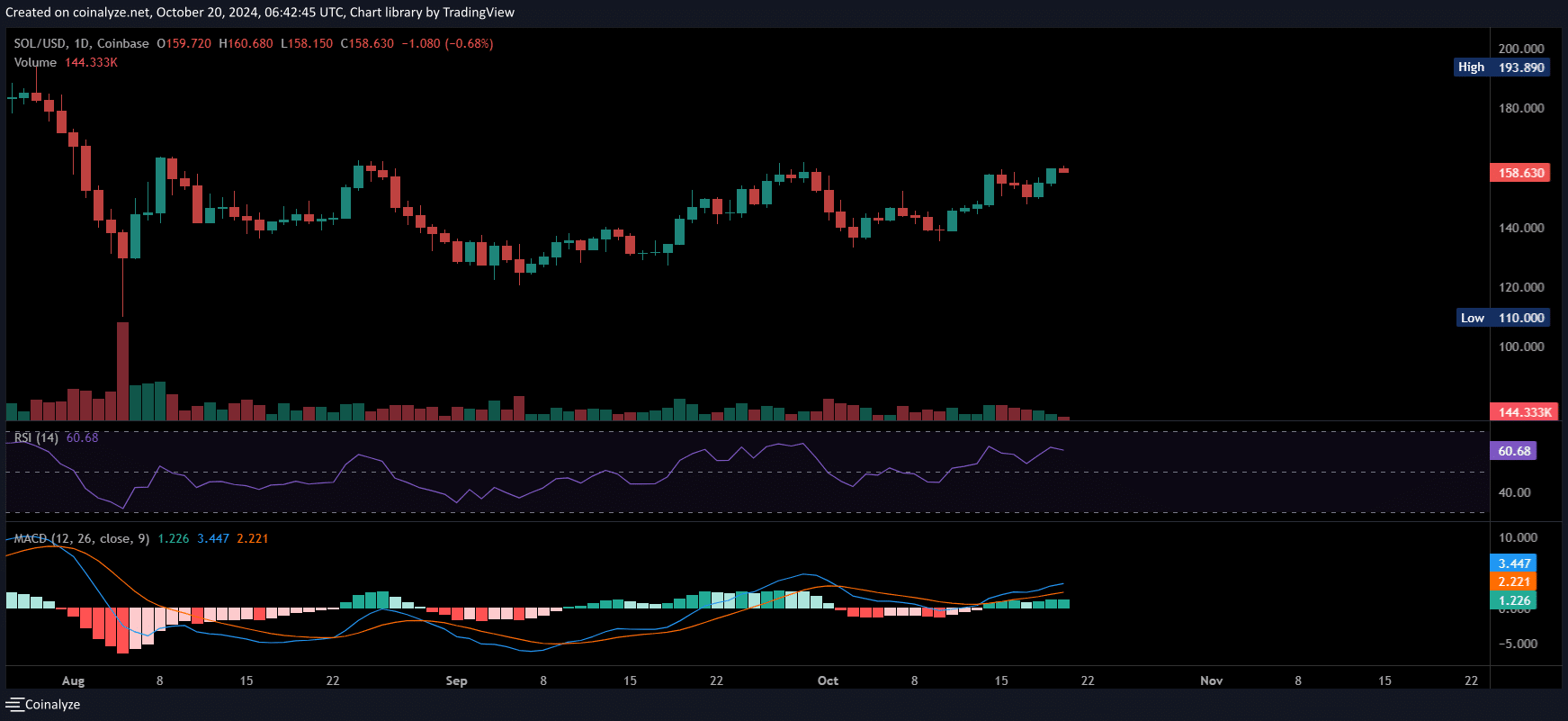

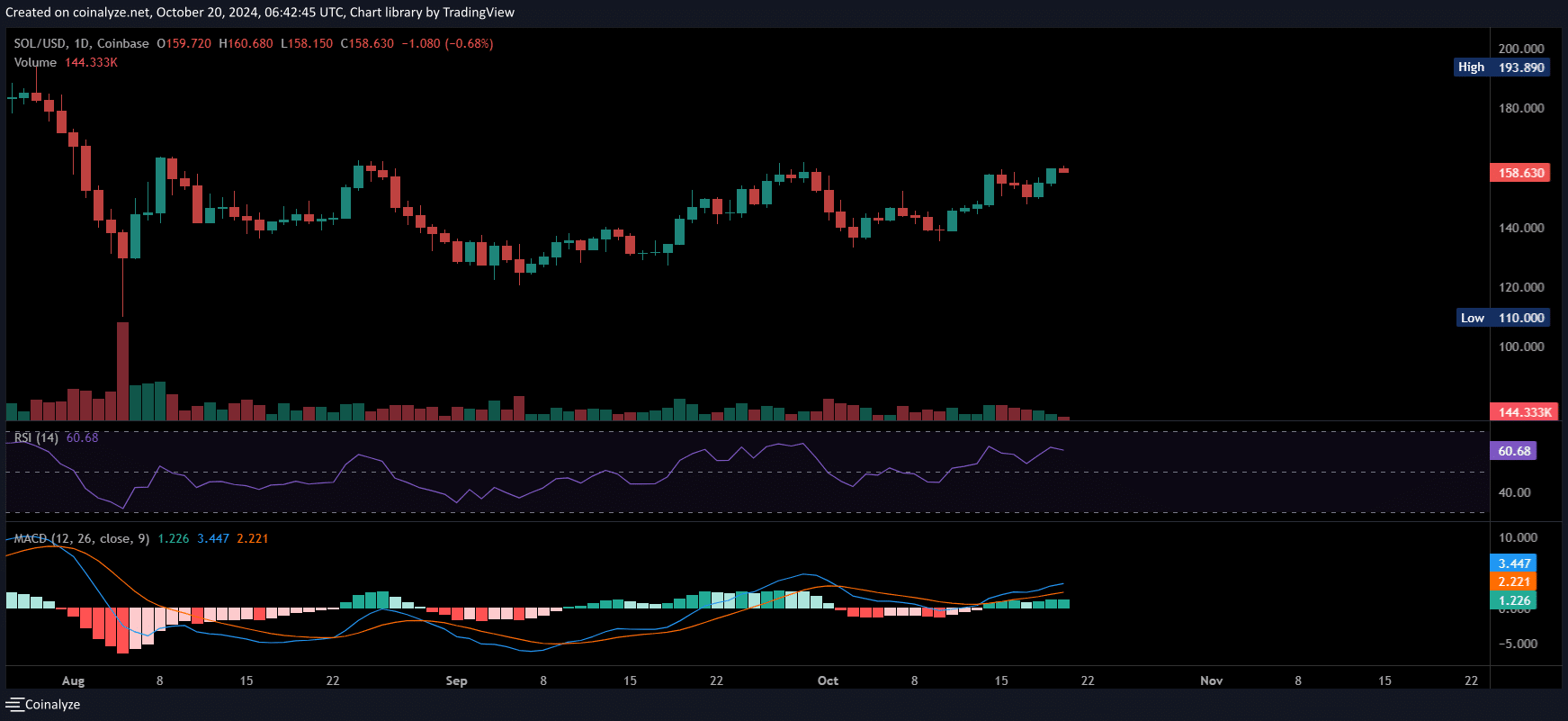

Solana [SOL] has risen almost 10% this week, bringing it close to the critical resistance level at $160 – a level it has struggled to break and has been rejected four times in the past three months.

All eyes are now on SOL as a decisive break above $160 could set the stage for a rally towards the coveted $200 benchmark.

The meaning of $160

Source: Coinalyse

Solana has been trading in a tight range of $110 to $160 since late July, after closing near $190. Despite Bitcoin’s two bull cycles during this period, which exceeded $66,000, SOL has seen minimal capital inflows.

Still, the bulls have shown resilience, preventing SOL from falling to a new local low. Still, this determination may not be enough to cause an impending outbreak.

To make a real move, SOL needs to break away from this consolidation by overcoming the USD 160 resistance.

The weekly gain of almost 10% adds to the optimism, especially as SOL outperforms many of the others top altcoins.

As a result, AMBCrypto analysts are wondering: could investors be willing to shift capital from BTC to SOL? If that happens, we might just see Solana take off.

Interest in SOL is growing, but there is a catch

Based on the idea of being an ‘Ethereum killer’, Solana has a mechanism able to achieve faster transactions and currently processes more than 3,000 TPS.

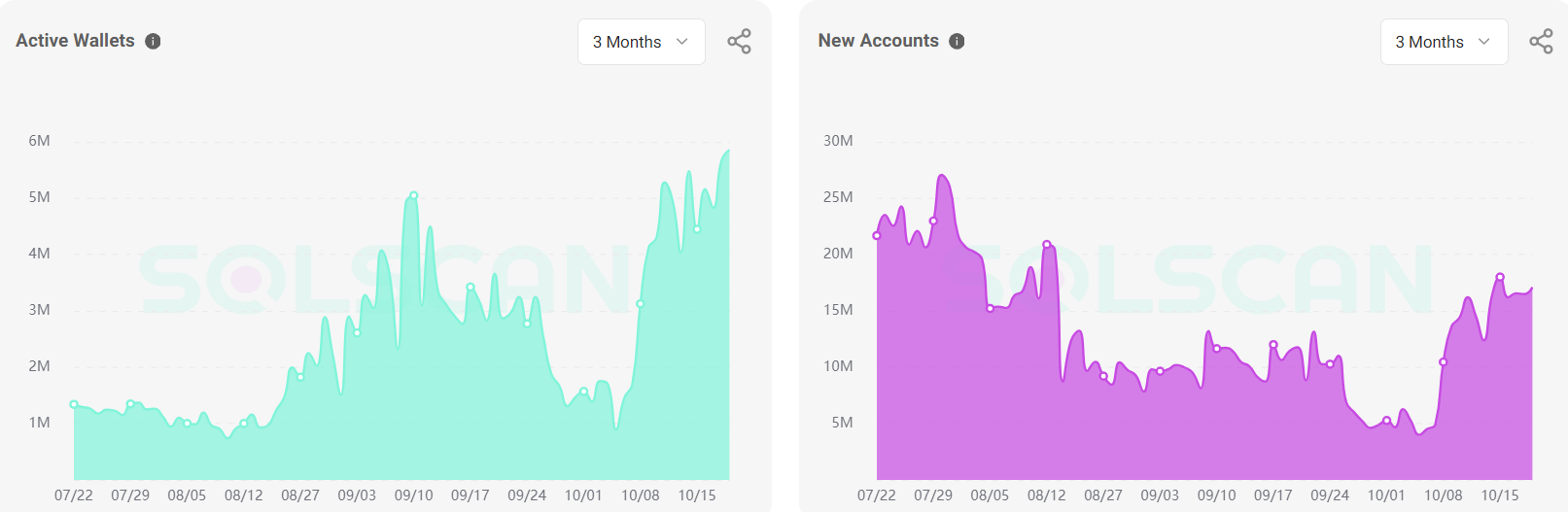

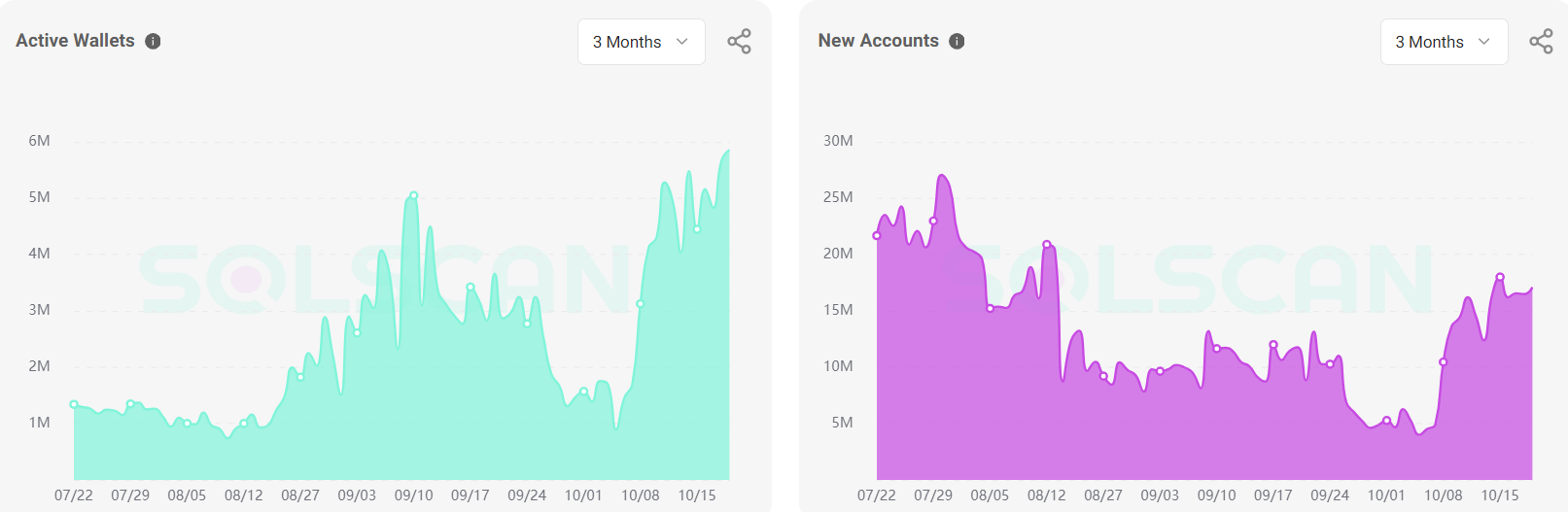

Moreover, after a sloppy end to the September cycle, marked by a dramatic drop in the number of active portfolios from almost half a million to 800,000 in just two weeks, October has seen an increase in liquidity.

During this time, active wallets reached an ATH.

Source: SolScan

Surprisingly, despite these milestones, SOL’s stock price has not responded as expected. One possible explanation could be a lack of aggressive accumulation by traders, who may not view the current price as a potential bottom.

If this trend does not reverse, the chances of a recovery could diminish, marking the fifth time in a row that the $160 resistance remains unchallenged.

An AMBCrypto report highlighted growing activity in the futures market, with open interest (OI) rising sharply to $2.45 billion, providing a bullish outlook for SOL.

However, this trend also brings a challenge, making SOL more vulnerable to sudden derivatives swings That could erode all the gains from the past week if liquidations occur.

Is your portfolio green? View the SOL Profit Calculator

Overall, SOL is at a crucial crossroads. While recent bullish momentum has kept SOL in the green, it may not be long before the price recovers and consolidates.

This potential pullback is largely due to a lack of aggressive buying by investors, who appear hesitant to view current price levels as an attractive entry point. Therefore, caution is advised.