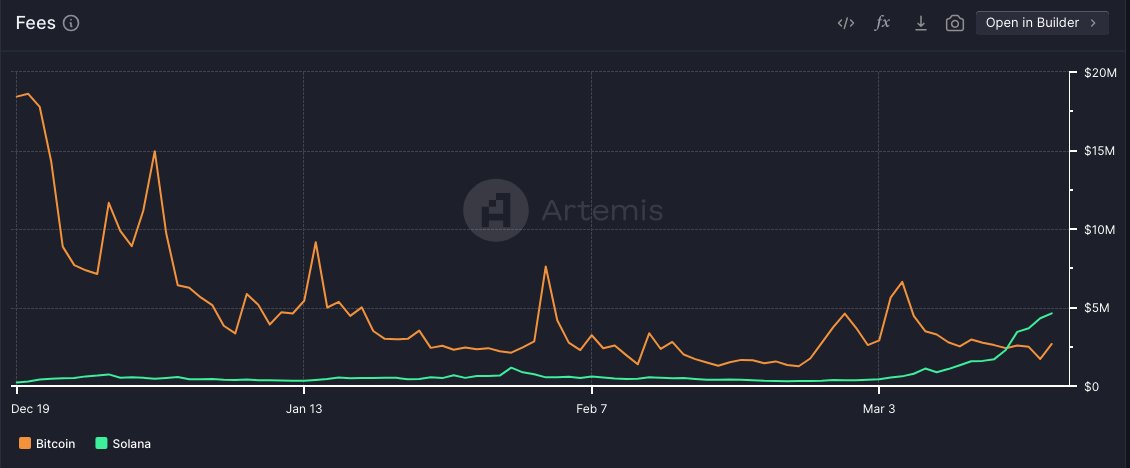

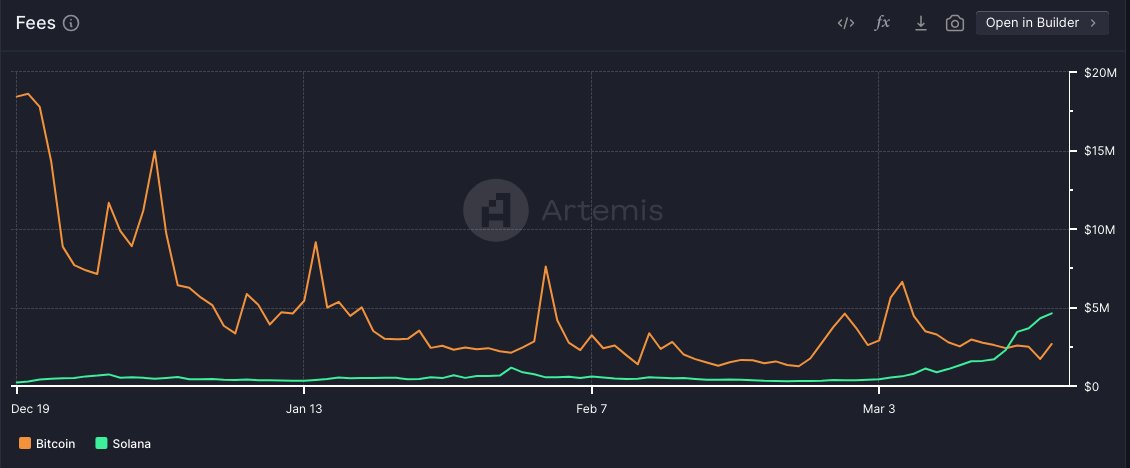

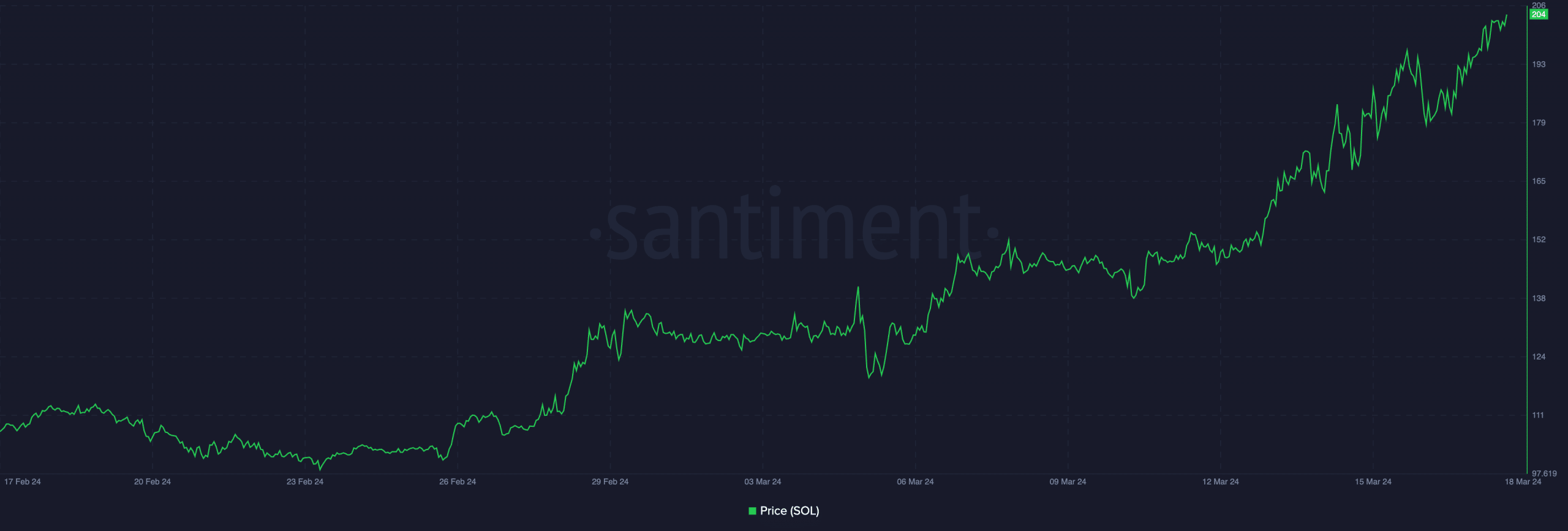

- The fees for the Solana validator were higher than the fees generated on the Bitcoin network.

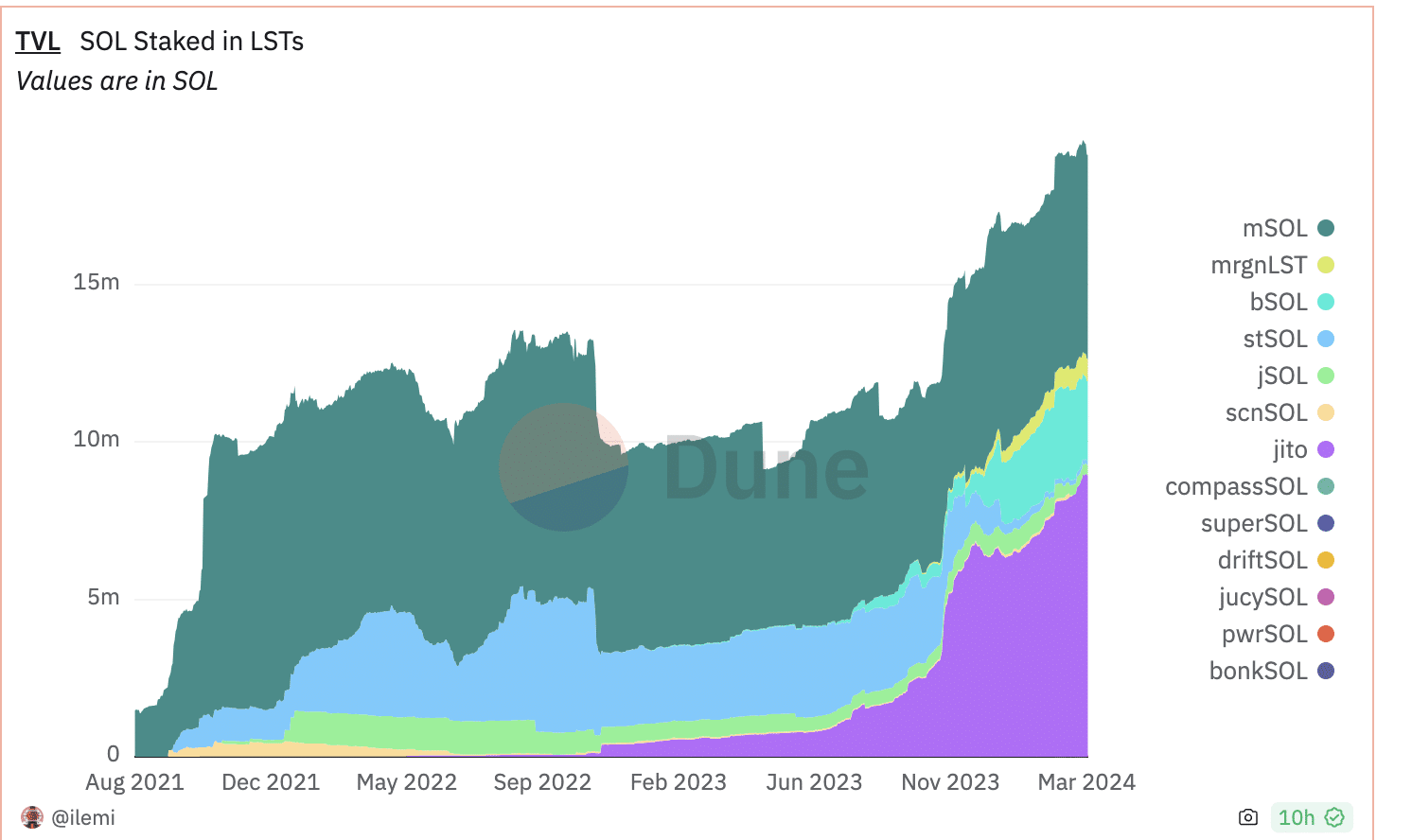

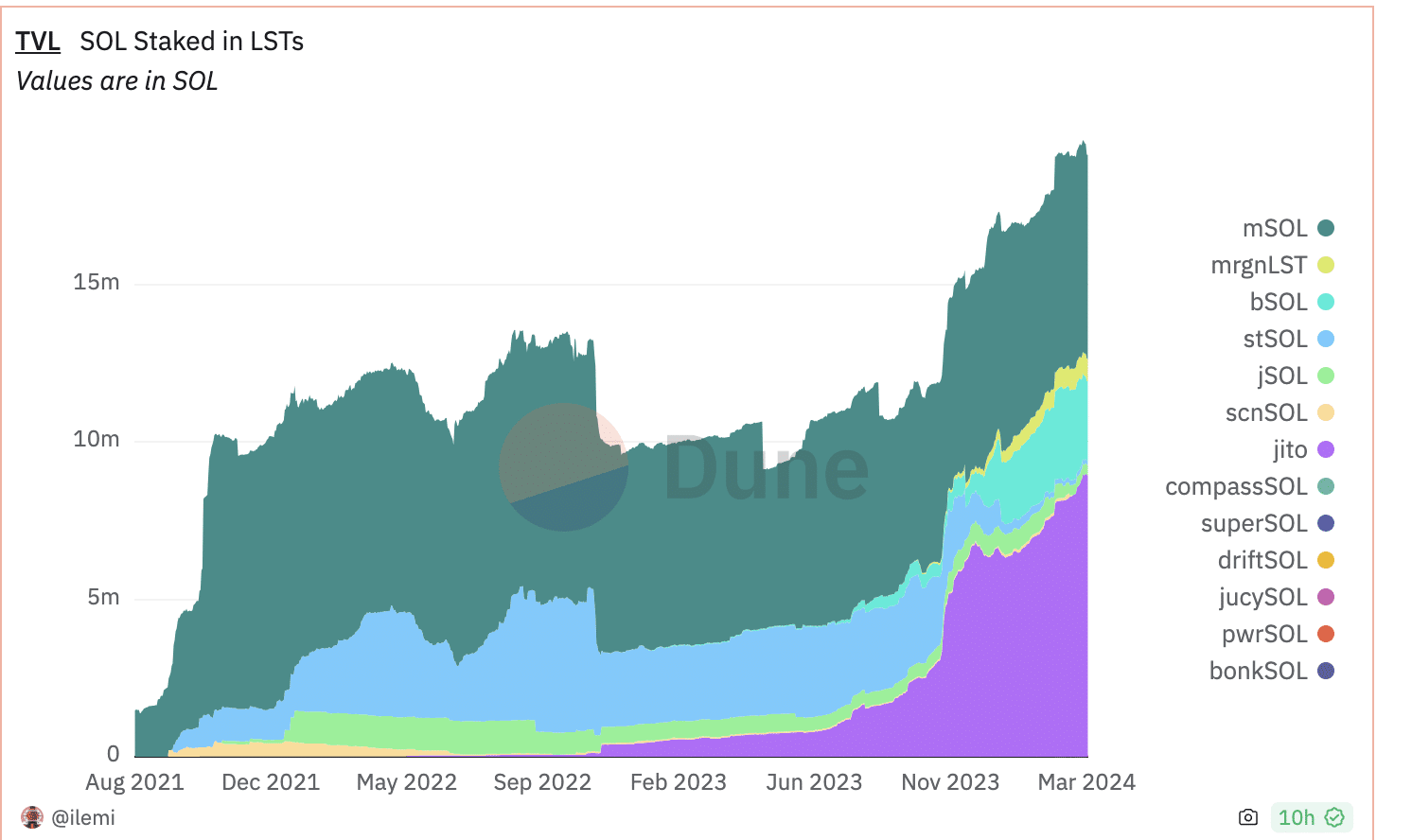

- Interest in deploying SOL grew as the price of SOL rose.

Solana [SOL] has surpassed several altcoins in terms of activity and transactions taking place on the network. However, the network began to show growth in other areas as well. Data indicated that Solana was able to agree with Bitcoin[BTC] in terms of fees collected on the network.

Higher fees

According to AMBCrypto’s analysis of Artemis data, Solana surpassed Bitcoin in validator fees. The higher fees earned by Solana validators indicate an increase in network activity, indicating greater adoption and use of the platform.

The increased activity not only demonstrates Solana’s scalability, but also highlights its efficiency in processing transactions and executing smart contracts.

Additionally, the ability to generate higher fees increases Solana’s attractiveness to validators, encouraging their participation and strengthening network security and decentralization.

As Solana continues to surpass Bitcoin in fee generation, it strengthens its competitive position and underlines its potential as a leading blockchain platform, attracting more developers, projects and users to its ecosystem.

Source: Artemis

While higher fees may indicate increased network activity, some investors worry that Solana’s rapid growth could be unsustainable or possibly indicative of speculative behavior.

There are also concerns about the scalability of Solana’s network and whether it can handle continued growth without encountering technical challenges or bottlenecks.

Solana’s history with downtime doesn’t help sentiment around the network either.

Interested in staking

In addition to the validator fees, high interest was also observed in staking Solana. Analysis of Dune Analytics data showed that there was an increase in TVL (Total Value Locked) stakes via LST (Liquid Staking Tokens).

Jito was the most popular choice for most of the stakers as it captured 46.1% of the total market share.

The increased participation in staking strengthens the security and decentralization of the network by securing more SOL tokens as collateral. This increased security helps ensure the integrity of transactions and increases trust in the Solana protocol.

Additionally, by staking SOL tokens, holders can earn rewards.

How much are 1,10,100 SOLs worth today?

This promotes a culture of long-term investment and helps reduce circulating supply, potentially leading to a more stable token price over time.

Source: @ilemi Dune Analytics

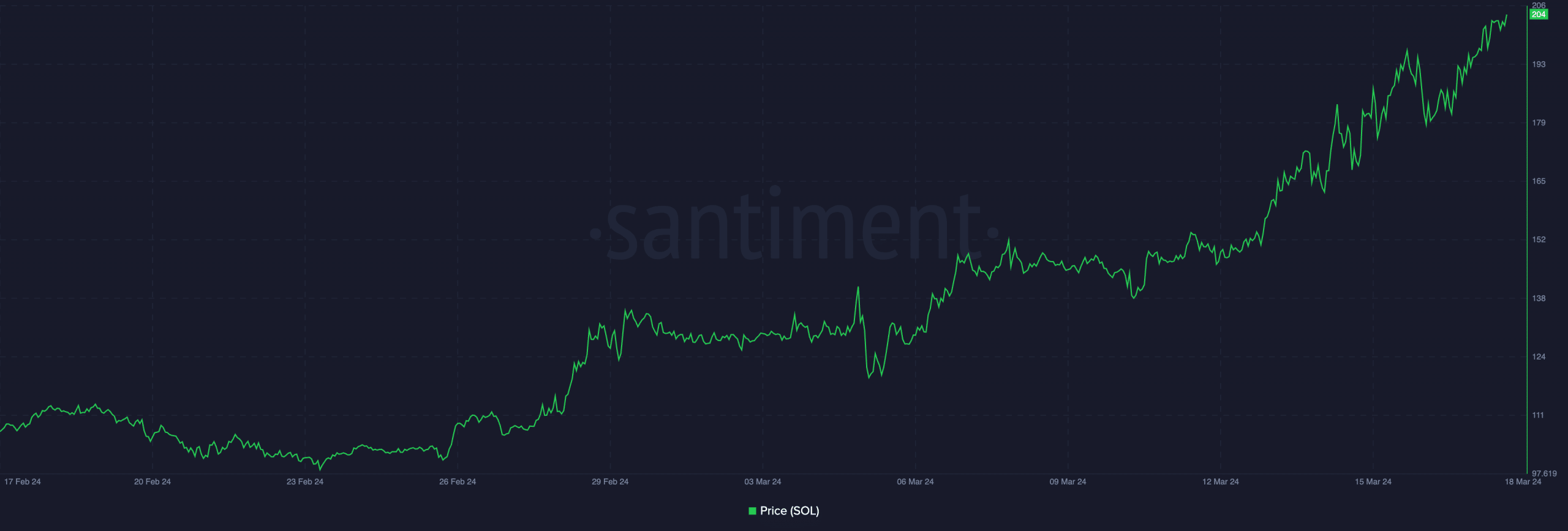

In addition to the staking of SOL, interest was also shown in the SOL token. In the last 24 hours, the price of SOL has increased by 10.46%.

Source: Santiment