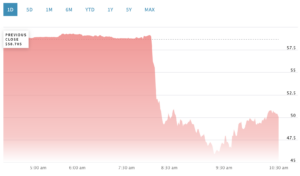

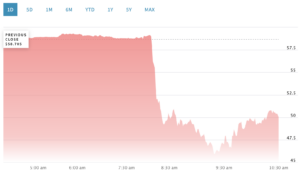

Coinbase shares fell 22% after news broke that the US Securities and Exchange Commission had filed a lawsuit against the platform for allegedly violating securities laws.

US stock market share fell from $58.71 pre-market to about $48, according to Nasdaq facts. At the time of writing, it had recovered slightly to $50.03, down 15% on the day.

Meanwhile, the lawsuit also caused a slight fall in the value of Bitcoin (BTC), which fell 0.51% on the 1-hour candle to $25,493 as of 13:30 UTC, acc from CryptoSlate facts. Shares of several Bitcoin miners such as Riot Blockchain, CleanSparks, Bitfarms, and Marathon Digital saw significant losses following the news.

Coinbase lawsuit

According to the SEC, Coinbase operated as an unregistered broker, exchange and clearing agency and offered unregistered securities through its Staking program. The regulator also alleged that the exchange is offering US investors through its platform unregistered security tokens such as ADA, SOL, etc.

SEC said:

“The Coinbase platform brings together three functions that are typically separate in traditional securities markets: that of brokers, exchanges, and clearing houses. Yet Coinbase has never registered with the SEC as a broker, national stock exchange or clearing house, circumventing the disclosure regime Congress has established for our securities markets.”

Meanwhile, the lawsuit comes less than a day after the watchdog filed similar charges against the largest crypto exchange by trading volume, Binance. The SEC stated that Binance has profited in the billions by asking US investors to trade through its unregistered platform.

Coinbase had consistently pointed to the regulatory vacuum in the US

Until now, the SEC and Coinbase have been embroiled in a protracted legal battle over the lack of regulatory clarity within the crypto space. In a May 15 lawsuit, the financial regulator stated that it was under no obligation to provide the requested clarification.

In testimony prepared for the House Committee on Agriculture on June 6, Paul Grewal, Chief Legal Officer of Coinbase, said:

“Regulation sets clear rules for the industry and also provides important accountability measures for potential bad actors. US law helps good guys innovate and ensures that bad guys are held accountable.”

On May 30, the exchange’s CEO, Brian Armstrong, said the US crypto industry was facing a strong challenge from China.

The post-SEC lawsuit sparks a sell-off in Coinbase stock, COIN fell 15% appeared first on CryptoSlate.