- Sol ETF Futures products have not reflected the success of BTC.

- Will the same fate probably be the American spot SOL ETF products?

Senior Bloomberg ETF analyst Eric Balchunas noted that it was recently launched Solana [SOL] ETF -Futures (exchanged funds) have not linked the performance of comparable BTC products.

Balchunas said”

“The new Solana Futures ETF has not done much, a million in volume first few days is decent for normal ETF, but nothing versus BTC, about 80x less than $ Bito’s first few days or $ ibit’s … The further you get away from BTC, the fewer assets will be.”

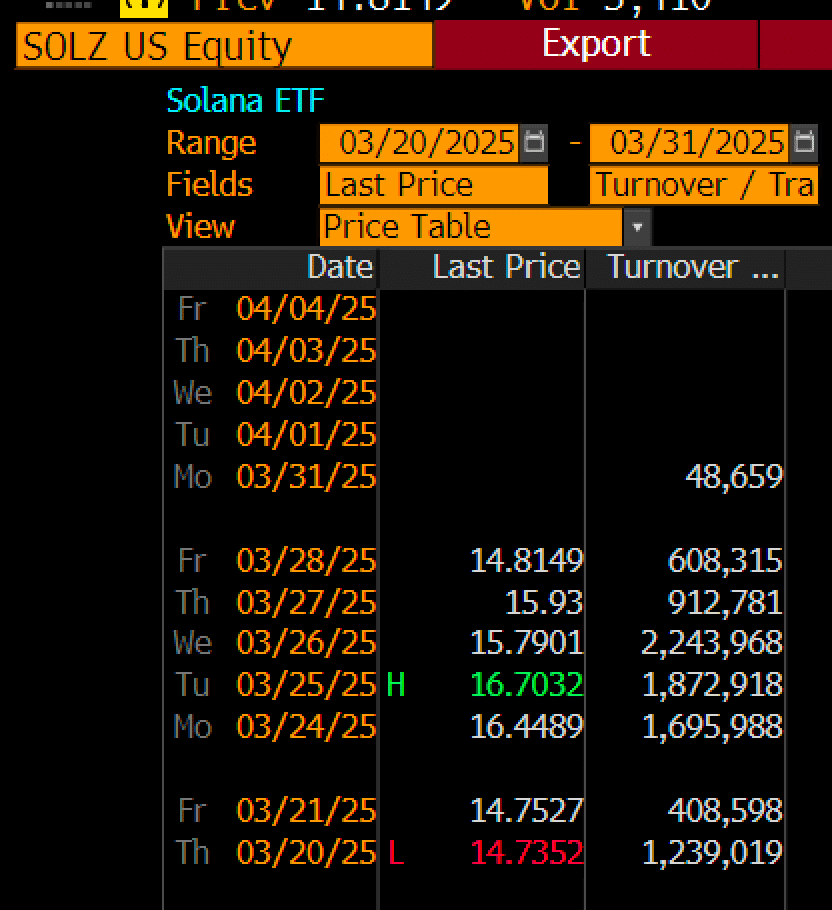

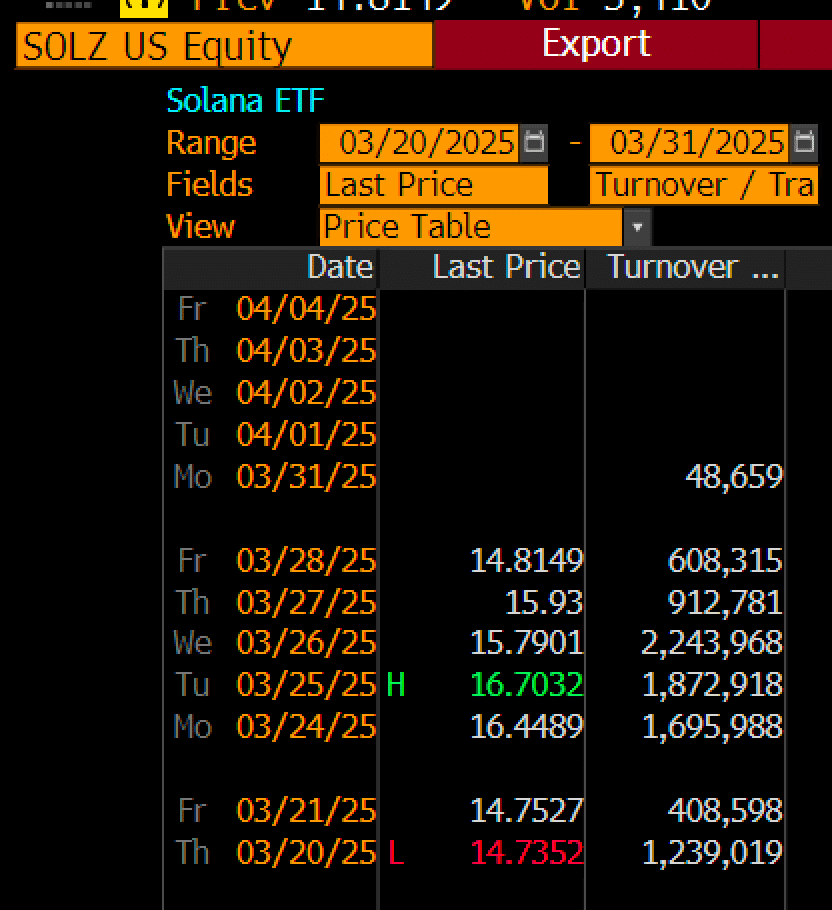

Source: Bloomberg

The SOL ETF Futures products per volatility shares debuted on 20 March and typed $ 1 million in trade volume during the early trading days.

As demonstrated by the attached Bloomberg graph, however, volumes refueled considerably on March 31, with a record layer of $ 48k.

Solana vs. Bitcoin

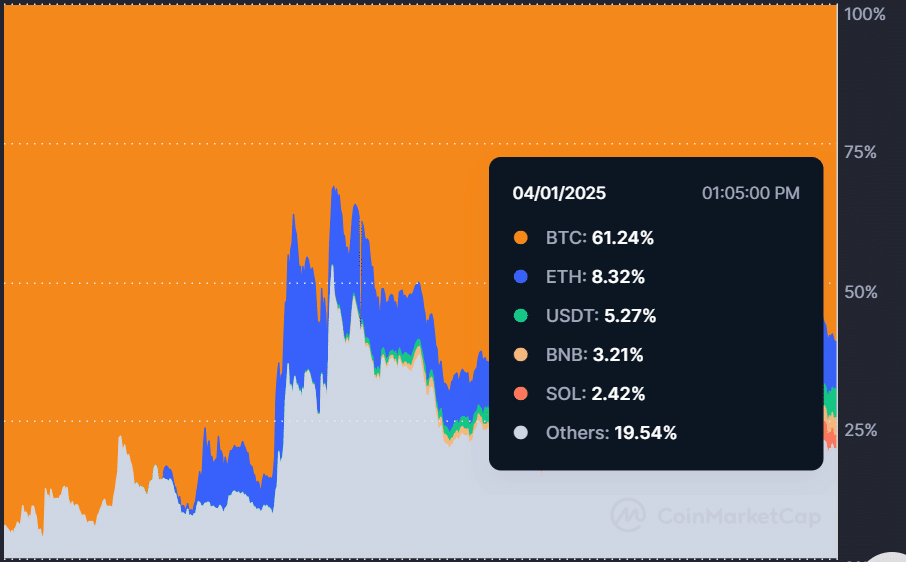

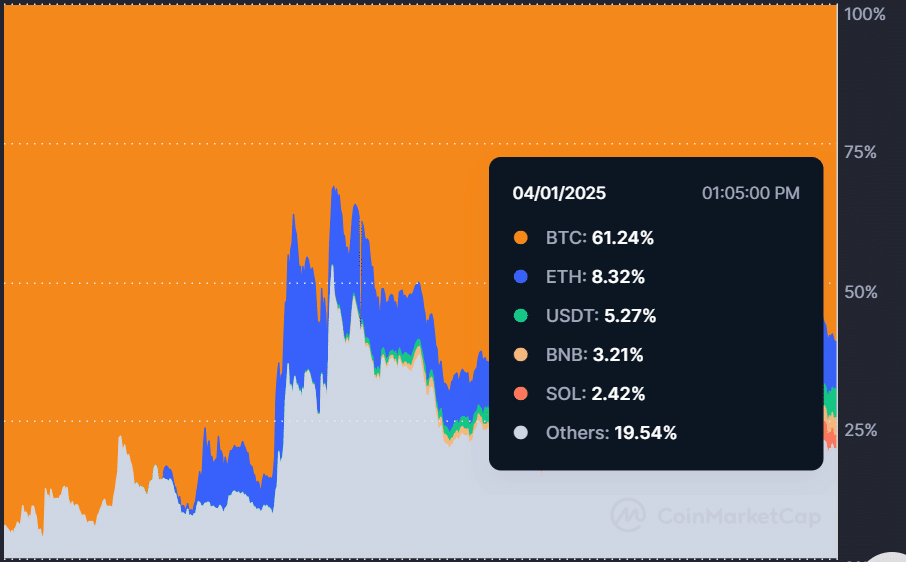

Balchunas had previously projected that their dominance on the spot could dictate the interest in new ETF products.

BTC currently dominates the market with 61%, followed by Ethereum [ETH] at 8%, while Sol is fifth at 2.4% after he has been reversed by Binance Coin [BNB] recently.

Source: Coinmarketcap

Just like the Dominance Chart van de Markt, BTC ETFs have registered the most traction since their debut. The Spot BTC ETFs have registered $ 36 billion in cumulative inflow since they were launched last year.

On the contrary, American spot ETFs, launched in July, saw $ 2.4 billion cumulative inflow – a 15x less than BTC ETFs.

If approved, does the same trend follow us spot sol ETFs? Even the recently launched Sol CME (Chicago Mercantile Exchange) Futures even repeated the similar trend that was projected by Balchunas.

On the debut day, Sol Cme Futures had $ 12 million in trade volumes, almost 10 times less than BTC CME Futures ($ 102 million) and ETHs $ 31 million.

In addition, speculators seemed more comfortable with BTC during market -wide drawings than ETH or Sol. During the Q1 racement, Sol BTC performed by almost 50%behind.

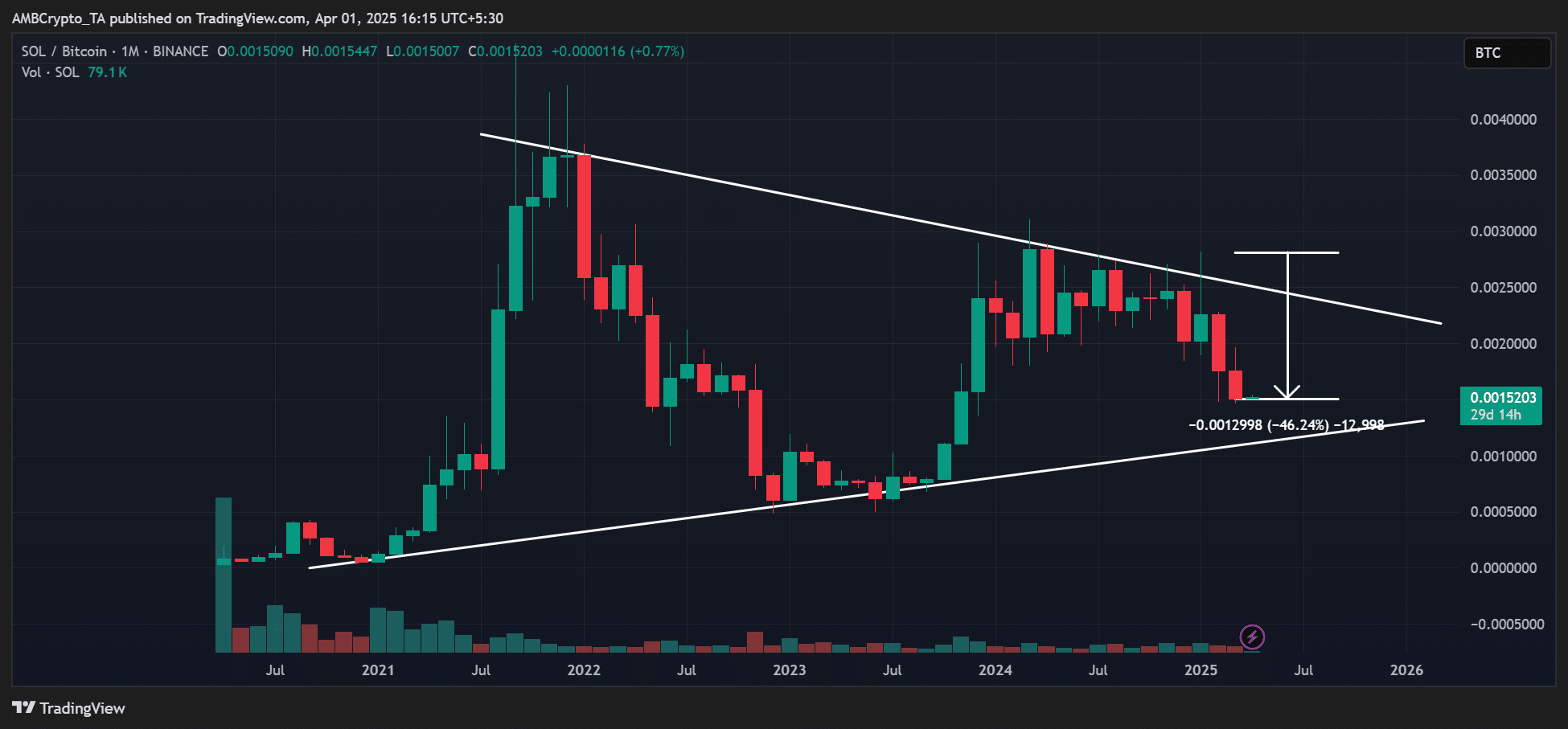

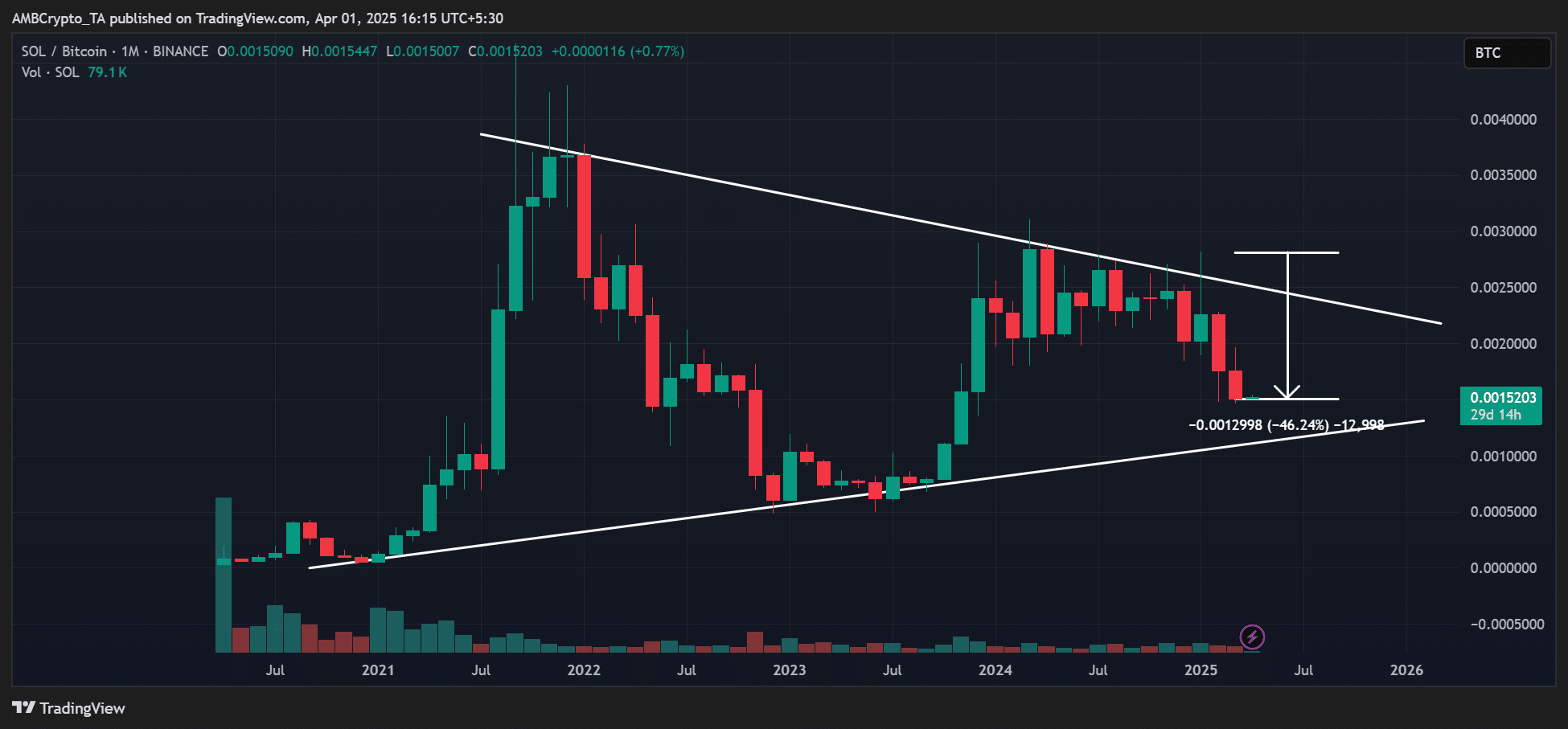

Source: SOL/BTC, TradingView

An extensive weakening could drag the SOL/BTC ratio to 0.0012 (Trendline support) before a potential rebound.

Measure the indicator -price performance of the Sol indicator compared to BTC. In the meantime, the Altcoin was appreciated at $ 128 at the time of writing and was still kept above the crucial $ 120 annual support.