The total crypto market cap dropped $53 billion as news of the U.S. Securities and Exchange Commission (SEC) filing against Binance broke.

On June 5, the SEC charged Binance, its CEO Changpeng Zhao and related entities with 13 violations, including wash trading, regulatory evasion and offering unregistered securities.

Binance said it was disappointed with the complaint and has always cooperated with the regulator’s investigations. However, it disputed the enforcement action and planned to “powerfuldefend the allegations.

A key part of Binance’s defense revolves around the SEC’s alleged unwillingness to provide regulatory clarity. It further claimed that the company was a victim of the ongoing “regulatory tug of war,“in which government agencies try”claim jurisdiction from other regulators.”

“Unfortunately, the SEC’s refusal to engage with us in a productive manner is just one example of the Commission’s misguided and deliberate refusal to provide much-needed clarity and guidance to the digital asset industry.“

Crypto markets are crashing

Markets tanked on the news of the SEC filing against Binance.

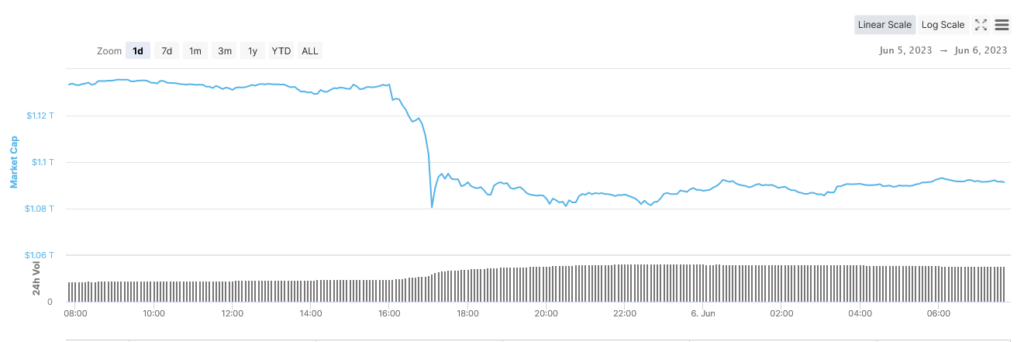

At 4pm BST on June 5, just before the news broke, the cryptocurrency’s total market capitalization was estimated at $1.13 trillion. As word spread, the ensuing dump hit a low of $1.08 trillion about an hour later, representing a withdrawal of $52.7 billion, or 4.7%.

A bounce followed to reach $1.1 trillion. The market has since traded flat as participants consider the seriousness of the situation, particularly allegations that several third-party tokens were named as securities in the SEC filing, including ADA, SOL, and MATIC.

Biggest winners and losers

Of the top 100, the biggest losers in the last 24 hours were Pepe, The Sandbox and Sui, who lost 15.2%, 14.8% and 12.7% respectively. The Sandbox was listed as an unlisted security in the SEC filing.

Kava was the only token from the top 100 (excluding stablecoins) to remain green over the period, growing by 9.6%.

Market leader Bitcoin suffered a 5% peak-to-trough loss to find support at USD 25,400. It has since reached a high of $25,890 but is about to retest the $25,600 support.