This article is available in Spanish.

Solana (SOL) is going through a turbulent period after a significant 33% correction from its all-time high of $264 reached in late November. Despite the sharp decline, Solana is showing resilience and offering investors a promising long-term outlook.

Related reading

Renowned crypto analyst Carl Runefelt recently shared his insights on X and highlighted a compelling technical setup for SOL. According to Runefelt, Solana has successfully retested a huge triangle pattern on the weekly time frame. This critical retest suggests that Solana’s price action remains intact and could soon serve as a springboard for a major rally.

While broader market corrections have dampened short-term sentiment, Solana’s ability to maintain its structural integrity during the recession offers a glimmer of hope for bulls. If the SOL can maintain its current levels and build momentum, it could soon regain lost ground and chart a path to new highs. Analysts are closely watching how Solana responds to this crucial technical signal as it could determine the altcoin’s trajectory in the coming weeks.

Solana has a bullish structure

Despite a 30% pullback from all-time highs, Solana (SOL) maintains a bullish structure on higher time frames, indicating long-term strength. This resilience has analysts and investors optimistic about Solana’s potential to outperform once the market regains momentum. Known for its strong fundamentals and rapid adoption, SOL remains a favorite among traders anticipating the next altcoin rally.

Top crypto analyst Carl Runefelt recently shared a detailed technical analysis on X, highlighting an encouraging pattern for Solana. Runefelt revealed that SOL successfully retested a massive triangle formation on the weekly time frame, a crucial milestone for its bullish trajectory.

According to his analysis, if Solana can remain firmly above $180, the cryptocurrency could rise to $330 in the coming weeks. This projection is consistent with expectations that Solana will be a frontrunner in the next market-wide rally.

Related reading

However, the broader market remains in a state of uncertainty. Bitcoin, the market leader, is struggling to regain the $100,000 level, and negative sentiment continues to weigh on traders’ confidence. This lingering doubt poses challenges for altcoins like Solana, which often rely on strong Bitcoin performance to support rallies.

Testing a crucial question

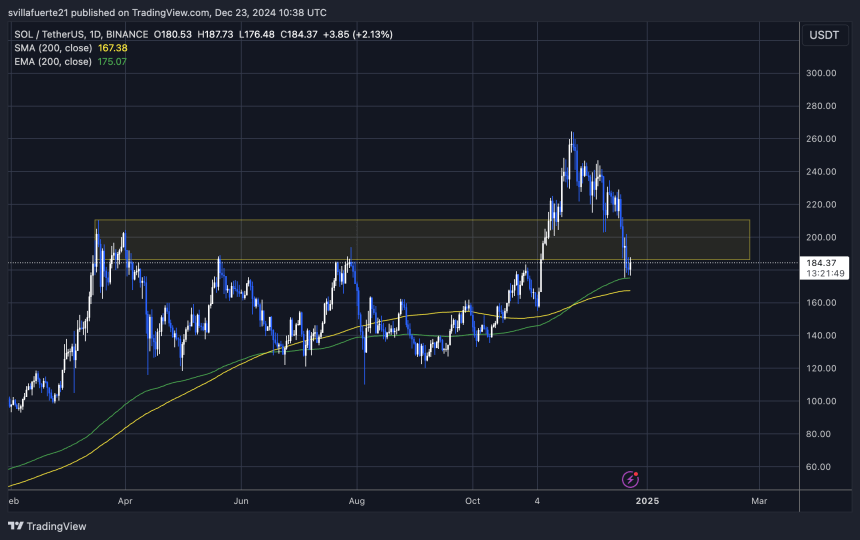

Solana is currently trading at $185, showing resilience after successfully holding the 200-day exponential moving average (EMA) at $175. This key level is often considered a strong indicator of long-term market strength, and SOL’s ability to defend this level underlines the asset’s bullish potential.

On a weekly time frame, Solana continues to make higher lows, indicating a positive trend despite recent market volatility. This price action suggests that buyers remain confident in SOL’s long-term prospects and are stepping in to defend critical support levels. If the $175 mark continues to act as a strong base, Solana will be well positioned for a quick recovery in the coming days.

Related reading

Staying above the 200-day EMA is a crucial step in building momentum for a broader rally. Analysts and investors are watching this level closely as it could pave the way for Solana to retest key resistance points and potentially make new highs. However, if SOL loses this crucial support, it could face increased selling pressure.

Featured image of Dall-E, chart from TradingView