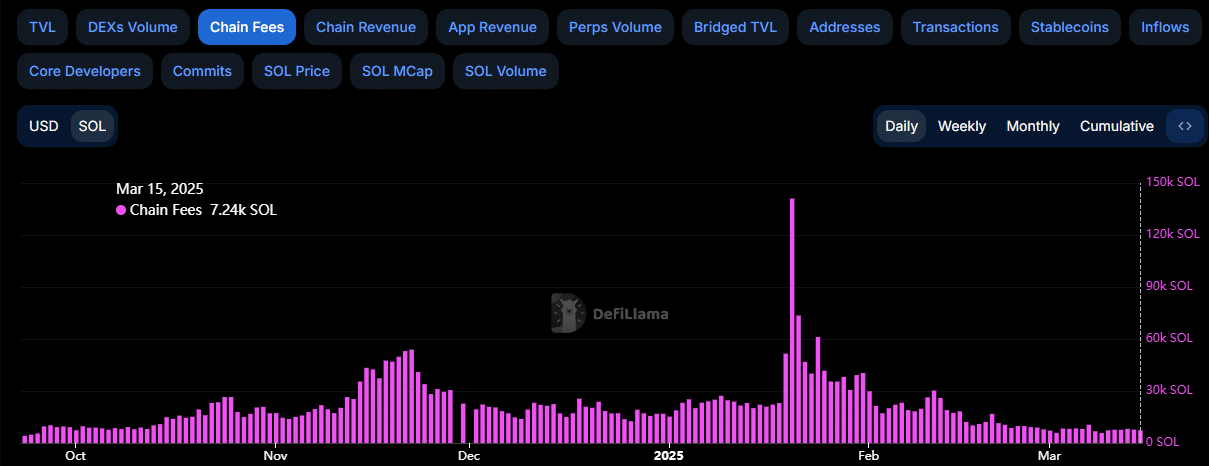

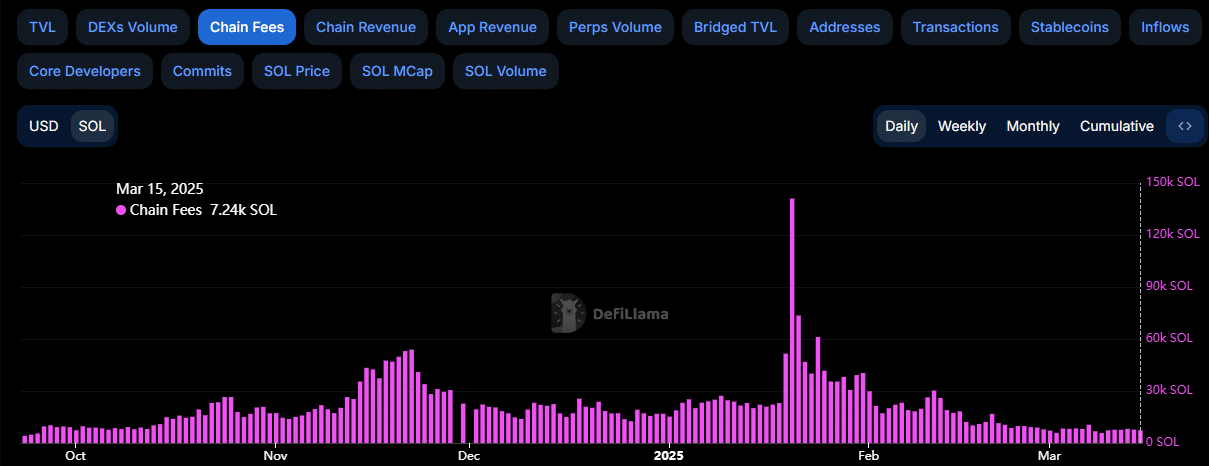

- Dex Volumes dragged Solana chain costs to levels of October 2024.

- Markets are now focused on next week’s FED meeting for potential catalysts.

Decentralized Exchange (DEX) Trade volumes on top chains have fallen 60% compared to January Highs, Solana [SOL] The most difficult, per coinbase analysts.

In January the Handelsdex volumes peaked at $ 457.5 billion. By the end of February, the DEX volumes fell below $ 300 billion; From mid -March the monthly volume was $ 100 billion, per aggregated data from Defillama per block.

Source: The Block

Solana hit the hardest

The top platforms of Solana, such as Raydium, Meteora and Orca, drove most January Dex volumes, especially after the launch of Meme-Coins by Trump and Melania.

Unfortunately, Solana Memecoins was cooled considerably in January, Coinbase (CB) also noted in their weekly market judgement.

“Memecoin Trading Activity has been particularly affected, reflected in Solana’s 82% decrease in Dex volumes since the US presidential inauguration in January.”

Pump.Fun’s traded volume, the most important motivation of the Meme Mania in Solana, decreased to October 2024 Lock points. As a result, added CB analysts added Solana transaction costs.

“This has had second-order effects on Solana transaction costs, which have reached their lowest levels since September 2024 (expressed in SOL).”

Source: Defillama

In terms of Sol, the chain costs in January to 7k Sol from 141K Sol from the moment of the press – no less than 95% decrease in reimbursements.

The value of SOL also refueled as a speculative interest from mid -January. It fell from $ 295 to a low of $ 112 before it bounced on the press to $ 134. Yet the Altcoin had still fallen by 55% from its all-time highlights.

On the contrary, the Dex volumes of Ethereum remained resilient according to the CB report.

That said, the decline was also part of a broader Market contractionAccelerated by macro uncertainty in the midst of Trump rate.

According to CB analysts, the risk-off trend could continue to exist, unless the FOMC meeting next week stops the quantitative tightening (QT) and stabilizes markets.

“We think there is a good chance of a break or stop in QT, because bank reserve levels approach the 10-11% of GDP threshold that is generally considered to maintain financial stability.”