- SAFE is up 76% in 24 hours, breaking a multi-month downtrend of strong volume.

- Social dominance has risen sharply, but overbought indicators and price gaps suggest caution.

Safe [SAFE] has soared, breaking out of a multi-month downtrend and skyrocketing more than 76% in just 24 hours. At the time of writing, SAFE was trading at $1.66, demonstrating a significant increase in investor confidence.

Furthermore, its market capitalization has increased by 76.69%, pushing its valuation to $770.48 million. Trading volume has increased by an astonishing 9981.24%, indicating increased interest in the token’s recent performance.

These numbers highlight the strength behind the current outbreak. However, traders are now wondering whether Safe can maintain this rapid growth or whether a downturn is looming.

Breaking the Downtrend: What Happens Next?

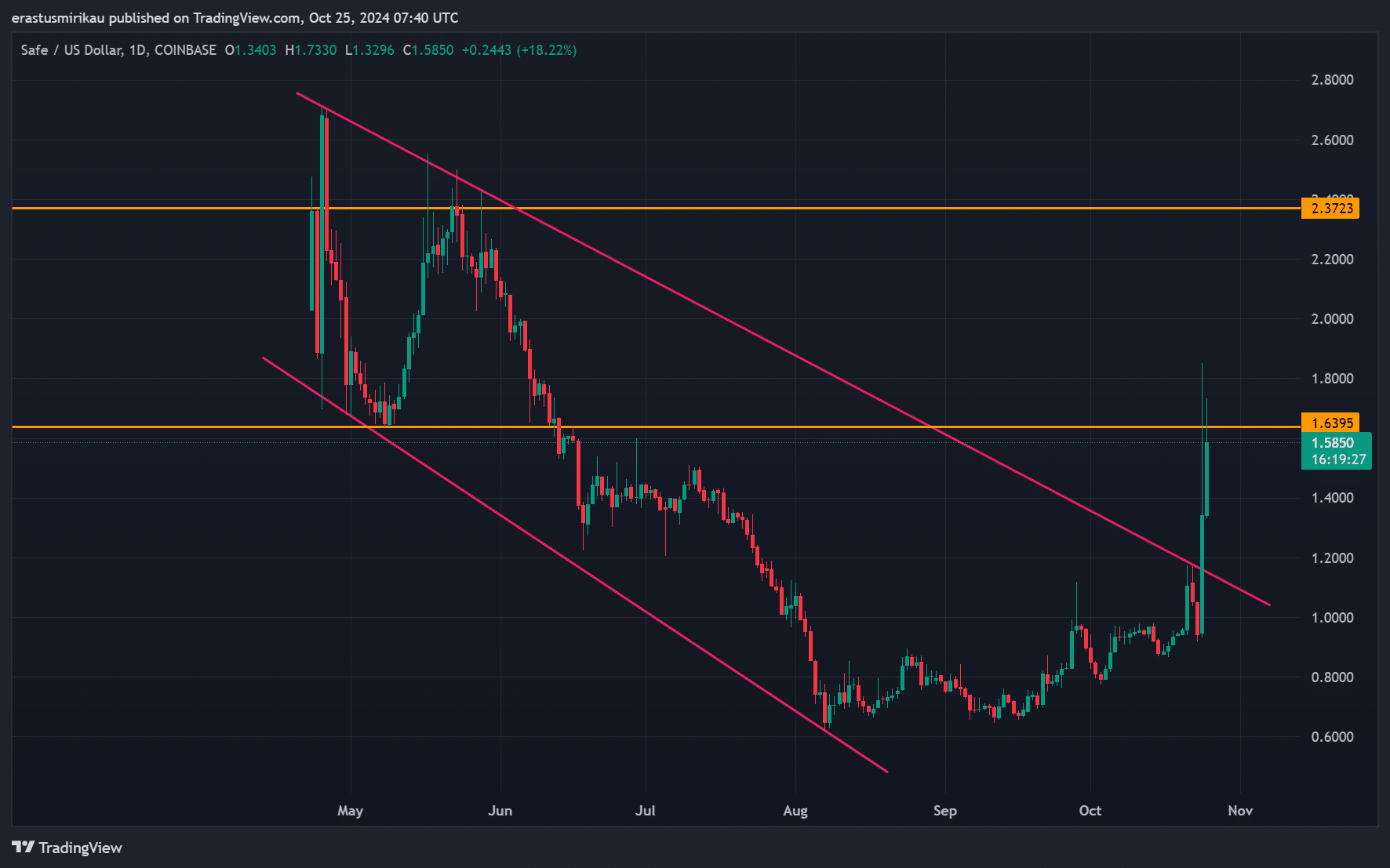

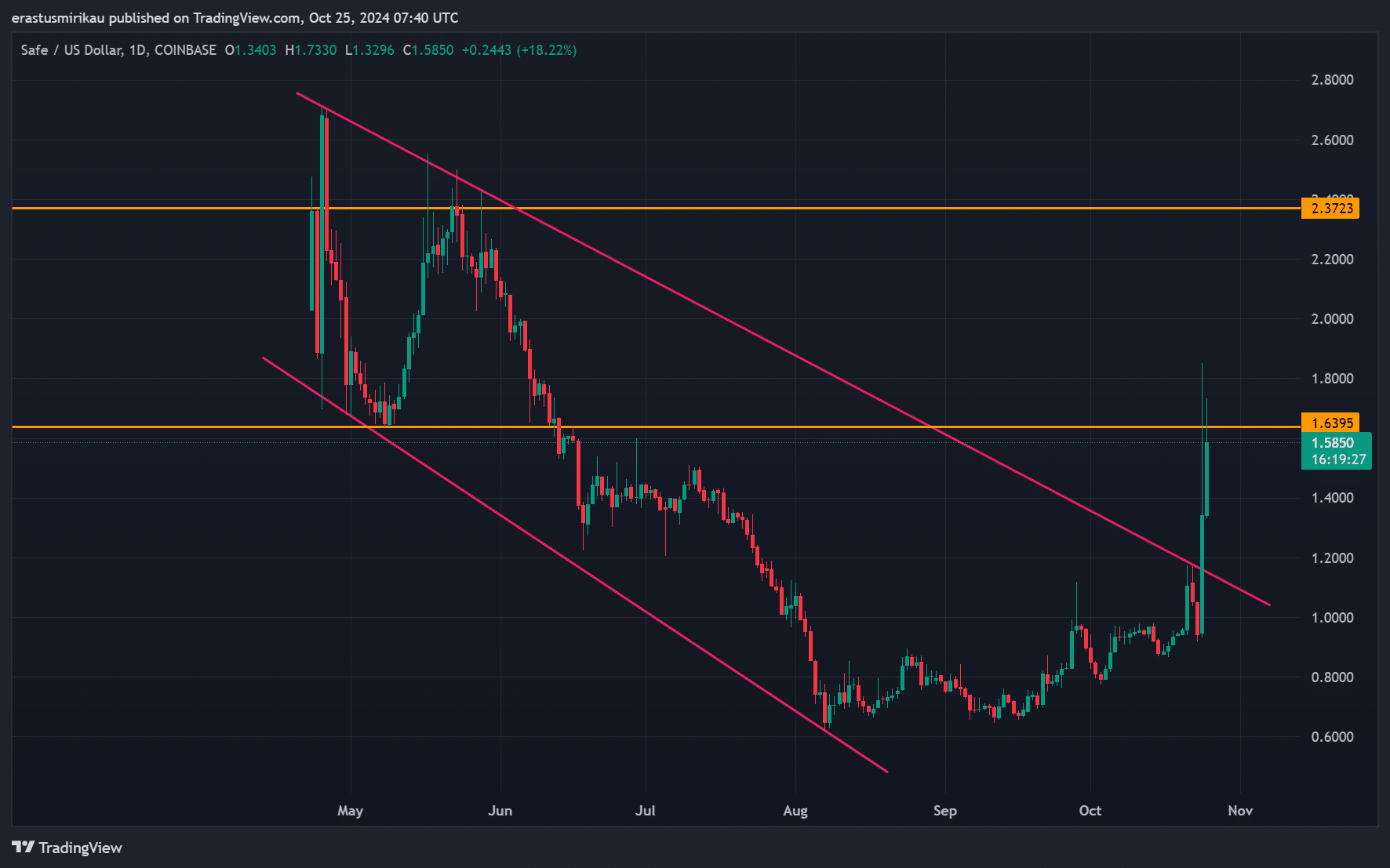

Safe has been in a long, drawn-out downtrend since the beginning of this year, which has been in a declining channel since the beginning of this year. However, the price has now broken out of this structure, signaling a bullish reversal.

Currently, SAFE is above $1.63, a key level that previously acted as resistance. Therefore, this level is now the key support that traders will be watching closely.

The next major hurdle is at $2.37, a strong resistance level that SAFE must overcome to continue its rally. A break above this point would indicate even more upside potential. Furthermore, holding at the $1.63 level would confirm that the bulls are still in control.

Source: TradingView

Technical indicators: RSI and MACD flash alert

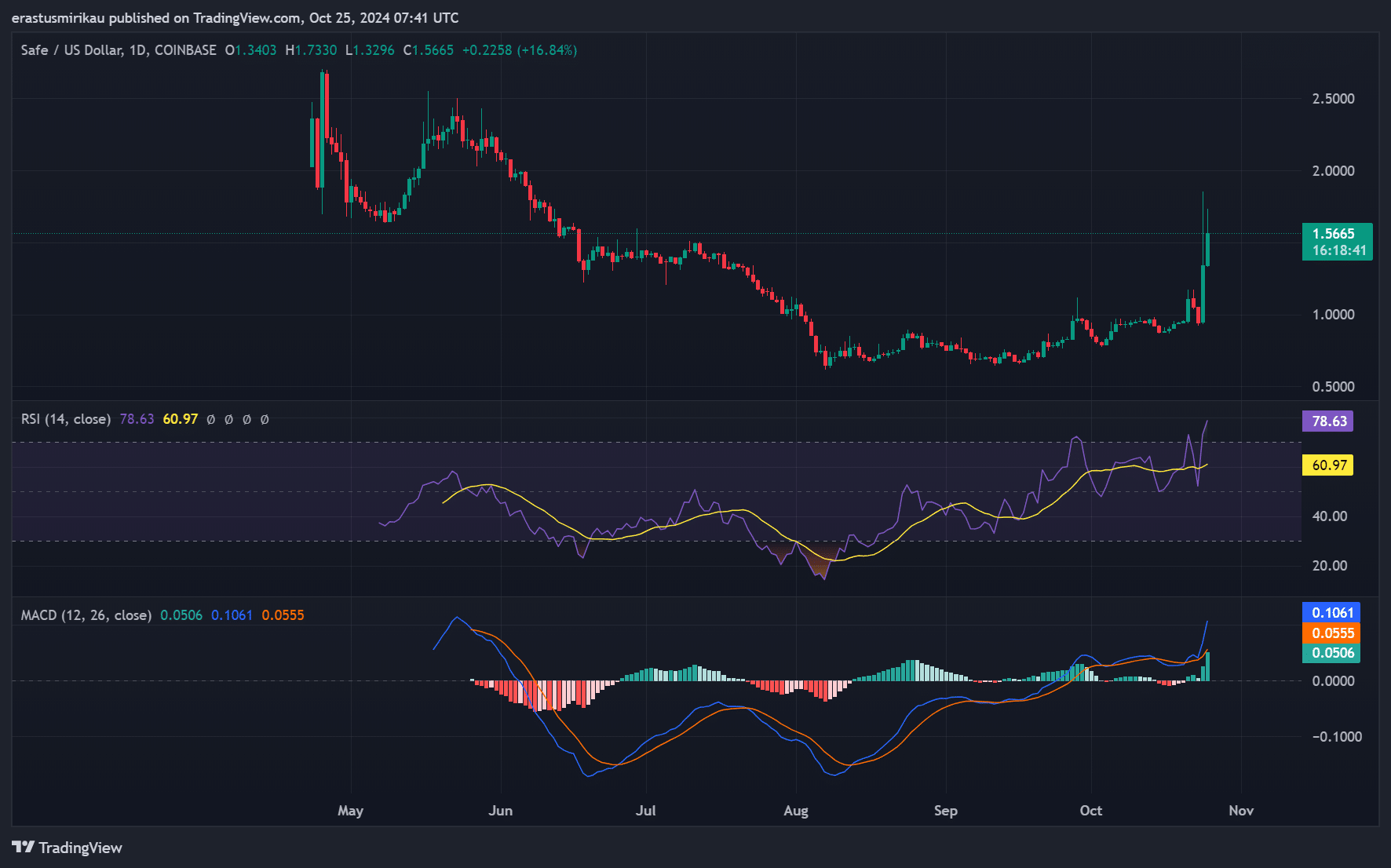

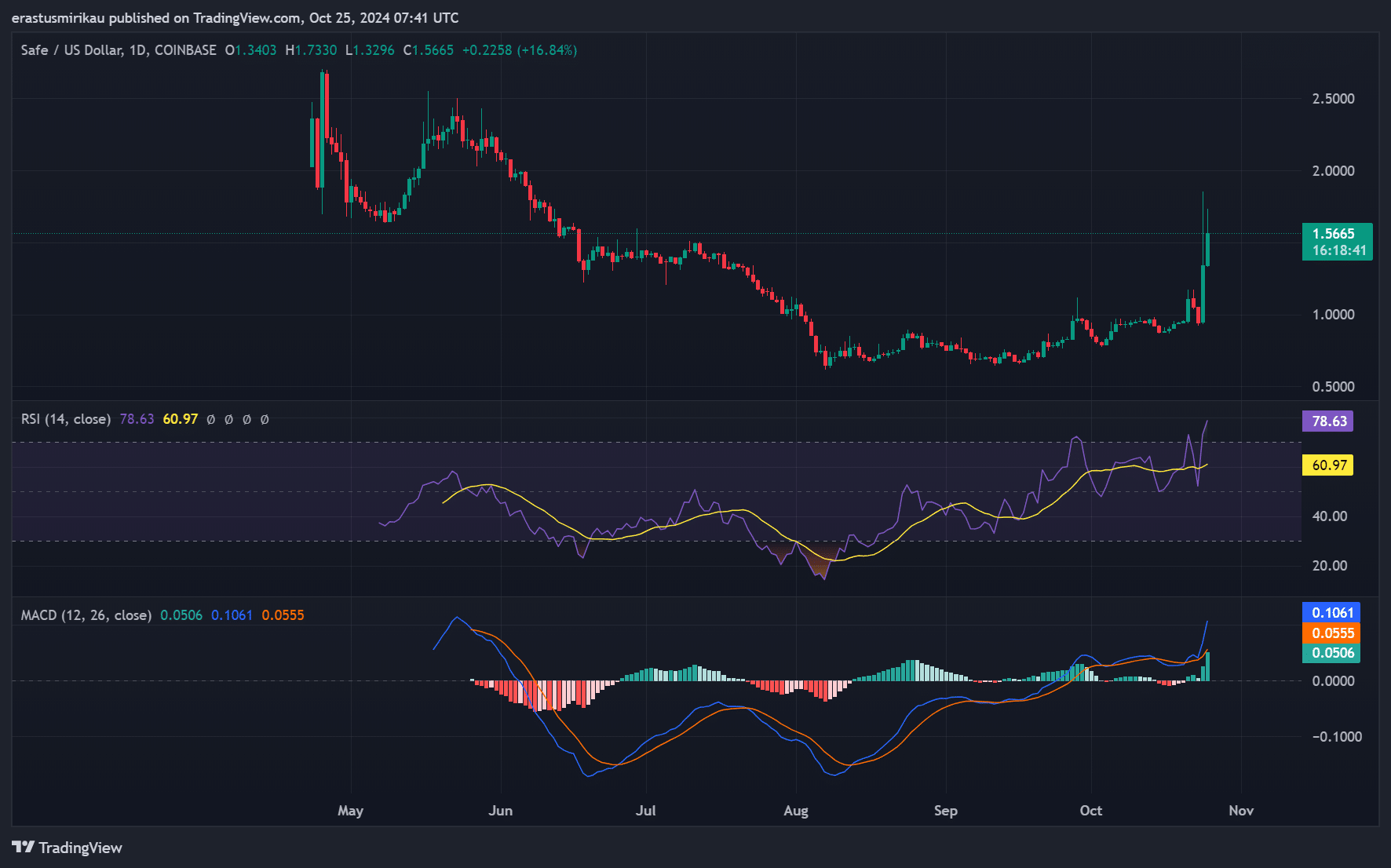

While the outbreak is promising, several technical indicators suggest caution is warranted going forward. The Relative Strength Index (RSI) currently stands at 78.63, putting it in overbought territory.

Therefore, SAFE may face a period of consolidation or even a short-term decline.

Moreover, the MACD has entered bullish territory, with the signal line confirming the continued momentum. However, the strength of the wave could mean a possible cooldown before the next upward leg.

Source: TradingView

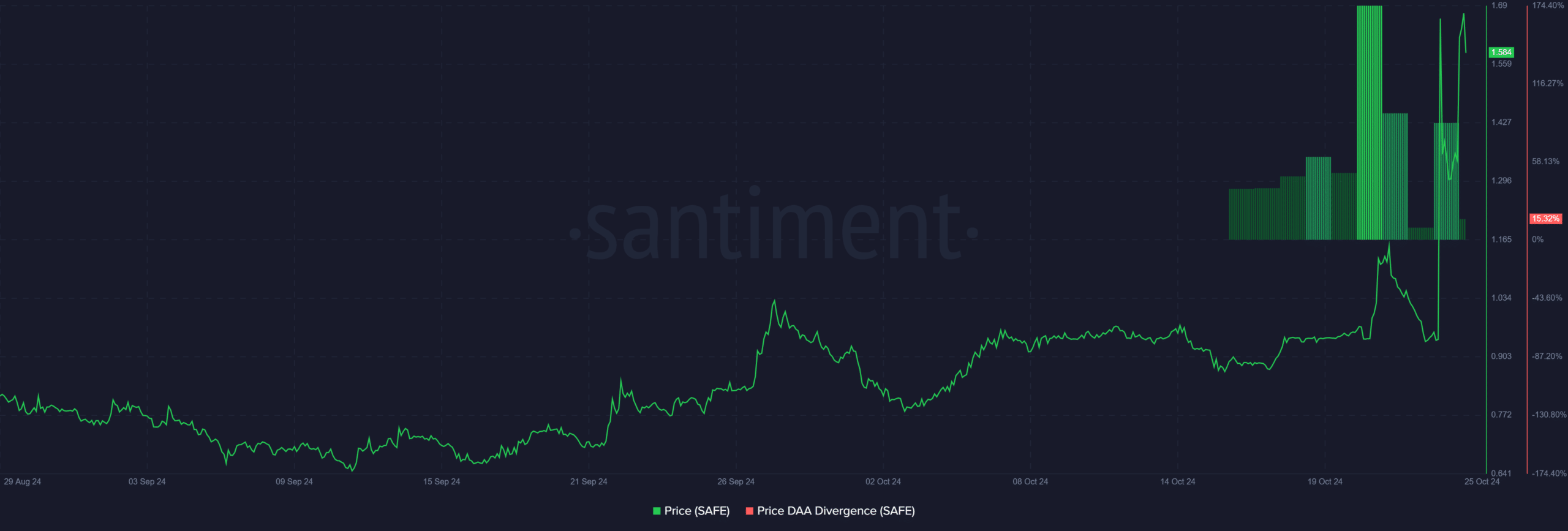

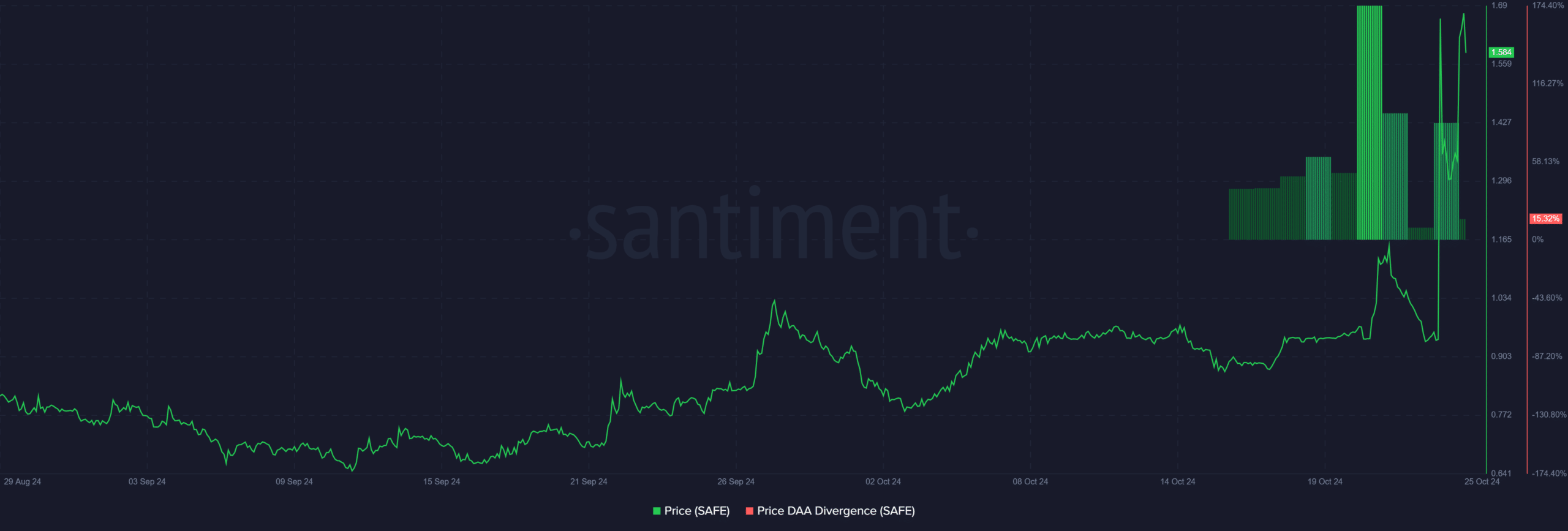

Price DAA divergence

The price-DAA divergence reveals a 15.32% gap between SAFE’s price increase and its network activity. Although the price has increased significantly, the daily active addresses have not increased proportionately.

The difference indicates that the price movement could be speculative, driven by short-term traders rather than consistent network growth. This calls for caution, as a lack of organic network activity can sometimes lead to a price correction.

Source: Santiment

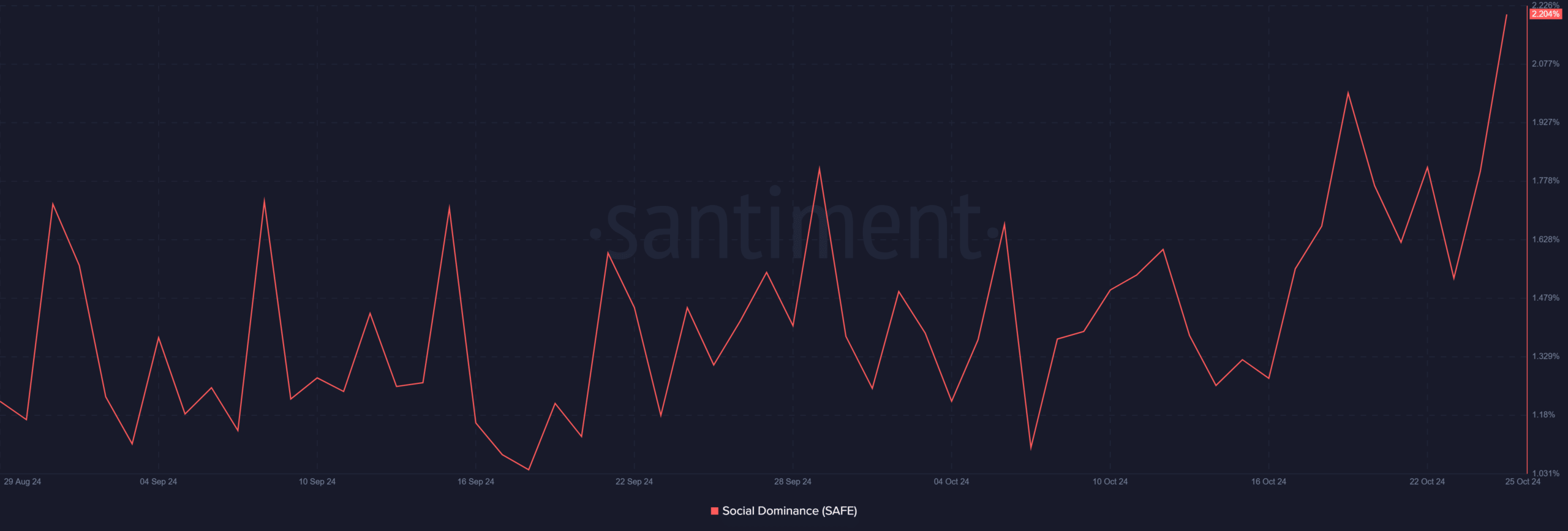

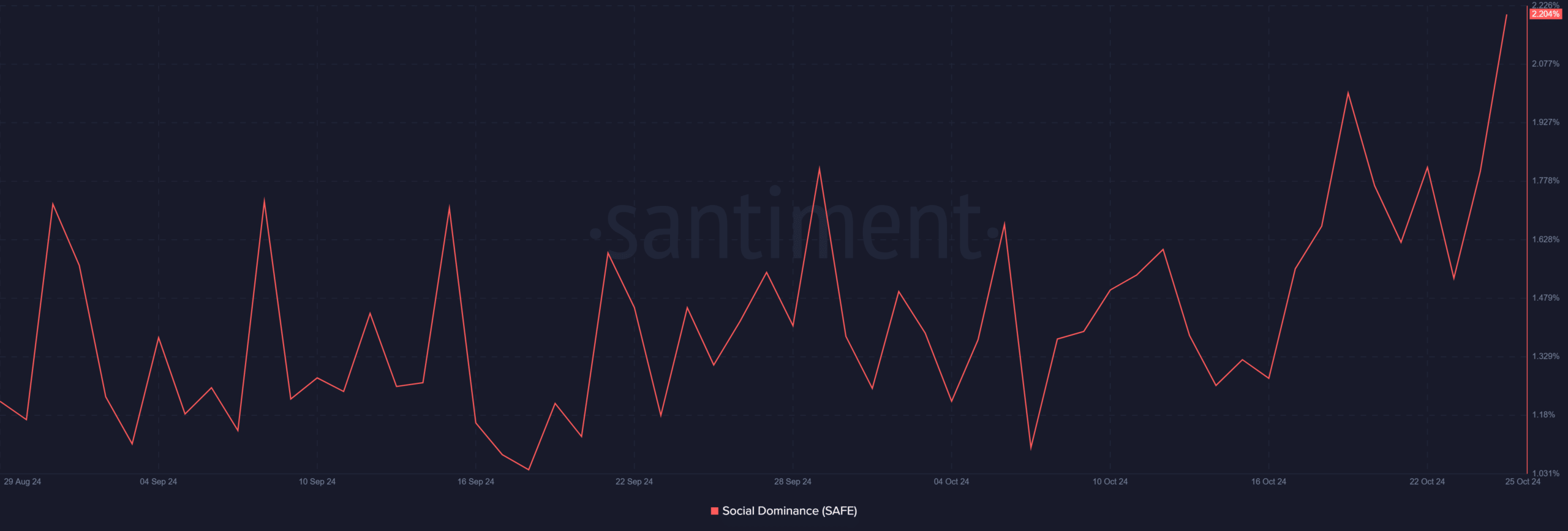

SECURE social dominance peaks

Social dominance has increased to 2,204%, a substantial increase from previous levels. Furthermore, this spike highlights that SAFE is receiving significant attention on social media platforms, which is often a sign of increased volatility and price action.

However, a sharp rise in social dominance does not always translate into sustainable growth and may indicate short-lived speculative interest.

Source: Santiment

Is SAFE About to Hit $2.37?

Given the strong increase in volume and the clear breakout from a multi-month downtrend, SAFE is likely to reach the $2.37 resistance level soon.

The bullish momentum remains intact, supported by increased social interest and technical indicators, despite overbought conditions. Therefore, unless a major pullback occurs, SAFE is well positioned to test the $2.37 mark in the near term.