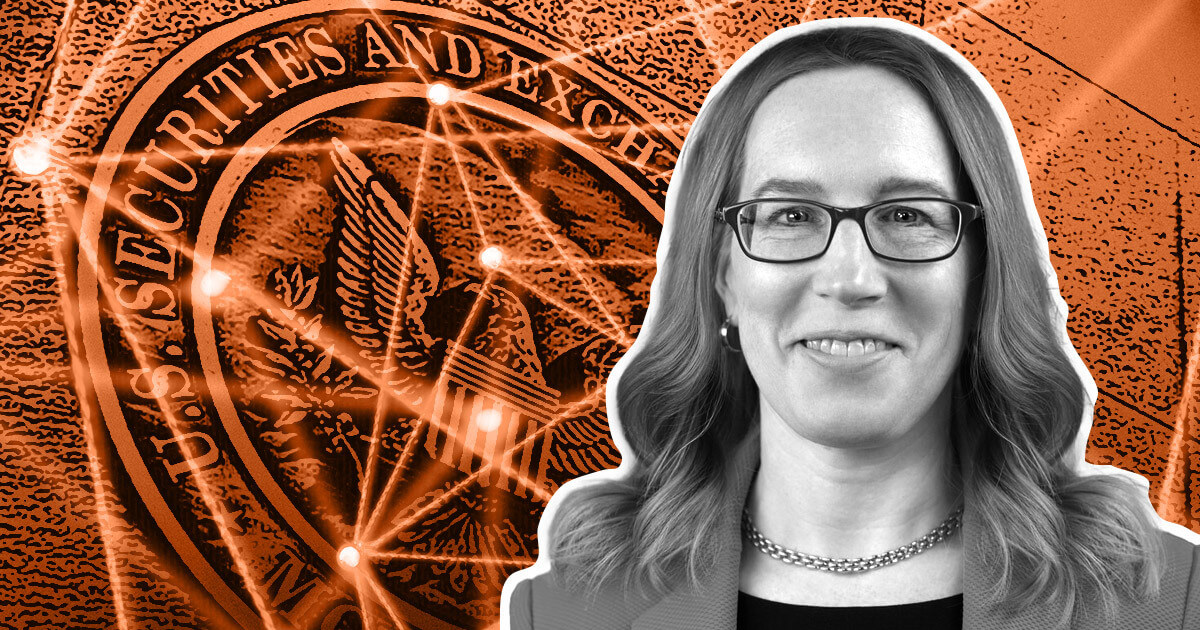

SEC Commissioner Hester Peirce discussed several current Bitcoin Exchange-Traded Funds (ETFs) in a call with CNBC on October 23.

Peirce noted that major asset managers such as BlackRock and Fidelity are now applying for spot Bitcoin ETFs. She said:

“I think [those applications are] a reflection of the fact that there are a lot of companies that think the public is interested in these types of products… we’re obviously seeing more and more interest from companies in these products, and I’m hearing a lot of interest from investors in these types of products as well.”

At the same time, Peirce cautioned investors against “trying to read the tea leaves” and guess how regulators will handle these applications.

Peirce could not comment on whether the U.S. Securities and Exchange Commission (SEC) would be willing to approve a spot Bitcoin ETF, but she reminded the audience that she has personally been a proponent of such an investment vehicle since 2018.

Peirce also acknowledged that recent adverse court decisions for the SEC have become “a major factor in the landscape.” A court ruled in August that the SEC must review a Bitcoin ETF application from Grayscale. Recent developments in October indicate that the SEC will not seek to appeal this outcome.

Peirce comments on broader crypto regulations

Peirce acknowledged that recent events, such as the collapse of FTX and Coinbase’s decision to open a new derivatives division abroad, have not been “positive for the image of crypto.” She said regulators should consider what they can do differently to make the US a viable location for crypto companies to operate in.

She also suggested that there is a “growing interest” among other lawmakers in creating workable regulations around cryptocurrency, especially in Congress.

Peirce expressed her liberal views on regulation, stating that it is not her role as a regulator to tell investors which assets they can and cannot invest in. She said the SEC’s role is to write disclosures, not to approve individual investments. Peirce nevertheless encouraged investors to be “skeptical of everything they buy.”

Peirce has regularly pushed back against her agency’s cryptocurrency decisions. In addition to her dissent on individual enforcement actions, she has also criticized broader policy proposals around asset protection and expanded definitions of currency.

The post SEC’s Hester Peirce Reflects on Investor Interest in Spot Bitcoin ETFs appeared first on CryptoSlate.