- Solana raises $10 billion in TVL, driven by protocol improvements and stablecoin liquidity

- The DeFi ecosystem has seen rapid growth as Solana’s technology attracts retail and institutional investors

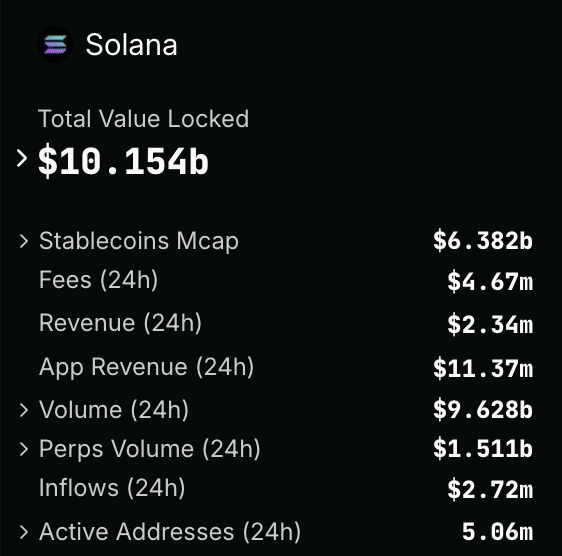

Solana’s DeFi ecosystem is making headlines again, crossing the $10 billion mark in TVL for the first time in three years. This milestone highlights Solana’s recovery from the collapse of FTX and a revival of confidence in its ecosystem.

With innovative technology, increasing protocol adoption and rising liquidity, Solana is regaining its place in DeFi. The key question is this: what factors are driving this growth, and how high can Solana’s TVL go if the crypto market turns bullish in 2025?

$10 billion TVL – What caused this?

Key protocols such as Solend have contributed to the growth by offering efficient borrowing and borrowing at low costs, while Marinade Finance’s competitive staking rewards have incentivized SOL token holders, improving the decentralization of the network. Platforms like Raydium have also played a crucial role by integrating with Orderly Network to launch Solana’s first perpetual Futures trading, increasing liquidity and trading volumes.

Source:

Solana’s TVL rise was also supported by significant stablecoin liquidity. By December 2024, the network will have $1 billion worth of stablecoins on board, bringing the total to approximately $5 billion. This was further amplified in January 2025, when Circle earned $1.25 billion in USDC on Solana. This influx of liquidity has enabled major DeFi activities such as trading, lending, and yield farming.

Ecosystem upgrades such as Solayer, low costs and high speeds have also attracted both private and institutional investors. In light of positive market sentiment and a potential US Spot Solana ETF, Solana’s DeFi ecosystem could be poised for sustainable growth and renewed investor confidence.

Realistic or not, here is SOL’s market cap in terms of BTC

Solana – prospects for 2025

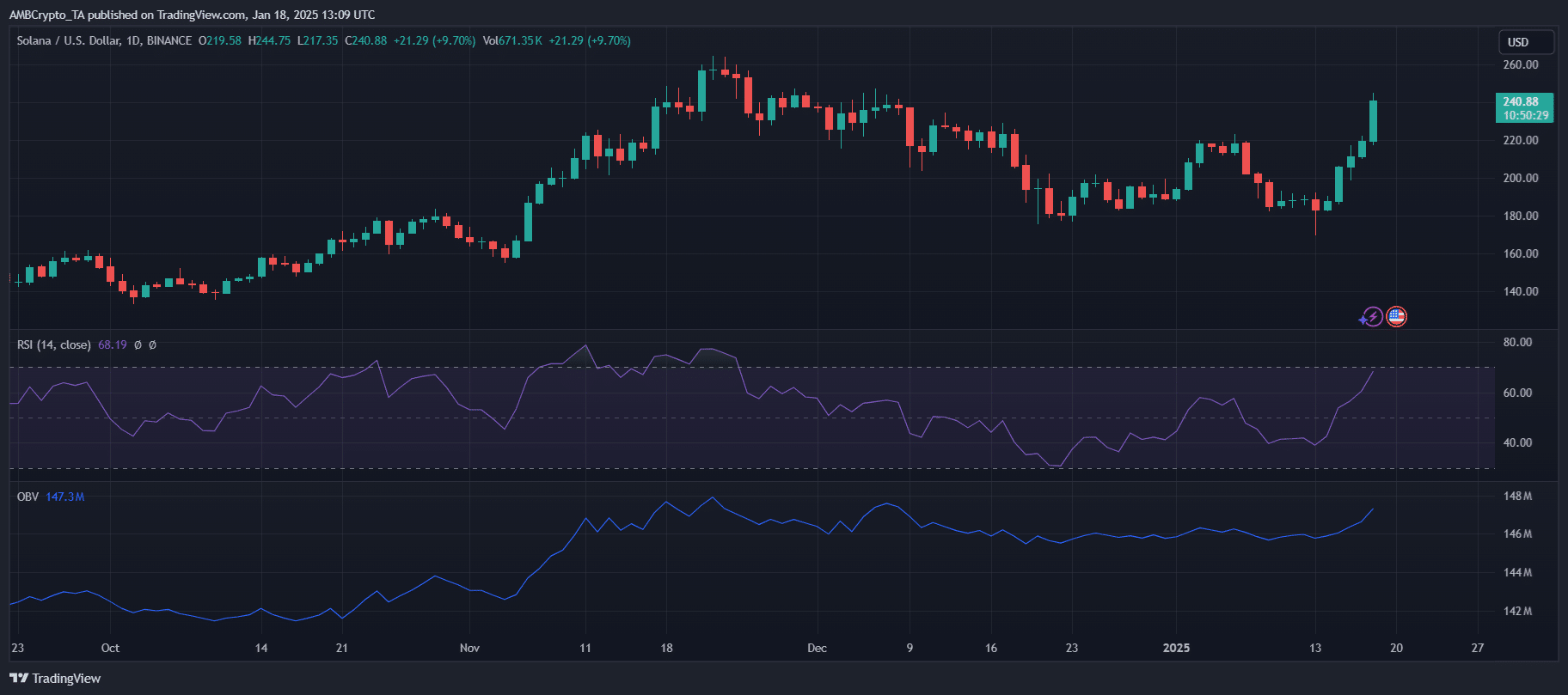

Source: TradingView

Solana’s latest price rise reflected strong market optimism, with SOL rising almost 10% in one day.

The RSI approaching overbought levels indicated growing investor confidence, but also raised concerns about possible corrections. Moreover, rising OBV highlighted increasing purchasing pressure, which could further boost TVL growth. If Solana maintains its current momentum, it seems likely that the $15 billion TVL will be surpassed, with a potential target of $20 billion as institutional inflows and stablecoin liquidity increase.

However, overheating indicators and market volatility come with risks. It is crucial to monitor network stability and regulatory developments for sustainability.