- Solana bulls did well to hold the $210 support, but selling pressure increased.

- The market structure and momentum favored the bears.

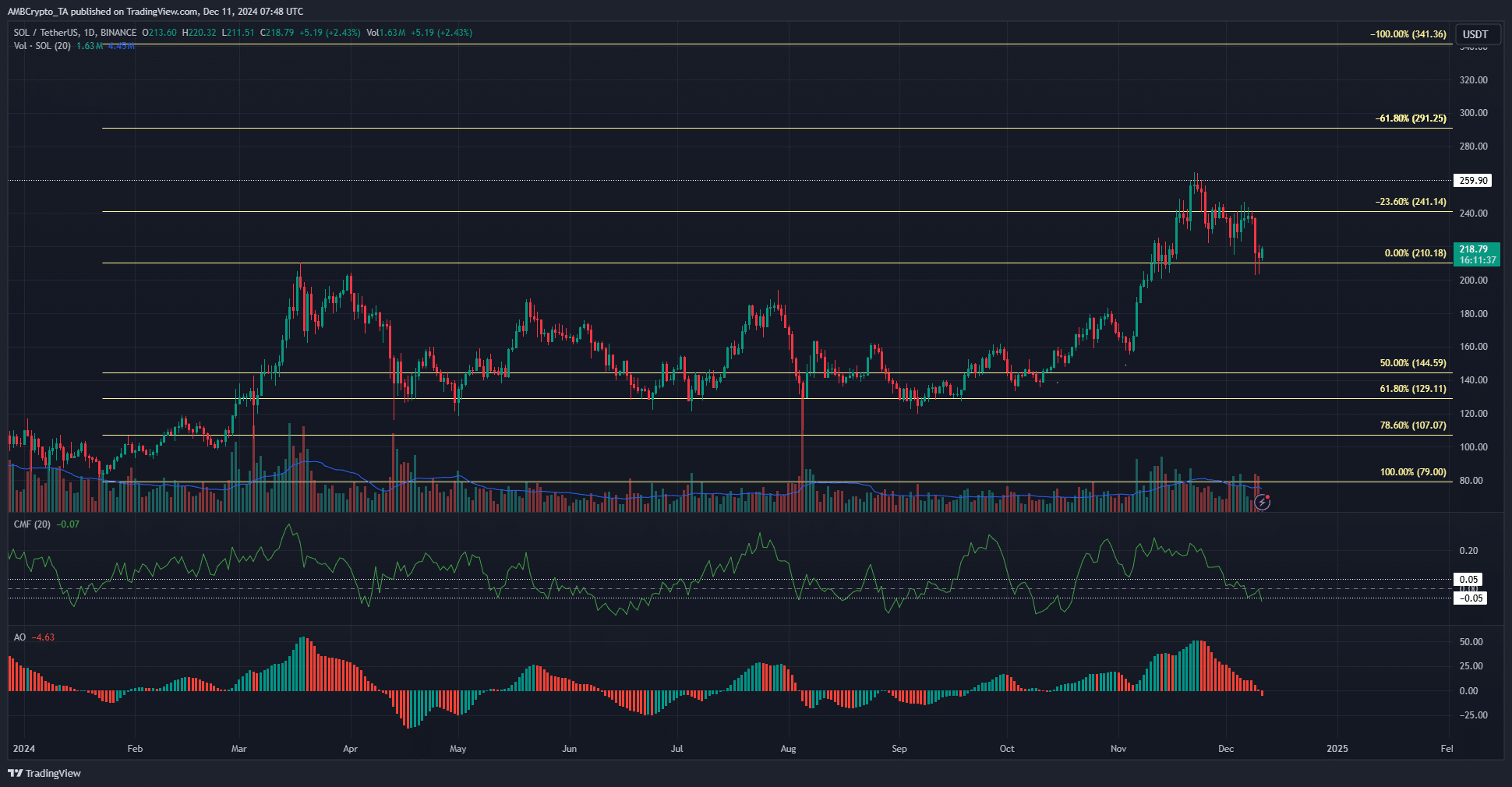

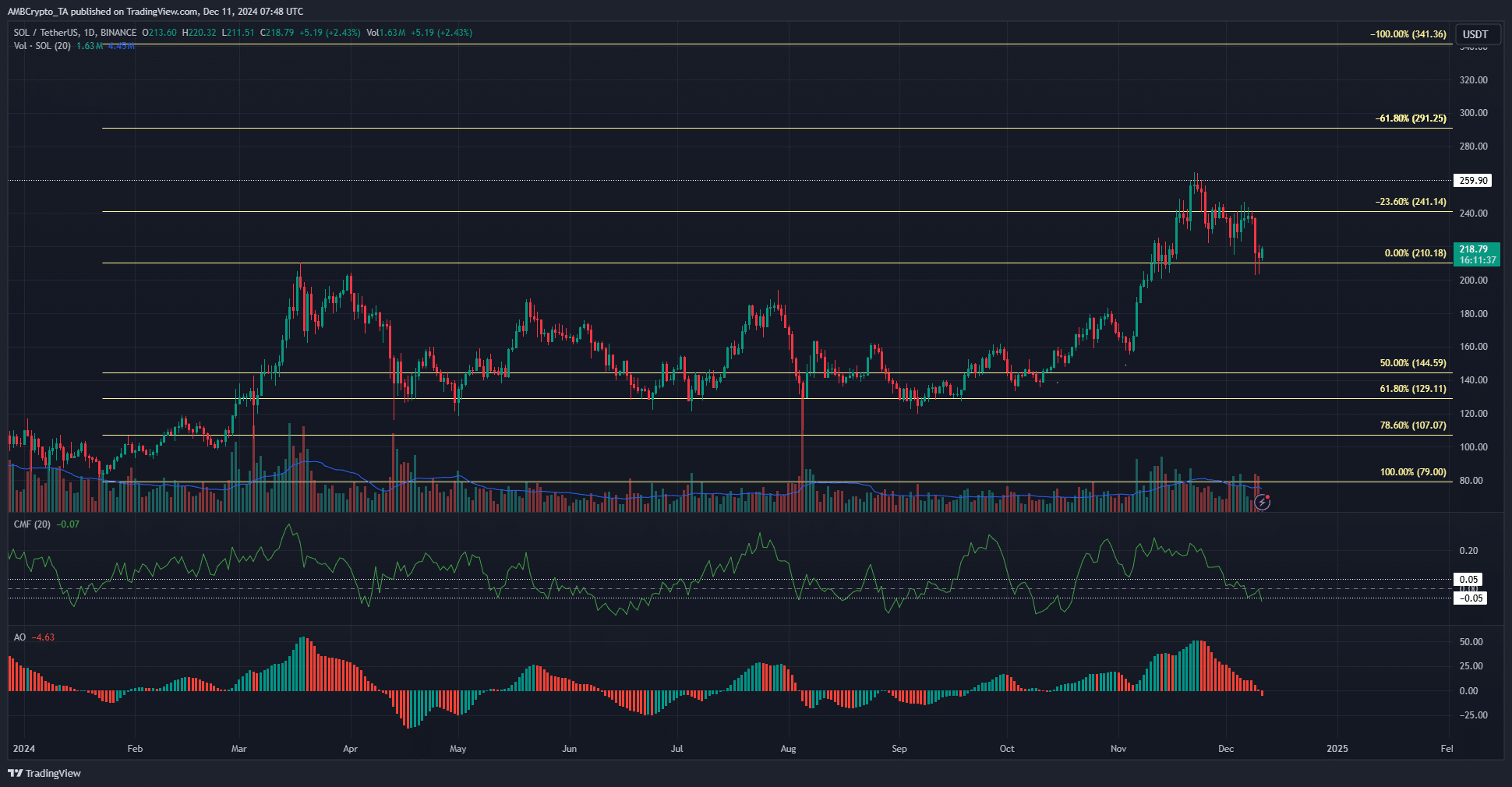

Solana [SOL] Bulls have defended the $210 support over the past two days and have managed to push the price higher. Still, the technical indicators showing bears prevailed. Bitcoin’s indecisive price action [BTC] also provided little support to Solana.

Consolidation between the $210-$230 region is expected in the coming days. Below $210, another important level was highlighted. A move below this level could cause SOL to drop another 10% in value.

Solana bounces 4% of support

Source: SOL/USDT on TradingView

On the daily term, Solana showed a bearish market structure. This came after the price hit a series of lower highs over the past two weeks. March highs at $210 have been defended over the past two days.

Still, the indicators have shifted and now reflect bearish pressure. The CMF fell below -0.05, signaling significant capital outflow from the market. The Awesome Oscillator also formed a bearish crossover to indicate that downward momentum was building.

Bulls are expected to defend the key support at $210 for Solana. There is a high probability of short-term volatility.

If SOL closes a daily session below $202-$203, it would be a clear indication that more losses are on the way. In that scenario, a move towards $180 can be expected.

Volatility expected between $210 and $230

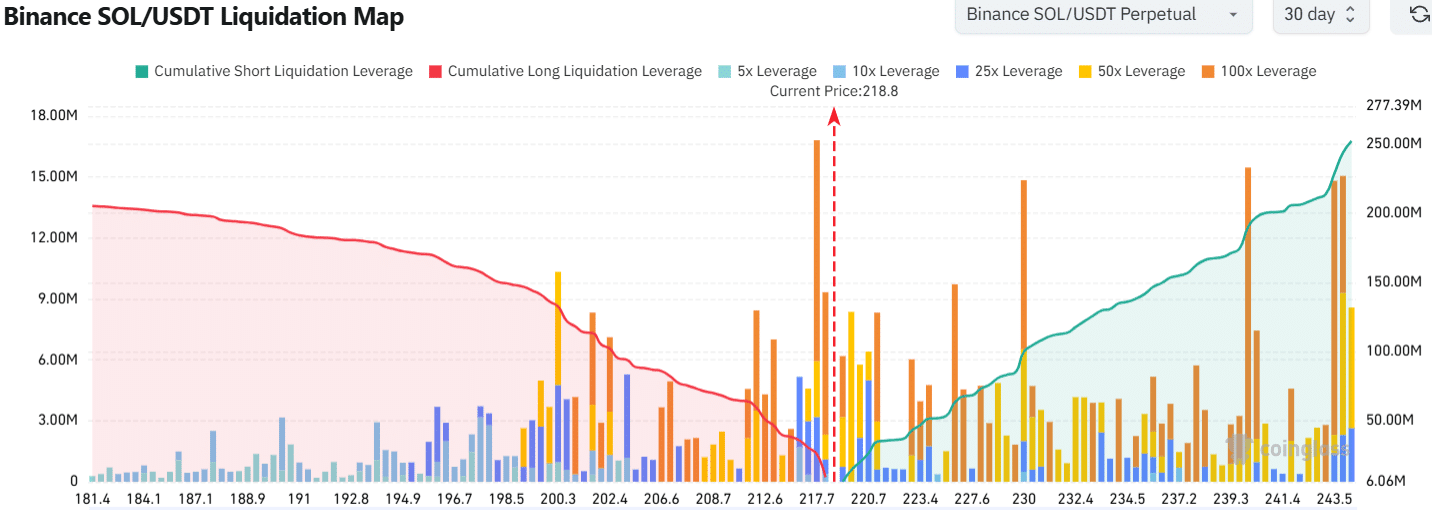

The liquidation map showed that there was a collection of highly leveraged long positions from $210.5 to $218. It will likely be revisited as prices depend on liquidity. To the north, the $220-$230.3 zone also has significant cumulative leverage.

Is your portfolio green? View the Solana Profit Calculator

Solana is expected to bounce between the USD 210 and USD 230 levels in the coming days before it can resume its previous uptrend. The chances of an uptrend would decrease if Bitcoin fell below $94k and $90.5k.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer