Ripple’s native token, XRP, is making waves in the cryptocurrency world after Donald Trump won the US presidential election. With this remarkable rally and bullish outlook, XRP has now reached a level where there is a good chance it could skyrocket in the coming days.

XRP Technical Analysis and Upcoming Levels

According to CoinPedia’s technical analysis, XRP is currently facing strong resistance near the $0.75 level. Historically, this level has acted as strong selling pressure, resulting in a price decline. However, the asset price reached this level after March 2024 and sentiment has changed, with investor and trader interest now focused on the next level.

Based on the recent price action and historical momentum, if to reach.

However, this goal may not be easy to achieve as there is a resistance level near the $0.95 level, which could pose a hurdle and potentially prevent XRP from recovering.

Currently, XRP is trading above the 200 Exponential Moving Average (EMA) on both daily and weekly time frames. Meanwhile, the Relative Strength Index (RSI) indicates potential bullish momentum in the coming days as it is in oversold territory.

Bullish statistics in the chain

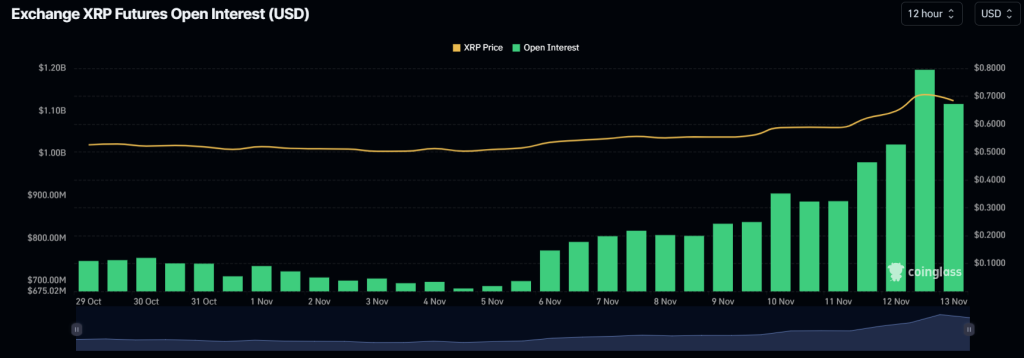

In addition to the bullish technical analysis, statistics in the chain further support XRP’s positive outlook. According to on-chain analytics firm Coinglass, the asset’s open interest (OI) has skyrocketed by 22% in the last 24 hours and 7.25% in the last four hours.

This rising OI suggests that traders are heavily participating in XRP tokens as they approach breakout levels, which is a bullish sign.

At the time of writing, the key liquidation levels are at $0.657 on the downside and $0.736 on the upside, with traders at these levels being over-leveraged, according to Coinglass data. The data suggests that $47.56 million and $31.72 million of open positions are currently at the liquidation level, which will be liquidated if the XRP price moves in either direction.

Current price momentum

At the time of writing, XRP is trading around $0.68 and has experienced a 13.5% price increase in the last 24 hours. During the same period, trading volume increased by 170%, indicating greater participation from traders and investors amid a potential outbreak.