On-chain analytics firm Santiment has revealed a Cardano pattern that may have helped trigger the recent 65% surge in ADA’s price.

Cardano observed a sudden loss of purses prior to the rally

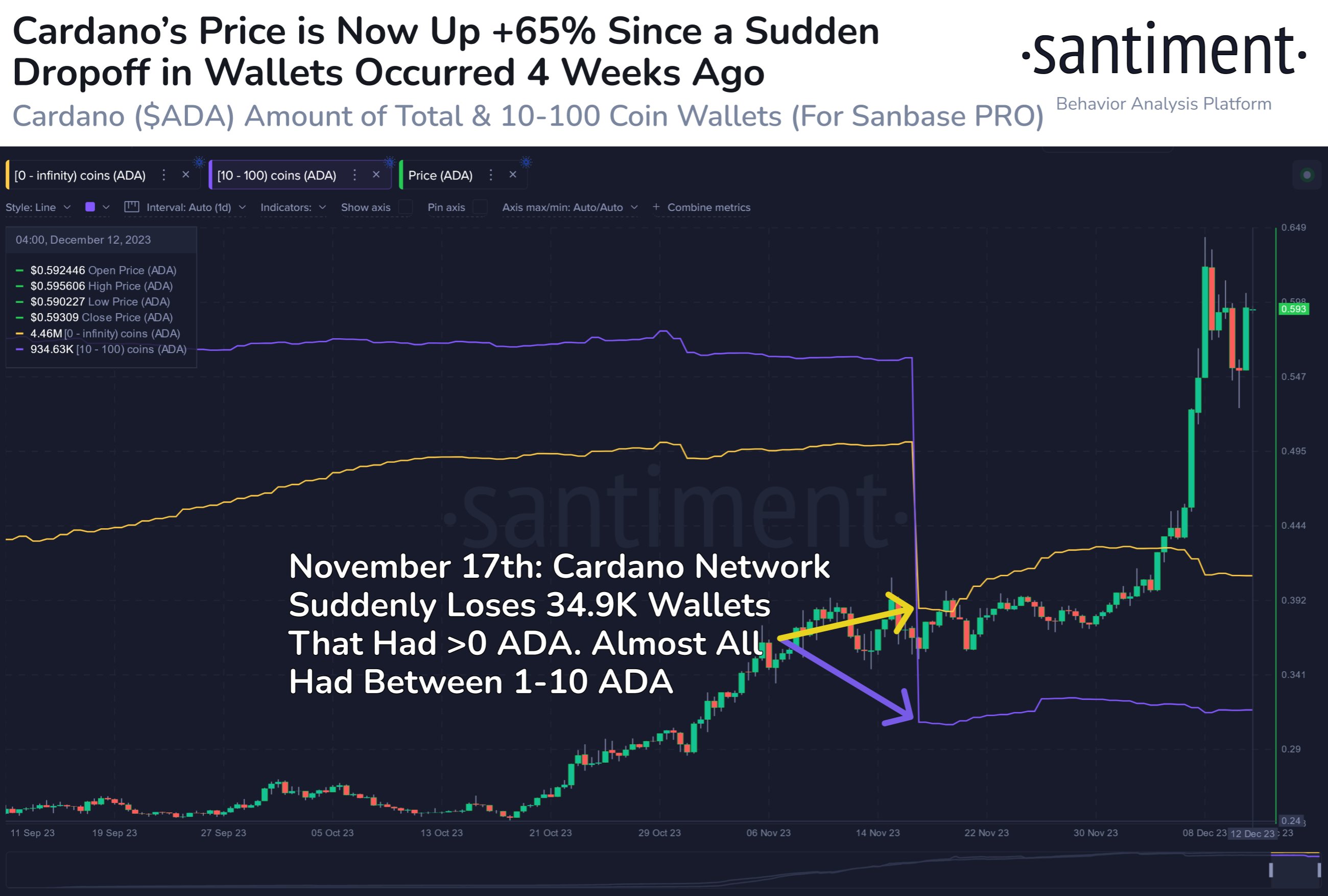

As explained by Santiment in a after on X last month, ADA witnessed a large number of small wallets clearing themselves. The relevant indicator here is the ‘Supply Distribution’, which tracks the total number of Cardano wallets belonging to the different groups in the market.

The wallets or investors are classified into these groups based on the number of tokens they have on their balance. For example, the 1 to 10 coin cohort includes all holders who hold a minimum of 1 and a maximum of 10 ADA.

If the supply distribution were applied to this group, it would (among other things) sum the number of wallets that currently meet this condition. In the context of the current discussion, Santiment has talked about the supply distribution of two groups: 10 to 100 coins and 0 to infinity. The second one here is obviously a combination of all existing wallet groups, as there is no upper limit.

Here is a chart showing the trend in the indicator for these two Cardano groups over the past few months:

Looks like both the metrics have observed a large plunge | Source: Santiment on X

As shown in the chart above, both Cardano groups saw a drop in their wallets on November 17. In total, the number of addresses with an ADA balance fell by almost 35,000 on this day.

Overall, this type of massive exit can be a bearish sign for the cryptocurrency as it indicates a sell-off is taking place. However, the finer details of exactly which groups participated in such a sale could impact the asset’s prospects.

Interestingly, as Santiment has pointed out, 98.1% of the portfolios involved in the aforementioned sell-off belonged to the small holders. This could indicate that the larger entities such as the sharks and whales saw only a minimal amount of disembodiment during this dive.

“A drop in the number of addresses of this size or smaller often signals capitulation and a possible price tipping point,” the analysis firm explains. It appears that the retail investors have fallen prey to fear and sold their assets, which the big investors may have picked up.

Related reading: Bitcoin rushes to exchanges, but this sign remains positive for the bulls

Since this mass exodus of small hands, Cardano has seen an increase of about 65%, perhaps indicating that this pattern may have been one of the reasons for the increase.

ADA Award

While Cardano started the month with continued bullish momentum, the rally has cooled in recent days as ADA has seen a notable pullback.

Since the local top of $0.648, the asset’s price has fallen by almost 11% and is now hovering around $0.577.

The value of the asset appears to have enjoyed some rapid growth recently | Source: ADAUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, Santiment.net

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.