- Analyst Ki Young supports buying Bitcoin at $100K, anticipating a price of $145K.

- Multiple metrics pointed to $100K as the level to push BTC to $160K.

Like Bitcoin [BTC] continued to show strength, CryptoQuant analyst Ki Young asked a timely question on X – Should you buy Bitcoin for $100,000?

Ki Young’s first major consideration in the checklist was whether potential buyers would wonder if they would regret it if Bitcoin rose to $145,000.

Also the readiness of potential buyers for a possible bear market and the ability to withstand corrections of more than 30% without panic selling.

He added that the long-term commitment was also crucial, suggesting a minimum investment period of one year.

Why the $100,000 level is crucial

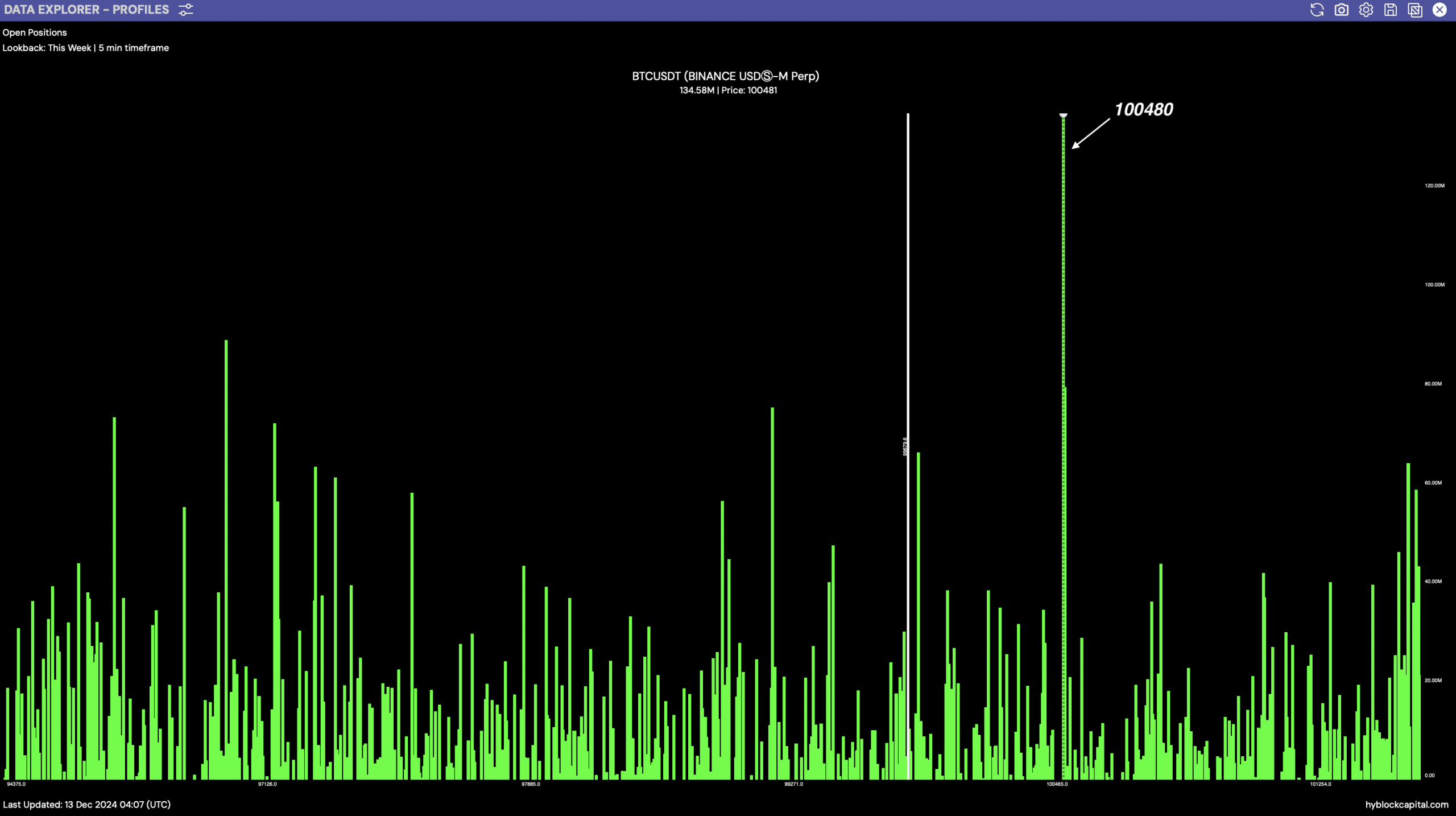

Analysis of Bitcoin’s open positions over the past week showed a concentration at the $100,480 price level.

This particular point recorded the peak number of open contracts and could be crucial to Bitcoin’s price movement. The emphasis on this level suggested that it was a key area for traders, indicating strong interest and possible competition between buyers and sellers.

Source: Hyblock Capital

There was varied activity at other price levels, but none matched the intensity of $100,480.

This concentration of open positions could act as support or resistance and, if tested, influence Bitcoin’s price movement. The patterns often indicated important psychological and strategic market thresholds, where future price action could pivot.

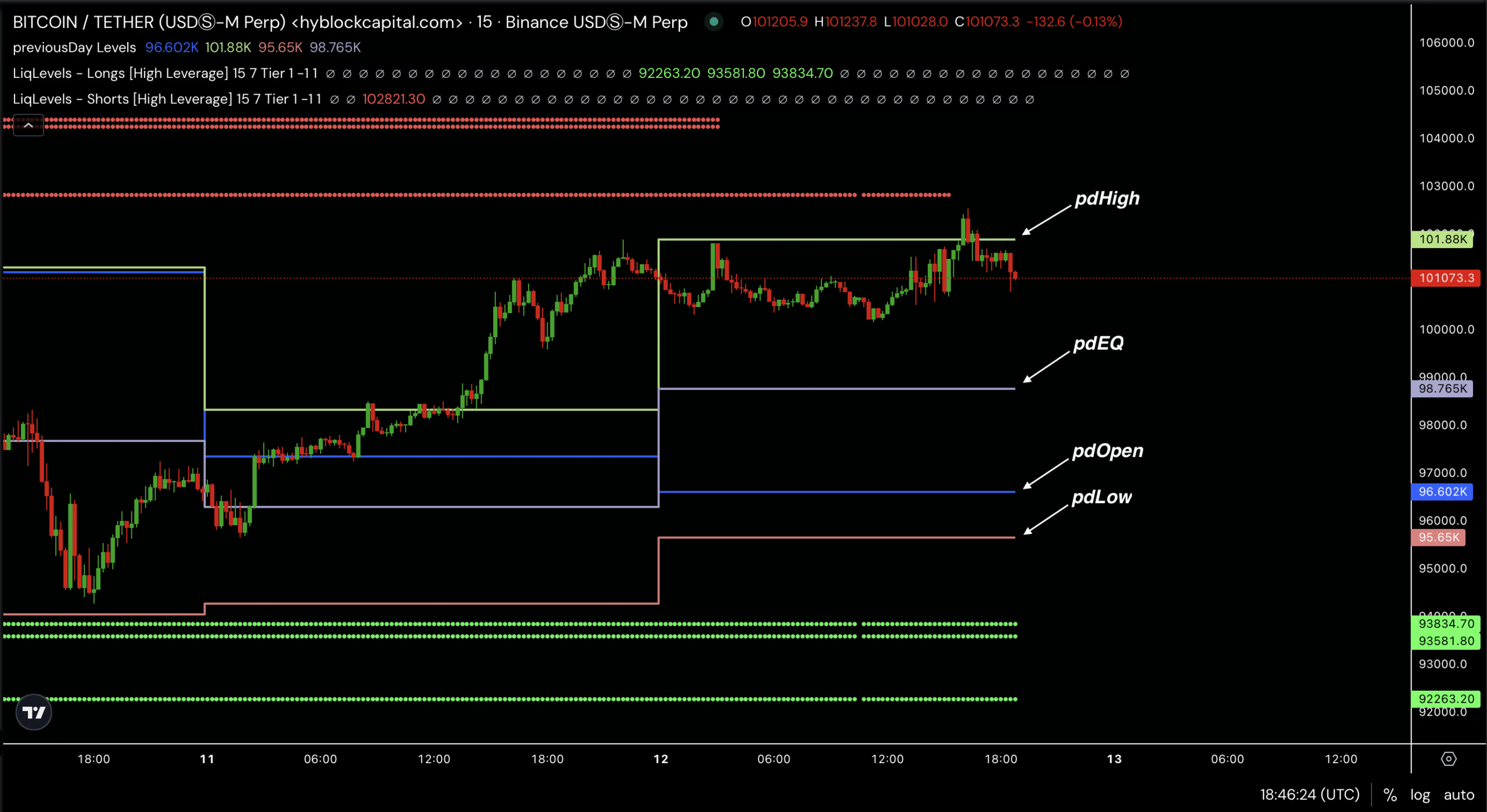

Further analysis showed that the price remained below the previous day’s high at $101,888.

This level, in addition to the high-debt short-term liquidity levels, formed a resistance area that BTC briefly approached before reversing, indicating difficulty moving higher.

Source: Hyblock Capital

The liquidity levels suggested that $100,000 was a critical level that provided traders with insights for potential high reward/risk entry points.

BTC price prediction

Bitcoin consolidated over an eight-month period and began a substantial rise. This phase served as a build-up before BTC experienced a breakout.

Historically, such patterns have suggested potential further gains. Therefore, analysts speculated that Bitcoin could rise to $145,000 in this cycle and perhaps even reach $160,000.

Source: trading view

BTC could rise if momentum is maintained after the breakout phase, coupled with increased market participation and favorable macroeconomic conditions.

Read Bitcoin’s [BTC] Price forecast 2024–2025

The steep uptrend reinforced the sense that Bitcoin’s previous consolidation was a prelude to bigger gains in the long term.

Bitcoin could test resistance levels or set new support zones, which is crucial to its path to potentially reaching $160,000.