- The Shiba Inu weekly price action imposed a strong bearish bias.

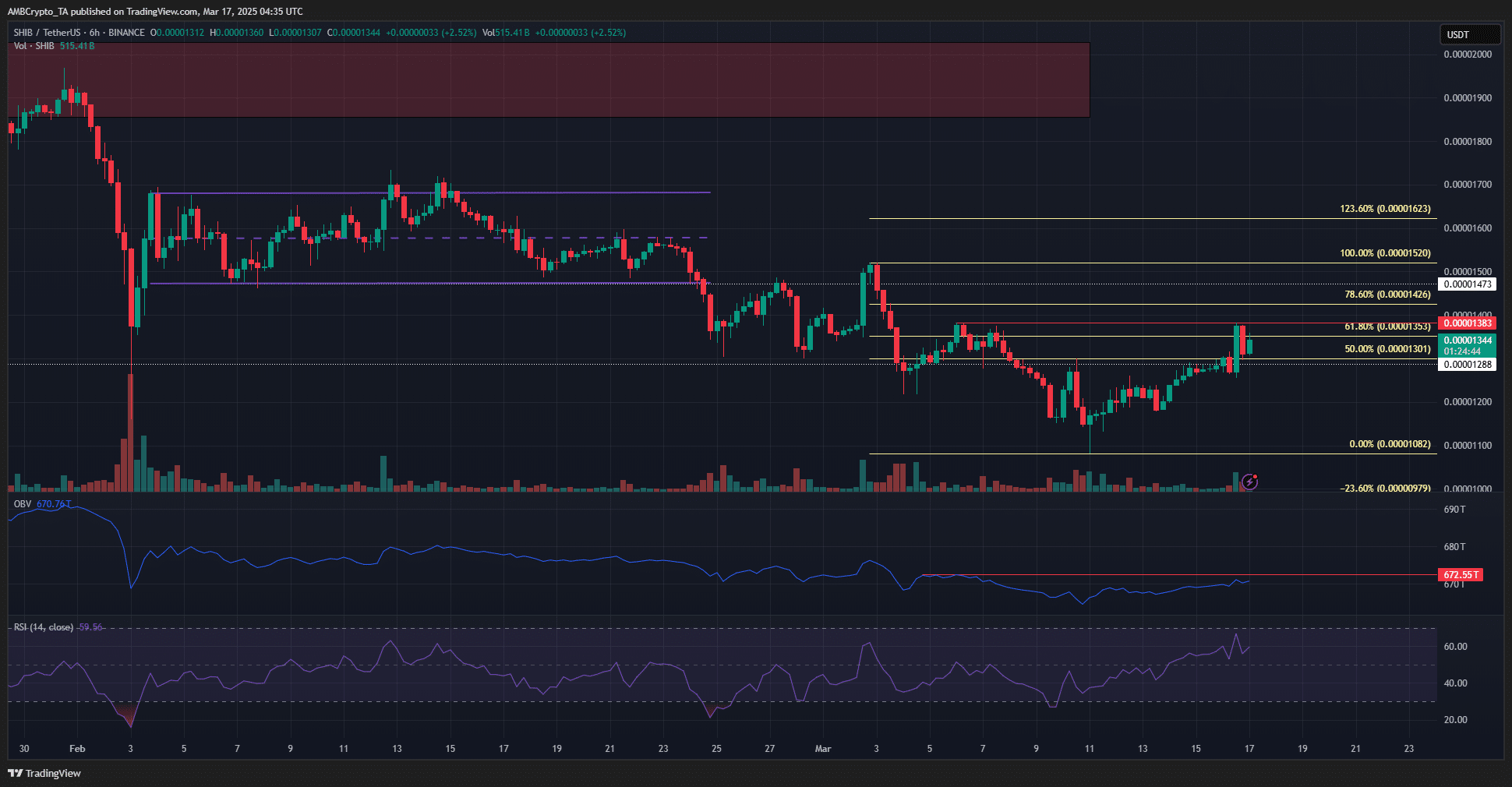

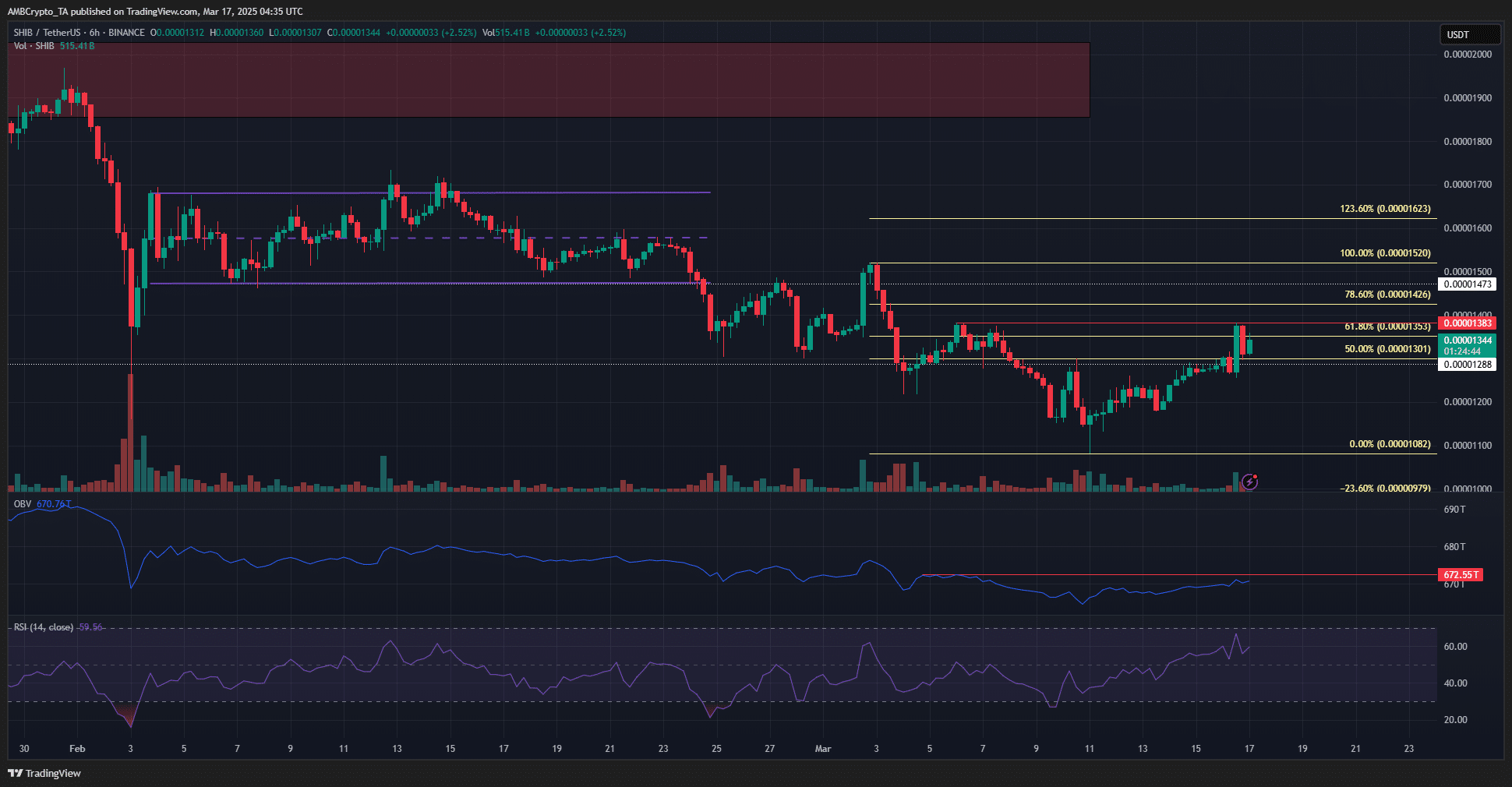

- The lower time frame graph emphasized two important Fibonacci retracement levels to view.

Shiba Inu [SHIB] Was below an important level in the long term last week, but tried to find his way back above. The price action in recent months, however, meant that the bias of the higher period of time Beerarish remained.

The Bitcoin [BTC] Range formation In December the Shib movement started down. Other events saw the bullish conviction in memecoins eroded, a trend that has not yet stopped.

Shiba Inu bulls will probably have a hard time

Source: Shib/USDT on TradingView

Shiba Inu has a bearish structure on the weekly graph. It broke below the level of $ 0.0000164, the lower high from November, and at the time of the press drove just above the support of $ 0.00001288. It concluded the first weekly session in March below this level and strengthened the Beararish for views.

The rallies at the beginning of 2024 and November 2024 were unable to challenge the highlights of the end of 2022. This was disappointing, because Bitcoin had much more capital inflow in the past year than in 2022. The hope of capital rotation in the memecoin might be misplaced.

A struiting of the outlined weekly support is expected. However, it would not be immediately. Just like the summer of 2024, there can be a few weeks of consolidation before the next movement.

Source: Shib/USDT on TradingView

The 6-hour graph showed Shib-trade near a local resistance to $ 0.0000138 (red). The OBV did not set in the set higher high compared to earlier this month.

In addition, Fibonacci racement levels identified $ 0.0000135 and $ 0.0000142 as important resistance zones in the short term.

This suggests that it is unlikely that ShIB will increase more than 6% compared to its current price. The RSI reflected Bullish Momentum after last week’s win, but the swing structure on the 6-hour graph remained Bearish.

An outbreak above $ 0.0000127 and the retest as support has fueled recent profits. Similarly, a movement above $ 0.0000152 could ride the next leg higher. However, the weekly graph does not indicate that such an outbreak is imminent.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer