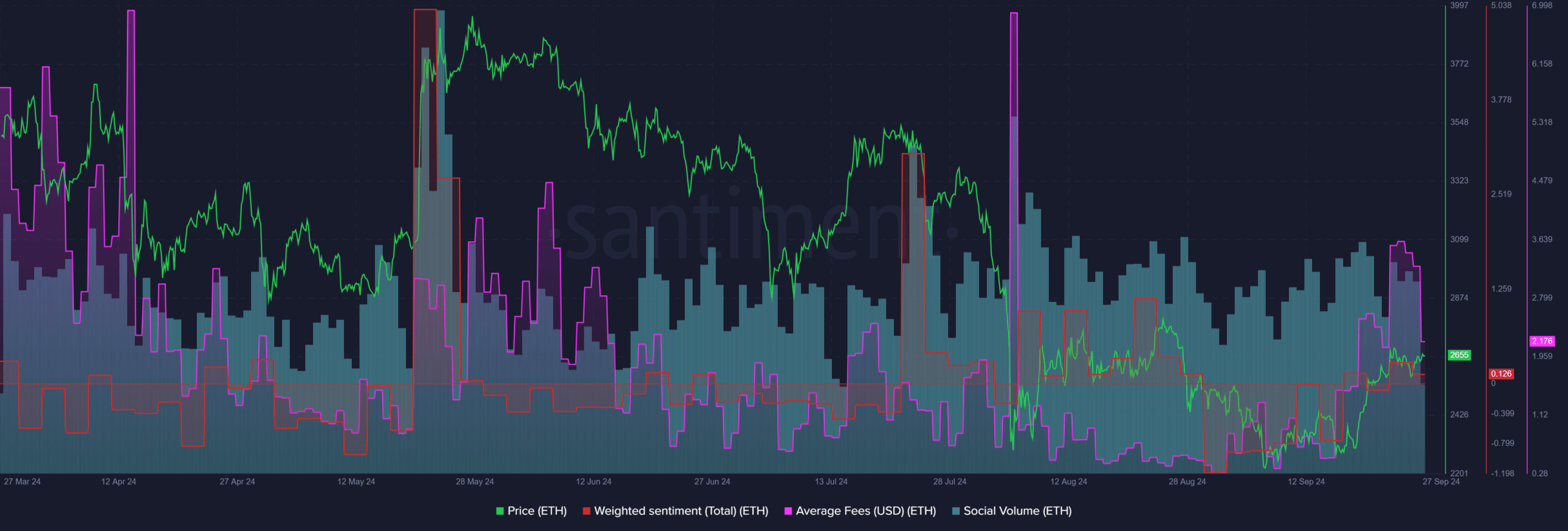

- Ethereum’s average transaction fees have risen rapidly in recent weeks

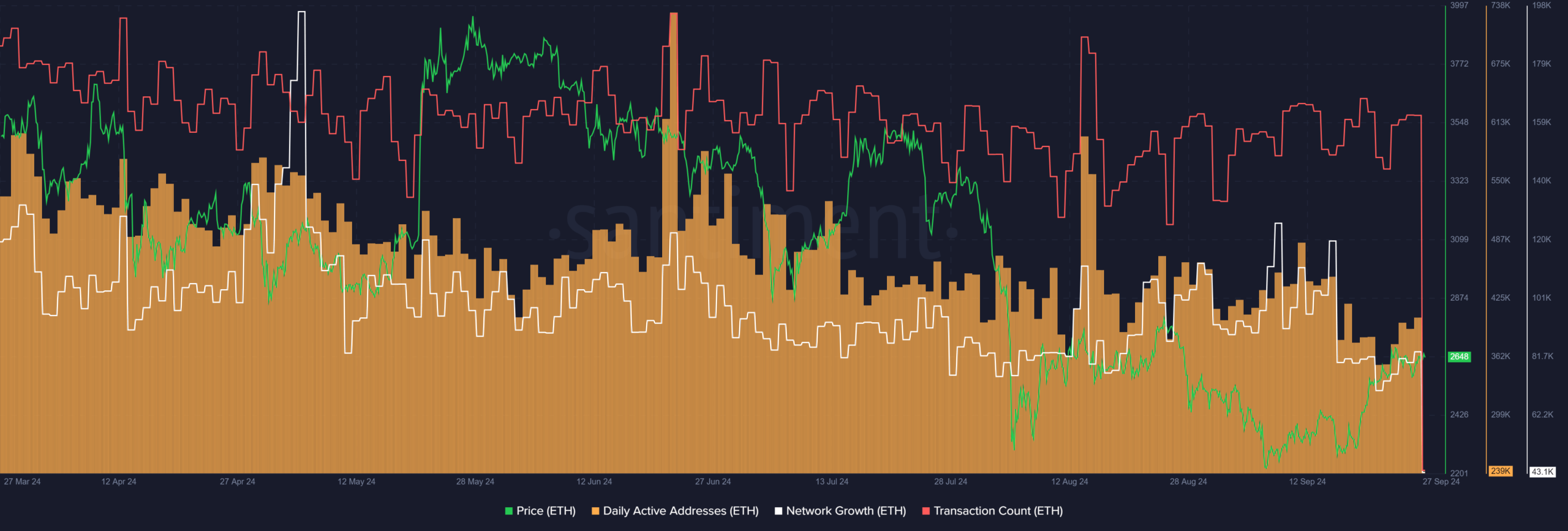

- Daily operations and network growth have not kept pace

Ethereum [ETH] was buoyed by the recent wave of bullishness that swept the crypto market when Bitcoin [BTC] rose past the $64k level.

Sustained gains above $64,000 are raising hopes in the market as this region has been a key resistance for BTC in recent weeks.

The average ETH fee was almost 12x higher compared to the end of August, but the price increases could offset user anger. The decline in the assets’ market dominance was another worrying sign, despite the price trend.

Ethereum fees have been steadily increasing

In one message on Xcrypto data analytics platform Santiment noted that the average compensation has risen steadily over the past month.

At the same time, Ethereum’s price has also risen 17.69% since the September 16 low.

The steady price increase has likely offset discussions about rising fees. But if we compare the average cost of $0.29 on August 31 to the cost of $3.61 on September 24, there is a notable increase.

In recent days, the fee has dropped again to an average value of $2.18. At the same time, weighted social sentiment has crept into positive territory.

This was good news for ETH investors, especially as the asset approaches the key resistance zone of $2.8k-$2.9k. Social media volume rose slightly in September, another small win for the bulls.

Transactions count in addition to costs

Network activity has not increased rapidly to explain rising network rates.

Read Ethereum’s [ETH] Price forecast 2024-25

Although the number of transactions is up about 10%, daily active addresses and network growth have declined over the past three weeks.

It was likely that the base fee was higher compared to August due to an increase in activity such as NFT coins, or users could be willing to pay higher priority fees to speed up their transactions.