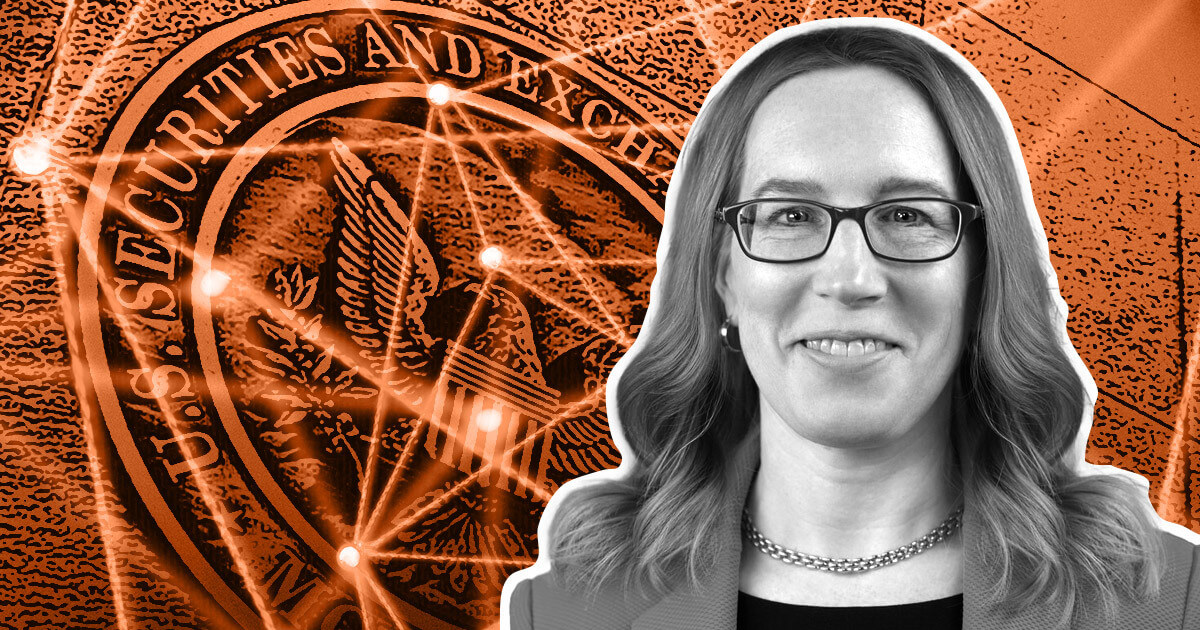

SEC Commissioner Hester Peirce proposed a shared digital securities sandbox between the US and the UK on May 29.

The proposal would extend the Bank of England and FCA’s joint digital securities sandbox (DSS) – which will accept UK applications this summer – to US companies.

Participants would be able to conduct sandbox activities in both countries under the same legal conditions, and the US and Britain would enter into an information-sharing agreement.

Participating companies would conduct activities under self-selected regulatory conditions and use the sandbox to build a market case for their products. They could also address potential design and implementation errors while serving real customers.

The sandbox would determine whether distributed ledger technology (DLT) can facilitate the issuance, trading and settlement of securities without consequences.

Wide range of participation

The SEC would allow any company not identified as a bad actor to participate in the sandbox, but also establish a list of eligible activities based on public input.

Companies could generally participate in the program for two years.

Participants must submit notifications of participation and make their involvement public. The SEC’s Strategic Hub for Innovation and Financial Technology, or FinHub, would help companies file participation notices and assist with no-action letters and relief orders.

The SEC would also apply existing anti-fraud authorities and pre-specified activity caps while monitoring participants’ compliance with self-declared terms and conditions.

Countless benefits

Peirce’s proposal addressed possible objections and stated:

“While allowing companies to choose their own regulatory terms may cause unrest in some regulatory circles… companies should adhere to reasonable terms.”

Outlining numerous benefits, she said companies that entered the FCA sandbox in Britain between 2016 and 2019 raised more capital and survived longer than other companies. Sandbox regulators also detailed majority support for the approach on several counts in a 2019 survey.

In terms of public benefits, Peirce said consumers will have access to products not normally available to them because the program will allow companies to quickly enter the market.

The proposed sandbox comes at a time when the SEC is facing heavy criticism. Critics have repeatedly criticized the SEC under Chairman Gary Gensler, citing numerous enforcement actions against crypto companies and the agency’s allegedly political motivations for approving spot ETH ETFs.

Peirce emphasized that her permissive proposal is not an SEC proposal, but a work-in-progress and a response to discussions with parties that want to engage in the US.

Peirce’s Safe Harbor proposal, which proposes temporary regulatory exemptions for token issuers, has made no progress since its last update in 2021.