- Shiba Inu signs a Shibarium deal with Chainlink to adopt the CCT standard.

- SHIB bulls show off, wiping out most of November’s gains.

Shiba Inu [SHIB] And Chain link [LINK] have reportedly struck a deal to boost Shibarium’s Mainnet business. After the recent downturn, will this development turn the tide in favor of the bulls?

According to the official announcementThe partnership will allow Shibarium to adopt Chainlink’s blockchain interoperability standard, CCT. This development will improve the efficiency and security of Shibarium, especially in DeFi.

It also shows Shibarium’s commitment to growth, which could potentially boost investor sentiment. However, this development is not expected to impact Shiba Inu in the short term.

Shiba Inu extends extreme sale

SHIB has been on a rollercoaster of price action, with the latest wave being extremely bearish.

At the time of writing, the stock was trading at $0.00002295, having fallen 12.84%, bringing its total weekly downside to 35.61%.

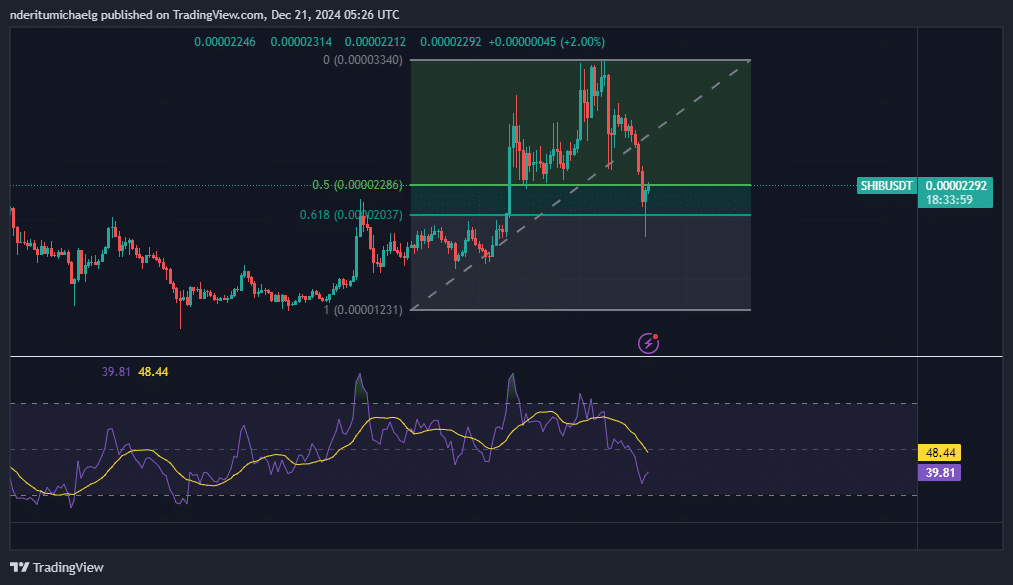

Source: TradingView

Selling pressure was intense, causing the price to drop below $0.00002737 and $0.00002289. This range, in line with the 0.5 and 0.618 Fibonacci levels of the September-December rally, had a high probability of a recovery.

The strong bearish momentum could still head lower, but Shiba Inu was approaching oversold territory according to the RSI, indicating a potential reaccumulation zone.

Coinglass reported outflows worth nearly $10 million on December 20, which at the time was the largest daily outflow in the past seven days. However, a subsequent wave of accumulation quickly turned into a positive net flow of $7.94 million.

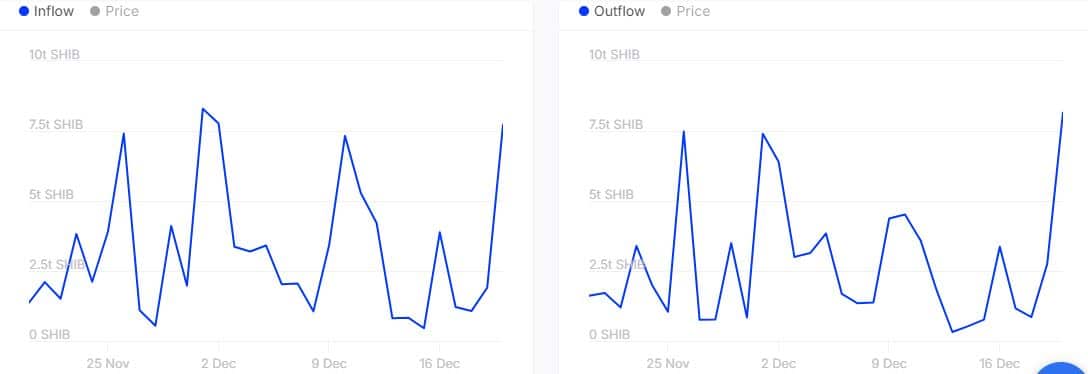

Source: Coinglass

Selling pressure gained new momentum mid-week as whale outflows increased. Major investor outflows increased from $856.14 billion SHIB on 18 Dec 18 to $2.75 trillion SHIB on 19 December.

There was also some accumulation of whales, evidenced by a slight increase in large holder inflows from 1.07 trillion SHIB on December 18 to 1.9 trillion SHIB the following day. However, outflows were significantly higher than inflows, driving the strong bearish momentum.

source: IntoTheBlock

Large holder outflows remained higher at 8.16 trillion tokens, versus 7.72 trillion large holder inflows during the same trading session.

In the derivatives segment, Shiba Inu open interest-weighted financing rates have turned negative over the past 24 hours, but are showing signs of shifting to positive. This indicated that investors were buying the dip, which proved accurate as the price bounced back hours later.

Source: TradingView

Read Shiba Inu’s [SHIB] Price forecast 2024–2025

Funding rates were back in the red on Saturday morning, suggesting there could be further downside this weekend.