- Shiba Inu saw a huge decrease in the Netflows with a large holder and watch a walk in sales pressure

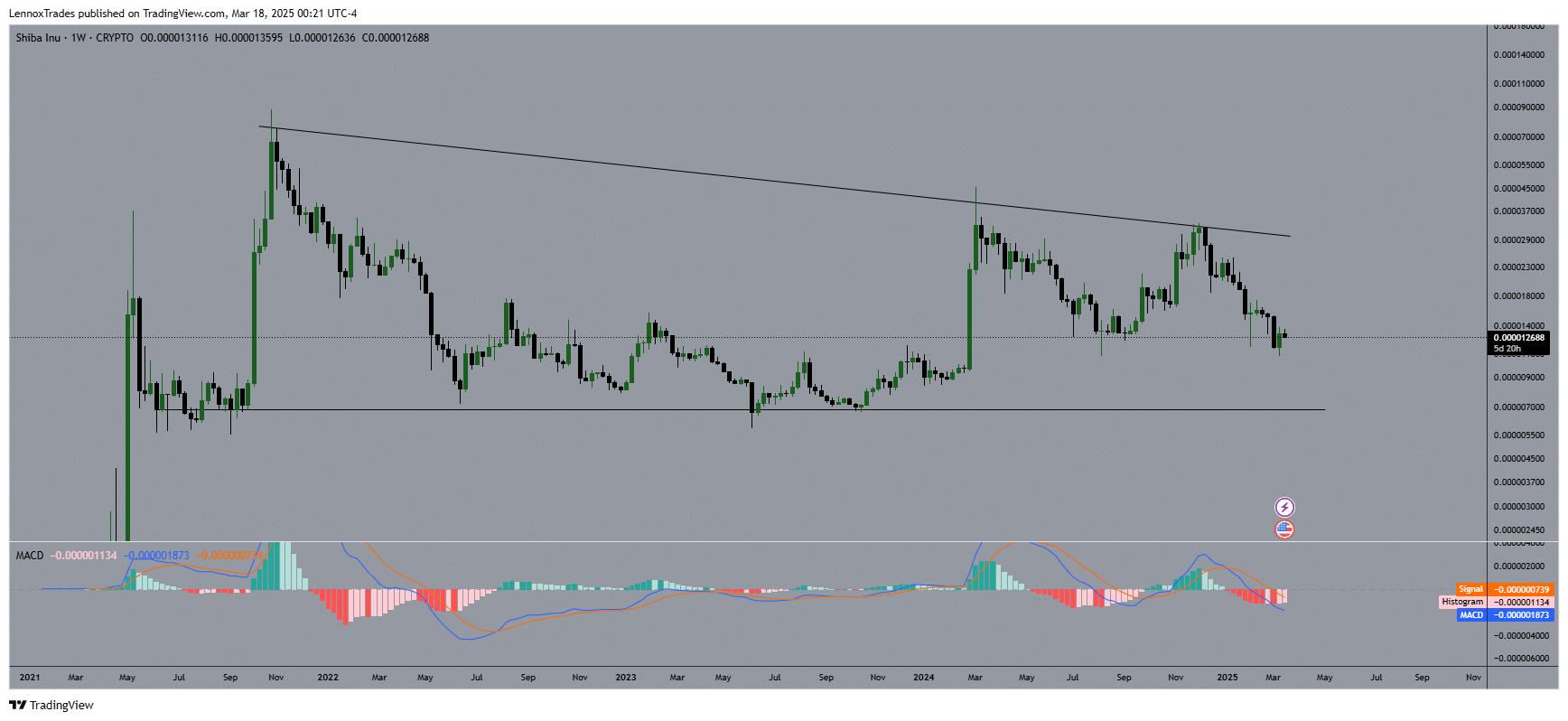

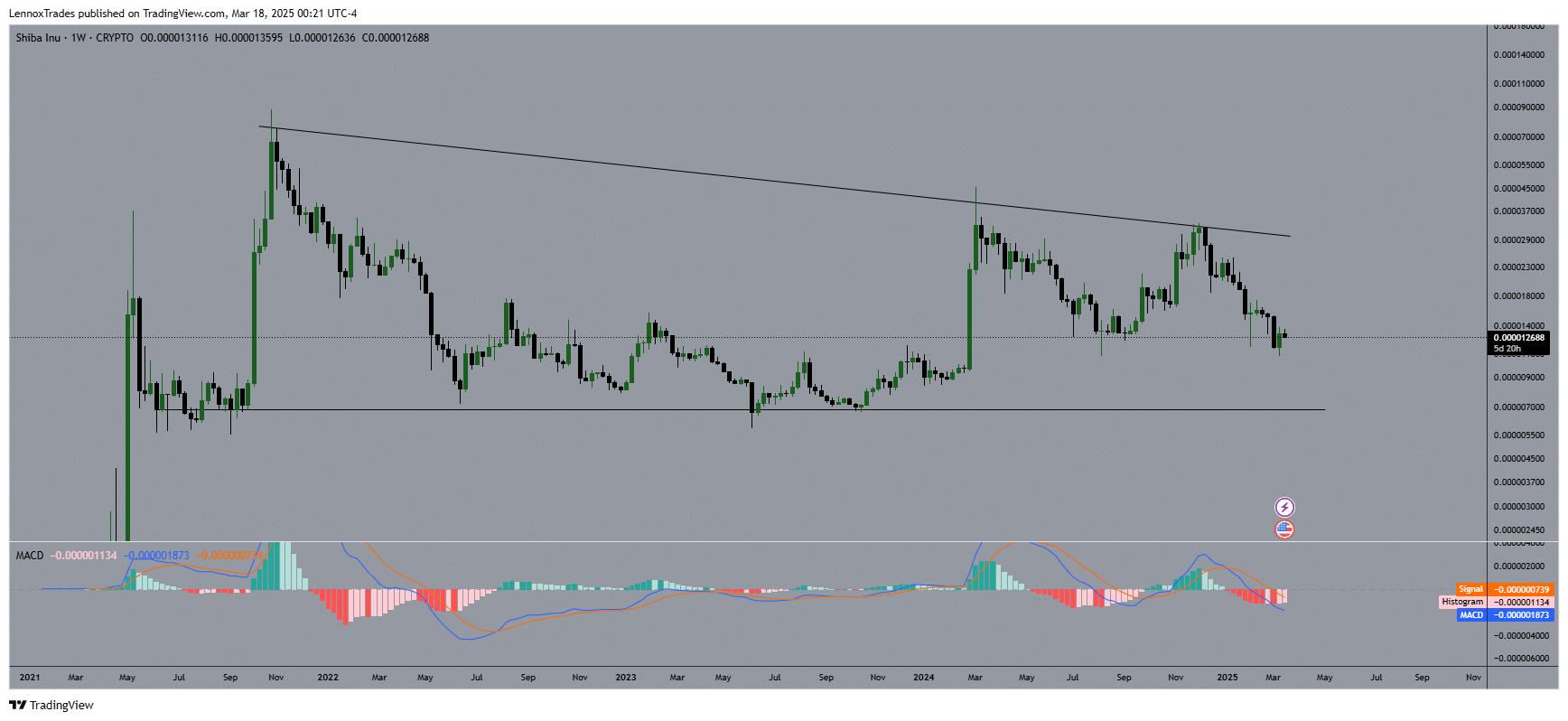

- Shib seemed to act in a falling triangle in the background of his long -term downward trend

The large holders of Shiba Inu (Shib) lost Momentum with a fall of 70% in their input, which indicates leaving the wholesaler wallet. The massive fall corresponded to the fall of large holder who dropped for a week when $ 1- $ 10 million Shib Wallet investors lowered their participations by 31% per day.

Whale of the market reduced the liquidity from Shib to levels where the price was stuck in Beerarish range below $ 0.000014. The lack of new whale activity would make it more difficult for Shib to recover because it would break important support levels.

Market stability can only be possible if new investors come on the market based on small increases in trade volumes. The next phase is full of unknown possibilities because investors have a divided opinion about the state of the market.

What does the weekly price promotion say?

The price action of Shib seemed to act within a falling triangular pattern at the time of the press. It gathered against the long -term downward resistance, but was supported by a critical horizontal support level. The time price of the press had risen to the level of 0.000012688, one where a strong question had been seen earlier.

If the support applies, the price can return to test both ends of the falling trendline and possible upward goals between 0.000030000 to 0.000045000. The Bearish structure would end when weekly price promotion shifts over falling resistance, because it would signal positive momentum trends.

Shib that goes under 0.000010000 would indicate extra situity. This would reveal $ 0.000007000 to $ 0.000005000 as upcoming important support levels.

Source: TradingView

The MACD trend further revealed bearish circumstances because the signal line was below zero while Histogram Momentum continued to fall -a sign of decreasing bullish power. An upward price shift would be supported by the occurrence of a bullish cross pattern in the MacD.

When buyers enter the market, they will try to generate an upward momentum. Staying above $ 0.000012500 for a long time is not possible and such circumstances can lead to more time being spent on current levels or a price fall.

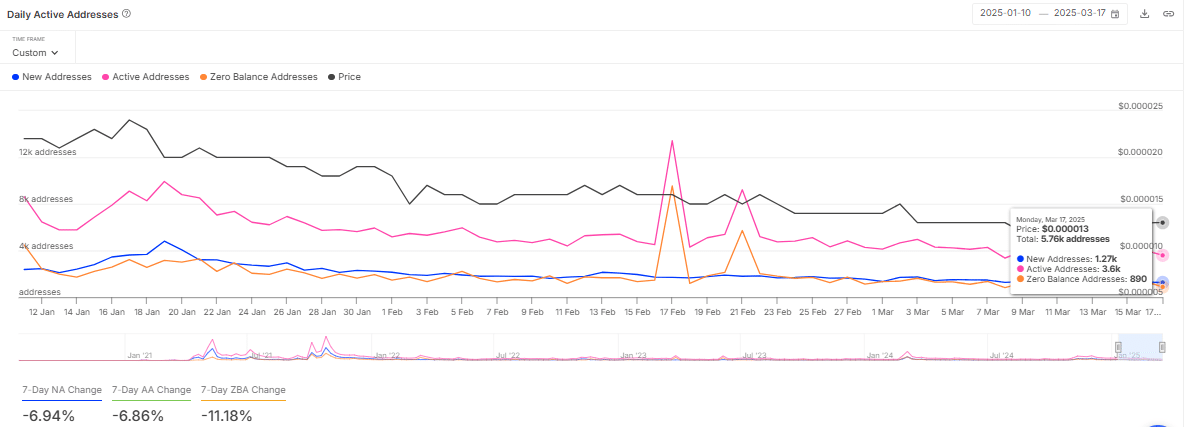

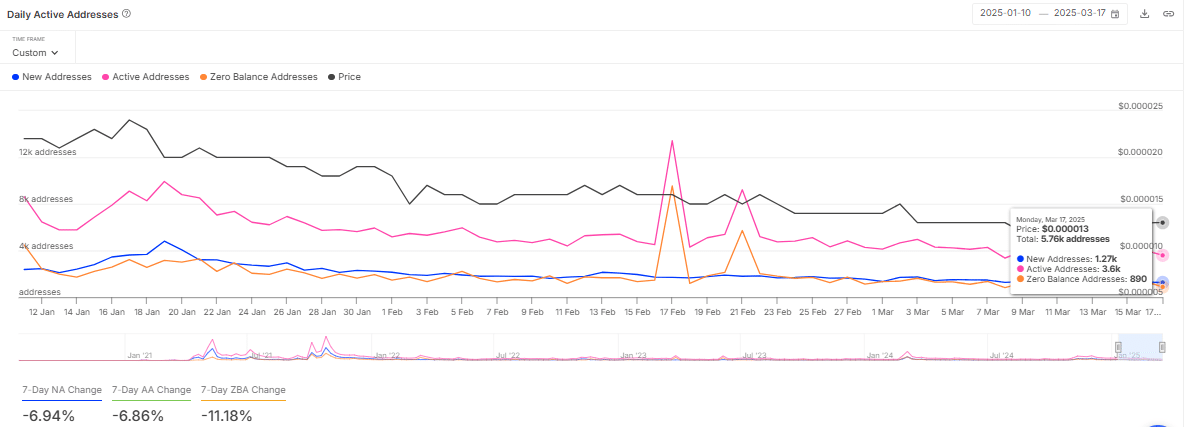

Shib’s active addresses and fire speed

In addition to reducing whale activity, the number of active Shib addresses fell by 6.86% as the new address creation fell by 6.94% and zero balance addresses fell by 11.18%.

In addition, active address numbers saw a peak of 15.6k in February before the figures be started to be written off again.

Source: Intotheblock

The network activity reached its peak at 1.4 m addresses. Unfortunately, it then dropped its minimum of 1.38 million addresses at the end of the middle of the February.

Worth to point out that the rise of 49,552% in daily fire speed did not lead to significant changes. This is even more evidence that some of the on-chain statistics are not always directly related to price versions.