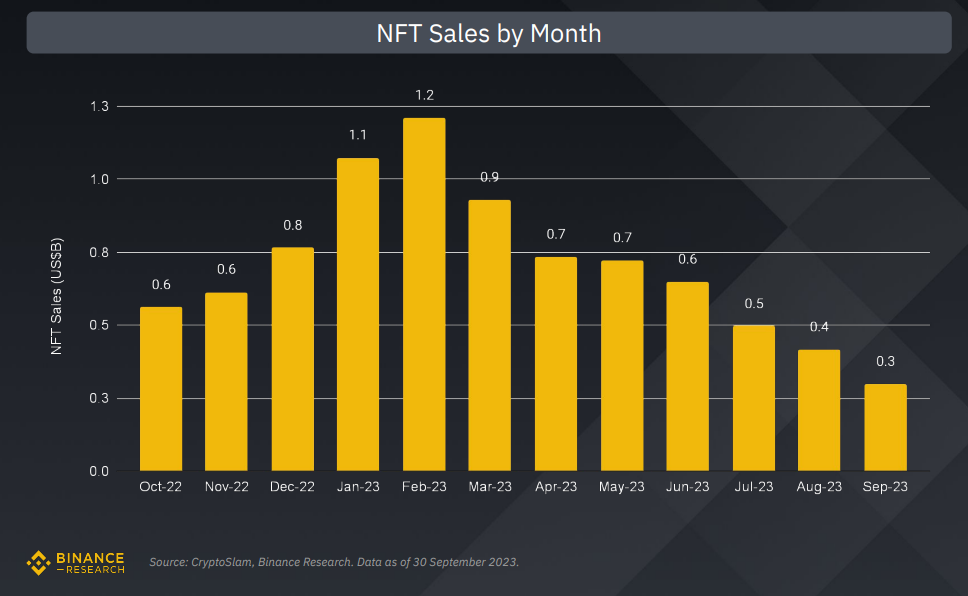

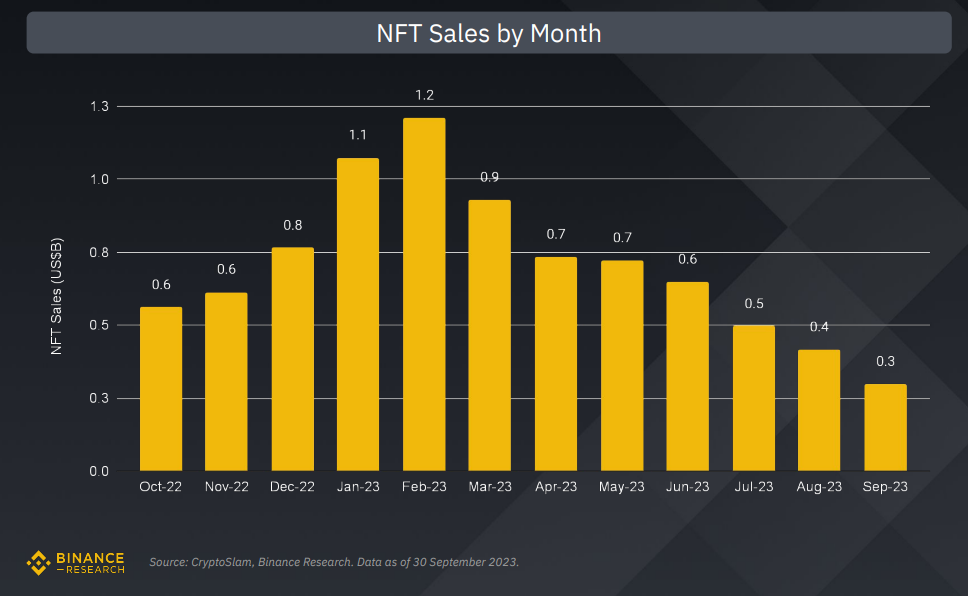

The third quarter of 2023 has been challenging for the non-fungible tokens (NFTs) market, with sales hitting their lowest point since the last quarter of 2020. Dismal sales of around $300 million were recorded in September alone. This downturn is mainly attributed to a significant decline in average sales prices and bottom prices of popular collections.

The NFT market is on a downward trajectory, especially in September, which saw the worst sales since January 2021. The average sales price in September plummeted to $38.17, a stark contrast from the peak of $791.84 in August 2021. Collections like Azuki, BAYC, and MAYC have seen their rock-bottom prices drop by more than 25% quarter-over-quarter.

Binance Research’s latest quarterly report shows that while the NFT market has struggled, Ethereum and Immutable X have managed to gain market share. Ethereum shares rose 6% in the third quarter, partly due to lower gas rates and a decline in ETH prices. Immutable X, a Layer 2 solution built on top of Ethereum, also saw its market share increase from 4% to 8%. The platform is home to popular blockchain games such as Gods Unchained, which took the lead in sales this quarter.

Our latest State of Crypto Report summarizes all the key insights, events and learnings from the third quarter.

Find everything you need to know about developments in space, including analysis of:

Low 1s & 2s

DeFi

NFTs

Gaming

Start reading here

https://t.co/ES5z6g8FMU

— Binance Research (@BinanceResearch) October 19, 2023

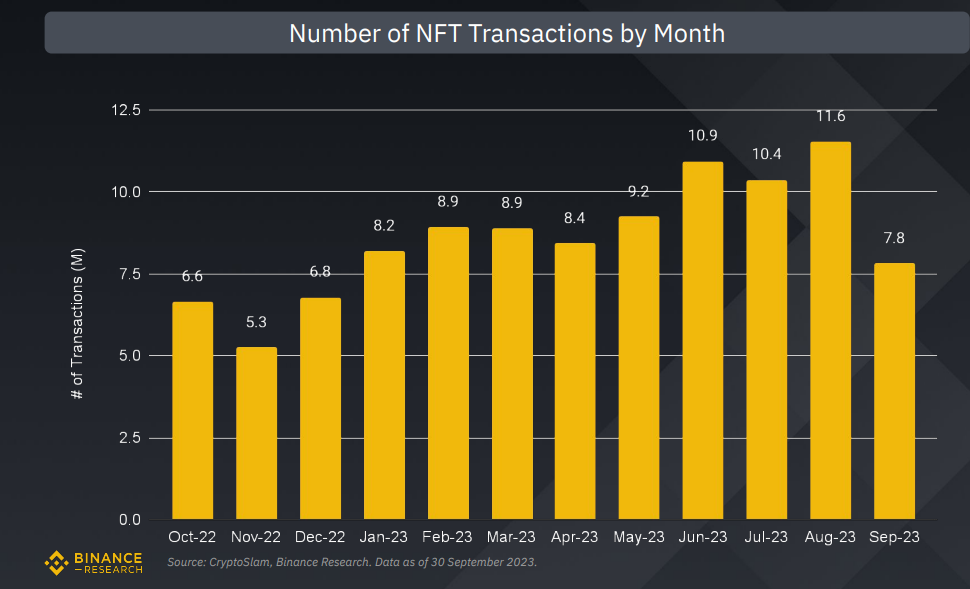

Despite the dismal sales figures, the number of NFT transactions increased by 4.6% in the third quarter compared to the previous quarter. Gaming NFTs such as Gods Unchained, Axie Infinity, NBA Top Shot, NFL All Day and Mythical Beings dominated in terms of number of transactions.

Fewer buyers, lower prices

The average number of daily unique buyers fell 14.1% to approximately 53,000, indicating a decline in overall market interest. Additionally, the NFT-500 price index, a measure of NFT performance, also took a hit, falling 31% in the third quarter. Several NFT collections across sectors saw a price drop, contributing to the index’s poor performance.

While Blur remains the largest marketplace by sales volume, it has lost ground to competitors like Opensea, which led the pack in active wallets. Newcomers like Element have also risen in the ranks, thanks to their integration with multiple networks like Base, Linea, opBNB, Bitcoin, and zkSync. This suggests that traders on Blur are trading in higher volumes, which aligns with Blur’s positioning as a platform for professional traders.

NFT art market takes a hit

The NFT market is in a slump, especially in the art segment, where both the number of sales and the total sales value have consistently declined. This downturn is not recent; it has been going on since the crypto crash of 2022. Although the market showed some signs of recovery, the overall trend remains negative.

Separate data from Statista and NonFungible corroborates Binance Research’s figures, showing that the total value of NFT art sales across the Ethereum, Ronin, and Flow blockchains was just $22.3 million in September 2022. This was as much as 40 times less than the turnover recorded in the same month. the previous year. By the end of 2022, the monthly sales value had fallen further to $17.1 million.

The data clearly shows that the NFT art market is facing a prolonged downturn, with little sign of an immediate recovery. This decline is not just a blip, but appears to be a more sustainable trend, raising questions about the future sustainability of the NFT art market.

Additionally, crypto and NFT thefts have skyrocketed, leading to investor losses of more than $26 billion. Criminals rake in $289,000 every hour.