Solana (SOL) has emerged as a formidable competitor to Ethereum. Solana, known for its fast transactions and low fees, is causing a stir in the crypto market. However, recent trends indicate that Solana is facing resistance above $20. This development has sparked a debate among investors and traders: will the SOL price initiate another decline?

Solana continues to display bullish data

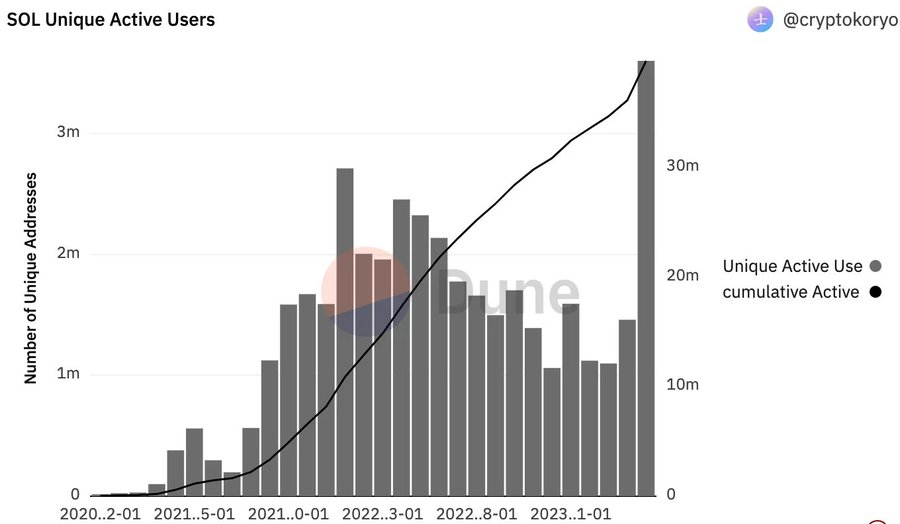

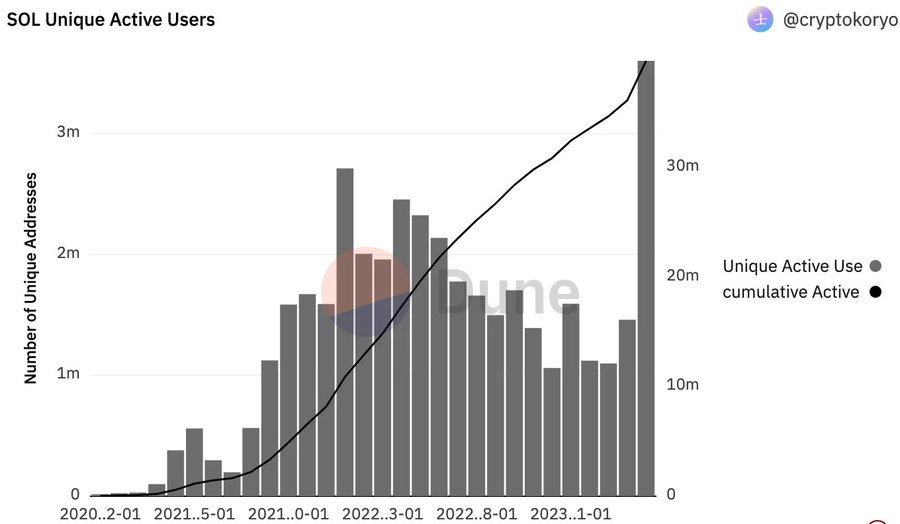

At the start of the new week, most of the cryptocurrency market, including Solana (SOL), has started on an optimistic note, with SOL successfully regaining key price resistance. In addition, recent on-chain data shows a significant increase in the number of active Solana users.

Specifically, Dune Analytics reports that the number of unique active users reached 3.6 million in May, an impressive 146.58% increase over the numbers recorded in April.

In addition, there is positive network development as Solana has green-lit a new update, v1.14, for its validators. Following the decision of a majority of network users to move to this new version, the cluster has now officially adopted v1.14. According to the official announcement, this version introduces several long-awaited features to the Solana blockchain, which will be gradually activated.

This release allows Solana developers to collect data on recently paid transaction fees, which can then be used to predict future transactions. This feature also paves the way for developers to take full advantage of localized fee markets that will be included in upcoming updates.

The past week has seen a remarkable increase in the number of SOL strikers, with an increase that can only be described as exponential. According to Staking Rewards, there has been an astonishing increase of over 1,800% in the number of SOL strikers over the past seven days.

What’s next for the SOL price?

On May 27, Solana managed to break the resistance line and on May 28 it surpassed the 20-day EMA, signaling a possible bullish rebound.

The flattening of the 20-day EMA and the RSI approaching the midpoint indicate a potential easing of selling pressure. The 100-day EMA ($21.22) is currently a minor hurdle, but will likely be overcome, potentially sparking a powerful relief rally to $24. At the time of writing, the SOL price is trading at $20.55, down more than 2% in the past 24 hours.

Solana price is currently tumbling near the EMA20 trendline; however, bulls try to avoid further declines in the support line.

If the price falls and breaks the 20-day EMA, it would imply that bearish investors are still profiting from rallies. In such a scenario, the Solana price could revisit the critical short-term support level at $18.66.