Law professor and filmmaker Brian Frye and songwriter Jonathon Mann have filed a lawsuit against the U.S. Securities and Exchange Commission.

The lawyers argue that the SEC’s regulatory approach threatens the livelihoods of artists and creators experimenting with NFTs.

Proud to represent my client and friend Jonathan Mann @songadaymann in his courageous and unfortunately necessary lawsuit against the SEC.

Art is not a certainty, and musicians working in a digital medium shouldn’t have to hire expensive securities lawyers just to release music. https://t.co/FBYL9FZZfG

— Jason Gottlieb (@ohaiom) July 29, 2024

Table of contents

What the lawsuit says

According to the document, the plaintiffs want to determine whether NFT falls under the regulator’s jurisdiction. The lawyers asked the SEC to answer what actions could lead to the application of securities laws to create and sell NFTs. The lawsuit also asks for information on how to register NFTs before they can be sold.

“Two recent administrative actions by the SEC suggest that the SEC is moving into the art world and determining when art must be registered with the federal government before it can be sold.”

The authors of the paper compared non-fungible tokens to Taylor Swift concert tickets, which are often resold on the secondary market. Mann and Frye are in exactly the same position in this lawsuit. The lawyers argue that it would be absurd for the SEC to classify such tickets or collectibles as securities:

“They are artists and they want to make and sell their digital art without the SEC investigating them or filing a lawsuit.”

The SEC’s first lawsuit against NFTs

In 2021, media company Impact Theory released the Founder’s Keys NFT collection. The company promoted the project from October to December 2021. The collection included tokens of three different rarity levels.

As a result, in August 2023, the SEC accused Impact Theory of promoting securities without registration. The company used NFTs to attract investors and raised about $30 million. This was the regulator’s first case against NFTs.

Today we sued Impact Theory LLC, a media and entertainment company headquartered in Los Angeles, for conducting an unregistered offering of crypto assets in the form of so-called NFTs. Impact Theory has raised approximately $30 million from hundreds of investors.

– U.S. Securities and Exchange Commission (@SECGov) August 28, 2023

The SEC believes that the company positioned the project as a business investment. In particular, it guaranteed holders high profits and promised expanded prospects.

For example, the regulator considered that the specified NFTs had the characteristics of an investment contract and were therefore classified as securities. By promoting the collection, the company violated federal laws in this industry.

Impact Theory agreed to pay a $6.1 million fine without admitting or denying guilt. Moreover, they decided to destroy the tokens and their mentions from websites and social networks.

What are considered securities according to the SEC

The Commodity Futures Trading Commission considers cryptocurrency a commodity. The regulator proposes to apply the tax regime developed for goods to cryptocurrency and consider the actions of issuers as producers of goods. However, there are no rules in the US requiring issuers to register tokens as goods.

When assessing the status of cryptocurrencies, the SEC relies on the Howey test.

The regulator considers the new financial instrument to have security characteristics and considers that cryptocurrency falls within its legislative scope.

According to the SEC, all tokens fall in one way or another under several criteria designated by the agency: pre-sales or fundraising, promises to improve the project through continued business and marketing development, and the use of social networks to expand its capabilities and benefits of the project.

However, no arbitration body could resolve the dispute between two US regulators, so each agency works according to its view of the situation.

You might also like: Vitalik Buterin Addresses the ‘Key Challenge’ in US Crypto Regulation: ‘You’re Screwed’ Because You’re ‘A Security’

Traders are losing interest in NFTs, unlike regulators

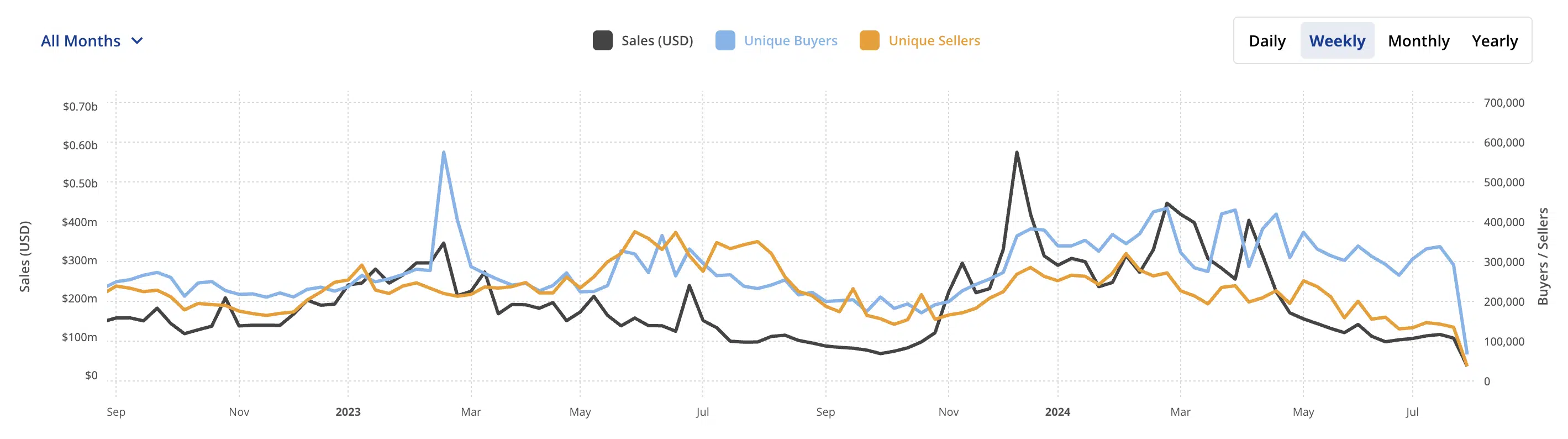

Despite regulators’ interest in non-fungible tokens, excitement around NFTs continues to wane. According to CryptoSlam, the turnover volume in the NFT sector in July was $395.5 million. This is a new minimum since November 2023.

The NFT sector has been in a downward trend for some time now. Sales volume and the number of unique buyers and sellers have steadily declined since March 2024.

Source: CryptoSlam

Furthermore, sales volume in the second quarter of 2024 fell 45% compared to the first quarter: $2.2 billion versus $4.1 billion.

The decline in July started mid-month. At the same time, there were signs of recovery in sales volume in early July, after a significant decline in June. At the same time, July became the third largest month in terms of transaction volume in 2023.

During this period, 9.9 million transactions were recorded, compared to 5.7 million in June. However, this can hardly be a positive sign, as the average sales price in July hit a new low since September 2023: $39.56.

What NFT threatens: SEC or a drop in interest rates

According to the latest lawsuit against the SEC, the status of non-fungible tokens has yet to be determined. However, the regulator is attracting less interest in this area due to the waning excitement around NFTs.

Either way, the SEC’s approach to regulation threatens NFTs, which were initially conceived as an element of creativity across the blockchain and cryptocurrency space.

You might also like: Will crypto regulation change after the head of the crypto sector leaves the SEC?