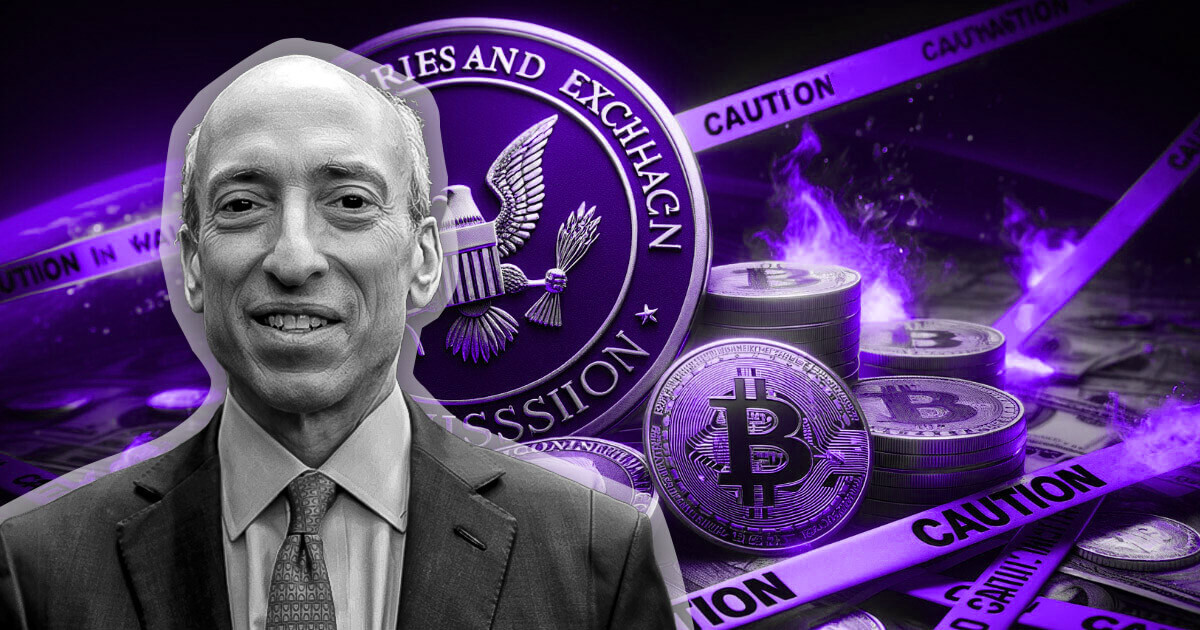

US Securities and Exchange Commission (SEC) Chairman Gary Gensler reiterated that Bitcoin is not classified as a security, providing a critical clarification amid ongoing scrutiny of the cryptocurrency industry.

During an interview on CNBC’s Squawk Box on September 26, Gensler reinforced the SEC’s position that Bitcoin remains a commodity under US law. He said:

“As far as Bitcoin is concerned, my predecessor and I said this is not a security.”

The statement follows the SEC’s approval of several spot Bitcoin Exchange-Traded Funds (ETFs), allowing the digital asset to be traded on prominent US exchanges, including the Nasdaq.

Ignoring regulations

While Bitcoin’s regulatory status is clear, Gensler criticized the broader crypto industry for widespread disregard for existing regulations. He accused many market participants of ignoring the rules and seeking exemptions from compliance.

According to Gensler:

“There are rules, but many have chosen to ignore them.”

He added that this non-compliance has contributed to instability and confusion within the market.

In contrast, Ethereum, the second largest cryptocurrency, has faced more ambiguous regulation. The SEC has yet to classify Ethereum as a security or non-security, putting projects built on the blockchain under constant scrutiny.

Despite this uncertainty, the SEC has approved Ethereum-based ETFs, but at the same time initiated investigations into companies associated with the Ethereum ecosystem, such as Consensys and Uniswap.

Lawmakers’ concerns

Gensler’s approach to regulating Ethereum has drawn criticism from members of Congress. US policymakers, particularly in the House of Representatives, have accused Gensler of sowing confusion by using terms such as “crypto asset security” in legal actions.

At a recent congressional hearing, lawmakers expressed frustration with the SEC’s handling of crypto regulations, with some claiming the agency has stifled innovation. Other SEC commissioners, including Hester Peirce and Mark Uyeda, echoed the criticism, saying the regulator has failed to provide clarity despite having the resources to do so.

Despite the criticism, Gensler maintained that the future of the crypto industry depends on stronger regulatory frameworks to protect investors and build trust.

The SEC Chairman stated:

“This field won’t last long if you can’t build investor confidence in the markets.”

Gensler compared the evolution of cryptocurrencies to the development of other industries, noting that regulations such as “traffic lights and stop signs” are essential to progress.

The SEC’s clear stance on Bitcoin contrasts with its ongoing investigation into other digital assets, leaving the regulatory future of the broader crypto market uncertain.