This article is available in Spanish.

Like most digital assets, Ethereum witnessed a correction this week by losing more than 5% over the past 24 hours while trading just above $2,500. While the increased activity on the chain could ultimately cause the bulls to bet on Ether’s recovery, a few experts disagree with this perspective.

Veteran crypto analyst Peter Brandt predicts further demise of Ether with a loss of more than 60% from its current price, with no indications of change.

Currently, Ether is trading at a 42-month low. While Bitcoin retested the $70,000 mark early this week, Ether maintains sluggish price action and is too far from the experts’ target of $4,000.

Related reading

Ether’s strong bearish move

Ethereum is trading at a 42-month low against the world’s leading digital assets, indicating bearish momentum. As we zoom out from the price chart, Ethereum is in a downward spiral and a painful market correction for holders and investors.

According to Brandt, Ethereum’s bearish sentiment will continue with no reassuring signs of reversal.

It is striking that no buy signal arrived $ETH

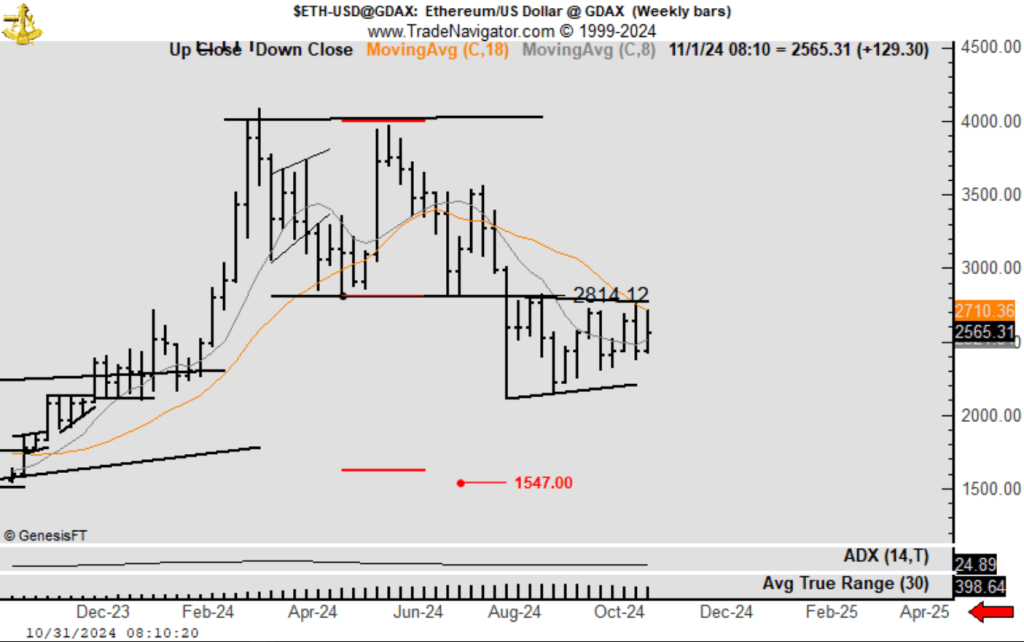

In fact, the chart remains bearish with an unmet target at 1551 pic.twitter.com/sjkXyTQXU2— Peter Brandt (@PeterLBrandt) October 31, 2024

In a Twitter/X post, Brandt shared a chart showing that there is no other signal for Ether. He added that Ethereum’s chart is bearish, with the bulls making it difficult to reach the $1,551 target.

The 1-day chart highlights the asset’s ongoing bearish momentum, which began last August, and was characterized by a descending channel. Ethereum’s bearish flag is terrible news for traders and holders, indicating a continued downward trend.

Analyst sees bearish stats for Ethereum

In addition to the bearish signals in the chart, Brandt also noted some discouraging numbers for Ethereum. Ether, for example, is down more than 5% in the past 24 hours, registering a sharper decline than Solana, at -4.91%, and Bitcoin, at -3.87%.

Brandt also noted that the ETH/BTC trading ratio fell to 0.03613, a 42-month low, as BTC continues to lead the broader crypto market. Although Ethereum is currently priced at $2,507, Brandt sees its value falling even further to $1,551, reflecting a possible 62% decline from its current value.

$1,551 as Ethereum’s unmet goal

Brandt considers $1,551 to be the asset’s unfulfilled goal and a significant milestone. In his analysis, this level serves as a capitulation point for the holders. The recent price drops have eroded investor and holder confidence, with Ethereum struggling to hold the $2,400 support.

Related reading

As the second largest cryptocurrency, Ethereum is showing the first signs of a rally. Many observers have predicted a market rally, targeting a long-term price of $6,000. Short-term estimates put Ethereum’s price at $2,750.

However, Brandt offers a more bearish outlook for Ethereum, saying its value will go downhill unless a new set of technical indicators emerge.

Featured image of Tokpie, chart from TradingView

Stay cool, stay onchain with .pengu

Stay cool, stay onchain with .pengu