- SOL showed a positive trend for the first time in three days.

- LTHs held steady despite recent declines.

Solana[SOL] is witnessing a rise in long-term holder activity, according to data from Glass junction. This increase reflects growing investor conviction, even as SOL is near $230.

Combined with increased network activity and a rising Total Value Locked (TVL) of $9 billion, these trends demonstrate the asset’s strong trend and potential for sustainable growth.

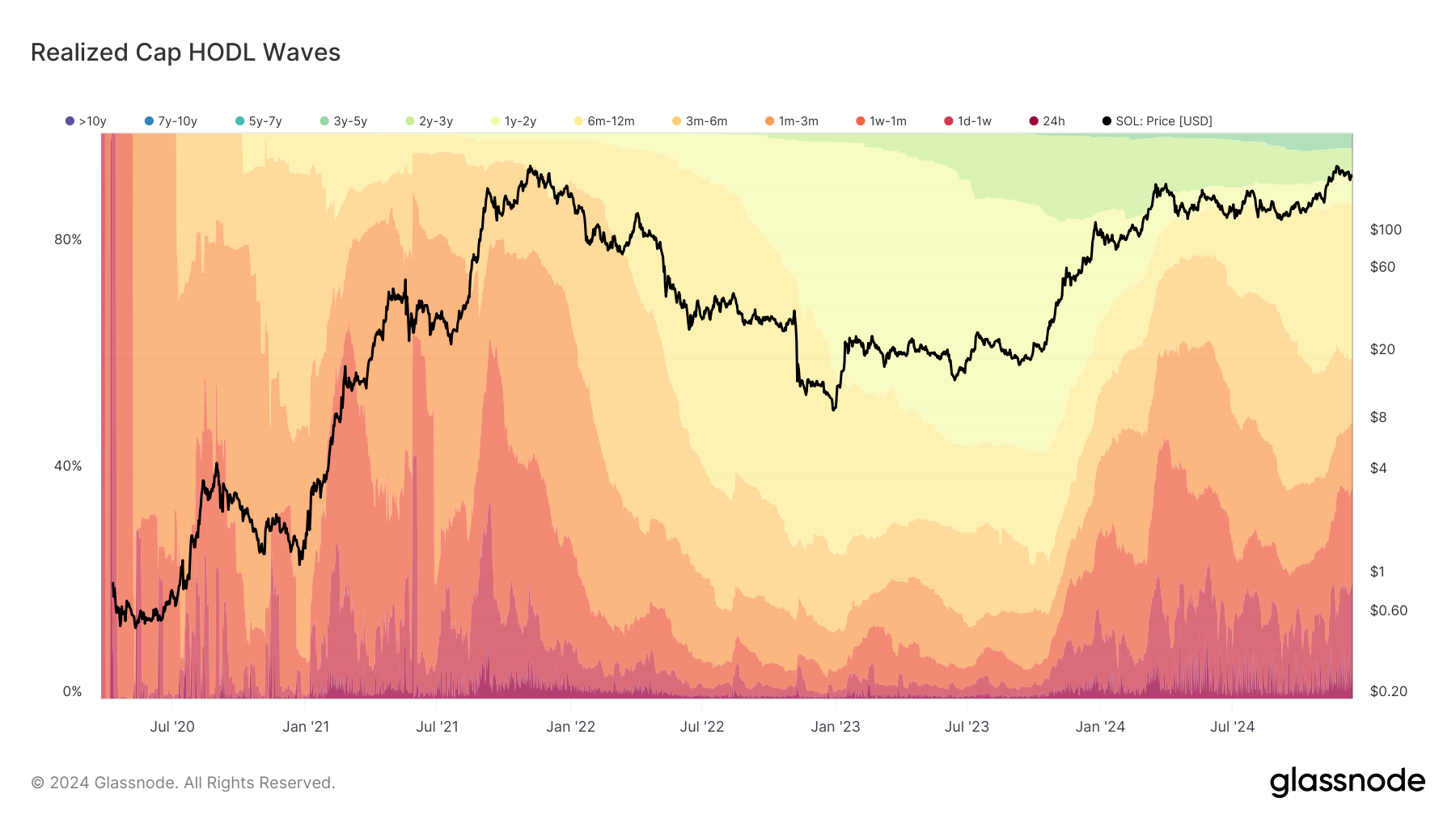

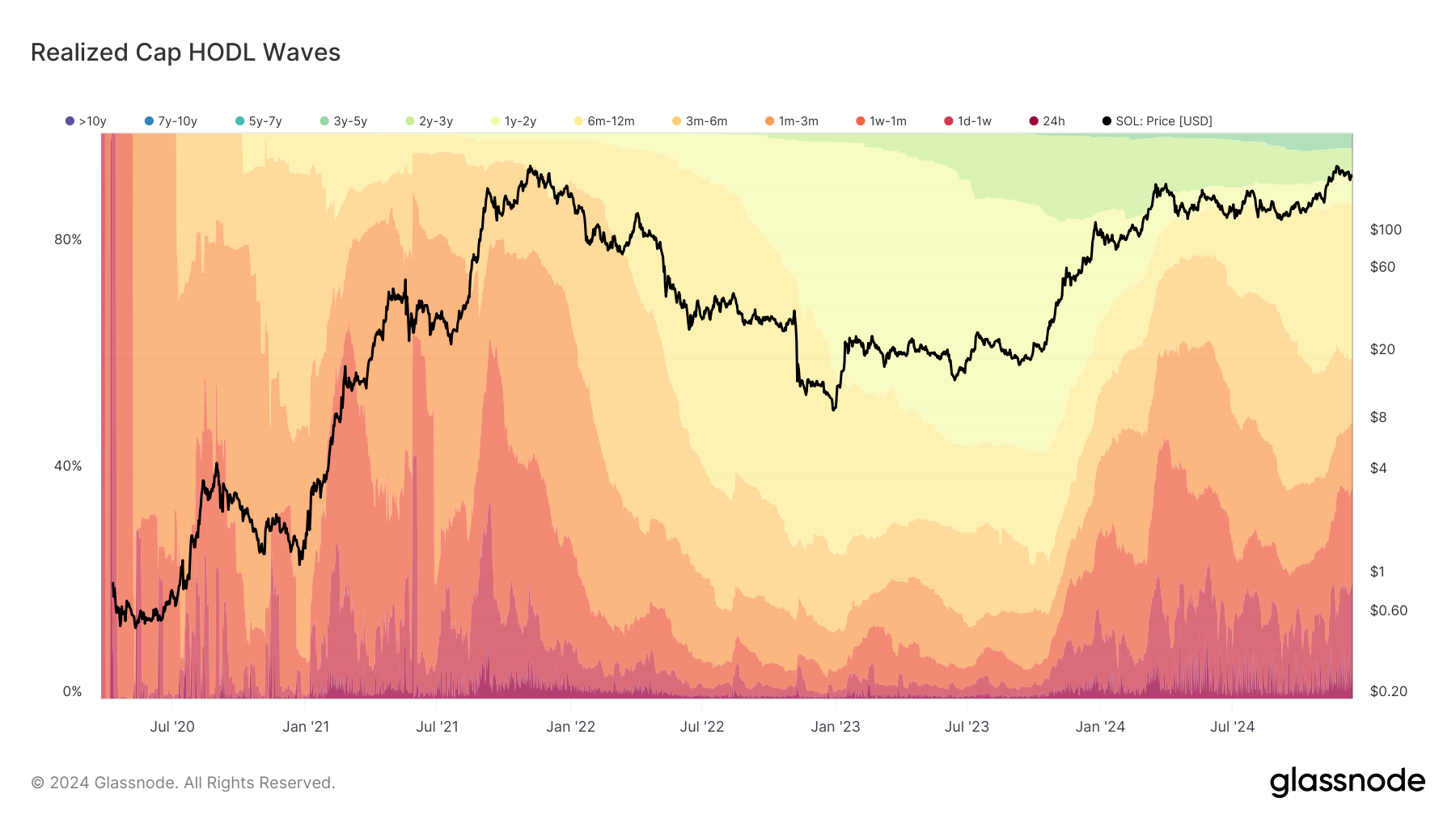

Analysis of Solana’s HODL waves

Solana’s recent price increase is supported by significant activity in the HODL waves. According to Glassnode data, the 6-12 month cohort now holds 27% of total supply, reflecting strong buyer conviction for Solana’s 2024 rally.

This trend indicates that investors are resilient and are choosing to hold on to their assets rather than liquidate at current levels. This is a bullish signal for the overall health of the network.

Source: Glassnode

The HODL waves illustrate how long-term holders have consistently increased their share of the wealth locked in the Solana ecosystem, especially as the price of SOL approaches the $230 mark.

This data underlines the confidence and optimism among investors despite market fluctuations. The increase in the number of long-term owners is often accompanied by reduced selling pressure, potentially paving the way for sustainable price growth.

Solana price is testing key resistance levels

At the time of writing, Solana was trading at $226, after testing a high of $227. SOL was trading comfortably above its 50-day and 200-day moving averages, indicating strong bullish momentum.

The Relative Strength Index (RSI) stood at 49.62, indicating neutral market conditions with no immediate signs of overbought or oversold status.

Source: TradingView

The upward trajectory indicates that SOL is consolidating before a possible breakout. A strong push above the USD 230 resistance level could propel the cryptocurrency to higher targets, with USD 250 as the next psychological barrier.

On the other hand, the $215 level represents a key support area, supported by increased buying interest during recent dips.

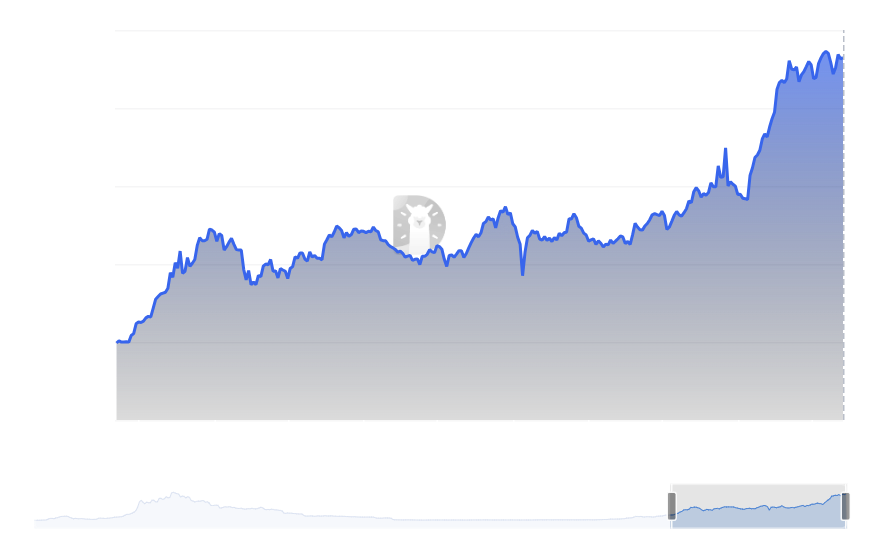

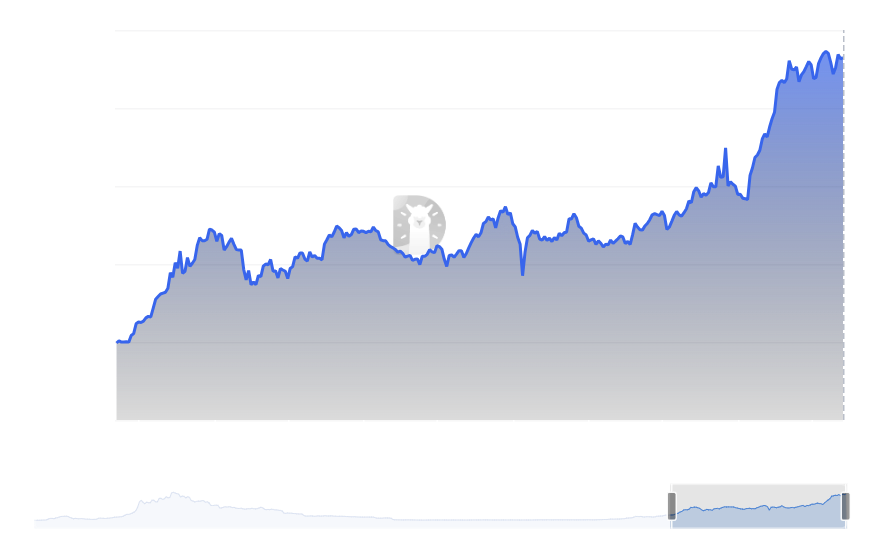

TVL correlation: growing network activity

Data from DeFiLlama reveals that the total value of Solana (TVL) has risen to almost $9 billion, marking a significant increase in network activity.

This increase in TVL highlights the increased user engagement and trust in the Solana ecosystem, especially among decentralized finance (DeFi) participants.

Source: DefiLlama

The correlation between rising TVL and HODL waves suggests that long-term holders are not just holding SOL for speculative purposes, but are actively using it within the network.

Increased TVL often correlates with stronger price trends, which means greater utility.

What awaits Solana?

Solana’s growing HODL waves, strong TVL and bullish price action indicate a robust outlook for the asset. The increase in long-term holder activity indicates reduced selling pressure, while the network’s growing TVL underlines its increasing adoption and utility.

– Is your portfolio green? View the Solana Profit Calculator

With key resistance levels in sight, Solana appears poised for further gains provided market conditions remain favorable. Investors should look for a breakout above $230 to confirm the continuation of the upward momentum.