- Binance sent $ 32 million Sol to Wintermute, while Coinbase sent $ 30 USDC to possibly buy the dip.

- The Solana market fell more than 10%during the weekend, possibly caused by the alleged manipulation of Binance.

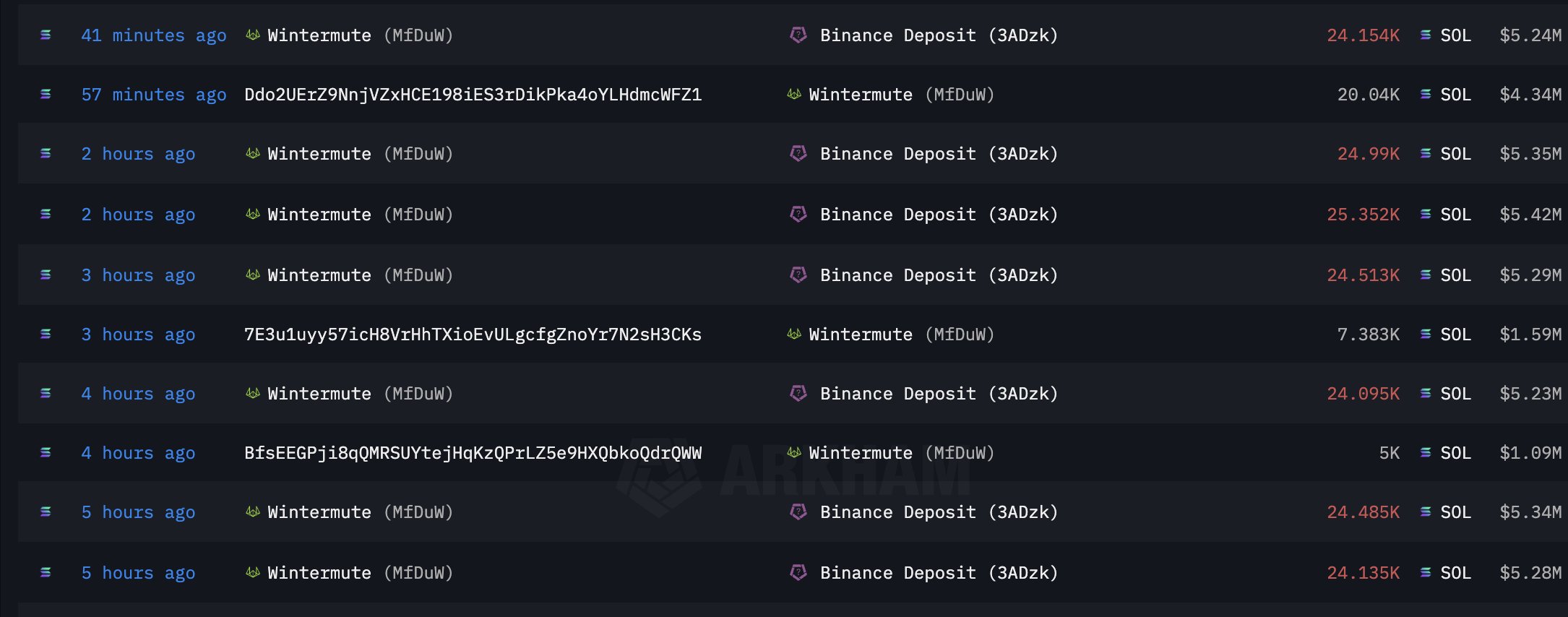

The Binance Exchange was reportedly involved in “flushing” or “liquidation hunt” by sending more than $ 32 million to Solana [SOL] To market maker Wintermute during a weekend with a low volume.

The intention was clear: to push the price of Sol down into the lower range, forcing long -term leverage traders to liquidate their positions.

This strategy is particularly effective on weekends, when trade volumes are naturally lower, making markets more sensitive to manipulation.

According to Ambcrypttos’s view of Arkham’s data, Wintermute played its role by selling the SOL at a lower price, so that the price is further dumped, only to buy it back at the artificial depressive rates.

Source: Arkham

After the dip was manufactured, Wintermute reportedly returned to Binance than it had initially received, so that the price difference used.

This was a win-win scenario for both entities, but according to crypto-commentator Martyparty”

“The losers are the leverage traders and the panic sellers.”

Likewise, Coinbase had sent $ 30 million in USDC to Wintermute on Solana, reportedly to take advantage of the dip, in response to recent claims of insufficient solholdings that mean that users received delays in their Solana recordings.

Source: Arkham

This step suggested a coordinated effort to use market conditions, possibly to stabilize or even benefit artificial volatility.

How you can benefit from Sol -Manipulation

Understanding these tactics can be crucial for traders. By checking unusual major transactions from trade fairs to market makers, traders can predict potential price drops, in this case Solana.

One strategy to take advantage of such manipulations includes waiting for a forced liquidation event and then buying in the dip, anticipating a fast recovery when the market corrects itself.

Sol has already been restored around a third of the weekend trap.

However, this approach requires a sharp sense of market timing and an understanding of the risk involved, because not all market manipulations lead to predictable recovery.

For those with high risk tolerance, such strategies can offer opportunities to take advantage of the volatility that others fear.

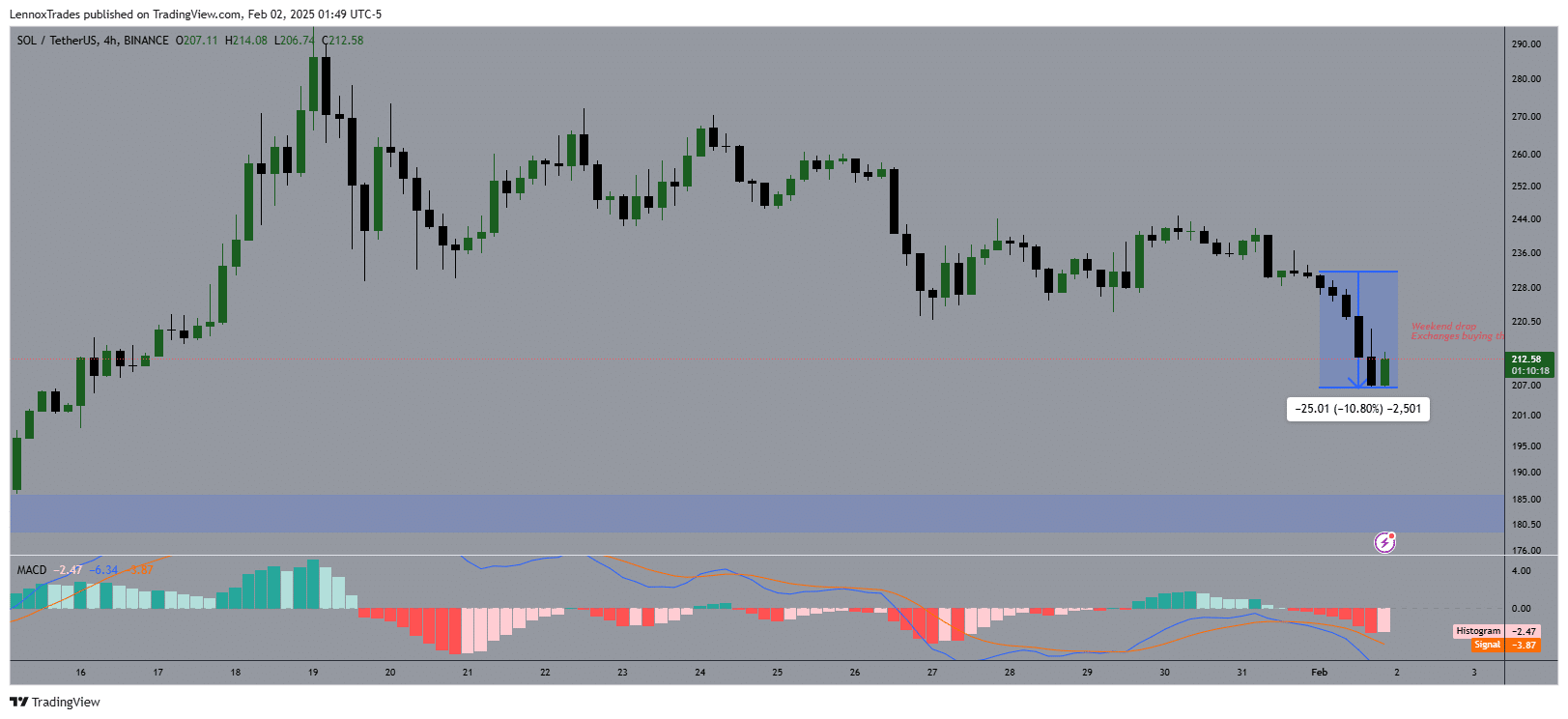

Source: TradingView

Sol’s price activity showed a sharp fall and reached a low point of $ 207 before they returned when stock exchanges arrived. Buying the weekend by exchanges suggested a strategic purchase during the DIP on this point.

Read Solana’s [SOL] Price forecast 2025–2026

This promotion correlated with a decline in MACD values, which indicates at a decreasing momentum, which shifted positively after buying.

If these buying patterns continue, Sol could test higher resistors near $ 235. Conversely, it cannot retain this support to a retest of lower levels.