- SEC pushed the decision on ETH ETF and in kind repayment until June 2025.

- The regulator has important players, including BlackRock, with regard to the above problems.

The US Securities and Exchange Commission (SEC) has delayed decisions about deployment and in kind redemption for Ethereum [ETH] ETFs (listed funds).

The desk sought -after More time on the postponement application on two shades of gray spot ETFs. As a result, the Deadline has been expanded to 1 June. The issue has the application In February.

What is the next step for ETFS

Others such as Bitwise, Vaneck, 21Shares, Fidelity, Invesco Galaxy and Franklin Templeton had applied for similar stakes for their respective ETH ETF products.

At the moment, only BlackRock has not applied for the same. But Robert Mitschnick, the head of BlackRock of Digital Activa, had publicly recognized the benefit of deporting the products.

The regulator too delayed Decisions about creating in kind and redemption for ETFs and BTC ETFs. In kind exchange, unlike the current settings of cash demanded by Gary Gary-guided SEC, the use of underlying assets such as ETH or BTC.

The method in kind avoids taxable events and improves liquidity. The regulator pushed the deadline in kind until 3 June.

That said, the Crypto Task Force of the SEC has held round table discussions with important players, including Jito, Multicoin Capital and BlackRock, about crypto ETF inserts and in-natule salvation.

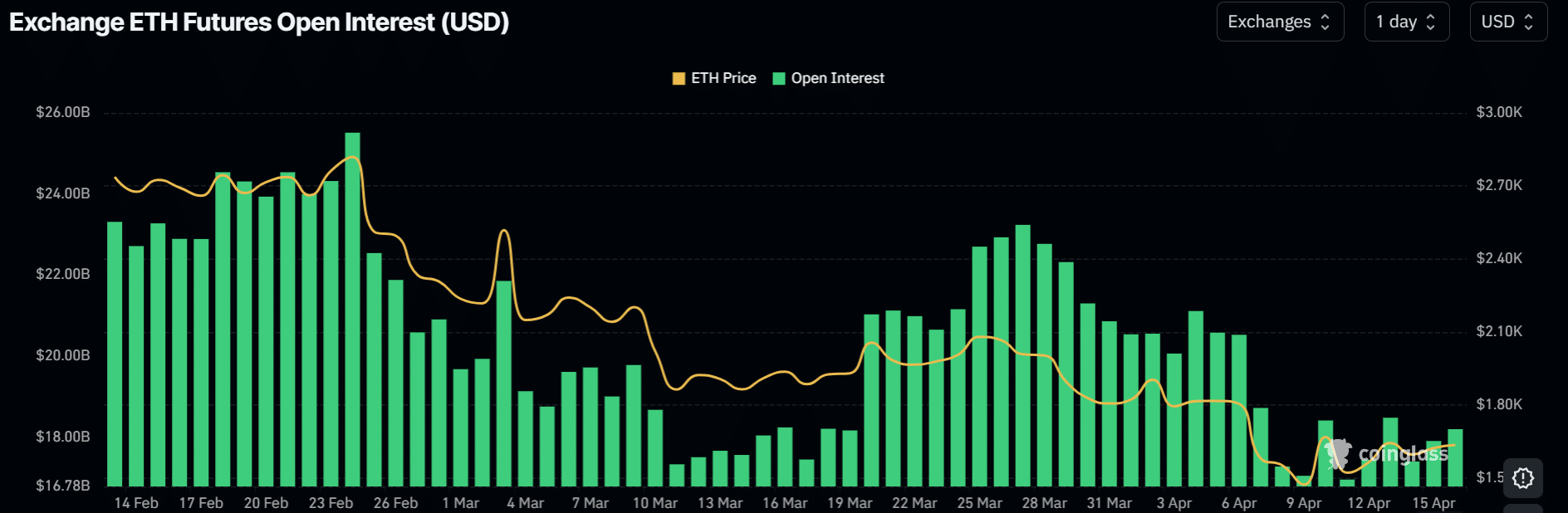

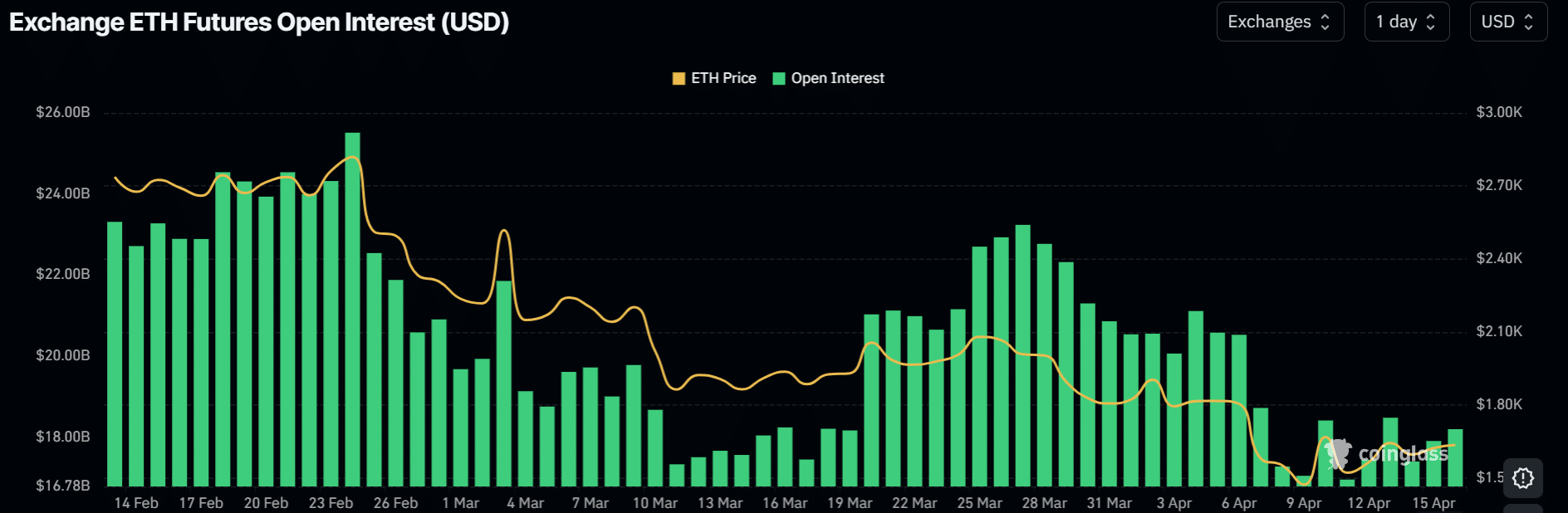

Source: Coinglass

In the meantime, the update has not stimulated any change in the speculative interest of ETH. According to Coinglass data, Open Interest (OI) has decreased since February and fell from nearly $ 26 billion to less than $ 20 billion.

This meant that the Bearish sentiment continued to exist, even after the update.

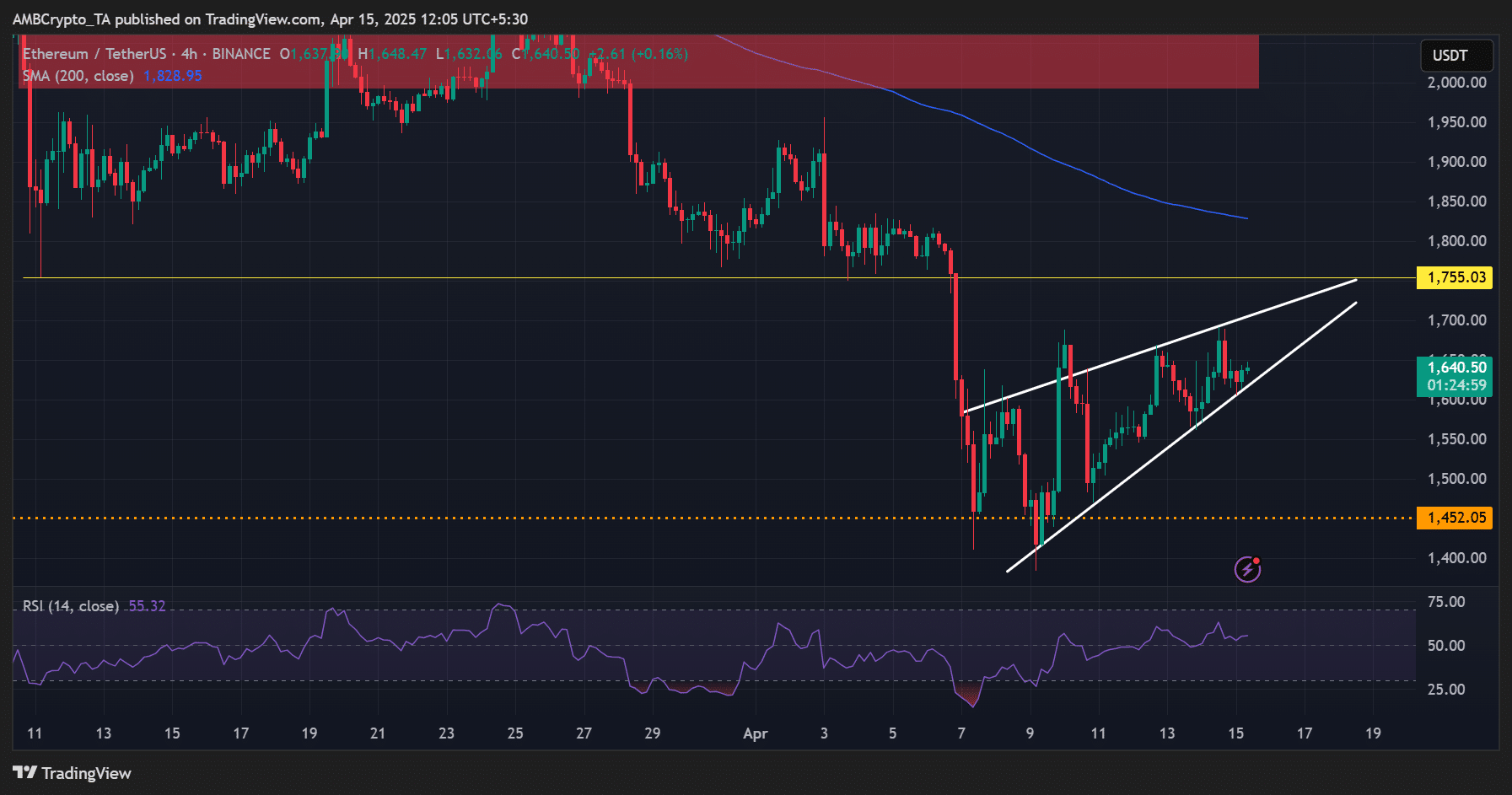

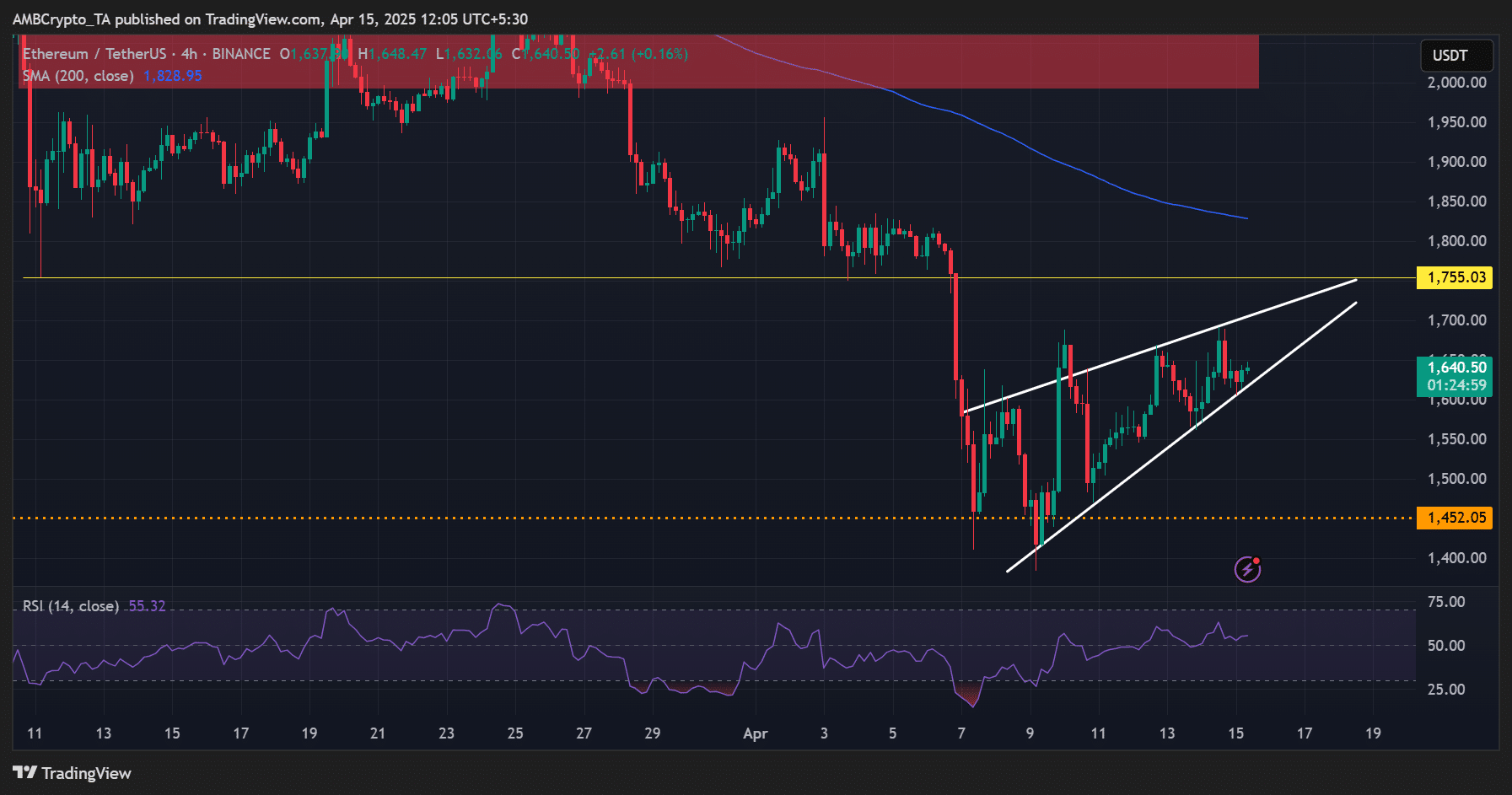

On the 4 -hour price chart, ETH has chalked a bearish -rising wedge, which could again drag it under $ 1500 if the pattern is validated. However, by reclaiming $ 1.8k, Bulls could continue.

Source: Eth/USDT, TradingView