- SOL’s short- and long-term prospects depend on breaking through two key resistance levels

- An increase to over $188 in the short term seems feasible

In recent weeks, SOL’s price charts have shown mixed performance, with the monthly and weekly metrics showing gains of just 7.64% and 5.38% respectively. However, it saw a daily decline of 1.49% after hitting a resistance line.

Despite these fluctuations, market sentiment has been volatile lately, with forecasts moving from bearish to more optimistic.

Resistance levels challenge SOL’s upward momentum

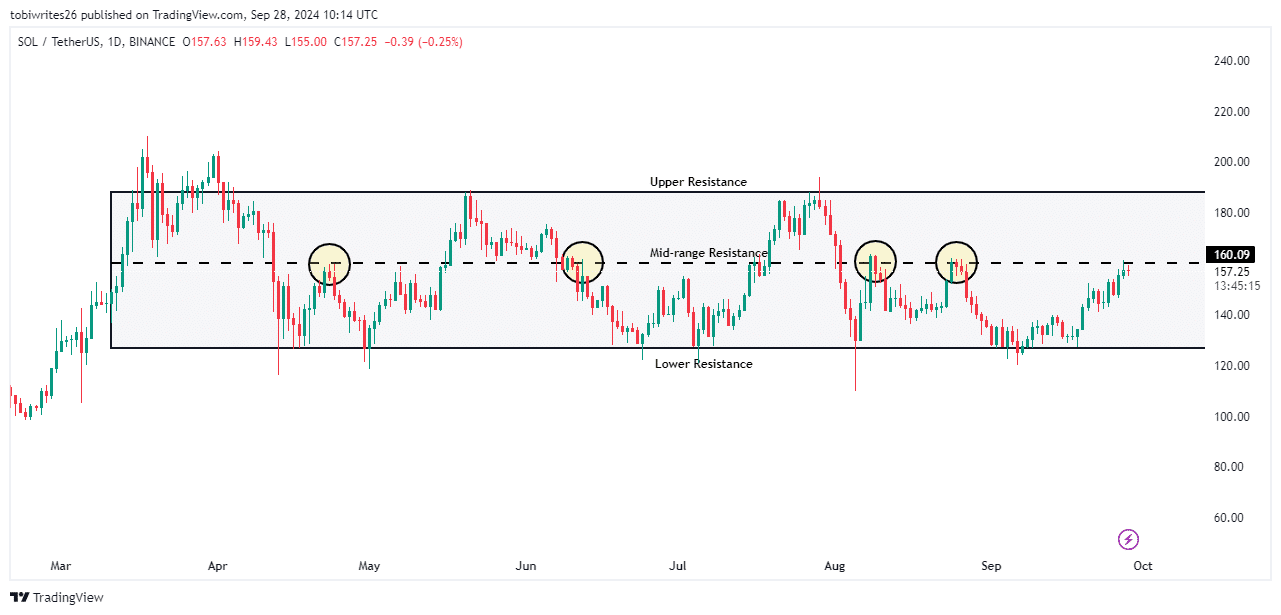

At the time of writing, SOL was trading in a consolidation phase, limited by clearly defined resistance levels at the upper, middle and lower limits.

The trajectory of SOL, both short and long term, is significantly affected by the mid and upper resistance levels. These have historically led to price declines. A continued rally for SOL will necessitate a break above the upper limit.

In the short term, SOL faces resistance in the mid-market, which has previously led to price declines. Overcoming this level could push it towards the upper limit and possibly reach the $188 mark, the upper limit of the consolidation channel.

However, if this resistance is not broken, the price could drop to $126 or even lower.

Source: trading view

Despite previous instances where this resistance zone has led to a sell-off, AMBCrypto’s analysis suggested that SOL is likely to make a push towards $188.

Market sentiment supports a short-term rally for SOL

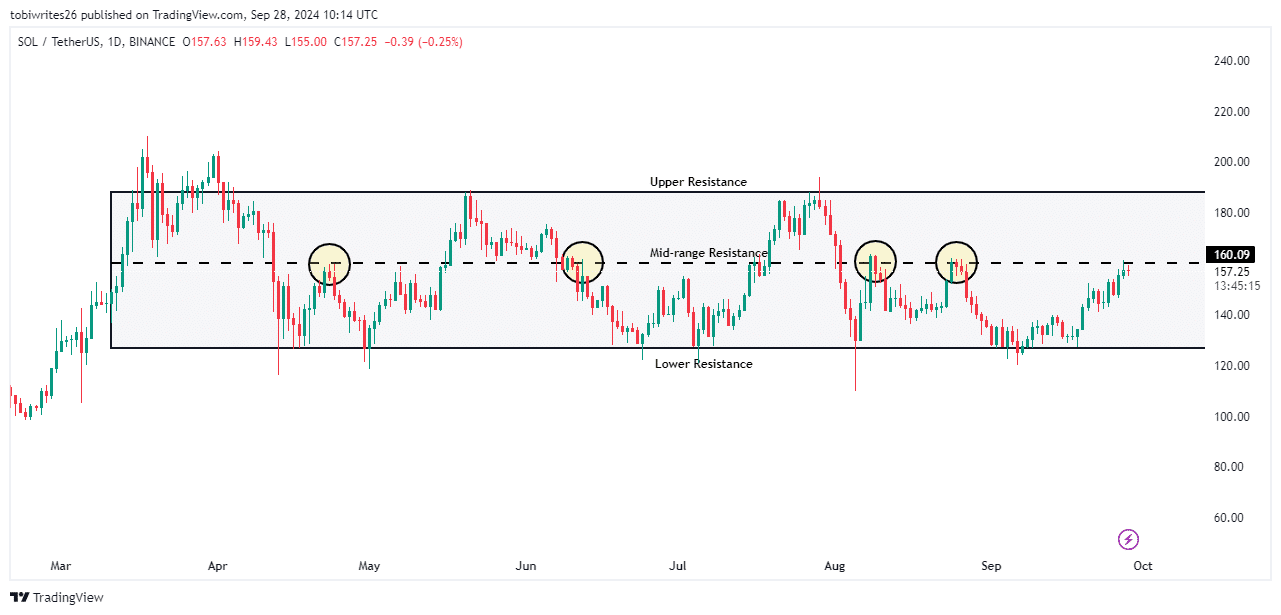

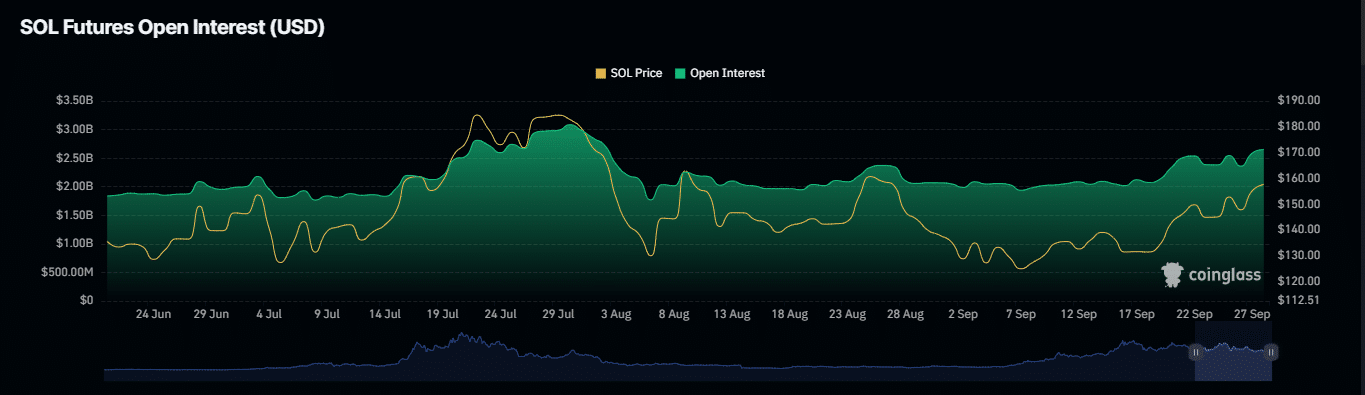

Market sentiment has shifted to a bullish outlook, with AMBCrypto seeing a rise in bullish activity. The same can be evident from short liquidations and rising open interest.

In reality, facts short liquidations showed a rebound, with $3.27 million in short positions closed. This implied that the market has moved contrary to short traders’ expectations and could potentially mark a possible new high for SOL.

Further influencing this bullish outlook is the rise in Open Interest (OI). The same increased by $290 million from September 26.

Source: Coinglass

This increase is a sign of an increase in market confidence, with investors taking new positions or expanding existing positions.

Moreover, AMBCrypto also identified indicators supporting a bullish advance for SOL.

Buying pressure for SOL is expected to increase

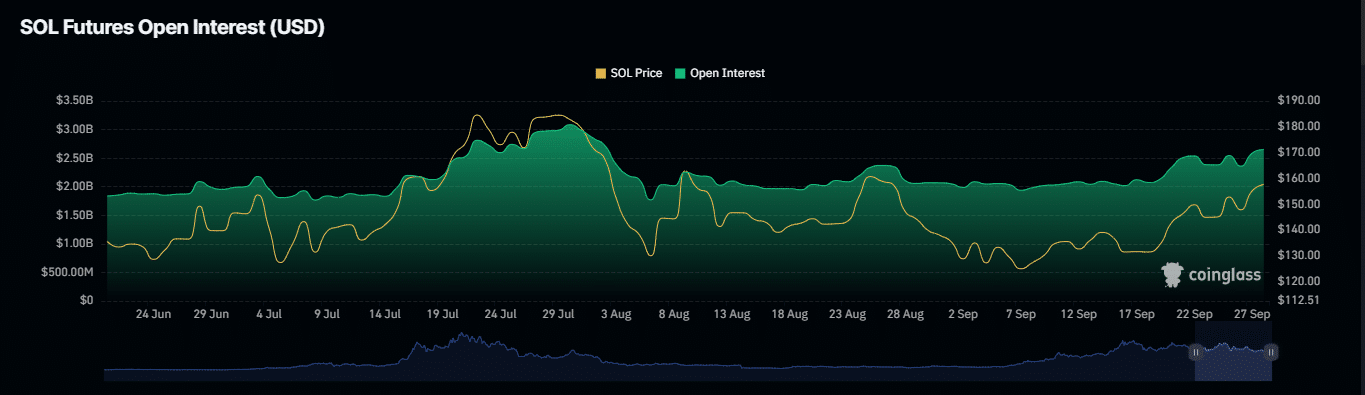

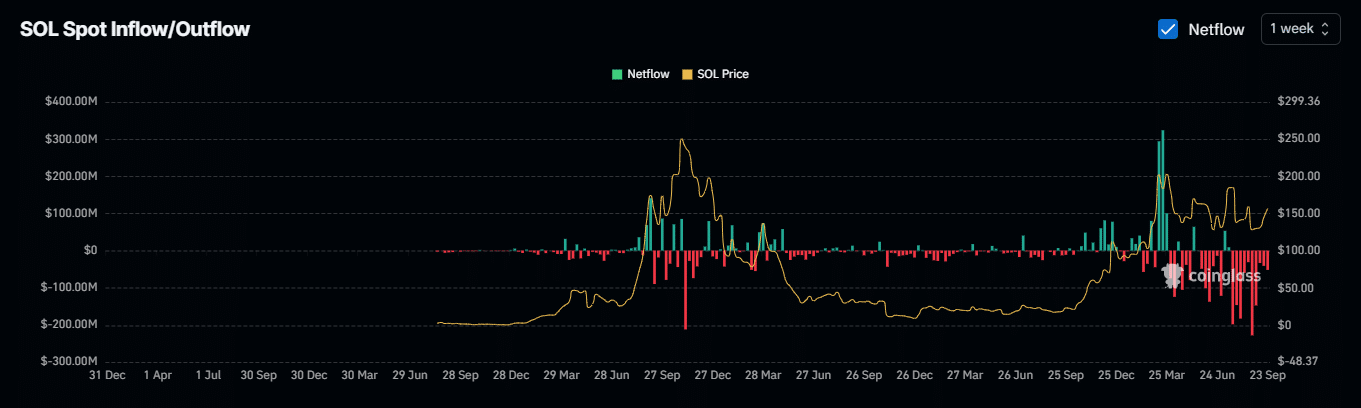

Recent data from Mint glass revealed that net flows for Solana, a measure that tracks the cryptocurrency’s movement into and out of exchanges, have been negative for the past seven days.

This means that more SOL is withdrawn from the exchanges than is deposited.

According to Coinglass, this trend indicates that investors are choosing to hold their SOL in anticipation of a price increase. This effectively reduced the supply available on exchanges.

Source: Coinglass

If this trend continues, the short-term outlook for SOL is bullish. This could help it overcome the prevailing resistance level it is facing, potentially pushing the price towards $188.