- SEI has broken through resistance and is now targeting $0.22, while bullish indicators support further upside.

- Increasing open interest and moderate social volume indicate growing investor confidence, pointing to continued growth.

Sei [SEI] has recently surged, reaching notable milestones with 871,000 daily users and $254 million in Total Value Locked (TVL). This surge has piqued investor interest, raising the question: Can SEI sustain its growth and raise more capital in the coming weeks?

Let’s examine the price action, key technical levels and broader market sentiment to answer this question.

What does the price action look like right now?

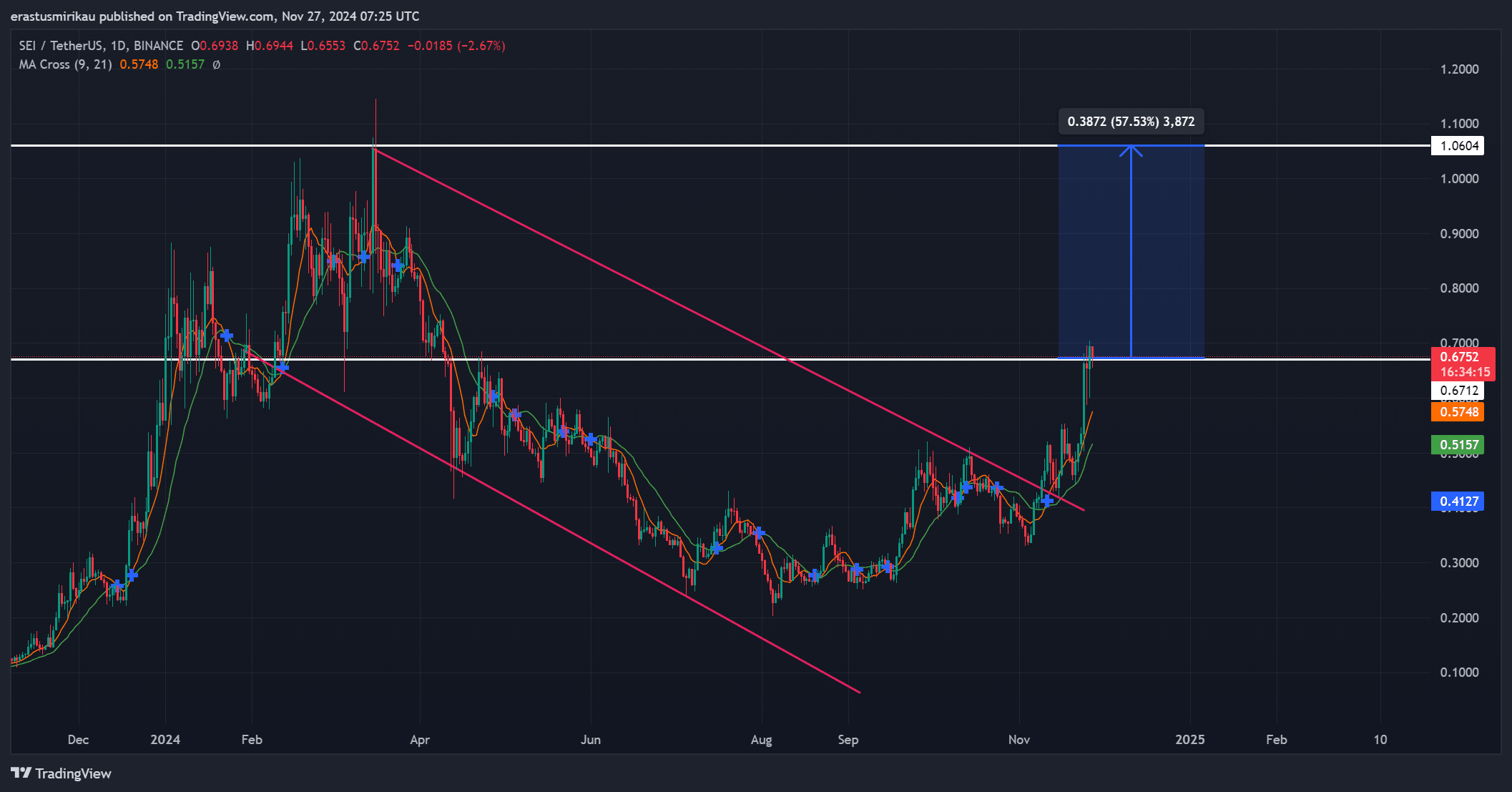

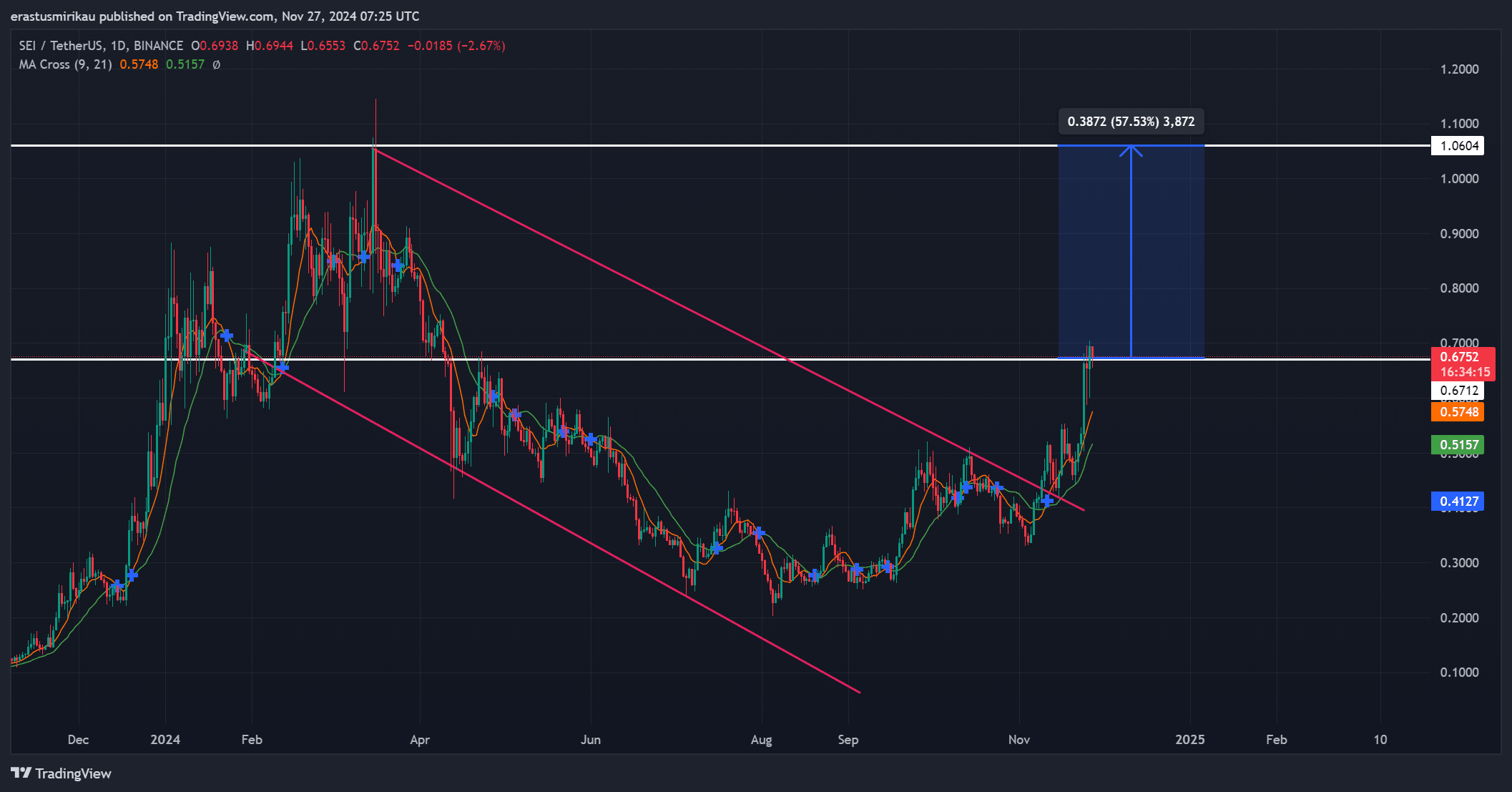

SEI has shown remarkable price action, with its upward momentum catching the attention of traders and investors alike. The cryptocurrency recently broke out of a descending channel pattern, signaling a potential trend reversal.

At the time of writing, SEI was trading at $0.6683, reflecting a daily increase of 4.14%.

Key resistance at $0.6712 was broken and SEI is now targeting $1.0604, representing a potential upside of 57.53% from current levels.

Furthermore, a bullish crossover between the 9-day and 21-day moving averages (MA Cross) reinforces positive sentiment. The 9-day MA is currently at $0.5748, while the 21-day MA is at $0.5157, further supporting the bullish trajectory.

Source: TradingView

What happens to SEI’s social volume?

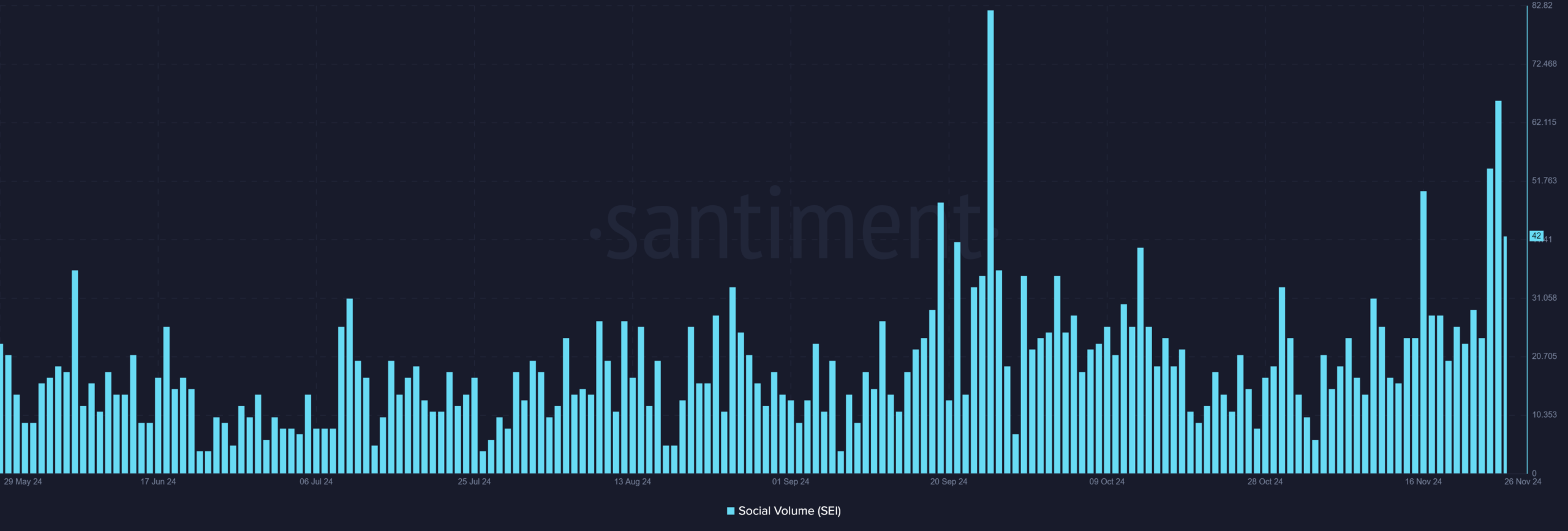

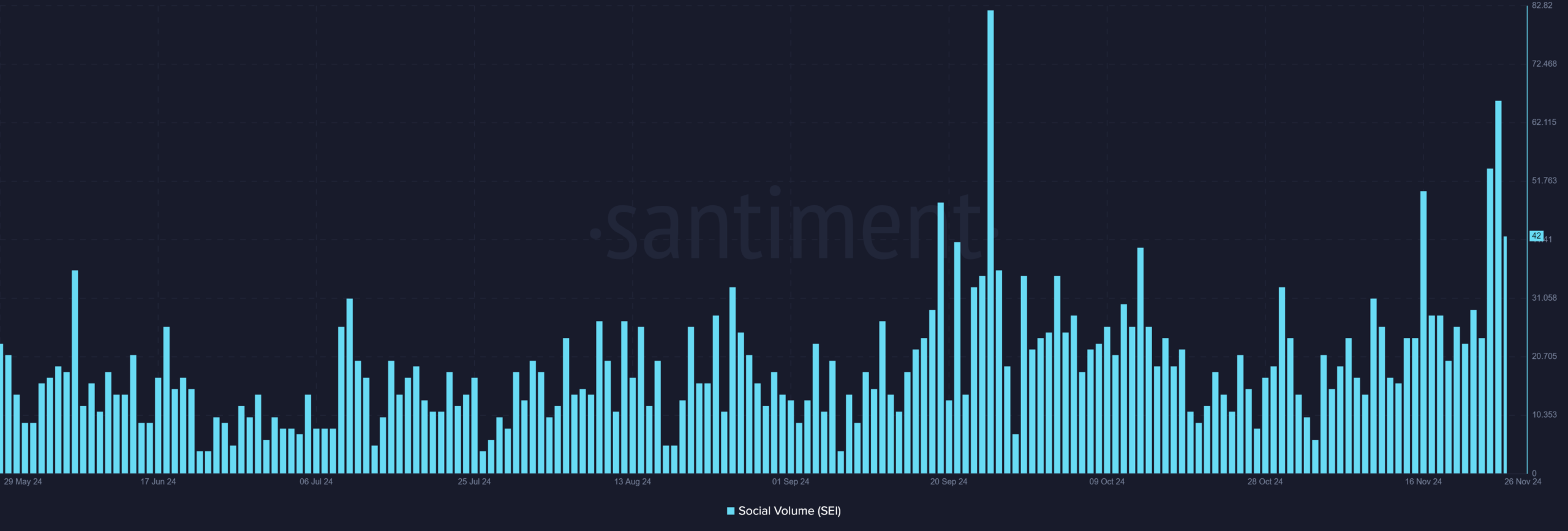

Social volume was moderate, with 42 mentions at the time of writing. While this indicates growing interest, it does not yet reflect the explosive activity that could trigger a major price move.

However, social volume often correlates with price movements, and any significant increase could indicate rising market confidence, potentially pushing the price higher.

Source: Santiment

What does the open interest say about the future of SEI?

At the time of writing, open interest is up 2.27%, bringing total open interest to an impressive $287.24 million. This increase indicates that more traders are positioning themselves for future price movements, with a majority holding long positions.

The increase in open interest indicates growing confidence in SEI’s bullish trend. However, a rapid rise in open interest could also signal that the market is becoming overcrowded, potentially leading to a correction if the trend slows.

Source: Coinglass

Is SEI’s momentum sustainable?

SEI’s recent growth in daily users and TVL is impressive, indicating strong ecosystem development. From a technical perspective, the bullish MA crossover and rising open interest support the idea of continued upside potential.

However, SEI needs to break the $0.67 resistance level to maintain momentum and attract more traders. If this fails, the price may consolidate or pull back.

Therefore, while SEI’s growth potential is clear, it must overcome significant technical barriers to maintain its bullish trend in the short term.