The crypto markets are witnessing a massive surge in liquidations amid the sudden loss of Bitcoin (BTC) from the $100,000 level.

New data from market information platform Coinglass shows Traders saw liquidations totaling $862.4 million over the past two days, mainly by those who were long betting on Bitcoin.

[

The top crypto asset reclaimed the $102,000 level on Monday but has since tumbled. Bitcoin is trading at $92,721 at the time of writing, down 4.7% in the past 24 hours.

The pseudonymous analyst Rekt Capital – who implemented the correction before Bitcoin’s halving last year – is warning his 528,400 followers on the social media platform

“Bitcoin will bounce back deep enough to convince you that the bull market is over. And then it will resume its upward trend.”

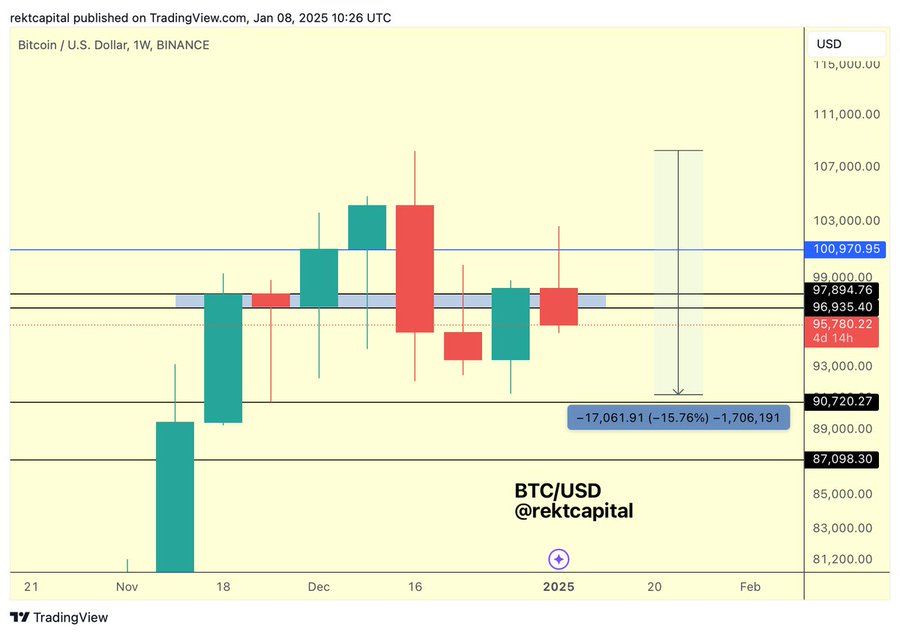

The analyst too warning of market volatility for the remainder of the week after BTC failed to convert a key resistance level into support.

“The orange technical uptrend continues to act as resistance and even facilitates the retest of the blue area. However, the retest in the blue area is volatile at the moment and with much of the week still to go, a lot can still change here.”

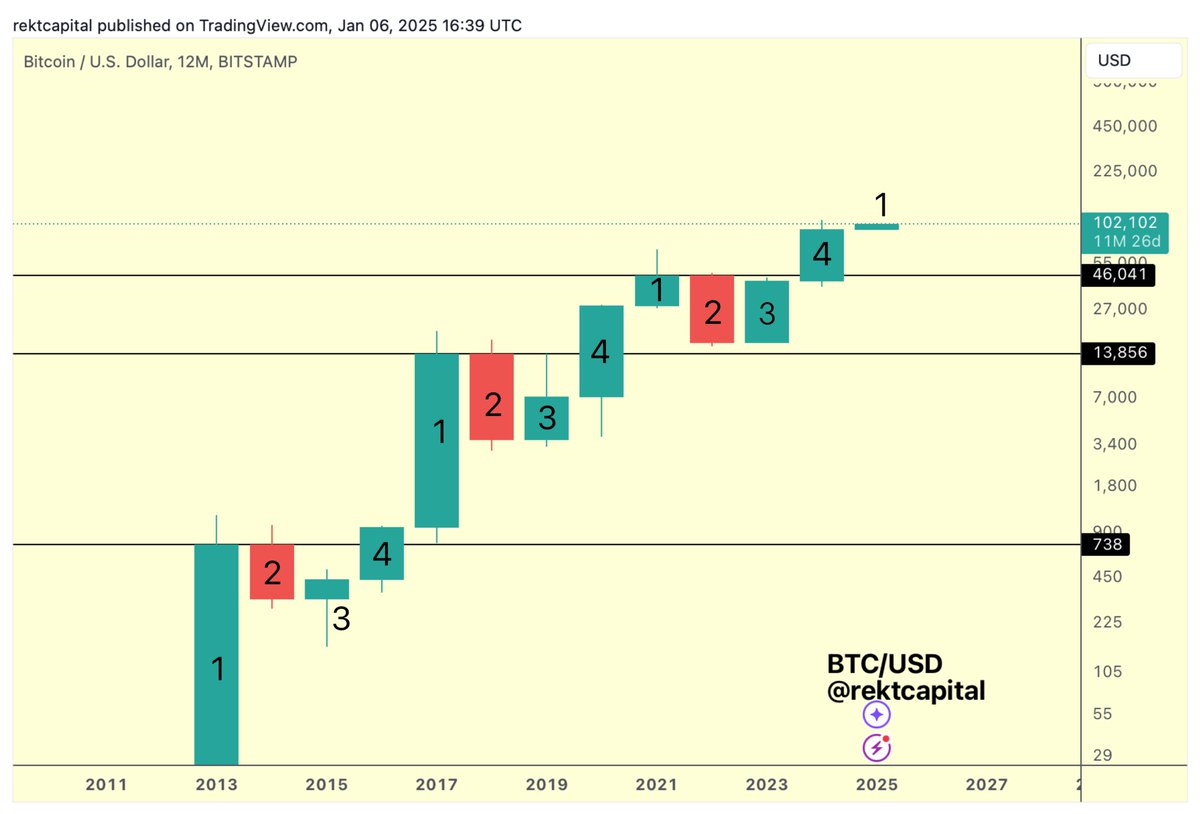

Finally, the analyst predicts that Bitcoin’s bear market will begin sometime this year and extend through most of 2026 if BTC follows the traditional halving cycle.

“2025 will likely see the peak of the BTC bull market and the start of a brand new bear market (Candle 1). However, the bulk of the bear market will occur in 2026 (candle 2). The bear market would last about 365+ days and be between -65% and -80% deep.”

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

Follow us further X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney