- Bitcoin and Solana shared most of the spoils in a week that saw around $66 million in investment inflows.

- SOL’s bullish momentum waned, indicating that the token could fall below $30.

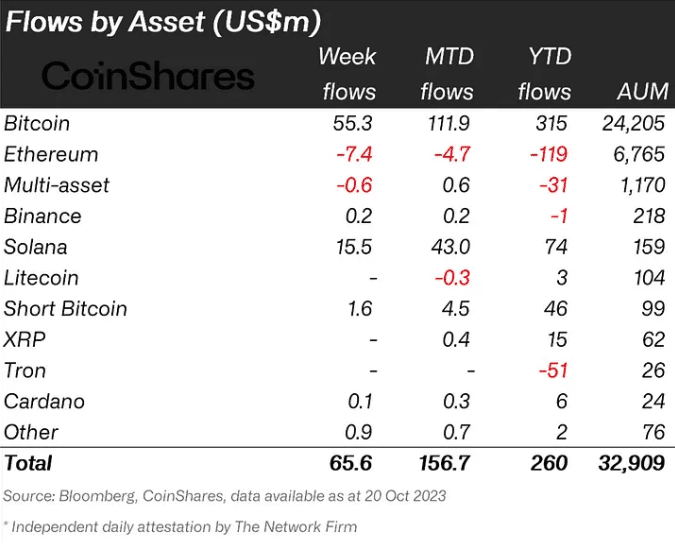

According to CoinShares’ October 23 update, digital asset investment products exceeded $60 million inflows for the fourth week in a row. But unlike previous weeks, Bitcoin [BTC] wasn’t the star of the show.

Read Solanas [SOL] Price prediction 2023-2024

Last week Solana was king

Instead of, Solana [SOL], whose price action has soared, received far more inflows than any other altcoin-related product. James Butterfill, the author of the report, revealed that Solana recorded an inflow of $15.5 million. Other assets such as Ethereum [ETH] And Litecoin [LTC] did not come close to the liquidity allocated to Solana.

Source: CoinShares

Bitcoin, as shown above, had an inflow of $55.3 million. However, Butterfill noted that despite the optimism surrounding the approval of a BTC spot ETF, inflows have been low. This was because he compared the value to June, when Blackrock announced it was also being added to the sign-up list.

CoinShares explained through Butterfill that the reason the inflows were not as high was because the broader market seemed to be adopting a cautious strategy to avoid getting caught in adverse conditions. The report read:

“It suggests that the lower inflows this time, despite the positive news from the Grayscale vs. SEC court decision, indicates that investors are taking a more cautious approach this time.”

For Solana, the attention it’s enjoying now goes beyond just the price action. A few months ago, Solana was referred to as a project that would no longer be relevant in the grand scheme of things. This was due to the tyres such was the case with the now collapsed FTX.

But a quick look at the blockchain performance the third quarter showed that a lot of hard work had been put into it. This was mainly where Solana was currently standing.

It was time to take it easy

Price-wise, SOL was the top to winr of the top 10 assets by market capitalization. At the time of writing, the token’s value has increased by 26.29% over the past seven days. However, it could be time for SOL to take a break from the rally. This was indicated by the Moving Average Convergence Divergence (MACD).

Judging by the four-hour SOL/USD chart, an intense sell-off may have begun. The price failed to break the USD 30.69 resistance. The MACD fell to -0.05. The negative value of the MACD implies that downward momentum increased.

This trend was also confirmed by the 12-day EMA (blue) and 26-day EMA (orange). The orange dynamic line overtaking the blue one indicates that sellers may soon take control of the market and the bullish bias may soon be neutralized.

Source: TradingView

Realistic or not, here it is The market cap of SOL in BTC terms

If selling pressure outweighs buying orders, the SOL could fall to $26.74 – a point that serves as support for the latest rate hike.