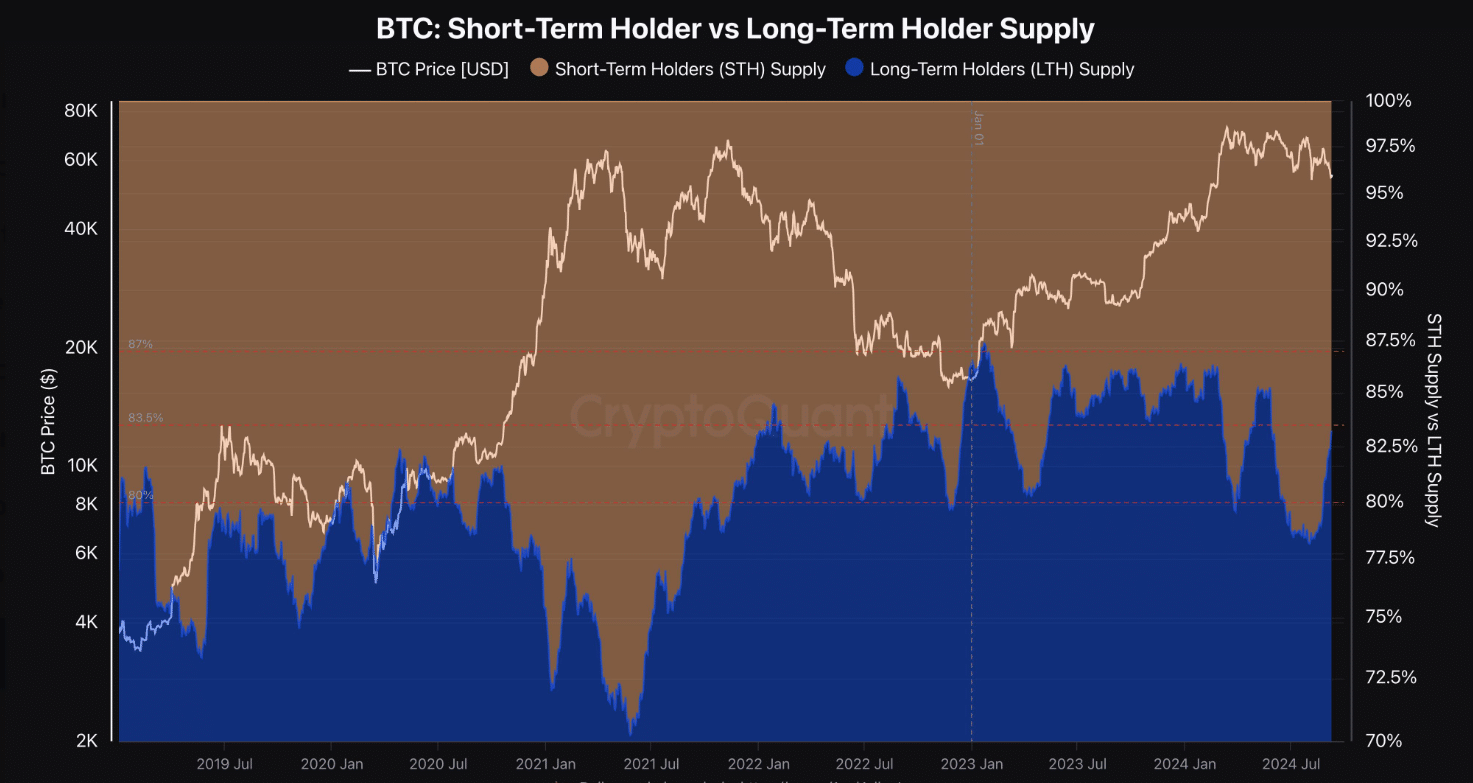

- Short-term Bitcoin holders began selling at unprecedented rates, while long-term holders piled in.

- The capital shift comes as traders chose to remain risk averse.

Bitcoin [BTC] was trading at $58,200 at the time of writing, after a 2.8% gain. The price rise followed the release of US inflation data, as traders believed the Federal Reserve’s interest rate cut story next week.

However, despite these gains, Bitcoin still faced challenges. CryptoQuant Author IT technology noted that short-term holders were leaving the market.

Over the past two weeks, this cohort has reduced its net position on Bitcoin through profit and loss taking.

Within the same period, long-term Bitcoin holders have accumulated more coins, demonstrating a significant capital shift.

Source: CryptoQuant

Short-term Bitcoin holders have a more direct impact on the price and by selling they contribute to choppy price movements.

However, accumulation by long-term holders could lead to price stabilization and pave the way for a recovery.

Bitcoin holders are getting out

The weak demand for Bitcoin is also reflected in the decoupling of gold, as the latter has recently reached an all-time high.

The head of research at CryptoQuant, Julio Moreno, noted that a sustained period of negative correlation between Bitcoin and gold indicates a risk-averse environment.

This showed that traders were willing to hold less volatile assets such as gold.

Furthermore, Bitcoin underperformed alongside a weak US dollar. This also showed risk aversion and uncertainty in global markets, reducing demand for digital assets.

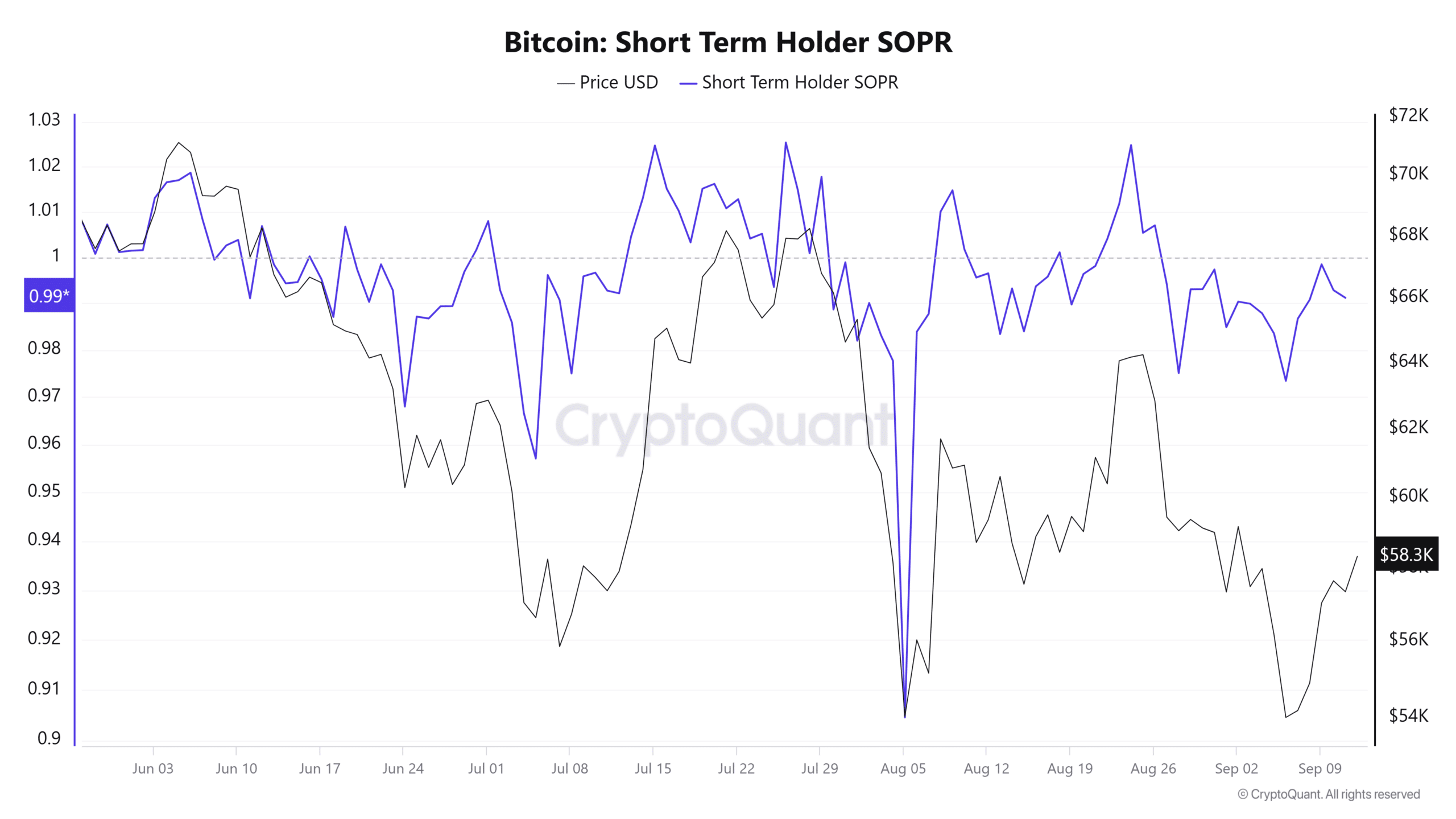

Short-term Bitcoin holders also sold at a loss, as evidenced by the Spent Output Profit Ratio (SOPR), which has been below 1 since August 27.

Source: CryptoQuant

So. traders who had held BTC for 155 days or less appeared willing to forego profits and exit their positions for fear that prices could fall further. It also showed the strength of bearish sentiment.

Price outlook

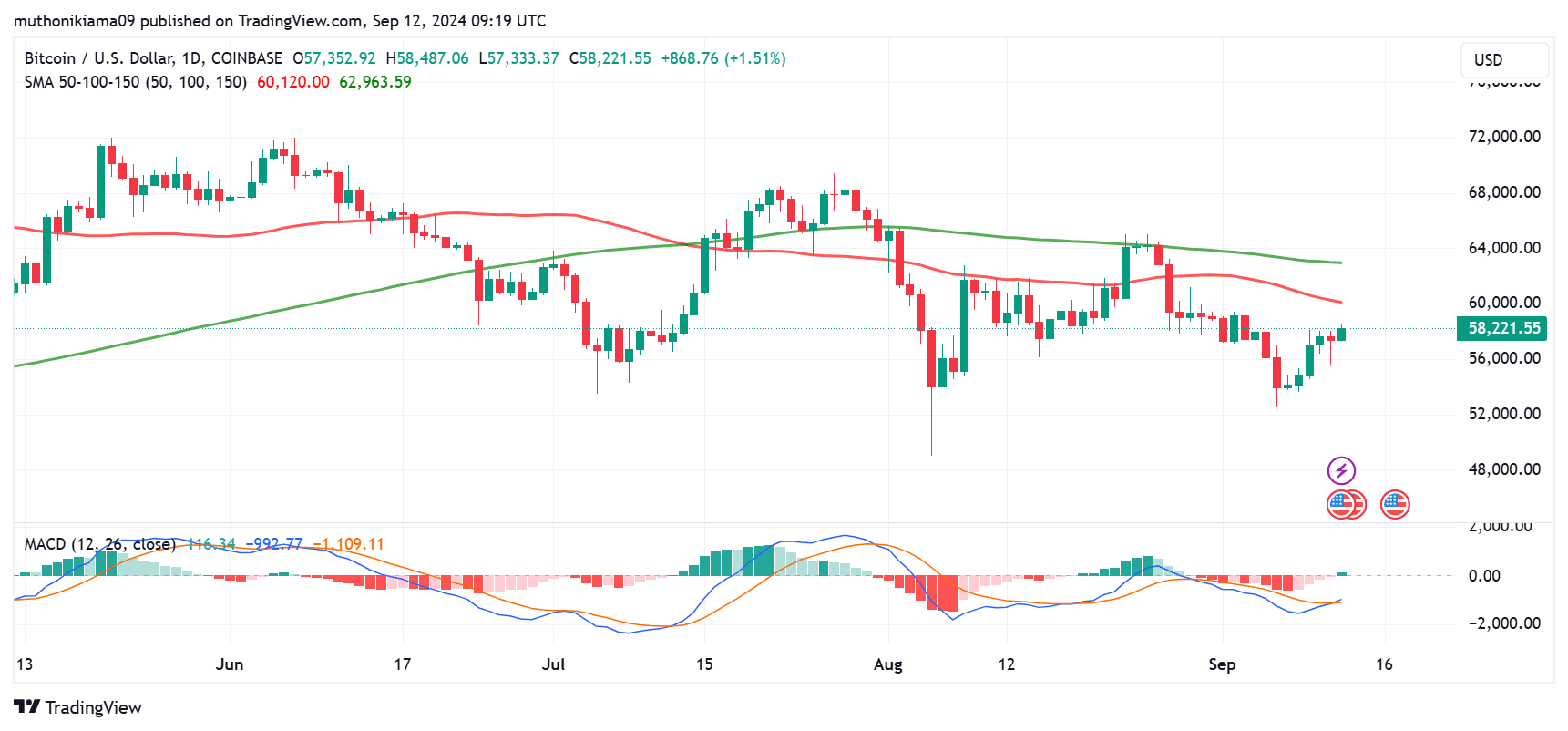

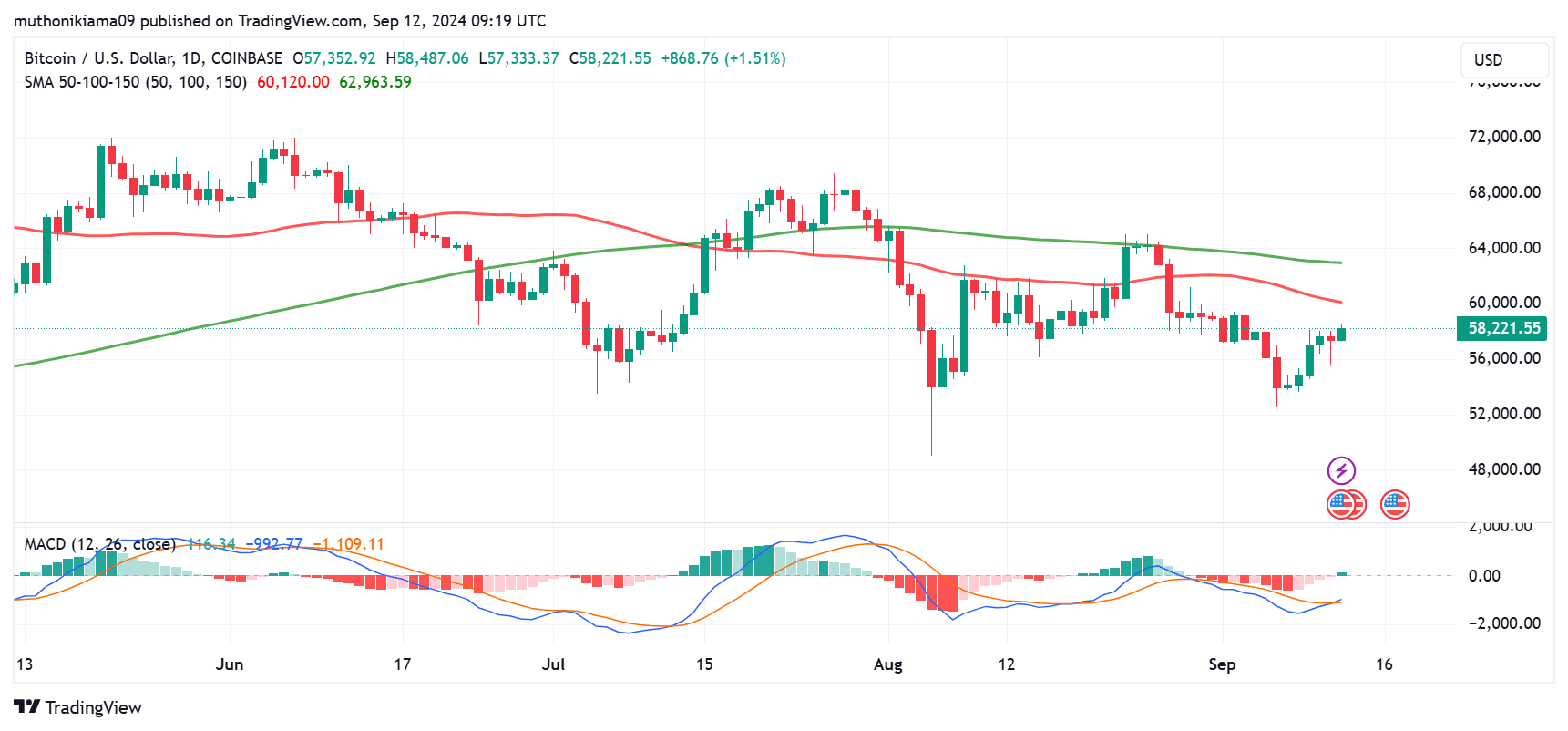

Short-term and long-term sentiment towards Bitcoin remained bearish as the price fell below the 50-day and 100-day Simple Moving Averages (SMAs).

The 50-day SMA, which at the time of writing was $60,000, was the immediate resistance for BTC. If the price reaches this level, short-term sentiment will turn bullish.

However, for a more sustainable rally, Bitcoin needs to reclaim $63,000.

Source: TradingView

The Moving Average Convergence Divergence (MACD) indicator also showed slightly bullish momentum. The MACD line has crossed above the signal line, while the MACD histogram bars have turned green.

Read Bitcoin’s [BTC] Price forecast 2024–2025

This trend suggested that bulls may have been preparing. However, a continuation of this uptrend will occur if the MACD line turns positive.

Despite recent gains, the Bitcoin fear and greed index on 31 it appears that the market is anxious. This could further weaken demand.