On Tuesday, the crypto market was taken by storm when a tweet appeared on the official X account (formerly Twitter) of the US Securities and Exchange Commission (SEC) stating that all Spot Bitcoin ETF applications had been approved. This was initially followed by a price increase, but this was short-lived as the price would crash shortly afterwards. This was because Gary Gensler, chairman of the Commission, revealed that the tweet was fake and that the regulator’s social media account had been compromised.

SEC hack causes $220 million in liquidations

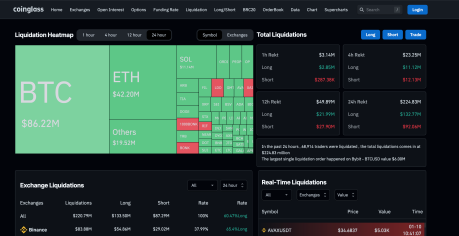

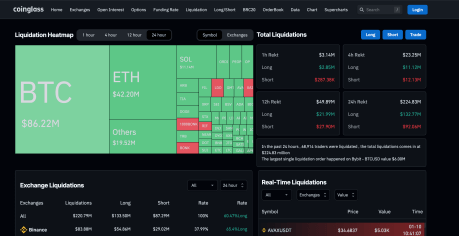

In the wake of the wild Bitcoin price swings caused by the SEC hack, a large number of crypto traders faced massive losses. According to facts of CoinGlass has liquidated more than $220 million in the last 24 hours, leading to the second largest liquidation event to date in 2024.

The website also notes that more than 70,000 traders were also victims of this liquidation. Considering that the price of Bitcoin and other assets in the crypto market had experienced price swings in both directions, both long and short traders were affected.

Source: Coinglass

However, as the downside crash continues for longer, long traders have emerged as the group with the most liquidations during this period. Of the more than $220 million in recorded liquidations, long transactions made up 60.47% at $133.5 million, while the volume of short liquidations for the same period amounted to $87.29 million.

Bitcoin also saw the largest liquidation order that took place on the ByBit exchange during this period. A single trade worth $6 million was liquidated within the BTCUSD trading pair, bringing the total number of liquidations on the crypto exchange to $36.66 million. This lags behind market leader Binance with $83.88 million and OKX with $73.97 million.

BTC bears struggle for control | Source: BTCUSD on Tradingview.com

Spot Bitcoin ETF is a sell-the-news event?

The debate over whether the approval of the Spot Bitcoin ETF is already priced in and whether an announcement will lead to a price drop has intensified in recent weeks. Experts have given their opinions on what will follow an approval.

Crypto analyst Andrew Kang believes approval would lead to a scramble among applicants to secure as much of the $10 billion to $20 billion expected to come from fees. As such, they will all be at the forefront of marketing to promote their ETFs.

On the other hand, noted economist Peter Schiff says: believes that a spot ETF would actually not be good for the asset. Apparently, the arrival of a spot Bitcoin ETF would mean that there is no more good news that could cause a price rally. As such, it would be a ‘sell the news’ event.

However, if Tuesday’s performance is anything to go by, it could mean the ETF is already priced in, as there was a price drop even before the SEC removed the tweet from the hacked account.

Featured image of SoFi, chart from Tradingview.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.